Trillion-Yuan Market Unleashed! iPhone 17 Sparks Full-Scale eSIM Adoption

![]() 09/11 2025

09/11 2025

![]() 587

587

Text: Shi Yu Xing Kong (Poetry and the Starry Sky)

ID: SingingUnderStars

It's that time again when Apple unveils its latest iPhone models. However, in recent years, Apple's new releases have been somewhat underwhelming, particularly lacking in groundbreaking innovation.

One of Steve Jobs' final acts before his passing was to acquire Siri, an AI company. Unfortunately, despite getting an early start, Apple has since lagged behind. Nowadays, the gap between Siri and various AI large models has become glaringly apparent.

There's little that can be done about this. A genius on par with Steve Jobs may not emerge for another 50 years.

The only standout feature is the iPhone 17 Air, renowned for its ultra-thin design.

The Air boasts a body thickness of just 5.6 millimeters and incorporates front and back ceramic shields for enhanced durability. Achieving such extreme thinness is a challenge for most phones. So, how does the Air manage it?

The answer is simple: the Air has done away with physical SIM cards. This move has freed up ample space for designers, though it has also raised concerns about potential bending issues.

How can one make calls without a SIM card?

The solution lies in eSIM, the so-called electronic SIM card.

Some may believe this to be Apple's innovation. However, Xingkongjun has unearthed a cherished relic from under the bed - a Personal Handy-phone System (PHS) device.

Abandoning physical SIM cards is hardly cutting-edge technology. Similar solutions have been around for years. The main obstacle to their widespread adoption has been disputes over operator interests.

Even eSIM cards are not a novelty. As early as 2018, China Unicom introduced this service, primarily targeting smartwatches and IoT applications.

After 2023, the eSIM business went quiet, with operators largely discontinuing the service. The primary reason was that some criminals exploited OTA vulnerabilities to register eSIM numbers in bulk using false identity information for telecom fraud and spam messaging.

Recently, with eSIM security vulnerabilities addressed, the service has made a comeback.

Apple simply launched a timely product.

Besides China Unicom, which already supports eSIM, China Telecom and China Mobile have applied for eSIM mobile phone services with the Ministry of Industry and Information Technology and are expected to receive approval soon.

Among A-share listed companies, Unigroup Guoxin Microelectronics produces eSIM chips compliant with national cryptographic standards.

01

Unigroup Guoxin Microelectronics' Semi-Annual Report

The most suitable application scenarios for eSIM are not mobile phones but expansive areas such as wearable devices, automotive electronics, and IoT.

Unigroup Guoxin Microelectronics stated that its eSIM solutions cater to over 400 global operators and have been successfully adopted by several renowned equipment manufacturers. Mass shipments have commenced, with the company's eSIM solutions widely utilized in mobile communication terminals, wearable devices, automotive electronics, and IoT terminals.

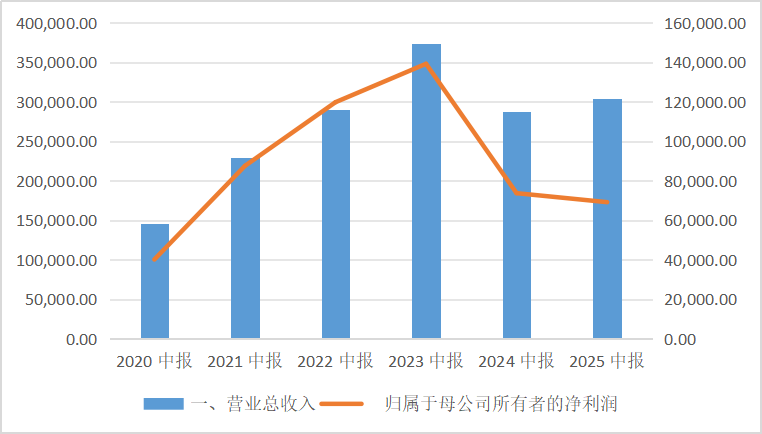

Data Source: iFind

In the first half of 2025, the company reported revenue of 3.047 billion yuan, marking a year-on-year increase of 6.07%. Non-recurring profit and loss attributable to shareholders amounted to 653 million yuan, up 4.39% year-on-year. Net profit attributable to shareholders was 692 million yuan, down 6.18% year-on-year. The decline in net profit was primarily due to a significant year-on-year decrease of approximately 73% in non-recurring gains and losses (approximately 112 million yuan in the same period of 2024, compared to approximately 39 million yuan in the same period of 2025).

From a segment perspective, the company's three major segments exhibited varying performances.

