Ride-Hailing Platforms Navigate Challenging Waters of Value Competition

![]() 08/21 2025

08/21 2025

![]() 585

585

Amidst the triple challenges of policy compliance, aggregation revolution, and sustainable development, ride-hailing platforms' collective reduction in driver commissions emerges as an inevitable strategy. Despite the painstaking process, these platforms must find a path forward, aiming to break the impossible triangle of income distribution among users, drivers, and platforms.

Original article by New Entropy's Auto & Travel team

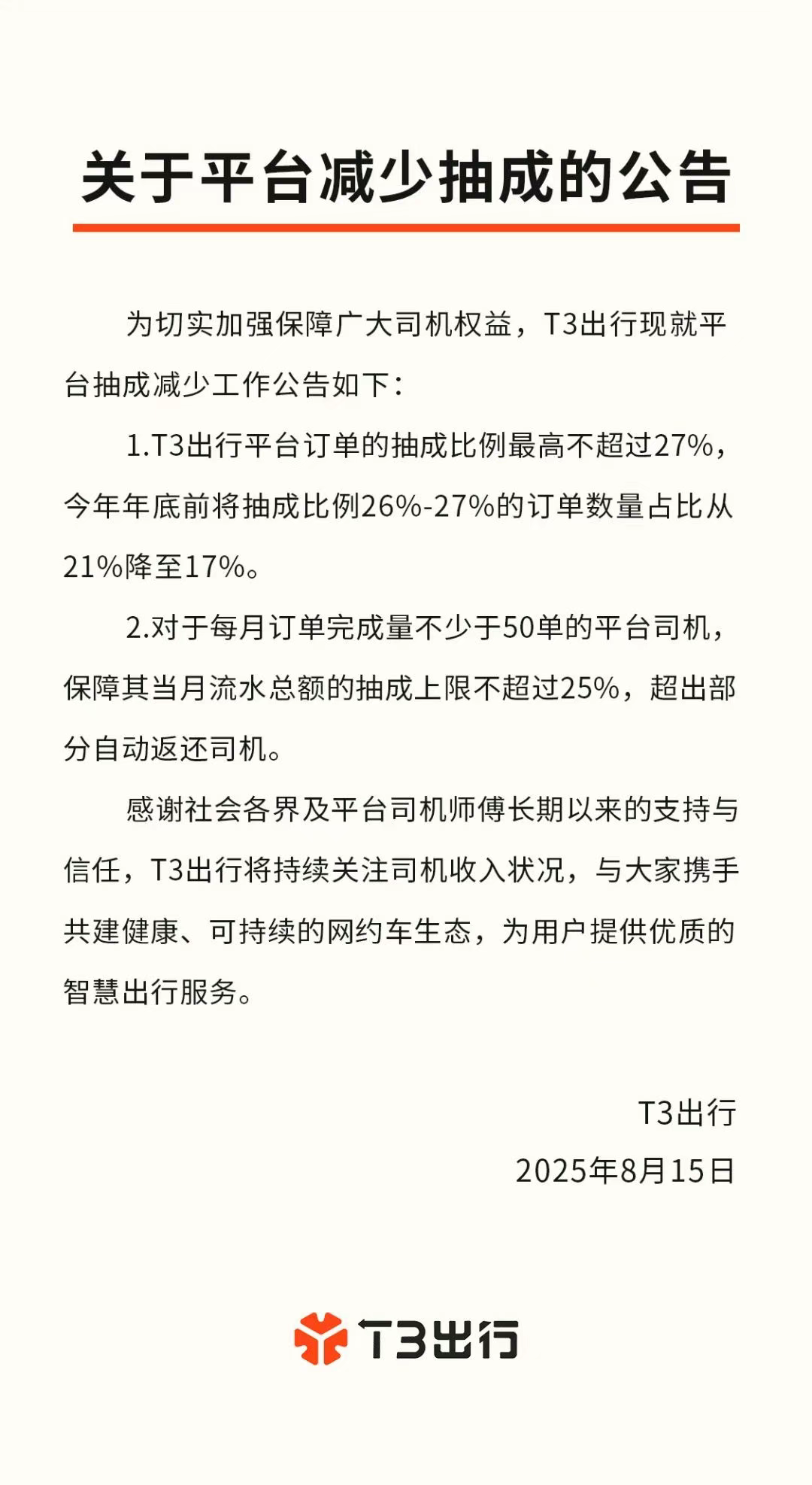

Recently, ride-hailing platforms have started to 'pass on benefits' to drivers. On August 15, Didi Chuxing, Cao Cao Chuxing, T3 Travel, and other ride-hailing giants collectively announced reductions in driver commission rates. The aggregated ride-hailing platform Gaode Maps also pledged to push for no fewer than 80 cooperating ride-hailing platforms to lower their upper limit on commission rates, while announcing measures to decrease the upper limit on information service fees in support of driver rights.

▲Image/T3 Travel Announcement

Earlier, Meituan Ride-hailing informed its drivers that, effective July 18, the platform commission rate for all order categories would be uniformly reduced to 18%. Additionally, for 'Special Offers' category orders, the platform guaranteed that drivers would earn no less than 1.5 yuan per kilometer. Both self-operated and aggregated ride-hailing platforms have successively reduced driver commission rates within a similar timeframe, reflecting a shared consensus: The ride-hailing industry has entered a critical phase, and under current competition, enhancing drivers' income levels to acquire more high-quality transportation resources has become a key strategic focus. For a long time, ride-hailing platforms have focused on competing for user resources, with subsidies predominantly targeting users. However, driver groups, as the platform's transportation backbone, have long faced issues such as opaque and excessive commissions, leading to unstable incomes and varying levels of service quality, which indirectly affects consumer experience. In response, the Ministry of Transport previously mandated that ride-hailing platforms disclose pricing rules and reduce excessively high commission rates. Apart from adhering to regulatory requirements, from the perspective of the platforms' own development strategies, enhancing driver income - improving driver service levels - delivering better user experiences - and attracting more loyal users forms a virtuous cycle. To acquire more high-quality transportation resources, it is essential to increase driver income and benefits through measures like commission reductions. However, the problem lies in the fact that industry competition remains fierce, and ride-hailing platforms, especially second-tier platforms, are still struggling to achieve profitability. Reducing commissions for drivers will further exacerbate corporate revenue pressures. Thus, exploring new businesses to find new revenue growth engines has become a pivotal research topic for platforms in the foreseeable future.

