Apple Appeals Against the “Sneaky” Fine

![]() 07/11 2025

07/11 2025

![]() 504

504

Appealing is the most cost-effective choice for Apple. Author | Xue Xingxing Editor | Jiang Jiao

Appealing is the most cost-effective choice for Apple. Author | Xue Xingxing Editor | Jiang Jiao

Cover | Sharp-tongued Lawyer

Apple has decided to challenge the European Commission to the fullest extent. Two months after being slapped with a 500 million euro fine by the European Commission, Apple filed an appeal with the General Court of the European Union before the deadline, aiming to uphold its dominance in the App Store.

Apple issued a strongly worded statement to the media, branding the Commission's fine as "unprecedented" and arguing that the ruling and fine exceeded legal requirements. Apple publicly stated, "As our appeal will demonstrate, the European Commission is dictating how we run our own store and imposing business terms that confuse developers and harm users."

At the heart of this dispute lies the "Apple Tax," which has garnered significant criticism for Apple in recent years. For a long time, Apple has imposed a 15%-30% commission on in-app purchases within the iOS system. Today, software service revenue, inclusive of the "Apple Tax," has emerged as Apple's fastest-growing and most profitable segment, generating over $100 billion in annual revenue.

However, this "tax rate" is under scrutiny in various regions as more countries begin to investigate the monopolistic practices of tech giants. Whether it's Apple, Google, Meta, or Amazon, they all face substantial fines and antitrust lawsuits globally. In April this year, the European Commission imposed fines of 500 million euros on Apple and 200 million euros on Meta, respectively, under the newly enacted Digital Markets Act (DMA). Apple's current appeal concerns this fine.

To some extent, Apple has no choice but to litigate. If the European Commission's ruling takes effect, other countries may follow suit and investigate Apple, thereby shaking the foundation of the App Store. Prior to this, Apple has already been embroiled in lawsuits and antitrust investigations related to the "Apple Tax" in various parts of the United States. Even in China, Apple has repeatedly clashed with Tencent over disputes involving tipping and commission fees within WeChat mini-programs.

Appealing is also the most cost-effective strategy for Apple—legal proceedings often stretch over years, allowing Apple to delay paying the fine as long as possible and prolong the court battle.

In fact, last year, the European Commission imposed a 1.84 billion euro fine on Apple for its monopolistic behavior in the streaming music business, but Apple has yet to pay this fine. Apple swiftly appealed and requested the withdrawal of the Commission's penalty, and the case remains pending.

The dispute between Apple and the European Union will not abate.

Despite the "Apple Tax" being controversial worldwide for many years, it was the European Union that first took action against Apple. The European Union was also the first region to enact legislation targeting the monopolistic positions of tech giants, initiating plans for the DMA Act as early as 2020.

However, the investigation into the "Apple Tax" began even earlier. In 2015, Spotify, the world's largest streaming music giant, began accusing Apple of unfair competition before the European Commission, opposing Apple's commission rate of up to 30%, and formally submitted a complaint in 2019. Spotify's founder, Daniel Ek, has criticized Apple for years for its unfair competitive practices, claiming that Apple acts as both a referee and a player, deliberately suppressing other app developers.

Open letter from Spotify's founder upon filing the formal complaint.

The case dragged on for seven years before a final verdict was handed down last year. On March 4, 2022, the European Commission officially fined Apple 1.84 billion euros, alleging that Apple had engaged in monopolistic behavior in the streaming music business.

Margrethe Vestager, Executive Vice-President and Commissioner for Competition of the European Commission, publicly stated that Apple had "abused" its dominant position in the App Store for streaming music software for a decade, preventing streaming music software providers from informing consumers about "cheaper" paid music services outside the Apple ecosystem, thereby violating EU antitrust regulations.

Apple issued a statement of opposition on the day of the verdict, claiming that the decision announced by the European Commission today was in the name of competition and "consolidated the leading position of a successful European enterprise in the digital music market."

At that time, this verdict sparked considerable discussion in the market—not because the EU continued its tradition of heavily fining tech giants, but because the verdict was issued on the eve of the official entry into force of the EU's DMA Act. Three days after Apple received the 1.84 billion euro fine, the DMA Act was fully implemented.

The DMA Act is specifically tailored for tech giants, with the first batch of key regulatory targets being global platform companies, including Apple, Microsoft, Google, Meta, Amazon, and ByteDance. The DMA Act imposes a regulatory intensity rarely seen globally, with fines of up to 10% of a company's global turnover for violations. If the company continues to violate the regulations, the fine ratio can increase to 20%. In the most severe cases, the European Commission can also force tech giants to sell related businesses.

