Ride-Hailing Apps Cut Commissions, Yet Challenges Persist

![]() 09/01 2025

09/01 2025

![]() 644

644

According to the "2024 National Ride-Hailing Market Annual Report," while daily active vehicles, drivers, and total orders increased for ride-hailing apps last year, driver earnings per capita declined. The sampled hourly income for drivers stood at 27 yuan, a 12.9% drop compared to 2023.

Recently, news that all Hema X membership stores will soon close dominated search trends. In July alone, Hema X stores in Beijing, Suzhou, and Nanjing announced closures, with the final store in Shanghai's Senlan district set to shut down on August 31.

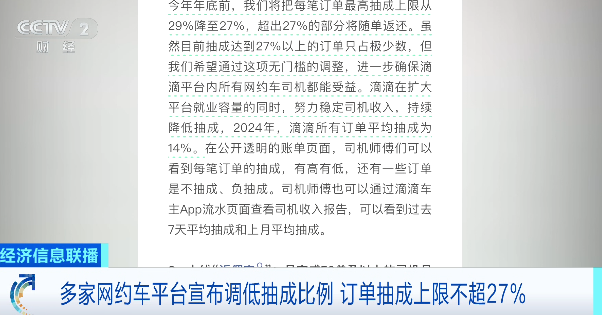

The ride-hailing industry has recently witnessed a "commission reduction trend," with multiple platforms announcing adjustments to their commission rates. Didi lowered the maximum commission cap from 29% to 27%, while Cao Cao Mobility reduced its maximum rate from 22.7% to 22.5%.

However, this positive news has not elicited a collective cheer among drivers. Some drivers note that the platform's algorithm is complex, making it difficult to ascertain precise income increases. Others mention that there are too many "fixed-price" orders, and commission reductions alone do not guarantee higher earnings.

Amidst fierce competition, platforms hope to mitigate cutthroat tactics and improve driver welfare by lowering commissions. Yet, this measure may not address the industry's core issues.

The root of drivers' longer hours yet lower earnings lies not solely in commission rates but in industry oversaturation, platform profitability challenges, and ride-hailing traffic dilemmas. Only when ride-hailing platforms discover viable survival strategies in a complex market can drivers find stability.

1

Low-Priced Ride-Hailing Services Halted

Besides Didi, T3 Mobility, and Cao Cao Mobility adjusting commissions, cities like Qingyuan (Guangdong), Yingtan (Jiangxi), and Ningbo (Zhejiang) have halted "fixed-price" and "special discount orders," effectively preventing drivers from accepting low-paying jobs.

The "anti-cutthroat competition" trend has reached the ride-hailing industry. Like the halted "food delivery wars," if ride-hailing focuses solely on low prices, it risks falling into an unending vicious cycle.

Mr. Wang, a ride-hailing driver, said, "Special discount orders have razor-thin margins. A 20-minute ride earns drivers about 6 yuan, barely covering costs. But refusing them might mean no orders for half an hour."