Ride-Hailing Platforms Enter the Era of Intensive Cultivation

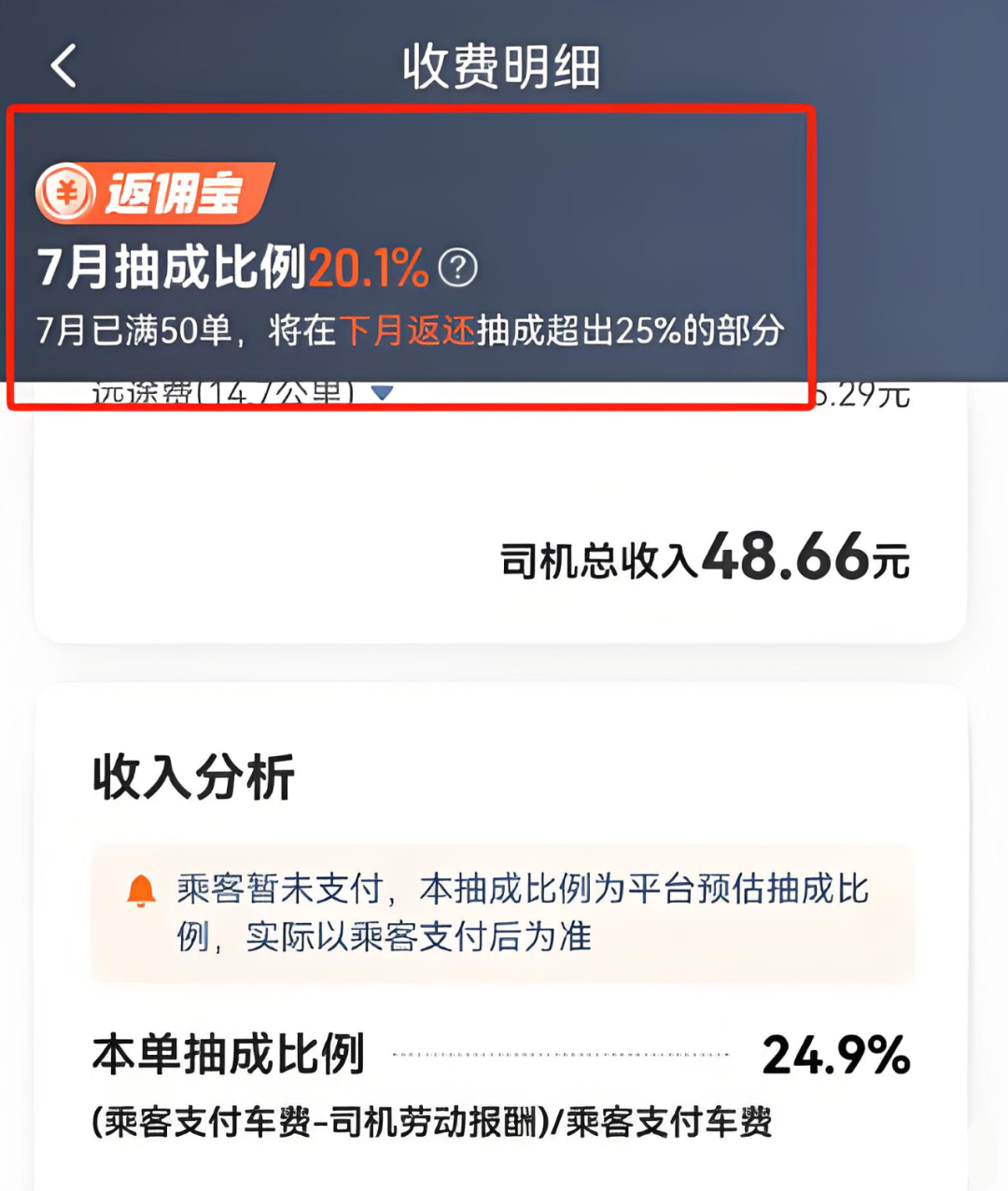

The current round of ride-hailing platforms announcing reductions in driver commissions encompasses almost all major players at the forefront of the domestic market. However, despite all claiming to reduce commissions, the specific reduction rates and strategies vary. As an industry leader, Didi Chuxing has introduced a more comprehensive and detailed subsidy policy: launching three new measures, including reducing the maximum commission cap per order from 29% to 27%, with any excess above 27% being returned with the order; initiating the 'Commission Refund Plan' to ensure that drivers who complete at least 50 orders on the platform each month have a monthly average commission cap of no more than 25%, with any excess automatically returned to the driver's account the following month; additionally, Didi announced that it will further reduce the proportion of high-commission orders by the end of the year through initiatives such as proactively increasing subsidies and optimizing order dispatch.

