Bilibili: All due to high expectations, Bilibili isn't actually that bad

![]() 11/18 2024

11/18 2024

![]() 579

579

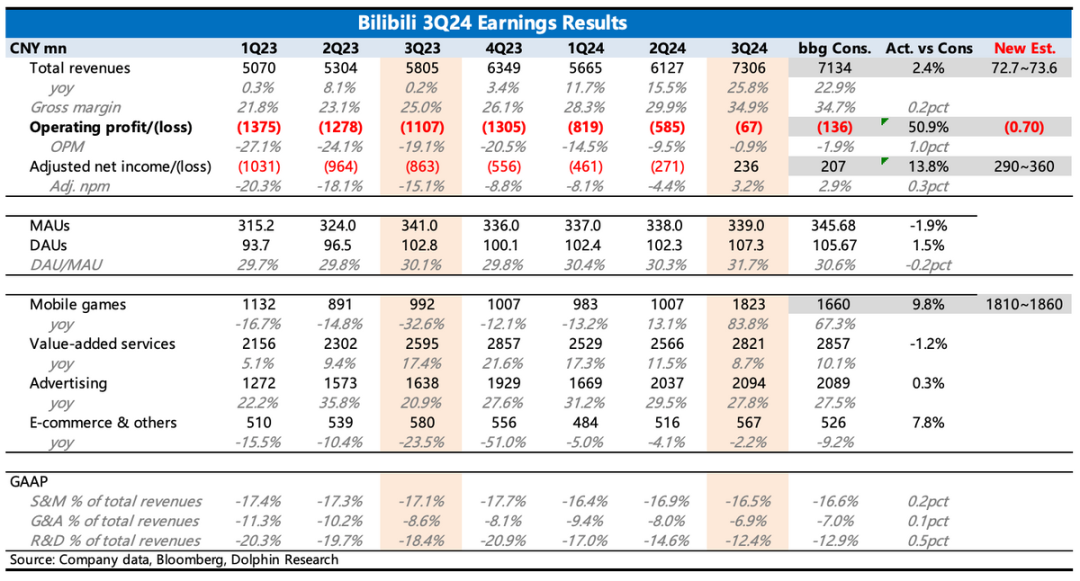

Bilibili's third-quarter performance was actually decent, but recent high market expectations required some adjustments. Compared to the latest expectations, due to game revenue slightly falling short of expectations, related income and profit indicators also performed averagely. The reason for the continued drop of over 10% on the day was that the guidance given by the company at a small meeting did not satisfy the high expectations of the market, especially in terms of advertising revenue.

Specifically:

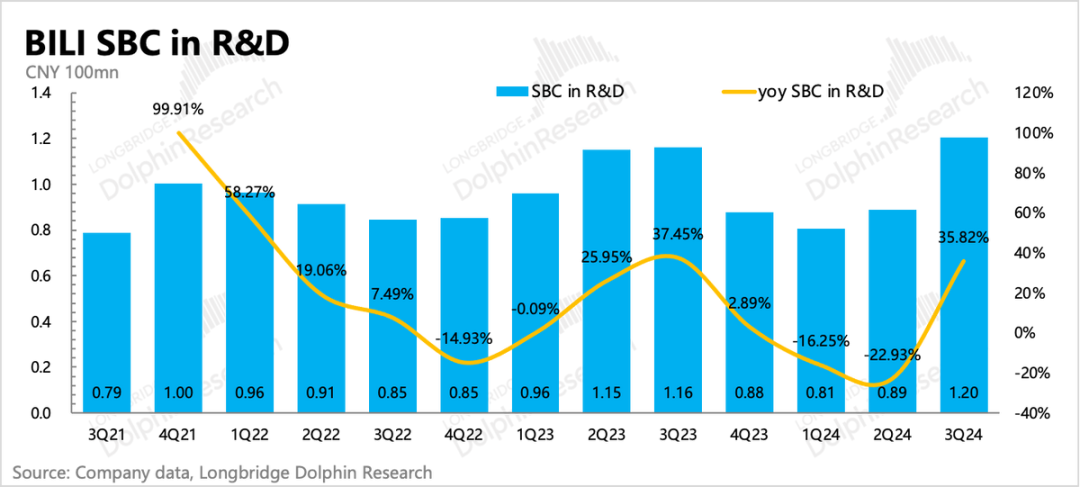

1. The shoe has dropped, and Bilibili is making money: Adjusted net profit for the third quarter was 236 million yuan, with a profit margin of 3.2%. The reduction in losses was driven by high growth in games and advertising, as well as a decrease in server depreciation costs. After a cycle, the SBC expenses for R&D personnel began to resume growth.