1. The specialty integrated circuit business generated revenue of 1.469 billion yuan, up 18.09% year-on-year, becoming the core driver of the company's performance growth.

The growth can be attributed to three factors: First, new product development planning, improved R&D efficiency, and market expansion. Analog chips (RF clocks, switch chips, etc.) account for 40%-50% of the revenue, with a growth rate of approximately 18%-20%. Second, the company offers over 800 off-the-shelf products covering multiple professional fields such as AI visual perception, processors, programmable devices, memory, networking and interfaces, analog devices, and ASIC/SoPC. Multiple series of products, including space-grade FPGAs, readback refresh chips, and memory, have been mass-applied by core users. Third, the self-built packaging line has commenced production smoothly, with continuous improvements in testing capabilities and production line automation levels, significantly enhancing supply assurance and shortening product delivery cycles.

2. The intelligent security chip business, including eSIM, underperformed, with revenue of 1.395 billion yuan, down 5.85% year-on-year, accounting for 45.78% of total revenue.

The main reason was intensified competition in the SIM card chip market, leading to price pressures and a decline in revenue. However, the company's eSIM products have been adopted by several leading mobile phone manufacturers and are being shipped in bulk. Automotive security chip solutions have been mass-produced by several leading Tier 1 suppliers and OEMs, with annual shipments reaching millions of units.

3. The quartz crystal frequency device business reported revenue of 151 million yuan, up 35.78% year-on-year, showing rapid growth.

Automotive-grade products have passed AEC-Q200/100 certification, with annual shipments reaching tens of millions of units. The consumer electronics market has improved, and demand in networking, communications, and smart automotive sectors has risen.

02

Four Major Growth Drivers

While netizens are abuzz with Starship and Starlink, China's commercial aerospace and commercial satellite communications are making steady strides.

Unigroup Guoxin Microelectronics is a behind-the-scenes supplier, with its space-grade FPGA market share exceeding 60%. With the advancement of commercial satellite projects like the "GW Constellation" (also known as the China Satellite Network Constellation, an internet low-earth orbit satellite plan led by China Satellite Network Group Co., Ltd., consisting of two sub-constellations: GW-A59 and GW-A2, forming a global internet satellite constellation that will introduce a direct-to-mobile satellite communication mode in the future, with plans to deploy 13,000 satellites, each requiring 10-15 aerospace-grade chips), the company is poised for explosive growth in a new business segment.

In the automotive electronics sector, the company's THA6 series chips have entered the supply chains of automakers such as BYD and NIO. It is estimated that the domestic substitution space is approximately $1 billion. With the increasing penetration of intelligent driving, demand for automotive-grade chips will continue to surge.

In the specialty integrated circuit sector, new application scenarios such as edge AI and 5G millimeter-wave communications, along with a rebound in military orders (driven by compensatory procurement in the final year of the "14th Five-Year Plan"), are ushering in new changes in the company's performance in this area.

The global commercialization of eSIM products and the localization of financial IC cards (the E450R chip made its pilot debut) will significantly boost the intelligent security chip business. The company plans to ship 50 million IoT security chips over three years, with a relatively optimistic outlook.

Xingkongjun is enthralled by the company's new business plans. Moreover, a considerable portion of these businesses boast significant barriers to entry, indicating a deep moat for the company. However, the path is not entirely without obstacles.

03

Risks of Self-Reliance and Controllability

What surprised Xingkongjun was that the company has not fully achieved self-reliance and controllability.

FPGA foundry services predominantly rely on TSMC (for processes below 14nm), with 70% of IP cores sourced overseas. The EDA toolchain still necessitates licensing from Synopsys and others, posing a risk of supply disruption.

In terms of technology, the company's 14nm FPGA lags behind the international 5nm technology by more than two years. Compared to giants like Infineon, the company faces substantial market pressure.

Additionally, the company is overly reliant on major customers, with the top five customers accounting for 42% of revenue. The specialty chip business suffers from low marketization rates, a single customer base, and weak bargaining power. Order fluctuations directly impact performance.

Furthermore, the accounts receivable turnover days are as high as 366.7, indicating a significant risk of bad debts.

-END-

Disclaimer: This article is based on the public company attributes of listed companies and core analysis and research relying on information disclosed by listed companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms). Shi Yu Xing Kong strives for fairness in the content and viewpoints presented in the article but does not guarantee their accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice. Shi Yu Xing Kong shall not be liable for any actions taken based on this article.

Copyright Notice: The content of this article is original to Shi Yu Xing Kong and may not be reproduced without authorization.