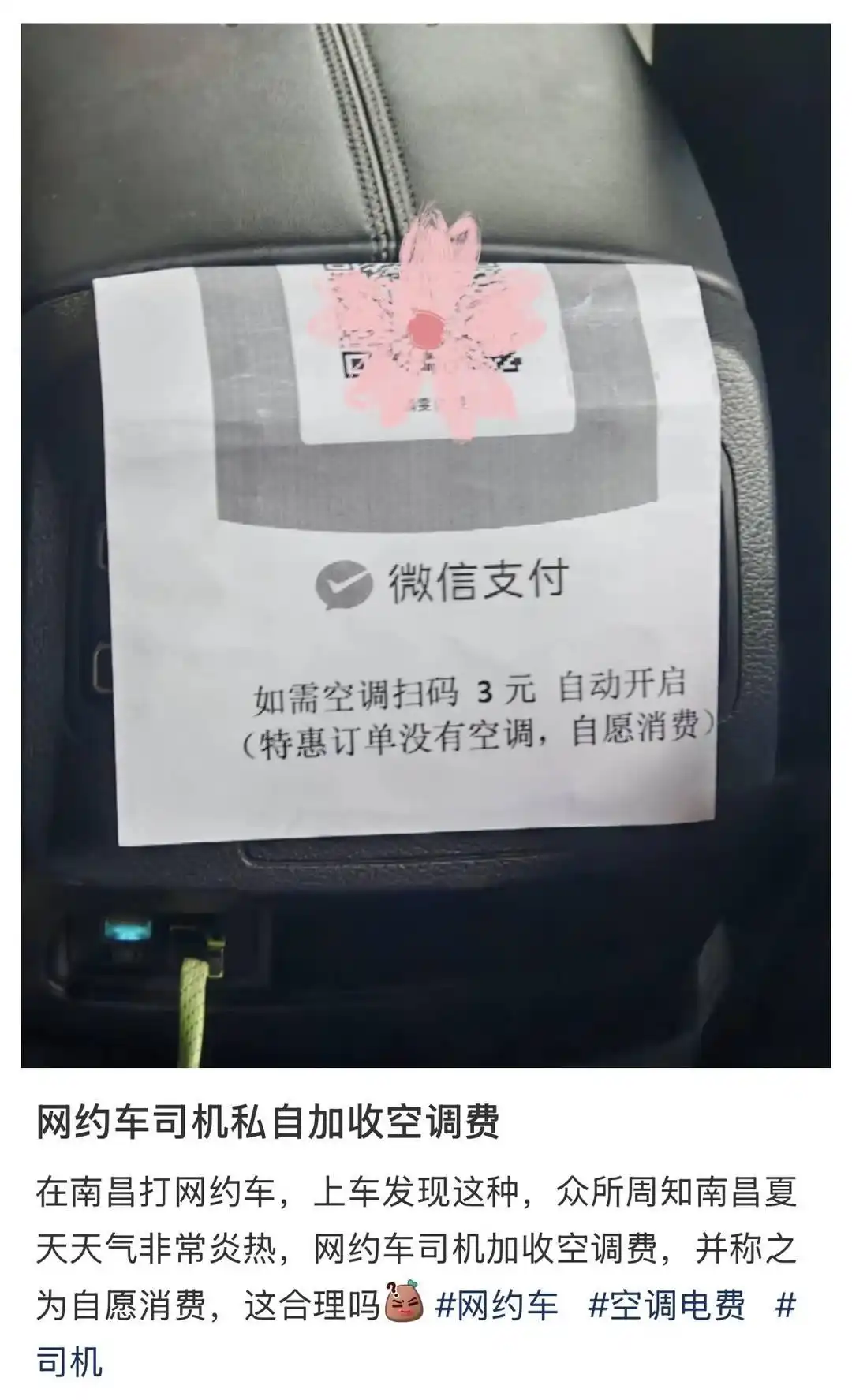

Cao Cao Chuxing announced a reduction in driver commissions from 22.7% to 22.5%; T3 Travel promised that the maximum commission rate would not exceed 27%, and by the end of the year, it would reduce the proportion of high-commission orders (26%-27%) from 21% to 17%, implementing a 25% commission cap for high-frequency drivers. Similar to Didi, for drivers who complete at least 50 orders per month, it guarantees that the total monthly commission cap does not exceed 25%, with any excess automatically returned to the driver. It is evident that although all platforms have announced reductions in driver commissions, the specific rates, reduction amounts, and implementation measures vary. As the ride-hailing business becomes increasingly competitive, many drivers now flexibly accept orders across multiple platforms, unlike the past when they served a single platform. Different commission rates make drivers still choose between platforms, and competition for drivers among platforms persists. Additionally, Didi and T3 Travel place significant emphasis on drivers who meet order completion criteria on their platforms, undoubtedly to maintain more loyal and high-quality transportation resources. In fact, apart from this round of collective reductions, for a long time before, various ride-hailing platforms have already prioritized improving driver benefits. For example, earlier this year, there was heated discussion about whether ride-hailing drivers should turn on the air conditioning when carrying passengers, especially for special offer orders with low prices and less driver income, with some drivers even charging passengers extra for air conditioning. The fundamental reason for this phenomenon is that turning on the air conditioning further compresses drivers' income for special offer orders, increasing operating costs.