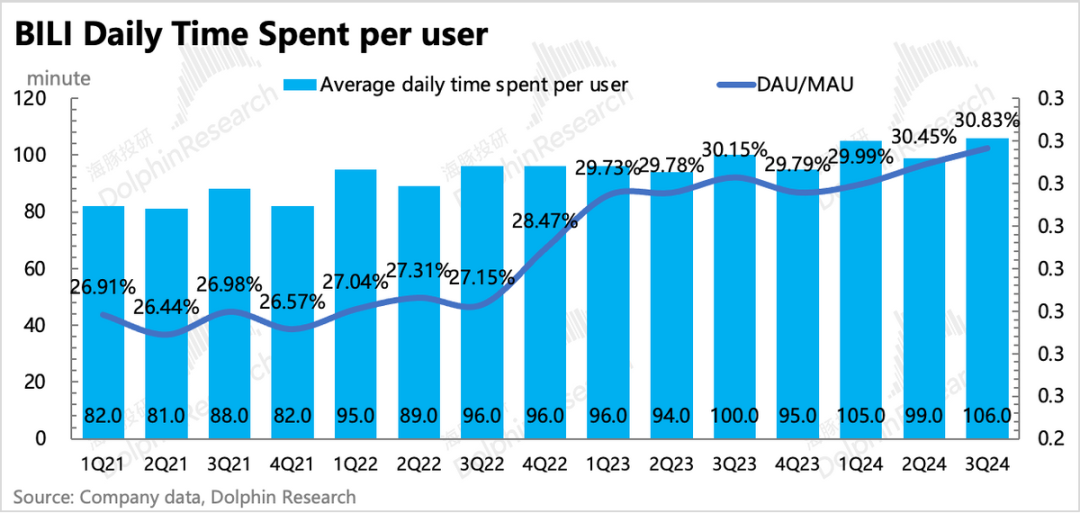

2. Traffic growth slowed, but user engagement increased: Monthly active user growth continued to slow down in the third quarter, falling short of expectations. According to APP data from third-party platforms, Xiaohongshu is rapidly catching up. However, for existing users, engagement with Bilibili continued to increase.

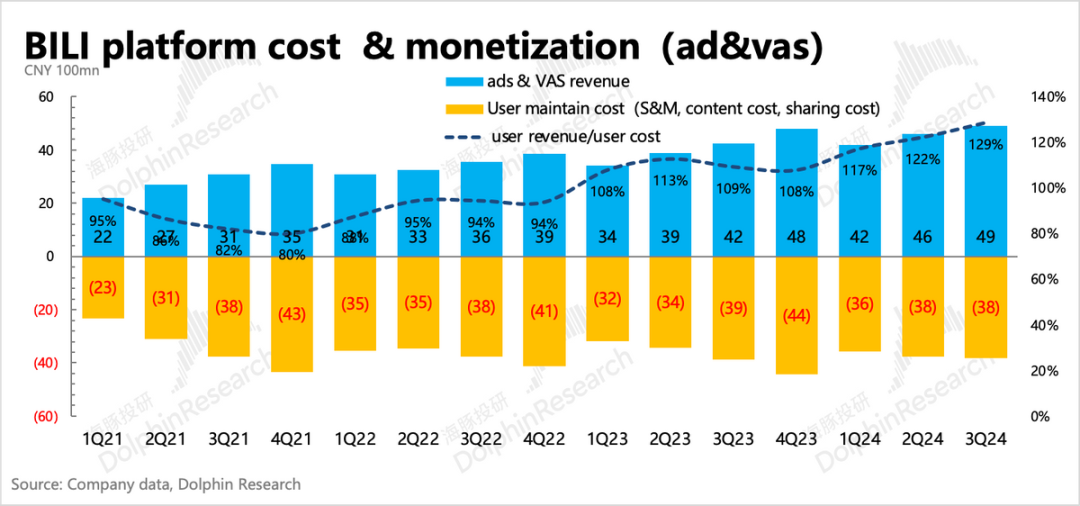

On the one hand, DAU/MAU increased, and on the other hand, average daily usage time and average monthly interactions per user further increased. From the perspective of average user traffic monetization and maintenance costs, the third quarter also became healthier in terms of trends. While the average maintenance cost decreased month-on-month, the monetization value increased.