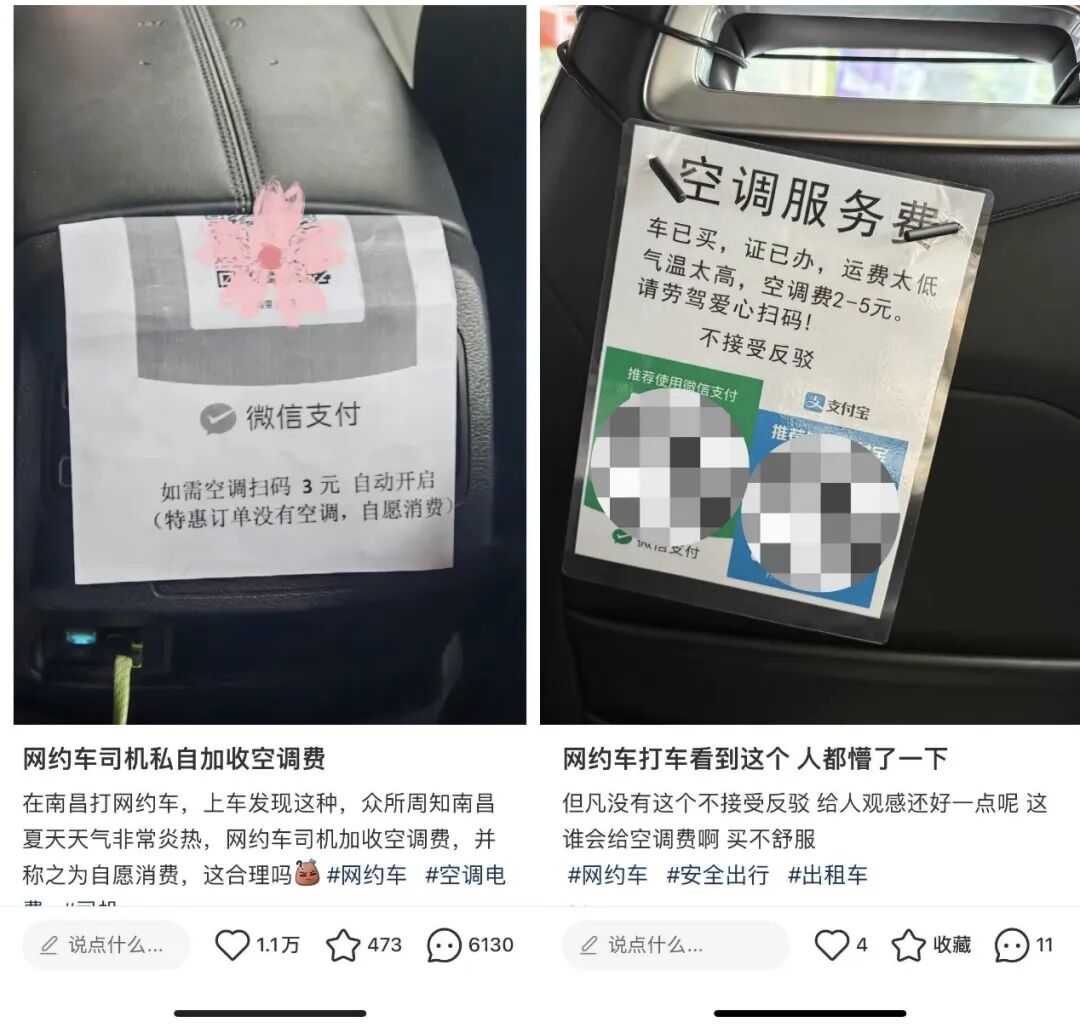

Many drivers "reluctantly" accept these orders, significantly impacting passenger experience. Some drivers post notices stating "special discount orders exclude air conditioning; activation requires extra payment." Others inform passengers they must pay round-trip tolls despite platforms' one-way toll policies, else they will refuse the order.

Passenger opinions on these income-boosting measures are divided. Some understand low prices and drivers' difficulties, but more believe in rules and established rights. Drivers should follow platform guidelines or choose not to accept special discount orders.

Both passengers and drivers have valid points, but essentially, drivers resort to such measures because fares do not match effort. Ride-hailing platforms' collective commission reductions aim to improve driver income and job satisfaction.

However, reality may be more complex. Mr. Cai, a driver, candidly said, "(Commission reduction) is positive but has little impact on actual earnings. This industry still relies on time for money."

According to "Kan Kan News," most platforms' actual commissions hover around 20%, rarely hitting the 29% cap. Drivers' income includes basic fees, mileage fees, incentives, and subsidies, often misunderstood due to complex algorithms.

Most drivers receive orders via third-party aggregation platforms, adding another layer of commissions on top of ride-hailing platform fees. Coupons offered to consumers are also borne by drivers, cumulatively exceeding the 30% commission red line.

For drivers, commission reductions do not significantly boost earnings. For passengers, post-competition reversal may increase ride costs. For platforms, lower commissions could further squeeze profits.

Thus, "commission reduction" seems a winless decision. Yet, for the ride-hailing industry, it's necessary. Only by addressing core issues can the false balance of "sacrificing long-term interests for short-term scale" be broken.

2

Why Ride-Hailing Faces Cutthroat Competition

The "2024 National Ride-Hailing Market Annual Report" reveals that while daily active vehicles, drivers, and total orders increased last year, driver earnings per capita declined. Sampled hourly income was 27 yuan, a 12.9% drop from 2023.

However, income decline is not solely due to increased special discount orders or high commissions. The real roots lie in market oversaturation, platform profitability challenges, and intensified homogeneous competition.

Firstly, industry consensus points to ride-hailing oversaturation. Last year, many regions issued risk warnings. The number of ride-hailing drivers surged 2.6 times in four years, while the average daily orders per driver dropped from 23 to 10.

Secondly, with more drivers than orders, platforms must compete for business at low prices. Facing fixed expenses like depreciation and car service costs, even low-paying orders must be taken to "get a taste of the soup" before figuring out how to "eat the meat."

Take Cao Cao Mobility, listed on the Hong Kong Stock Exchange's main board in June, which has lost money annually since inception, totaling over 13 billion yuan in losses. However, Cao Cao is not alone; most second-tier ride-hailing companies struggle with profitability amidst Didi's 70% market share.