▲Image/Xiaohongshu Screenshot

In response, Didi Chuxing announced in June this year that, starting from June 9, it would successively launch a high-temperature subsidy of over 600 million yuan in nearly 300 cities nationwide, to be distributed continuously over the three summer months. This subsidy aims to cover drivers' operating costs for turning on the air conditioning in high-temperature weather and encourage drivers to adjust the in-car temperature according to passenger needs. The platform's increasing emphasis on drivers' related benefits and welfare reflects the industry's transition from wild growth to value reconstruction. Minsheng Securities believes that the announcement by major industry platforms to reduce fee rates will enhance the stability and sustainability of driver supply, leading to a stable market structure for ride-hailing platforms in the long run.

Second-Tier Players Still Trapped in Profitability Dilemmas

However, not all platforms can easily undertake such industry value reconstruction and cost investments. For second-tier players with relatively limited resources and strength, they are still trapped in profitability dilemmas. From the perspective of sustainable industry development, while continuously improving driver benefits undoubtedly benefits ride-hailing platforms in alleviating conflicts between drivers and platforms, for the platforms themselves, further reducing commissions also means bearing more financial pressure. Especially for second-tier ride-hailing platforms, with industry leader Didi Chuxing occupying 70% of the market share, they are compelled to rely on aggregated platforms with traffic advantages such as Gaode Maps, Meituan, Tencent Maps, and Baidu Maps to acquire more orders, which requires them to pay additional commissions to these platforms in exchange for orders. Taking currently listed platforms such as Qi Travel and Cao Cao Chuxing as examples, from 2022 to 2023, the proportion of orders from third-party aggregated platforms for Qi Travel increased from 28% to 59%. Although this data was not disclosed for 2024, the company mentioned an 'increase in orders obtained from third-party travel service platforms'. From 2022 to 2024, the proportion of aggregated platform channels in Cao Cao Chuxing's total GTV (Gross Transaction Value) increased from 49.9% to 85.4%.

