Who Reigns Supreme in Profitability Among Xiaohongshu's Industrial Chain Enterprises?

![]() 01/16 2025

01/16 2025

![]() 484

484

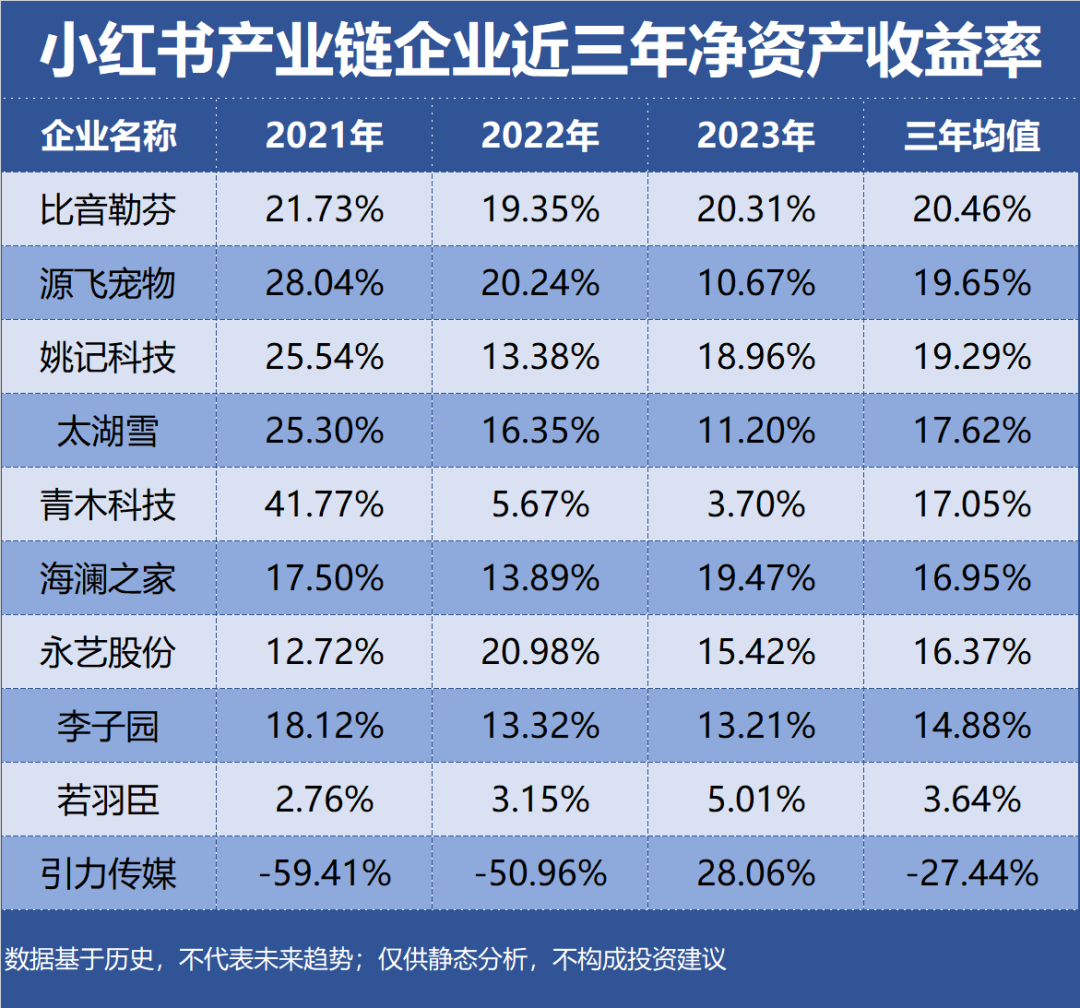

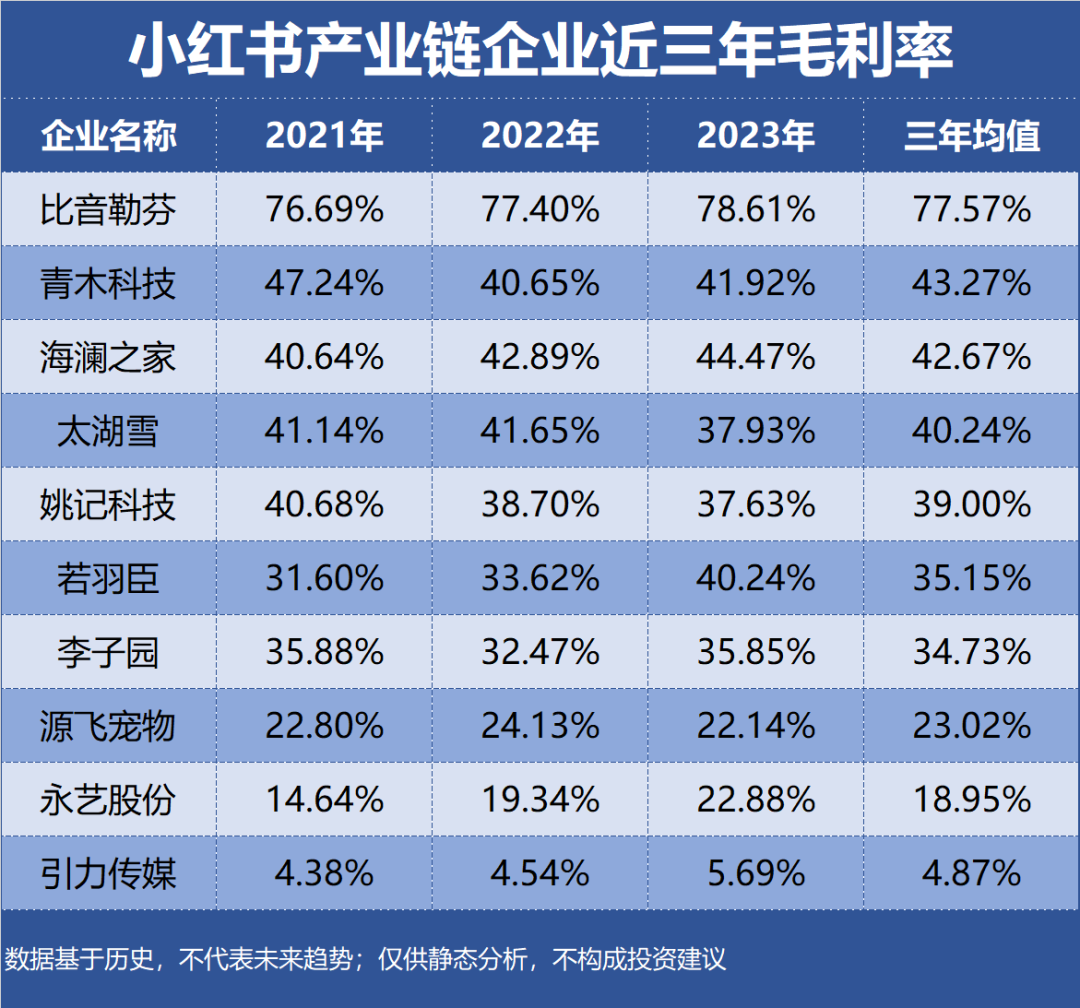

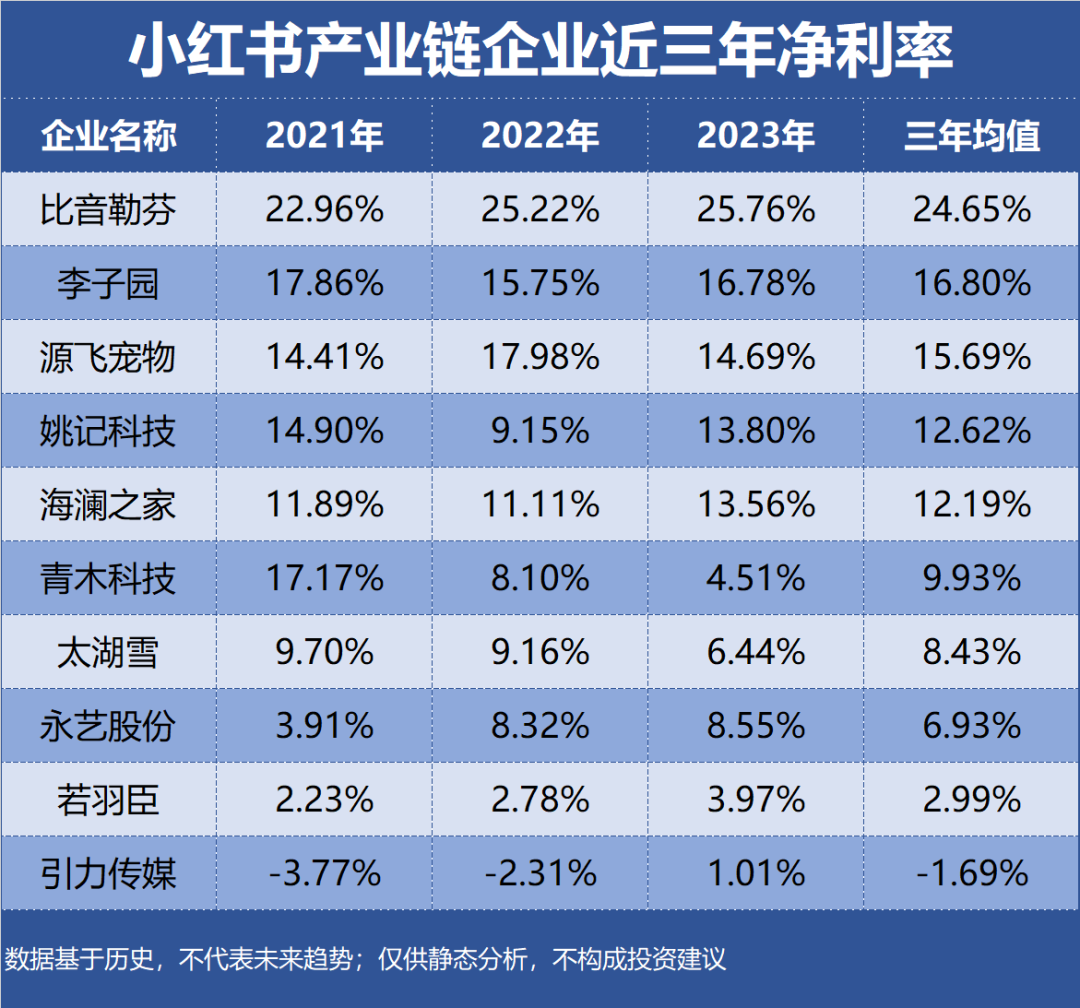

Xiaohongshu stands as a lifestyle platform and a hub for consumption decisions, leveraging machine learning to efficiently match vast amounts of information with users. On this platform, users capture life's moments and share their lifestyles through short videos, images, and text, fostering interactions rooted in shared interests. Profitability, typically gauged by the volume and level of corporate earnings over a specific period, involves a deep dive into a company's profit rate. This article, part of the "Corporate Value" series, focuses on "Profitability," analyzing 48 enterprises within the Xiaohongshu industrial chain using return on equity (ROE), gross profit margin, net profit margin, and other metrics as evaluation indicators. Note that the data presented is historical and does not predict future trends; it serves as a static analysis and does not constitute investment advice.

