"Am I Heard Correctly? Some Still Doubt Our Seriousness?"

![]() 07/15 2025

07/15 2025

![]() 637

637

Introduction

The truth is, both sides now stand on equal footing.

I'm not sure when it began, but ever since new entrants in the automotive industry started ramping up production, they've developed a penchant for releasing the previous month's sales figures on the first day of each month. Frankly, this level of enthusiasm is unmatched by many traditional automakers. Even those with storied histories, impressive sales numbers, and marketing prowess never considered sales figure releases as a strategic move.

Indeed, under the influence of these newcomers, the entire automotive sector has become exceedingly focused on sales announcements. In recent years, whether traditional automakers, independent brands, or joint ventures, they all rush to announce positive sales figures as soon as they're available. Even if sales aren't stellar, they'll still find highlights to share the good news.

However, for consumers, they continue to prefer the sales figures of these new automotive players, with the top and bottom performers getting the most attention. So, rushing to release sales figures remains an effective strategy for the newcomers. On the other hand, despite traditional automakers now offering many new energy vehicles, it's still challenging for them to be included in industry data statistics.

In particular, some traditional automakers have not only nurtured numerous so-called "new automotive players," the most notable being national team members like Lantu, AVATR, IM Motors, ARCFOX, etc. Moreover, some automakers have differentiated their new energy lineups by introducing a plethora of new energy models, such as Geely Galaxy, Changan Qiyuan, Chery Fengyun, etc.

Today, everyone is in the new energy space. While the so-called "new automotive players" have nearly a decade of market experience, some new energy brands or series from traditional automakers may only be 3-5 years old. However, longevity doesn't guarantee success. Only compelling sales figures speak the truth. At this juncture, it's better to examine the capabilities of these overlooked traditional newcomers.

01 Newcomers with Enhanced Strength

If we rewind to the new energy vehicle market three years ago, there were no Geely Galaxy or Changan Qiyuan in the Chinese automotive landscape. Back then, among traditional automakers venturing into new energy, BYD and AION were perhaps the most renowned. However, it's only in the past two years that a group of new traditional automakers has emerged, each making a significant impact.