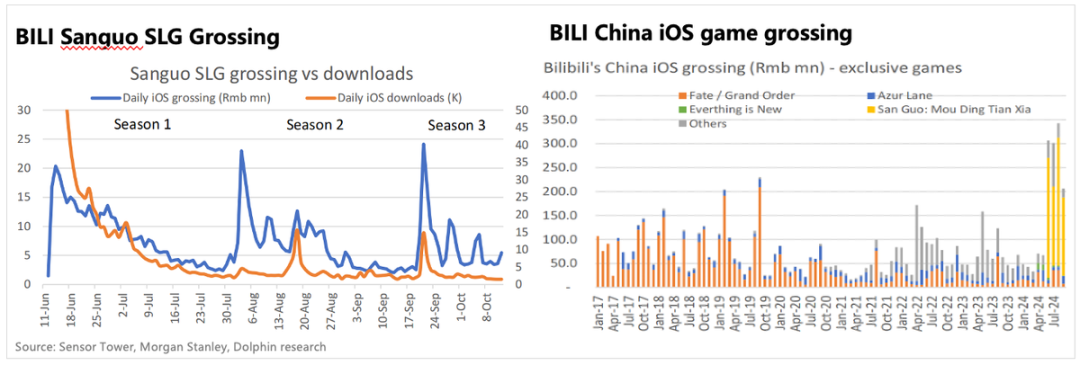

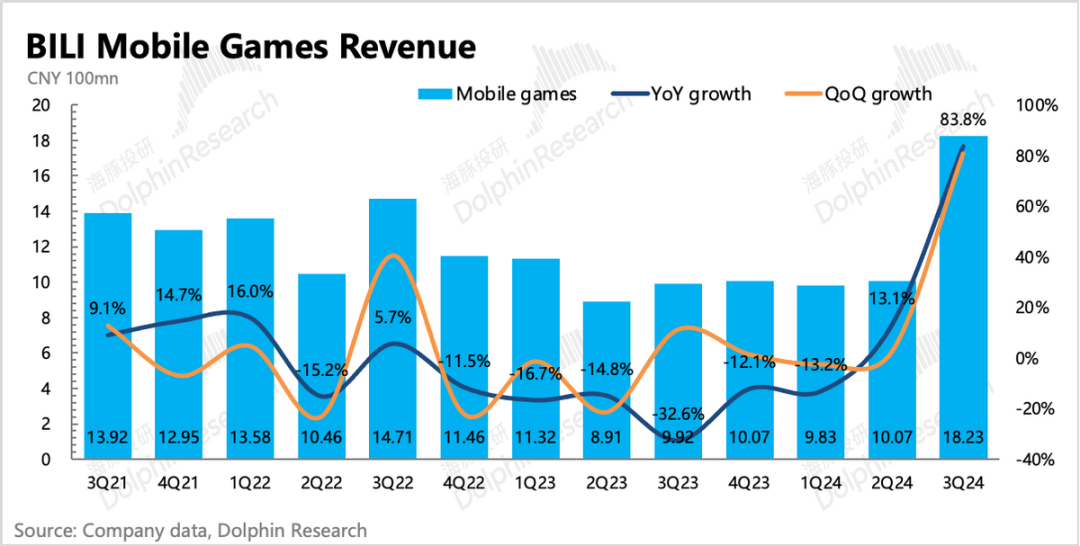

3. "Three Strategies" deserves credit: Game revenue achieved 84% high growth in the third quarter, with "Three Kingdoms: Strategy and Ambition," launched in June, being the main increment. Based on data from third-party platforms, Dolphin estimates that "Three Strategies" had a revenue flow of 1.5 billion yuan in Q3, and based on the usual recognition cycle, it is estimated that 1 billion yuan in revenue was recognized in the current period. However, if this 1 billion yuan is excluded, other older games are still declining year-on-year.

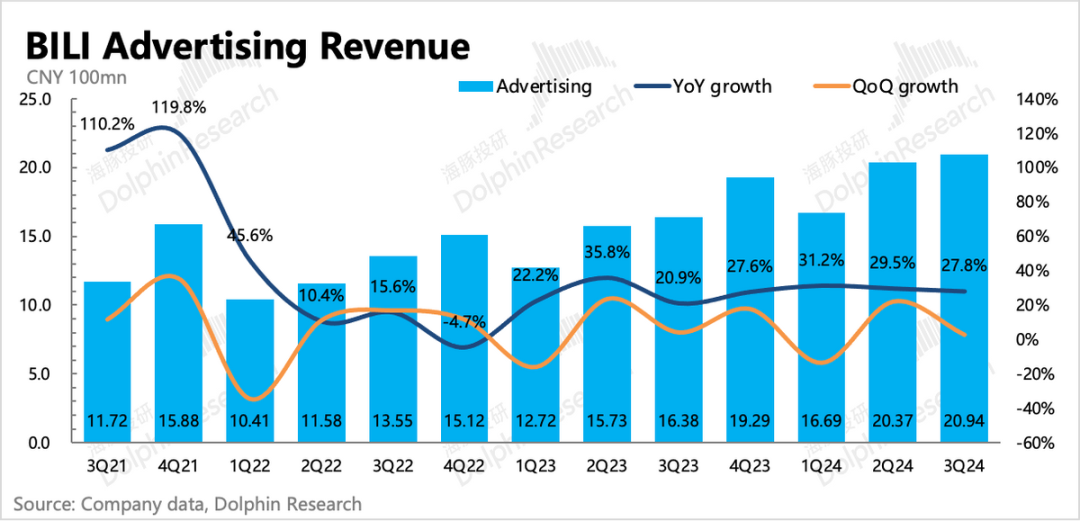

4. Continued high growth in advertising: Advertising revenue increased by 27.8% year-on-year in the third quarter, continuing the boom. In addition to benefiting from the chaos in the gaming and e-commerce industries, Bilibili has also been working hard: this year, it upgraded its advertising system, improved the accuracy of algorithm recommendations, and launched new purchasing tools for Up users, thereby helping Bilibili share a portion of Up users' e-commerce sales in another way.

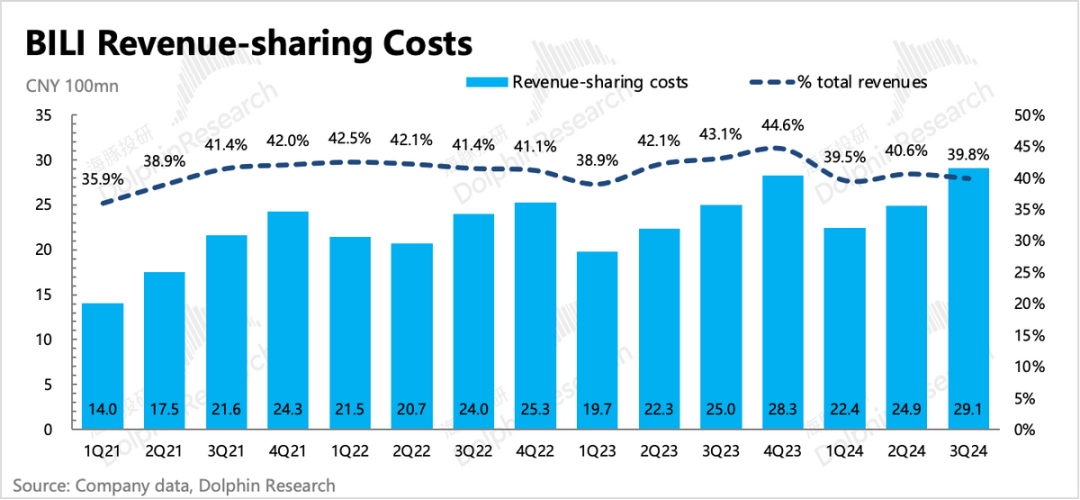

Otherwise, following the rule that only 5% of Spark advertising revenue goes to the platform, Bilibili's establishment of the Spark platform would be equivalent to charity. In the eyes of advertisers, the most valuable advertising space on Bilibili's platform, which has a high private domain attribute, is still the videos produced by Up users.