Apple's dissatisfaction with the European Commission's ruling also stems from the fact that they had already decided to change the App Store policy before the DMA Act came into effect, believing that the EU was forcing the ruling through before the DMA Act officially took effect.

Even under the latest DMA Act, the European Union did not spare Apple. Over the past year, Apple has made several adjustments in the EU region, such as lifting restrictions on third-party app stores in the EU and allowing EU users to bypass the App Store for payments.

However, in the view of the European Commission, these measures by Apple still hinder the principle of fair competition. In April this year, the European Union imposed another fine of 500 million euros on Apple, citing Apple's violation of the "anti-steering obligation" in the DMA Act. This was the first fine issued under the DMA Act.

The DMA Act requires digital platforms not to restrict users from using other products and services. The EU believes that Apple artificially imposes multiple restrictions, trying to guide users back to the App Store system and preventing third-party developers from providing users with information about sales and discounts outside the App Store.

The European Commission fines Apple 500 million euros.

Apple appealed to the General Court of the European Union yesterday. The General Court of the European Union is the second-tier court in the EU legal system, specializing in cases involving EU law. Previously, many controversial cases between Google, Microsoft, Apple, and the EU were heard by the General Court of the European Union.

Lin Xiaojian, a lawyer at Beijing Guoshun Law Firm, explained that the General Court of the European Union mainly handles disputes involving administrative actions of EU institutions, including cases in the fields of competition law, trade, and the environment, and has jurisdiction over administrative penalty decisions made by the European Commission. As the court of first instance, the General Court of the European Union focuses on factual review and legal application.

These cases often take years to hear. Lawyer Lin Xiaojian explained that cases in the General Court usually take 1-3 years, and complex cases may be extended to 5 years. In 2019, after the EU imposed a fine of 1.49 billion euros on Google's AdSense advertising service, Google appealed to the General Court of the European Union, and the verdict was not handed down until last year, reversing the fine imposed by the European Commission. If tech giants are dissatisfied with the judgment of the General Court of the European Union, they can still appeal to the Court of Justice of the European Union (CJEU), further extending the litigation cycle.

Lawyer Lin Xiaojian stated that the outcome of the lawsuit between Apple and the European Union will directly impact Apple's antitrust investigations worldwide, including countries such as Brazil, Switzerland, and Turkey, which have all initiated antitrust investigations against Apple, with allegations highly similar to those in the EU case. The EU's intervention in Apple's App Store policies serves as a benchmark and can provide a reference enforcement template for regulatory authorities in countries like Turkey and Brazil.

Currently, both appeals filed by Apple against the European Commission's penalties are still in the acceptance stage and have not yet entered the substantive trial process. Based on the timeliness of similar cases in the past, these judgments may not be known until around 2030.

Tom Smith, a competition law lawyer at Geradin Partners, told the media that Apple fundamentally resents any attempt to change the App Store. He said that for Apple, spending a few million dollars in legal fees to disrupt and delay the development of a more open app ecosystem is entirely worth it, given that it is a market worth tens of billions of dollars annually.

How long will the "Apple Tax" endure?

When Apple's late founder Steve Jobs launched the App Store in 2008, he might not have realized that it would spawn a mobile internet market hundreds of times larger than smartphones.

Initially, Jobs even refused to open the App Store to the public, believing that third-party apps would degrade the iPhone's user experience. There was no rigorous justification process for the 30% commission rate set by Apple for the App Store; it was simply chosen as a cheaper alternative to the offline distribution ratio of physical software, which was roughly 40% to 50%.

Bloomberg evaluated that for early app developers, the 30% tax rate set by Apple seemed like a fair deal at the time. Without the hardware, software, development tools, payment methods, and even platform investments provided by Apple, the current prosperous mobile internet economy would hardly exist.

The purchase process provided by Apple is also swift and elegant, allowing users to complete in-app payments with just a tap on the phone screen, eliminating the need for developers to build their payment processes or consider global regional differences.

Decades later, these app developers have gradually grown into giant companies themselves. Today, almost all the well-known Chinese internet giants are built on apps on mobile phones, whether it's Alibaba, Tencent, or ByteDance.

Apple's latest generation of operating systems.

Essentially, app stores represented by the App Store have become the infrastructure of the digital economy era. Consumers no longer require re-education, third-party payment methods are sufficiently developed, and even developers themselves can establish a comprehensive app distribution and payment ecosystem. Apple's stubborn adherence to a 30% commission rate now seems somewhat outdated.