Here are the top 10 most profitable enterprises in the Xiaohongshu industrial chain:

10th - Taihuxue Industry Segment: Home Textile

- Profitability: ROE 17.62%, Gross Profit Margin 40.24%, Net Profit Margin 8.43%

- Performance Forecast: ROE has declined to 11.20% over the past three years, with the latest forecast averaging 9.95%

- Main Products: Silk quilts, accounting for 53.54% of revenue with a gross profit margin of 33.87%

- Company Highlights: Taihuxue employs a matrix communication strategy encompassing "celebrity and other high-potential group recommendations + authoritative media and top KOL content co-creation + waist KOL seeding," comprehensively covering popular social media platforms like Xiaohongshu.

9th - Yuanfei Pet Industry Segment: Entertainment Products

- Profitability: ROE 19.65%, Gross Profit Margin 23.02%, Net Profit Margin 15.69%

- Performance Forecast: ROE has declined to 10.67% over the past three years, with the latest forecast averaging 11.30%

- Main Products: Pet snacks, accounting for 46.04% of revenue with a gross profit margin of 16.05%

- Company Highlights: Yuanfei Pet operates and sells its own and agent brands primarily through major domestic e-commerce platforms, with online stores on Tmall, Taobao, Douyin, JD.com, Pinduoduo, Xiaohongshu, and other e-commerce platforms.

8th - Qingmu Technology Industry Segment: E-commerce Services

- Profitability: ROE 17.05%, Gross Profit Margin 43.27%, Net Profit Margin 9.93%

- Performance Forecast: ROE has declined to 3.70% over the past three years, with the latest forecast averaging 9.80%

- Main Products: E-commerce sales services, accounting for 51.44% of revenue with a gross profit margin of 48.18%

- Company Highlights: Qingmu Technology's brand digital marketing business spans various in-station marketing IPs, platform marketing channels, and social media platforms inside and outside the station.

