Apple's Manipulation on Douyin's 618 Sale: Tax Reduction for Europe and America, Tax Increase for China

![]() 06/12 2024

06/12 2024

![]() 714

714

Written by: Chen Jiying

Edited by: Wan Tiannan

On the evening of May 24, iOS users opened Douyin's live streaming room intending to snatch up iQIYI memberships, but they witnessed a bizarre scene. While the anchor was still explaining vigorously, the links to monthly, quarterly, and annual memberships suddenly disappeared and have not been relisted since.

After inquiring with customer service, Yinbai received the explanation, "Dear, I'm very sorry, but Apple phones are restricted by the platform and cannot view product links or place orders. We suggest you switch to an Android phone to place your order."

With no other choice, Yinbai ultimately logged into the same Douyin account using an OPPO phone and snatched up an annual iQIYI membership.

From May 24 to the present, coinciding with the intense 618 sales promotion, neither Douyin nor merchants wished to miss out voluntarily.

An informed source revealed that Douyin's removal of the aforementioned digital products was indeed out of necessity.

Every new version of an iOS App must pass Apple App Store's review before being released. This is Apple's unique ability to stranglehold.

On the eve of the 618 sale promotion, Douyin needed to update its App version, setting up new entry points and features for e-commerce promotions. Apple seized the opportunity to pressure Douyin to remove digital products such as audio-visual memberships, cloud storage memberships, and paid knowledge content on the iOS end. It is reported that Douyin had to "give in" for the 618 sale promotion.

The game between Apple and Douyin is essentially about increasing revenue - the products sold on Douyin do not pay Apple's 30% commission (also known as the "Apple tax").

After Douyin removed the relevant products, iOS users were forced to return to the corresponding apps to purchase more expensive membership services, and Apple could legitimately charge a 30% commission.

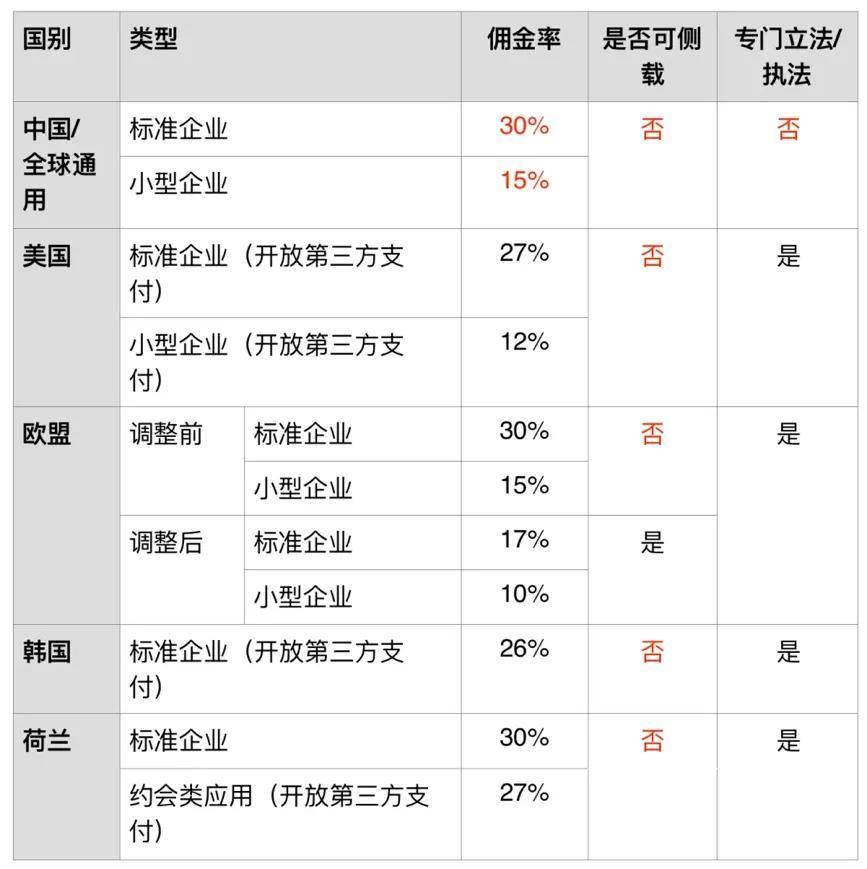

Compared to easily winning in the Chinese market by collecting the highest Apple tax globally and continuing to "increase taxes" by expanding the tax base, Apple does not have such arbitrary opportunities in other overseas markets and is forced to reduce taxes.

In March this year, under the antitrust stick of the European Union, Apple was forced to pay a penalty of over 10 billion yuan and was also forced to lower the "Apple tax" commission rate - from the original 30% and 15% (for small developers with annual income below $1 million) to 17% and 10%, respectively.