Over the past few years, government regulatory agencies, industry giants, and even small and medium-sized developers have begun to oppose the "Apple Tax." From the European Commission to the US Department of Justice, from game company Epic Games to streaming giant Spotify, and even domestic disputes between Tencent and Apple surrounding WeChat mini-programs, they are all impacting Apple's ecological foundation.

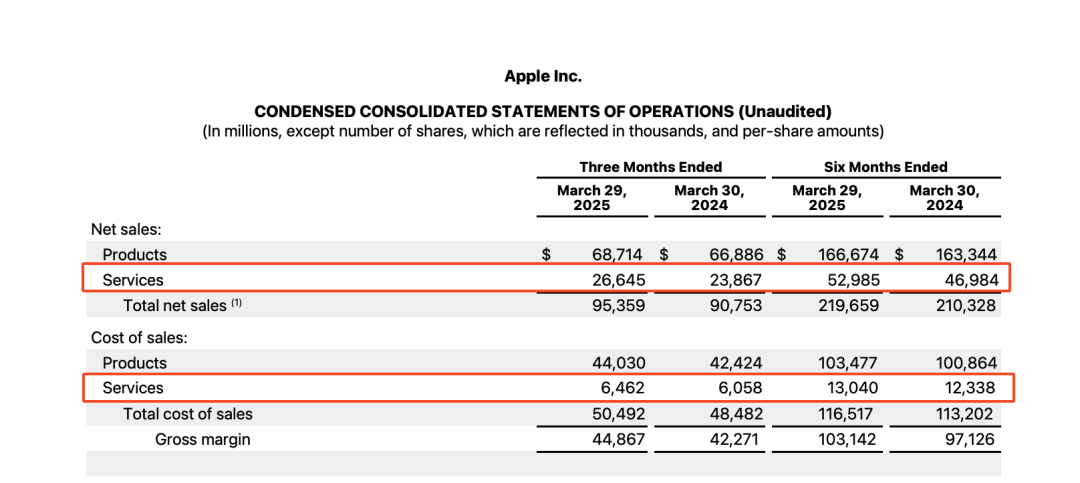

Apple certainly does not want to relinquish this revenue. Over the past few years, service revenue, including third-party commissions, has surpassed hardware revenue to become Apple's most important source of growth, with a profit margin consistently above 70%, making it Apple's "cash cow." In the first quarter of this year, Apple's service revenue reached $26.6 billion, a year-on-year increase of 12%, with a gross margin climbing to 75.7%, contributing nearly 45% of the company's gross profit with one-third of its revenue.

Apple's Q1 2025 financial report

Apple's Q1 2025 financial report

After regulatory agencies worldwide strengthened their antitrust investigations into tech giants, Apple had to make changes to the App Store, but these changes were often forced. For example, third-party app stores have been opened up in the EU region, but users in most parts of the world, including China, can still only download apps within the App Store. Or due to the lawsuit from Epic Games, Apple had to open up third-party payments in the US this year, but this change is still limited to the US region.

Even in China, the "Apple Tax" is facing increasing opposition. In 2021, a Chinese consumer, Mr. Jin, sued Apple, with the lawsuit involving excessive "Apple Tax" charges and monopolistic suspicion of the sole payment method. In May last year, the Shanghai Intellectual Property Court ruled in favor of the defendant in the first instance. Lawyer Lin Xiaojian stated that although Mr. Jin's case against the Apple Tax ended in defeat, the Shanghai Intellectual Property Court had already ruled that Apple had a dominant position in the Chinese market, providing a basis and reference for subsequent regulatory actions.

He said that from a legal perspective, China's Anti-Monopoly Law and the Anti-Monopoly Guidelines for the Platform Economy have strengthened the supervision of the platform economy, clearly prohibiting the abuse of market dominance and restrictive competition behaviors. Apple's 30% high commission rate, closed payment system, and restrictions on third-party channels in the App Store are likely to be deemed as imposing unreasonable trading conditions, violating the market principle of fair competition.

On May 27, Apple issued a press release highlighting the App Store's success in thwarting over $9 billion in fraudulent transactions over the past five years. Notably, in 2024 alone, Apple prevented more than $2 billion in fraudulent activities and intercepted approximately 2 million high-risk app submissions.

Apple's official press release

However, it's crucial to recognize that tech companies' persistent opposition to the so-called 'Apple Tax' does not inherently align them with justice. For instance, Tencent has steadfastly declined to pay Apple's commission on WeChat mini-games within the iOS ecosystem, yet simultaneously, Tencent levies commissions ranging from 30% to 40% on WeChat mini-games within the Android system.