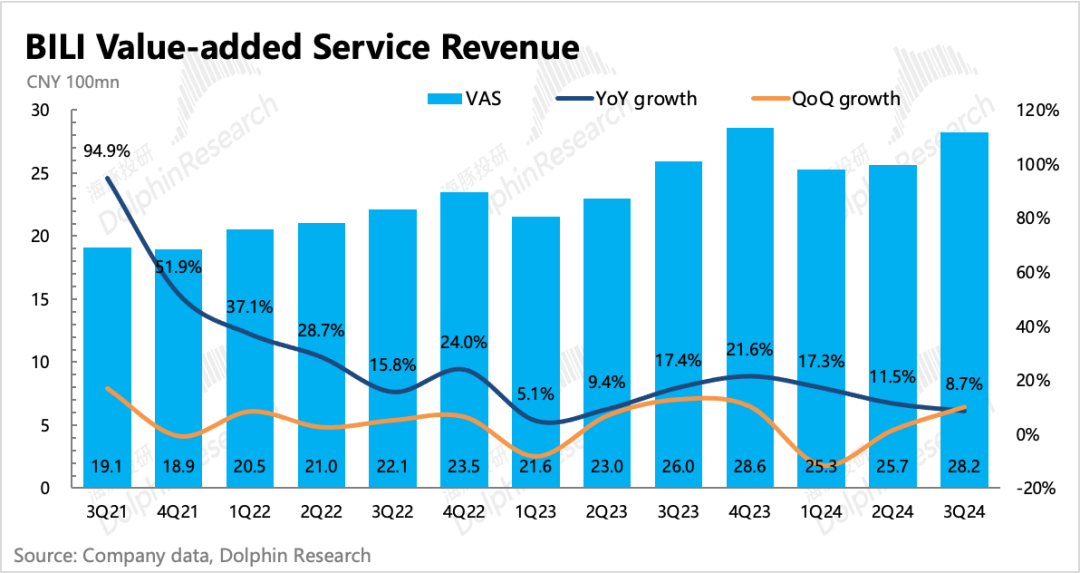

4. Pure payment pressure is gradually increasing: Live streaming and premium membership subscription revenue increased by 8.7% year-on-year in the third quarter, continuing to slow down month-on-month. Dolphin believes that the slowdown in growth is partly due to poor performance in live streaming tipping, which is in line with industry trends. On the other hand, premium members are also facing competition from other long-video platforms, with user churn occurring for the first time in the third quarter (month-on-month decline). In addition, Bilibili Up users' private domain paid content (paid gifts such as charging) launched in the past two years is also expected to face some environmental pressures.

5. Significant improvement in cash flow: Games are generally good at generating cash flow. Therefore, with the support of "Three Strategies" in the third quarter, Bilibili's cash, deposits, and short-term investments increased to 15.2 billion yuan. After deducting short-term debt of 4.3 billion yuan, net cash was 10.9 billion yuan, an increase of 1.6 billion yuan compared to the first quarter. Thanks to improved profitability, net cash inflow from operating activities was 2.2 billion yuan, an increase of 500 million yuan compared to the second quarter.

6. Overview of performance indicators

Dolphin's Perspective

The market has fully anticipated Bilibili's strong third-quarter performance, and as game revenue can be tracked through third-party platforms, market expectations for games have been increasing over the past month.

Although there were no surprises compared to the latest expectations, "Three Strategies" actually performed quite well. As a niche vertical game with many similar games on the market and high single-user spending, it was able to maintain revenue scale through seasonal operations in the third quarter, which faced increasing macroeconomic pressures, performing significantly better than Dolphin's initial expectations.