For instance, Ruqi Travel, listed on the Hong Kong stock market, incurred a cumulative loss of 2.569 billion yuan from 2021 to 2024. Shanghai Saike Travel Technology Service Co., Ltd., operator of Enjoy Travel, issued a notice in July reducing registered capital solely to cover losses.

Finally, to improve operations, ride-hailing platforms rely on aggregation platforms like Gaode and Meituan for more orders, with mixed results.

On one hand, platforms must pay 10%-25% of order commissions to aggregation platforms, further squeezing already thin margins.

From 2022 to 2024, Cao Cao Mobility paid third-party aggregation platforms 322 million yuan, 667 million yuan, and 1.046 billion yuan, respectively, accounting for 50.3%, 79.7%, and 85.6% of sales and marketing expenses.

On the other hand, aggregation platforms prioritize low-priced or highly responsive capacity, leading ride-hailing platforms to favor low-priced orders for traffic. Consequently, driver income and treatment remain difficult to improve.

Clearly, drivers' "low income" dilemma is not caused by a single factor but a vicious cycle of "market saturation - decrease in platform orders - dependence on aggregation platforms - falling into low-price competition - decrease in driver income - drivers working longer hours - market becoming even more saturated."

Therefore, to truly change driver income and treatment, ride-hailing platforms must find sustainable profit paths to pass on benefits to drivers and break the low-price competition cycle.

3

Didi and Others Seek External Growth

Currently, regional authorities have interviewed ride-hailing and aggregation platforms, requiring them not to disrupt market order through improper pricing, effectively halting "low-price cutthroat competition" from a regulatory perspective.

However, for sustainable and healthy ride-hailing development, policy guidance alone is insufficient. Internal self-optimization and resource coordination are crucial to align user, driver, and platform interests.

Simply put, platforms ceding more value to users and drivers within reason are more likely to succeed in the ride-hailing market.

Yet, the domestic ride-hailing market is mature, with limited platform growth fluctuations. Where can ride-hailing companies find new value? Exploring external business directions has become a common choice.

Firstly, expanding diversified businesses boosts income. Didi, Cao Cao Mobility, and T3 Mobility have invested in autonomous driving. After a $298 million C-round funding last year, Didi allocated funds to autonomous driving R&D. Cao Cao Mobility partnered with Spacetime Insight to offer standard low-orbit satellite communication services, while T3 Mobility collaborated with CATL Times Intelligence to accelerate Robotaxi commercialization.

Didi's empire spans wider, with a mobility + food delivery + finance collaborative model in overseas markets. For example, "ride-hailing for food delivery" captured 56% of Mexico's food delivery market and replicated this model in Brazil.

Secondly, achieving business synergies optimizes operational efficiency. Besides cross-border investments, ride-hailing platforms can enhance platform traffic efficiency through alliances.

Recently, Didi upgraded its membership system, introducing five benefit categories and over 20 membership perks. V7 and V8 users enjoy cross-platform benefits from Hilton, Huazhu, and Yado hotels, as well as value-added services like Haidilao memberships, covering "eating, living, and traveling" scenarios.

With Taobao and Meituan upgrading their membership systems to integrate ecosystem segments, Didi's large membership system integrates high-frequency life consumption scenarios, deepening user connections, tapping consumption potential, and strengthening user-platform stickiness.

For Didi's high-level members, benefits include free breakfast and hotel executive lounges. By offering differentiated platform value, it breaks homogeneous "price war" competition.

Finally, seeking differentiated positioning establishes new barriers. In the ride-hailing market's low-price competition, consumers often choose the cheaper option, reducing user loyalty.

In this context, ride-hailing platforms must delve deeply into their unique strengths and strive to establish fresh competitive barriers. For instance, Cao Cao Mobility, which targets the mid-to-high-end market, has introduced value-added services such as translation cars and special care vehicles. Last year, it further launched the "Good Air 3.0" initiative to create an odorless and healthy travel environment.

On the other hand, Didi focuses on high-end business travelers by enhancing and broadening its membership benefits. This approach not only reinforces Didi's business attributes but also offers users a unique value proposition that is hard to replicate on other travel platforms.

Reducing commissions for ride-hailing platforms marks merely the initial step in the industry's fight against cutthroat competition. Moving forward, platforms must also achieve growth by optimizing operational efficiency and diversifying revenue streams. This will help strike a balance in profits among drivers, users, and platforms, fostering a win-win ecosystem for all stakeholders.

Ultimately, the prosperity of ride-hailing drivers will not stem from unilateral concessions by platforms but from the overall advancement of the industry's healthy development. As ride-hailing companies transition from "price wars" to "service and ecological competition," the industry will embark on a new narrative trajectory.