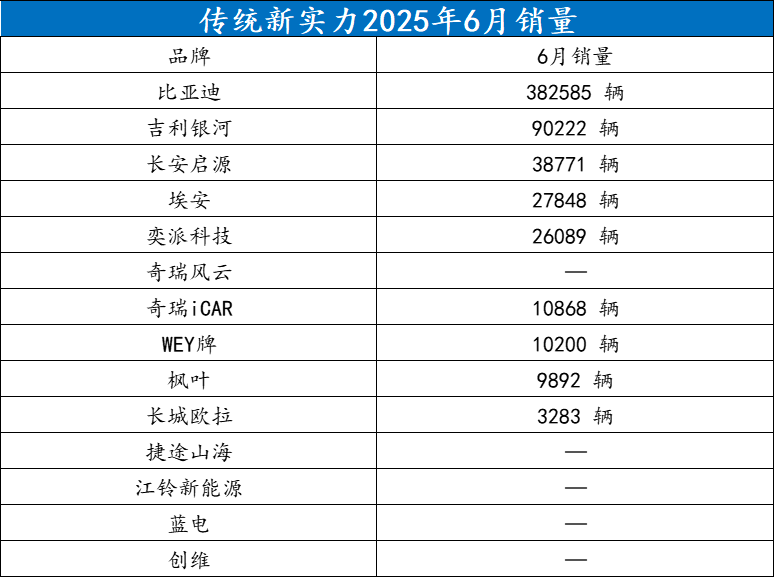

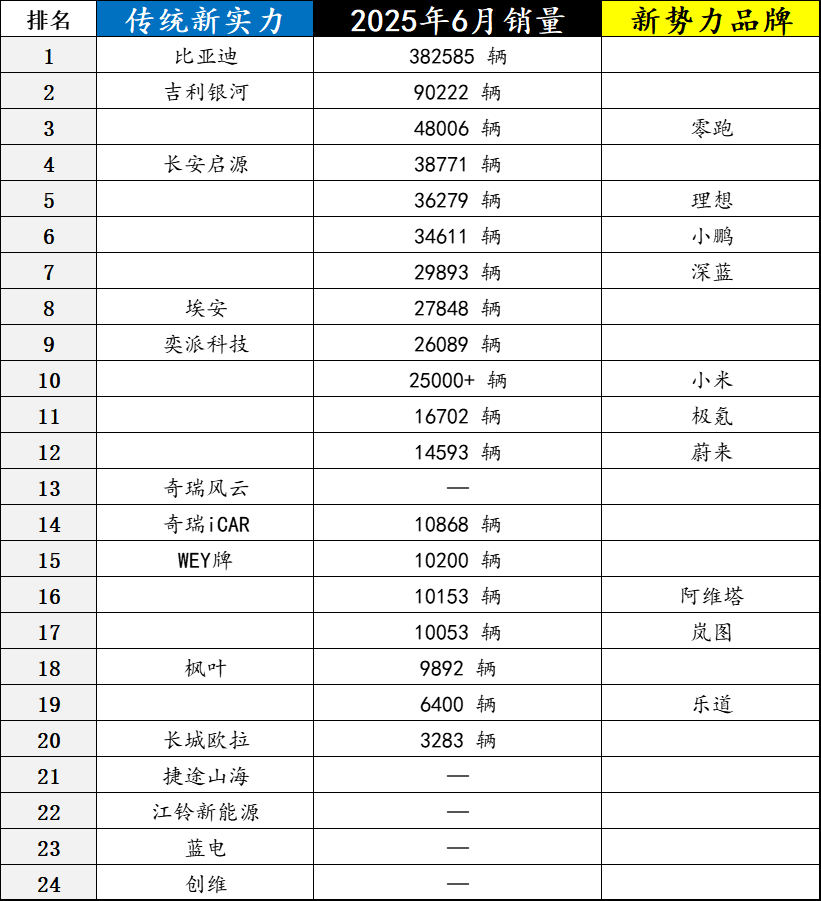

On the first day of July, the internet buzzed with sales rankings of new automotive brands. Now, with the release of data by the China Passenger Car Association (CPCA), we finally get a glimpse of the new energy sales levels of these new traditional automakers. Actually, compiling this list was quite challenging, as many brands still don't proactively release their sales figures.

From the list, if BYD is classified as a new traditional automaker, it undoubtedly reigns supreme, with no other brand able to challenge its position. Therefore, using BYD's overwhelming data to prove the competitiveness of new traditional automakers isn't convincing.

But the second-ranked Geely Galaxy is now a household name. With sales exceeding 90,000 units in a single month, it's truly a dark horse in the new energy vehicle market. This not only showcases Geely Galaxy's strength but also indicates that it has spearheaded a wave of transformation among new traditional automakers.

For instance, third-ranked Changan Qiyuan and fifth-ranked E-Pai Technology are, like Geely Galaxy, brands or entities specializing in new energy that have spun off from the parent brand. Changan Qiyuan didn't garner much market attention due to its products, but with the rapid sales growth of the Changan Qiyuan Q07, this model is expected to revitalize the entire Changan Qiyuan lineup.

E-Pai Technology is actually a new company established at the end of June, encompassing the sales of three brands: Dongfeng Fengshen, Dongfeng E-Pai, and Dongfeng Nano. However, Dongfeng Fengshen also sells fuel vehicles, so including E-Pai Technology in this statistics is a bit of a "stretch." But it doesn't matter, as Dongfeng Fengshen is also transitioning to new energy, and fuel vehicle sales are minimal.

Many, including myself, have been keeping an eye on Chery Fengyun's moves. Unfortunately, Chery Fengyun was previously considered a series and was only officially upgraded to a brand on July 8, a few days ago. So, it's understandable that there were no specific sales figures for Chery Fengyun before, and it's estimated that there will be separate sales figures next month.

Even though Chery Fengyun hasn't released its sales figures, another standalone new energy brand under Chery has performed quite well. It's iCAR. In fact, the iCAR brand is on par with the Chery brand, Jetour brand, and EXEED brand. So, it cannot be said to be under Chery, but iCAR's sales figures are definitely counted towards Chery Automobile.

Today's WEY brand is considered one of the more successful Chinese brands in transitioning from fuel vehicles to new energy vehicles. Previously, WEY brand vehicles were all fuel SUVs like the VV5/VV6/VV7. Nowadays, WEY brand only has a unified lineup of new energy models, with the Blue Mountain and Alpine as the pillar products, along with the "Coffee Series."

These are the brands that new traditional automakers can boast about. By compiling the data, it's evident that the number of brands from new traditional automakers is now comparable to that of new automotive players, and both may be on equal footing. However, in terms of sales, they also seem to be at a similar level.

02 Newcomers Are All New Forces

However, those well-versed in the new energy automotive industry and its brands will easily notice that a few new energy brands are missing from the list. The most prominent are the "Hongmeng Zhixing" category, as well as BYD's brands of Denza, FANGCHENGBAO, and Yangwang.

Hongmeng Zhixing is easy to understand. Communicators, demanders, and statisticians all have different strategies, so whether "Hongmeng Zhixing" is considered a single brand or whether its "Four Realms" brands are counted separately isn't worth delving into. It's just a matter of different statistical approaches.