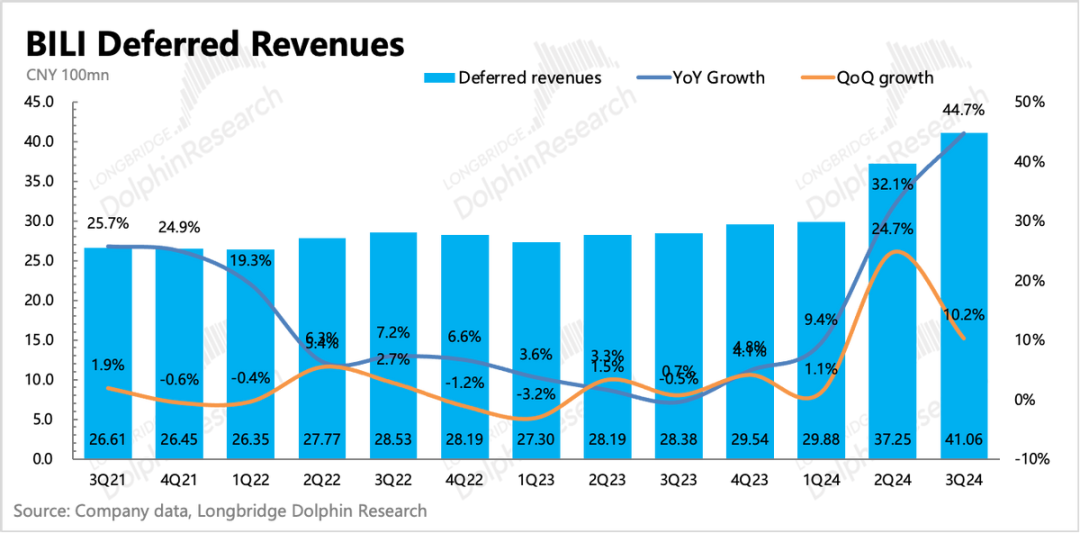

For the next quarter, Dolphin believes that due to the peak season of Double 11, advertising is expected to continue its high growth. Therefore, game performance will be the key to whether performance can continue to improve. From the perspective of deferred revenue, deferred revenue in the third quarter increased by 10% month-on-month and continued to grow year-on-year. Calculations show that revenue in the current quarter significantly accelerated growth compared to the low base of the previous year, implying that the strong performance of games in Q4 is expected to continue.

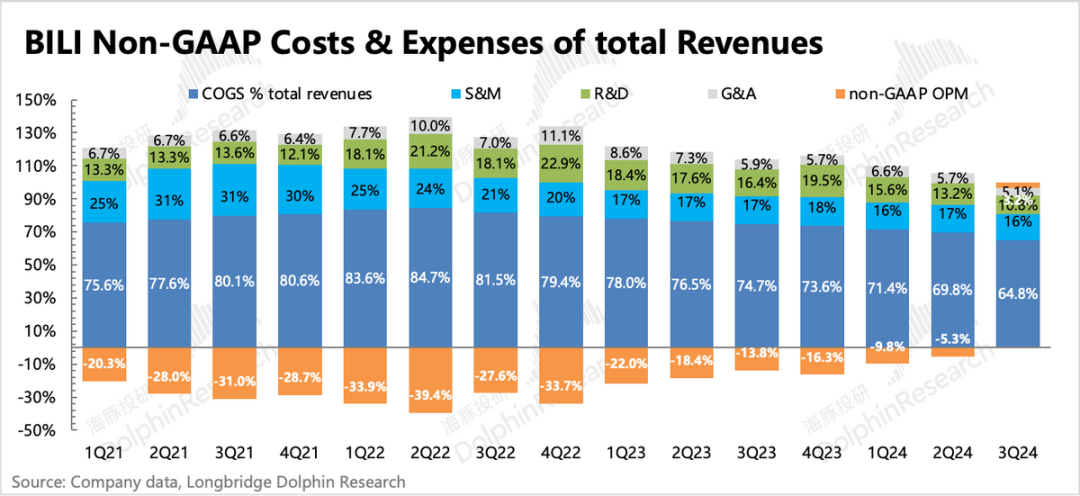

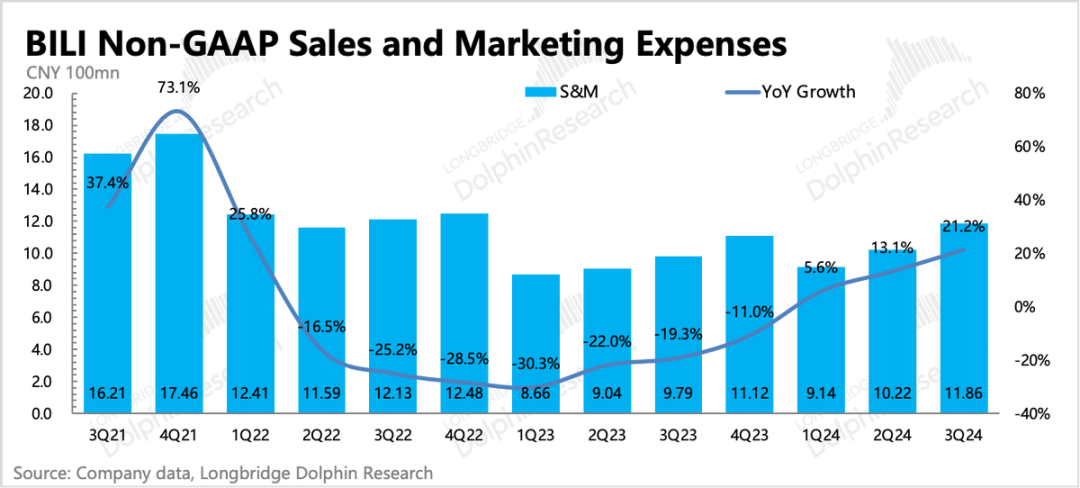

Looking at the expense side, since Bilibili has more issues with monetization rather than high expenses, cost control and efficiency improvement are mainly reflected in R&D expenditures, i.e., reducing server depreciation costs through extending the usage cycle and resource reuse. For other expenses, sales expenses increased significantly due to the promotion of new games, while administrative expenses and R&D personnel expenses began to end the optimization cycle and start expanding.

The issue of expense expansion, while having a significant impact on financial indicators for the newly profitable Bilibili, is not a core factor affecting valuation from the perspective of valuation logic. In the short term, after high expectations are adjusted to some extent, and with high revenue flows expected to continue after the new season of "Three Strategies," market sentiment may repair, potentially driving valuation back up.