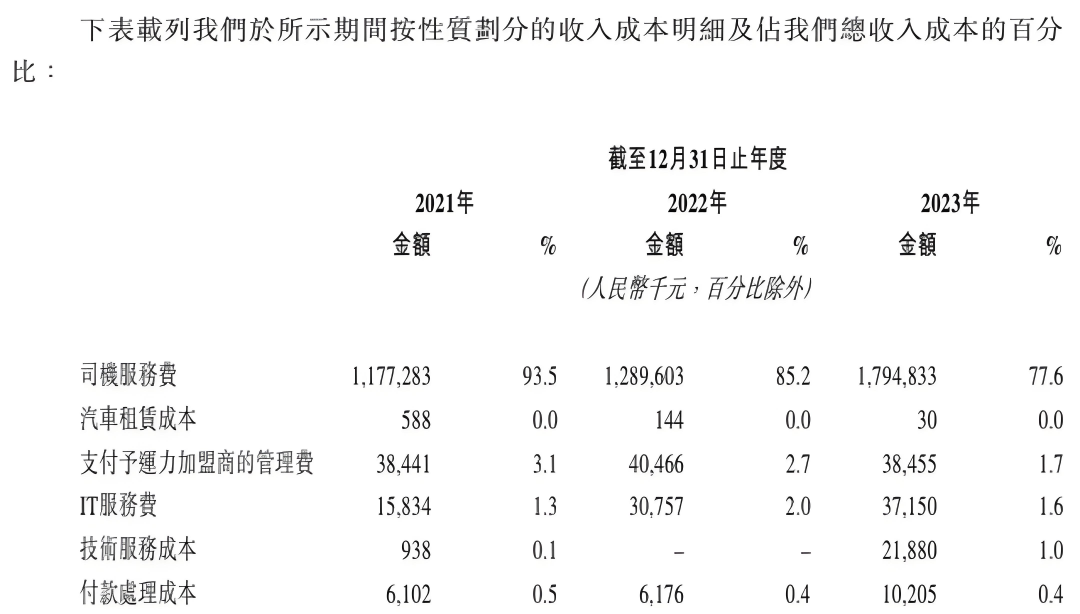

▲Image/Qi Travel

In 2024, Cao Cao Chuxing's sales expenses reached 1.222 billion yuan, a year-on-year increase of 46.13%, of which over 80% (1.05 billion yuan) was paid to aggregated platforms as commissions. In their reliance on aggregated platforms, the traffic distribution mechanism of the aggregation model prioritizes low-cost or high-response transportation capacity, which also forces second-tier ride-hailing enterprises relying on aggregated platforms to continuously improve order prices and driver benefits to compete for more orders among numerous platforms. This also leads to the fact that currently, only Didi is truly profitable in the ride-hailing business, while Cao Cao Chuxing, Qi Travel, and Enjoy Travel are not yet profitable. Among them, although the successfully listed Qi Travel and Cao Cao Chuxing have gradually narrowed their losses, analyzing their cost expenditure structure reveals that expenses for driver income and subsidies still account for a significant proportion of the company's sales costs. Cao Cao Chuxing's driver income and subsidy expenses for travel services in the first half of this year were 4.5 billion yuan, compared to 3.9 billion yuan in the same period last year. From 2021 to 2023, these expenses were 7.2 billion yuan, 6.2 billion yuan, and 8.15 billion yuan, respectively, accounting for around 80% of total sales costs over the long term. Qi Travel's service fees paid to drivers accounted for 77.6% of total cost expenditures in 2023.

▲Image/Qi Travel Prospectus

Of course, second-tier ride-hailing platforms are also striving to improve their losses. It is reported that Shanghai Saike Mobility Technology Service Co., Ltd., the operator of Enjoy Travel, issued an announcement in July to reduce its registered capital, indicating that the company's registered capital would be reduced from approximately 4.106 billion yuan to 350 million yuan. The reduced registered capital will be specifically used to cover the company's losses. Qi Travel has chosen to reduce the reward amount per order and marketing costs for drivers. From 2021 to 2023, the company's rewards for each order for registered drivers providing ride-hailing services were 2.87 yuan, 1.71 yuan, and 1.46 yuan, respectively, with a decrease of approximately 49% in 2023 compared to 2021. Based on available information, Qi Travel has not yet participated in the current round of collective commission reductions by ride-hailing platforms. From this perspective, second-tier ride-hailing platforms face considerable survival pressure. Under such circumstances, further reducing driver commissions will undoubtedly lead to greater financial pressure. Apart from internal adjustments such as reducing registered capital, exploring new businesses has become one of the few viable options.

Seeking Growth Requires Looking Outward

Intense internal competition has long been a hot topic in multiple industries. For example, this year's food delivery wars, from food delivery subsidies to improving rider benefits, centered on each company's desire to acquire more users and transportation resources. In the ride-hailing market, industry competition has already compressed ride-hailing profits to a relatively low level. Within the broad framework of sustainable industry development, balancing the relationship between users, drivers, and platforms has become a long-term challenge. Whoever can better balance the relationships among the three and cede more benefits to users and driver groups within a reasonable range will prevail in fierce competition. This is the endogenous motivation for platforms to provide price subsidies to users and reduce commissions and related subsidies for drivers. It also determines that in the current industry environment, it is not easy to obtain windfall profits through the ride-hailing business. Against this backdrop, exploring new business directions externally has become a common choice for platforms. At the end of July this year, Didi Express, a subsidiary of Didi Chuxing, launched a four-wheel delivery service and reached a cooperation with InterContinental Hotels Group. It will first pilot luggage delivery in more than 300 Holiday Inn Express hotels in Shanghai, Beijing, and other cities, with other brands under InterContinental Hotels Group to be gradually integrated. Didi Express stated that it will continue to cooperate with more hotel brands and transportation hubs in the future.