7th - Ruoyuchen Industry Segment: E-commerce Services

- Profitability: ROE 3.64%, Gross Profit Margin 35.15%, Net Profit Margin 2.99%

- Performance Forecast: ROE has risen to 5.01% over the past three years, with the latest forecast averaging 9.99%

- Main Products: Agency operations, accounting for 49.69% of revenue with a gross profit margin of 34.86%

- Company Highlights: Ruoyuchen is a comprehensive e-commerce service provider for global high-quality consumer brands, collaborating with channels such as Tmall, Douyin, JD.com, Xiaohongshu, and Pinduoduo.

6th - Liziyuan Industry Segment: Soft Drinks

- Profitability: ROE 14.88%, Gross Profit Margin 34.73%, Net Profit Margin 16.80%

- Performance Forecast: ROE has declined to 13.21% over the past three years, with the latest forecast averaging 12.86%

- Main Products: Milk-containing beverages, accounting for 96.57% of revenue with a gross profit margin of 38.78%

- Company Highlights: Besides shelf e-commerce, Liziyuan has ventured into live streaming on Douyin, Kuaishou, Xiaohongshu, and major e-commerce platforms, enriching its online sales product matrix.

5th - Uees Industry Segment: Finished Furniture

- Profitability: ROE 16.37%, Gross Profit Margin 18.95%, Net Profit Margin 6.93%

- Performance Forecast: ROE has fluctuated between 12%-21% over the past three years, with the latest forecast averaging 13.43%

- Main Products: Office chairs, accounting for 96.36% of revenue with a gross profit margin of 16.60%

- Company Highlights: Uees continuously engages in content and topic marketing through platforms like Douyin, Xiaohongshu, Bilibili, and Zhihu.

4th - Heilan Home Industry Segment: Non-sports Apparel

- Profitability: ROE 16.95%, Gross Profit Margin 42.67%, Net Profit Margin 12.19%

- Performance Forecast: ROE has fluctuated between 13%-20% over the past three years, with the latest forecast averaging 13.76%

- Main Products: The Heilan Home series, accounting for 75.28% of revenue with a gross profit margin of 45.33%

- Company Highlights: Heilan Home utilizes Xiaohongshu as its primary promotion platform, supplemented by other self-media platforms, to create multi-channel and multi-platform communication and conversion.

3rd - Yaoji Technology Industry Segment: Games

- Profitability: ROE 19.29%, Gross Profit Margin 39.00%, Net Profit Margin 12.62%

- Performance Forecast: ROE has fluctuated between 13%-26% over the past three years, with the latest forecast averaging 17.38%

- Main Products: Digital marketing, accounting for 46.03% of revenue with a gross profit margin of 4.99%

- Company Highlights: Yaoji Technology's shareholder company, Qinchen Technology, is an official S-level MCN agency certified by Xiaohongshu.

2nd - Bifenefun Industry Segment: Non-sports Apparel

- Profitability: ROE 20.46%, Gross Profit Margin 77.57%, Net Profit Margin 24.65%

- Performance Forecast: ROE has fluctuated between 19%-22% over the past three years, with the latest forecast averaging 18.11%

- Main Products: Upper garments, accounting for 51.14% of revenue with a gross profit margin of 81.09%

- Company Highlights: Bifenefun collaborates deeply with e-commerce platforms, diverting high-quality offline VIP customers online through live streaming, Xiaohongshu seeding, Douyin, WeChat Mini Programs, and other methods.

1st - Yinli Media Industry Segment: Marketing Agency

- Profitability: ROE -27.44%, Gross Profit Margin 4.87%, Net Profit Margin -1.69%

- Performance Forecast: The highest ROE over the past three years was 28.06%, with the latest forecast averaging 18.57%

- Main Products: Digital marketing, accounting for 97.07% of revenue with a gross profit margin of 5.31%

- Company Highlights: Yinli Media integrates multiple new media platforms like ByteDance, Alibaba, Kuaishou, and Xiaohongshu to offer customers comprehensive data marketing solutions, including global GTM breakdown, touchpoint efficiency optimization, multi-platform audience targeting, and content communication point diagnosis.

Visual representation of the top 10 most profitable enterprises in the Xiaohongshu industrial chain, including their ROE, gross profit margin, and net profit margin over the past three years:

For more insights on enterprise growth and profitability, join the Knowledge Planet.

(Add WeChat: cuixs92)