However, after next year's Q1, the unavoidable issue of medium- and long-term growth will be raised again for repeated discussion. As traffic gradually peaks, advertising growth will be affected. In terms of games, relying solely on "Three Strategies" is unsustainable, and it is relatively difficult for vertical games such as SLGs to become evergreen titles. However, for now, among the pipelines announced by Bilibili, there is no promising blockbuster that could be the next "Three Strategies," so it is crucial for management to provide a clearer growth blueprint during this conference call.

Detailed Analysis Below

I. Traffic Gradually Peaks, but User Engagement Increases

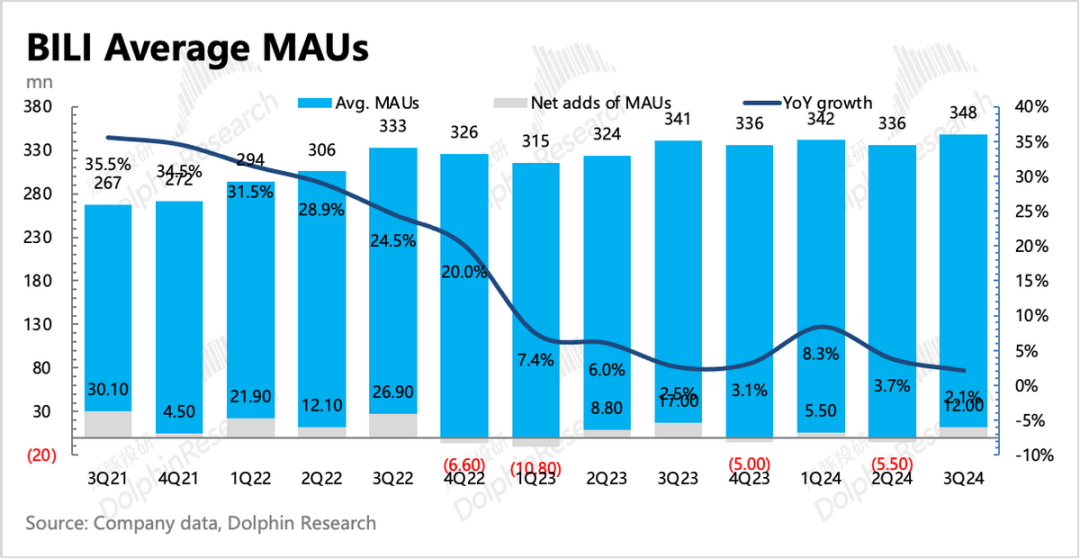

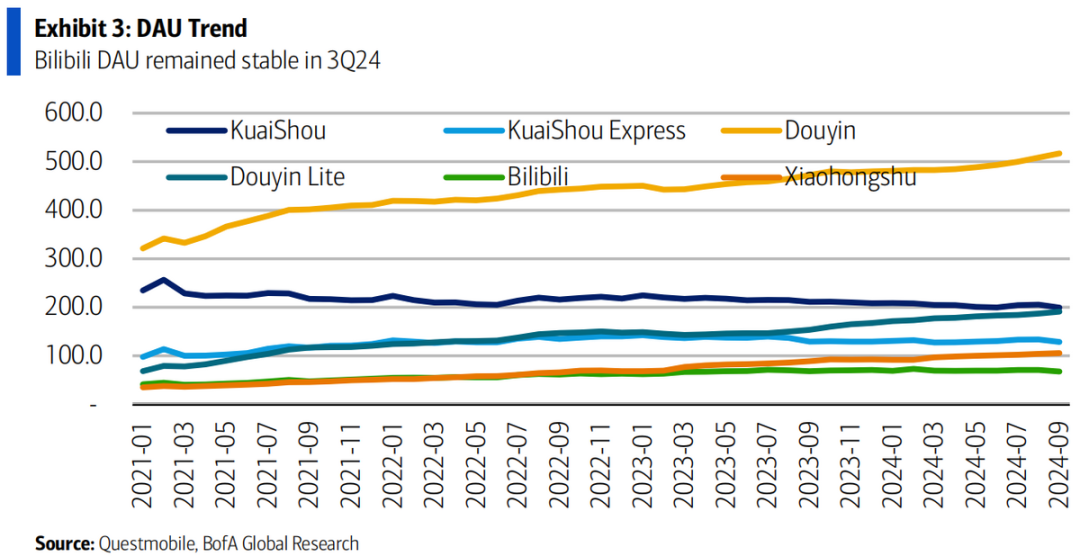

User growth further slowed down in the third quarter, but user engagement (DAU/MAU) increased significantly month-on-month. Facing the offensive of Douyin and Xiaohongshu, Bilibili has to confront the issue of traffic gradually peaking.

Specific User Data:

1. Bilibili's overall monthly active users (App, PC, TV, etc.) in the third quarter were 348 million, a year-on-year increase of 2% and a net increase of 12 million month-on-month, driven by the summer peak season.

2. The engagement of existing users increased slightly month-on-month. In the third quarter, DAU reached 107 million, and DAU/MAU reached 30.8%. The average daily user time was 106 minutes, reaching a historic high driven by the peak season. In addition, the average number of interactions per user (likes/comments/favorites) continued to increase.

The slowdown in user growth is mainly due to competition. According to Sensor Tower data, Xiaohongshu is almost catching up with Bilibili, but Xiaohongshu's DAU is higher than that of Bilibili, indicating stronger user engagement on Xiaohongshu. In addition, with a higher proportion of female users, Xiaohongshu has higher monetization value in the eyes of merchants compared to Bilibili, which has a slightly higher proportion of male users.