▲Image/Didi Express

In addition to domestic operations, platforms have ventured into overseas markets, including the introduction of international travel services on domestic apps and the establishment of food delivery businesses in Brazil and other regions. Cao Cao Chuxing, with its newfound ambitions for revenue growth, is focusing on customized vehicles. As a platform supported by Geely, a leading automaker, Cao Cao Chuxing has launched the 'Cao Cao Auto' brand, developing models tailored for ride-hailing and offering these custom vehicles for sale or lease to partner transportation companies and drivers. Moreover, autonomous driving has emerged as a new frontier that ride-hailing platforms are actively pursuing. The core motivation behind this shift is to accelerate the commercialization of Robotaxi, addressing fundamental challenges in the current business model (such as driver costs, transportation resource supply, enhancing service standardization and safety) and securing a prominent position in the future mobility market to foster a more innovative business ecosystem. Earlier last year, Didi Autonomous Driving announced the completion of a Series C funding round worth $298 million, which will be allocated to intensify investments in autonomous driving technology R&D and expedite the mass production of the first Robotaxi. Recently, rumors circulated that Didi Chuxing had invested in Neolith Auto, an unmanned commercial vehicle enterprise, though Didi has yet to comment on this matter.

▲Fig./Didi

In July, shortly after the first L4 vehicle model collaboration between autonomous driving and GAC AION, Cao Cao Mobility teamed up with Spacety to deploy satellite communications to bolster autonomous driving fleets. Ruqi Mobility also unveiled the "Robotaxi+" strategy, providing a comprehensive solution for local regulatory bodies, autonomous driving technology firms, and other ecosystem partners, and affirmed its commitment to accelerating the implementation of Robotaxi within the next five years. Jiang Hua, CEO of Ruqi Mobility, underscored, "The future of travel services undoubtedly lies in Robotaxi," underscoring the significance attached to this technology. A Goldman Sachs research report from May 2025 projects that China's Robotaxi market will undergo explosive growth, reaching a market size of $47 billion by 2035, marking a nearly 700-fold increase from 2025, with Robotaxi contributing over 25% of shared travel capacity. While public debate persists on whether Robotaxi will replace human drivers, the likelihood of complete replacement appears minimal, at least in the short term. A more plausible scenario envisions a symbiotic coexistence between human drivers and Robotaxi. Based on this outlook, a more optimistic scenario emerges: as Robotaxi commercialization gains momentum, the platforms' savings on human labor costs could be channeled into improving the welfare benefits of ride-hailing drivers. The competition for transportation resources among ride-hailing platforms continues unabated. On the surface, it appears as a tactical maneuver by platforms to navigate regulatory and competitive pressures. However, it fundamentally signifies the industry's transition from the "first half" focused on scale expansion to the "second half" emphasizing a healthy ecosystem and sustainable value creation. The ultimate winners in this race will be those enterprises that can pioneer a tripartite balance of "reasonable driver income, superior user experience, and healthy platform profits." Reference materials: Iguanchaijing, "Clustering to Hong Kong IPO, Is Ride-Hailing Still Profitable?" DingjiaoOne, "Didi's Little Brothers No Longer Want to Work for Gaode" Shangye Data Pai, "Cao Cao Mobility Finally Obtains a Ticket to Go Public, But Being the 'Number Two' in Ride-Hailing Isn't Easy" Hong Kong Stock Research Society, "Robotaxi Blossoms Inside the Wall While Fragrant Outside, Overturning the Old Rice Bowls of Uber and Didi?"