Why Apple's iPhone Faces Declining Popularity in China Amid a 25% Sales Drop?

![]() 01/24 2025

01/24 2025

![]() 650

650

According to data from Canalys, in the fourth quarter of 2024, Apple maintained its top spot in the Chinese market but witnessed a year-on-year decline of 25%. The gap between Apple and the second-placed VIVO and third-placed Huawei narrowed to merely 200,000 units.

Even in comparison to Xiaomi, which ranked fourth, the difference amounted to just 900,000 units, with the market share variance remaining within 1%.

In terms of growth rates, Apple stood out as the only brand to record a decline of 25%, while other major players—Xiaomi (up 29%), Huawei (up 24%), OPPO (up 18%), and VIVO (up 14%)—all witnessed positive growth.

It is evident that almost all domestic mobile phone brands are vying for Apple's market share, resulting in a drop from 24% in the same period last year to 17%, a significant decrease of 7 percentage points.

Given that the fourth quarter is typically Apple's most crucial period due to the launch and robust sales of new iPhones, a lackluster performance during this time can significantly hamper its momentum, which undoubtedly poses a significant challenge.

So, what hindered Apple's sales in China in 2024? The iPhone 16 did not perform exceptionally poorly and enjoyed strong initial sales.

Firstly, Huawei's robust comeback has significantly impacted Apple. Following the release of the Huawei Mate 60, marking its strong return, Huawei has continued to launch phones such as the Pura 70, Mate 70, Mate XT, and Mate X6.

Apple's previous dominance in China was partly attributed to Huawei's challenges, allowing Apple to capture a significant share of the high-end market. With Huawei's resurgence, Apple's sales are inevitably affected.

Consequently, we observe a steady growth for Huawei and a decline for Apple. In 2024, iPhone shipments in the domestic market plummeted, with annual shipments reaching 42.9 million units, a decrease of nearly 10 million units compared to 2023, representing a 17% drop.

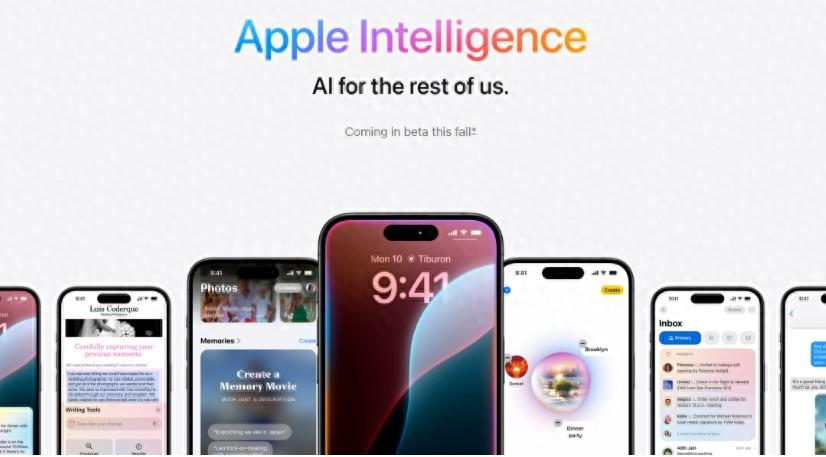

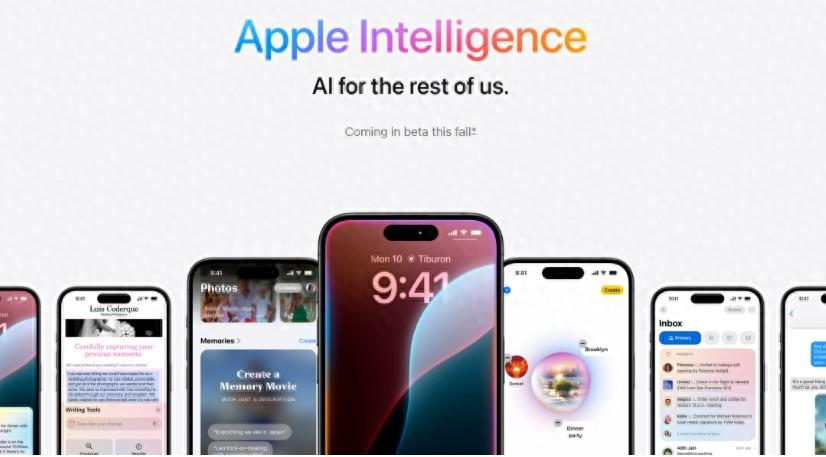

Secondly, the highly anticipated AI feature in Apple's products has yet to be implemented in China. Notably, AI is a key selling point of iOS 18, but its absence in the Chinese market has left many users disappointed and impatient with Apple.

Furthermore, with the resumption of state subsidies, many Apple phones, particularly the Pro series, are priced above 6,000 yuan, rendering them ineligible for subsidies.

It is anticipated that as state subsidies continue to promote the sales of Huawei and other domestic mobile phones, Apple's sales will likely continue to decline. What are your thoughts on this?