II. Short-term Sustainability of High Advertising Growth

Bilibili's advertising revenue in the third quarter was 2.09 billion yuan, a year-on-year increase of 27.8%. The high growth was mainly driven by the summer game chaos, e-commerce competition, and increased spending by industries with short-term high prosperity such as AI and education and training.

In addition, Bilibili upgraded its advertising system this year, improving the accuracy of algorithm recommendations, and also launched full-service advertising to attract more marketing budgets from small and medium-sized businesses. Coupled with the launch of new purchasing tools for Up users, this helps Bilibili share a portion of Up users' e-commerce sales in another way.

Otherwise, following the rule that only 5% of Spark advertising revenue goes to the platform, Bilibili's establishment of the Spark platform would be equivalent to charity. In the eyes of advertisers, the most valuable advertising space on Bilibili's platform, which has a high private domain attribute, is still the videos produced by Up users.

III. Game Turnaround, "Three Strategies" Deserves Credit

Game revenue achieved 84% high growth in the third quarter, with "Three Kingdoms: Strategy and Ambition," launched in June, being the main increment. Based on data from third-party platforms, Dolphin estimates that "Three Strategies" had a revenue flow of 1.5 billion yuan in Q3, and based on the usual recognition cycle, it is estimated that 1 billion yuan in revenue was recognized in the current period. However, if this 1 billion yuan is excluded, other older games are still declining year-on-year.

Bilibili has cut self-developed games and instead chosen to exclusively represent some high-quality games that cater to Bilibili users' preferences. At least from the success of "Three Strategies" (guaranteed revenue flow, low customer acquisition costs, low overall channel sharing, and a strong position towards developers to reduce development sharing), it proves that the strategic transformation has worked. Considering that "Three Strategies" is, after all, a heavy-spending, niche SLG game, the normal pattern for this type of game is high revenue flow initially and then a decline, so sustainability remains an unavoidable topic.

From the perspective of deferred revenue, the short-term high growth of "Three Strategies" is expected to continue, but after the base period next year, whether there will be a new "Three Strategies" to contribute incremental revenue is crucial. However, from the currently announced pipelines, nothing has been seen yet, so it can be noted whether management provides any updates during the conference call.

IV. Increasing Pressure on Pure Payment Value-Added Services

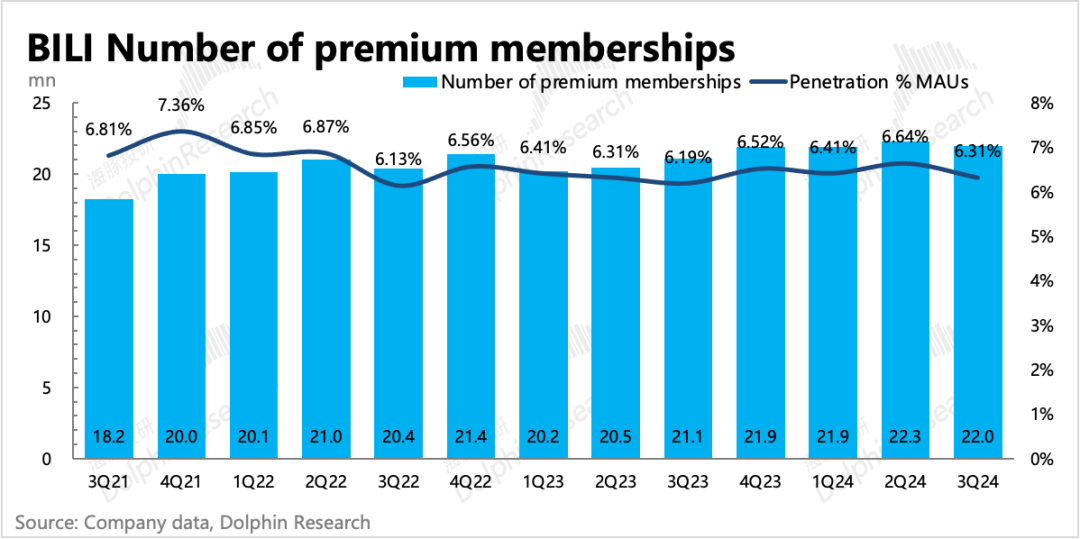

Live streaming and premium membership subscription revenue increased by 8.7% year-on-year in the third quarter, continuing to slow down month-on-month. Dolphin believes that the slowdown in growth is partly due to poor performance in live streaming tipping, which is in line with industry trends. On the other hand, premium members are also facing competition from other long-video platforms, with user churn occurring for the first time in the third quarter (month-on-month decline). In addition, Bilibili Up users' private domain paid content (paid videos, charging, and other paid gift incentives) launched in the past two years is also expected to face some environmental pressures.

However, compared to other long-video platforms, Bilibili mainly introduces high-quality historical film and television content that has been proven to be excellent, along with a small amount of self-produced variety content that aligns with hot discussion topics on the platform (making it easier to attract attention).

Therefore, although the scale of paid users is significantly smaller than that of iQIYI, Youku, and Tencent Video, Bilibili's profit pressure may be relatively smaller. Currently, the paid user rate is still relatively low at 6.3%, significantly lower than the 20-25% of iQIYI, Youku, and Tencent Video. As more high-quality content that differs from iQIYI, Youku, and Tencent Video is introduced, the paid user rate is expected to continue to increase.