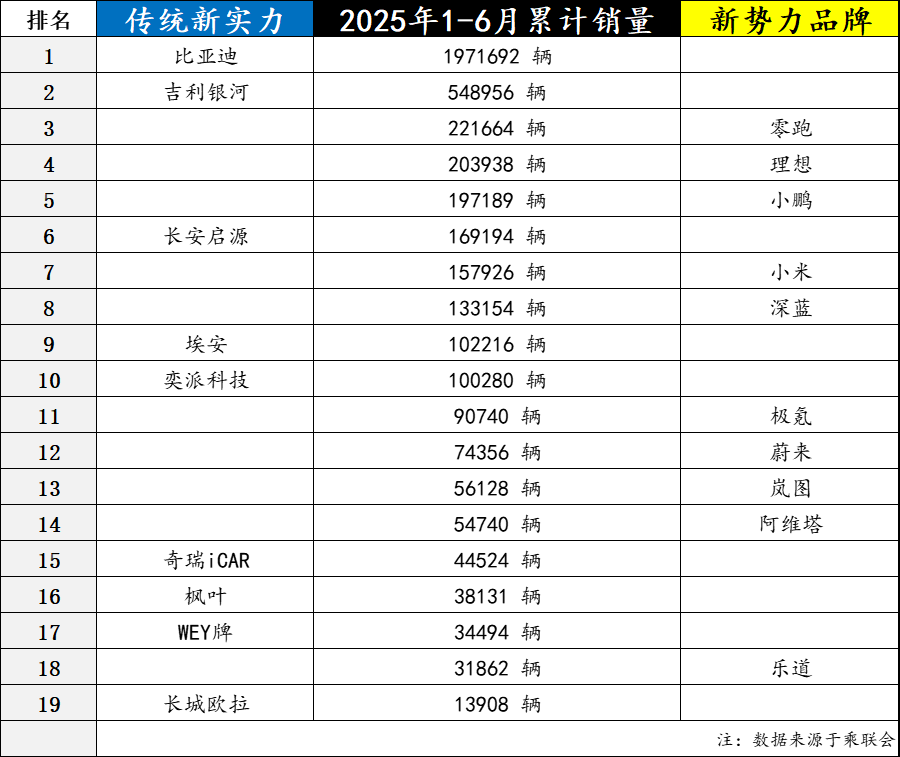

Of course, Hongmeng Zhixing also released its sales data for June this year: 52,747 units. It's said to have set a new record, and of course, this sales figure also surpassed NIO, ranking second only to Geely Galaxy, so the sales are still very impressive. Some have also calculated its cumulative sales for the first half of 2025, amounting to 215,064 units, slightly lower than NIO, but still considerable.

Consolidating sales figures isn't unique to Hongmeng Zhixing. For example, last month, when other media outlets were compiling NIO's sales figures, they also included the sales of Letao, collectively referred to as the NIO Group. We also know that Zeekr and Lynk & Co. have undergone related integrations, but Zeekr's sales are calculated separately. So, sales statistics are indeed a complex task.

As for why brands like Denza, FANGCHENGBAO, and Yangwang aren't often included in statistics alongside new automotive players like Lantu and AVATR, I can't provide a clear explanation. But I believe that with BYD, the leading automaker, paving the way, these three brands will find it easier to achieve their missions compared to other automotive companies.

Regardless, from the cumulative sales of new energy brands in the first half of this year, both new traditional automakers and new automotive players can be evaluated together. The aura surrounding new automotive players has faded, and the efforts of new traditional automakers continue. It's still unclear who is stronger and who is weaker.

However, the reason various automakers compete in "sales releases" is actually a form of comparison, and the same is true for those compiling sales tables. They always want to use numbers to gain an edge. Especially when traditional automakers haven't fully transitioned to new energy, they were heavily criticized and belittled by new automotive players and their supporters.

Now, as traditional automakers step up their efforts, the new energy automotive sector is witnessing a true contest. As the market moves from an experimental phase to widespread adoption, consumers' considerations for vehicle quality, service networks, and long-term value gradually surpass technological gimmicks. Traditional automakers, leveraging their deep industrial heritage, are building overwhelming advantages in these core dimensions.

The new forces once disrupted the industry with their revolutionary approach, but the transformation of traditional automakers is far from a passive response. They deeply integrate their automaking experience with new energy technologies, forming barriers in underlying capabilities such as supply chain stability, production scale, and quality control standardization, enabling them to deploy technological iterations and market expansion at a more leisurely pace.

The market will eventually return to the essence of rational competition. The ultimate battle in the new energy automotive sector won't hinge on numerical games on spec sheets but on who can provide more reliable products at lower costs and who can solve users' worries with a more comprehensive network. The accumulation of traditional automakers in manufacturing heritage, channel coverage, and brand trust is transforming into a key bargaining chip for gaining the upper hand.

Of course, this isn't to say that new automotive players have no opportunities. On the contrary, if they learn from the advantages of traditional automakers while leveraging their own strengths, they can continue to compete in the Chinese automotive market. But relying solely on simplistic tactics like public opinion wars to compete against traditional automakers is definitely not an effective approach anymore.

Editor-in-Chief: Yang Jing | Editor: He Zengrong