V. The Shoe Has Dropped, and Bilibili Is Making Money

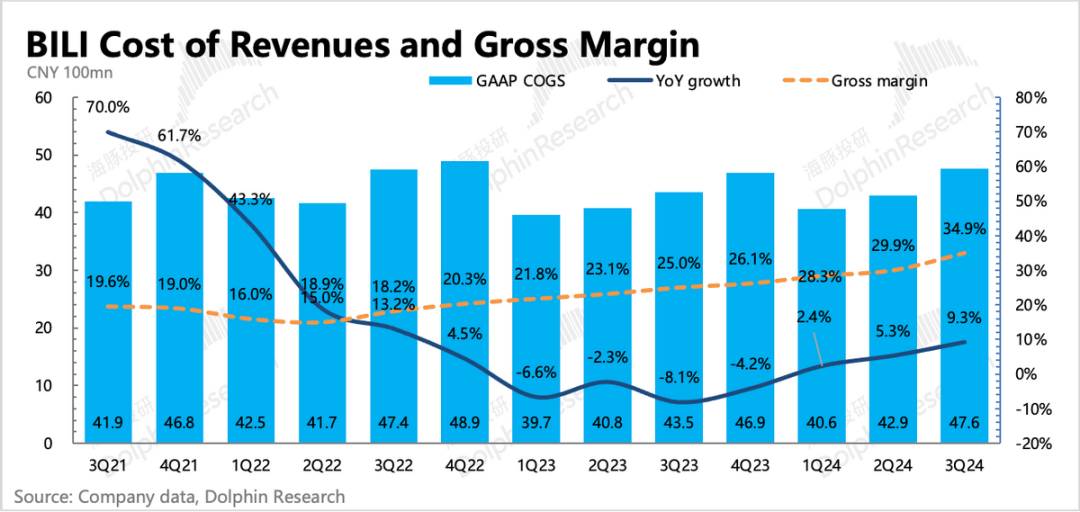

Bilibili achieved an adjusted net profit of 236 million yuan in the third quarter, although the profit margin was still relatively low at 3.2%. However, achieving profitability is a good start. A closer look reveals that the reduction in losses comes from two drivers:

(1) On the one hand, the increased proportion of game and advertising revenue drove the overall gross margin up to 35%, exceeding most previous periods when most revenue came from games.

The absolute value of revenue sharing costs increased month-on-month. Dolphin expects that this may be mainly due to high game sharing and high sharing of Up users' Spark advertising (Bilibili only shares 5%, with the remaining 95% going to Up users).

(2) On the other hand, it is mainly driven by a decrease in server depreciation costs. After a cycle, the SBC expenses for R&D personnel began to resume growth.

In terms of other expenses, the third quarter was mainly characterized by a significant increase in game promotion costs.

However, from the perspective of traffic monetization/cost relationship that Dolphin has been observing, the overall value that can be extracted from a single user has increased in the third quarter, indicating that the platform's monetization efficiency is improving.

Bilibili

Financial Report Season May 24, 2024 Financial Report Review "Crazy Decline, What Did Bilibili Do Wrong Again?" March 7, 2024 Financial Report Review "Bilibili: Recognize Reality, Seek Survival Through Independent Research and Development" November 29, 2023 Financial Report Review "Bilibili: The Worst of the Worst, Confidence is Being Worn Away" August 17, 2023 Financial Report Review "Bilibili: Can Advertising Save This Small, Broken Station? Not So Easy!" June 1, 2023 Financial Report Review "Bilibili: The 'Never-Growing' Small, Broken Station" March 3, 2023 Financial Report Review "Bilibili Needs an 'iQIYI-Style' Blood Transfusion" November 29, 2022 Financial Report Review "Is Bilibili's Operating Inflection Point Approaching? Still Needs a 'Strong Medicine' to Break Doubts" June 9, 2022 Financial Report Review "Will the Wild Bilibili Return to Its Original Form?" March 3, 2022 Financial Report Review "Average Grades, No Obstacles to Rising? Bilibili's Faith Comes from Rui Di" November 17, 2021 Financial Report Review "Is Bilibili Spending Too Much Money Again? Continuing to Break Out of the Circle for You" August 19, 2021 Financial Report Review "Is the Racing Bilibili About to Fall to Earth?" May 13, 2021 Financial Report Review "Bilibili Q1 Report Review: Advertisers Have Long Been Attracted to This Small, Broken Station" February 25, 2021 Financial Report Review "Dolphin Investment Research | Advertising Monetization Exceeds Expectations, Bilibili's Breakout is Still Accelerating" November 19, 2020 Financial Report Review "Dolphin Investment Research | Confirmed! This Small, Broken Station is Still the Brightest Star in the Pan-Entertainment Circle"

In-Depth January 6, 2023 "Pan-Entertainment 'Grand Opening', Which Rebound Will Last Longer, Tencent or Bilibili?" June 15, 2022 "Both Suffering from 'Massive Losses' - Can Kuaishou or Bilibili Recover?" May 5, 2022 "Breaking the Pan-Entertainment Pattern: Exploring the Vast Universe of Tencent and Bilibili" March 22, 2021 "Falling Prices and Second Marriages: Is Bilibili a Trap or an Opportunity?" March 12, 2021 "Dolphin Investment Research | Bilibili Series II: Can Bilibili Really Never Have Ads When It Comes to Supporting a Family?" March 9, 2021 "Dolphin Investment Research | How Far is Bilibili from Rui Di's Four Hundred Million User Goal?"