Subsequently, the United States, Japan, and others have also announced that they will initiate antitrust investigations into Apple.

After Tim Cook showed goodwill towards China, Apple's double standards have directly broken the defenses of Chinese users, merchants, and platforms.

Douyin's new App version update was throttled by Apple

The platforms and merchants affected by this Douyin removal controversy are not few.

Tests conducted by "Finance Story Collection" on June 12 revealed that membership products from Douyin's official flagship stores of iQIYI, Mango TV, and others are still offline.

The blank product pages leave only explanations such as, "The product is gone," "No more available," and "New products are being listed."

Not only long-form videos, but multiple industries have also been affected. For example, Internet platform stores selling digital products such as Xunlei, Himalaya FM, Baidu Cloud, and Unicom Cloud, as well as independent merchants offering paid knowledge content.

Due to the high consumption level and strong payment ability of iOS users - according to a survey by Asymco analyst Horace Dediu, the average spending of Apple iPhone users on apps is 7.4 times that of Android users, and they naturally occupy the mainstream among paid knowledge users. After this removal controversy, some Douyin merchants offering paid knowledge content were even forced to stop broadcasting.

Both private and state-owned enterprises have been affected. For example, state-owned enterprises such as Unicom Cloud and Mango TV have also had to swallow their pride and have not yet resumed listing related products.

Some Douyin official flagship stores and merchants had to temporarily adjust the stickers in their live streaming rooms to apologize to iOS users watching the live broadcast; at the same time, they urgently updated their scripts, saying, "iOS users (Apple phones) cannot see the links and can use an Android phone to purchase. The purchased product can also be used on iOS devices after purchase."

In fact, this is not the first confrontation between Douyin and Apple.

According to a report by the Beijing News, at the end of March last year, Douyin had removed virtual course products, and after they were relisted, "they are temporarily only available for viewing and ordering by Android clients."

The incident was suspicious, and after multiple investigations, the Beijing News reporter concluded that the reason for the removal was also related to the "Apple tax".

Previously, Douyin's paid course products completed transactions through the "Yellow Car" feature, not through Apple Pay, and were not subject to the "Apple tax".

The so-called "Apple tax" refers to the 30% "toll" charged by Apple App Store for in-app transactions of virtual items, commonly including game recharges, entertainment rewards, membership services (such as video memberships, social software), etc.

After a year, a similar scene has played out again. Douyin suffered in silence and did not dare to make a fuss, officially stating that it was a "system upgrade."

Industry insiders analyze that if Apple continues to pressure, virtual digital products on platforms like Taobao and JD.com may also have to say "no" to iOS users.

Such speculation is not unfounded.

Regarding whether Apple has the right to "tax" digital products from e-commerce channels, some industry insiders explained that Apple relies on the relevant provisions of its "App Review Guidelines."

However, Apple makes and interprets the rules, so it can both tacitly allow stores like Baidu Cloud's flagship store to operate on Douyin for three years and suddenly pressure Douyin to remove them.

Whether e-commerce platforms like Taobao and JD.com can pass this hurdle depends on Apple's mood.

The "tax-free" Mango membership, with an e-commerce price less than 40% of the Apple price

In this zero-sum game, the only beneficiary may be Apple.

Users are being exploited - the same service costs more and requires more payment.

Because digital products sold on e-commerce platforms do not need to pay up to 30% of the Apple tax, coupled with promotions on e-commerce platforms, their pricing is lower than that within iOS apps.

After comparing, we found that the annual card prices of iQIYI, Tencent Video, Youku, and Mango TV on e-commerce platforms are significantly lower than their iOS pricing. Among them, the price difference for Youku Video's annual membership card is the smallest, ranging from 10-20 yuan, with the lowest e-commerce price being 84% of the iOS price; the largest price difference is for Mango TV membership, reaching 149 yuan, with the e-commerce price less than 40% of the iOS pricing.

In the future, if Taobao and JD.com follow Douyin's lead and comprehensively remove the above-mentioned membership products for iOS users, it will completely cut off the right of iOS long-form video users to enjoy low e-commerce prices.

Subsequently, we also compared the pricing differences between Android and iOS users within apps. It was found that the pricing for annual cards, which are benchmark products, remains largely consistent on both ends, but for pricing such as continuous monthly subscriptions, iOS pricing is equal to or higher than Android pricing.

For example, the continuous monthly subscription price for basic VIPs of iQIYI's Android users is 8 yuan, while the price for iOS users is 15 yuan.

In fact, it's not just the long-form video industry. In May this year, New Media Tech Fox counted the virtual item pricing of 50 popular apps and found that 19 paid services had more discounts on the Android side, accounting for 38%.

Users pay more, but after deducting the Apple tax, apps do not benefit more and may even suffer losses.

Industries such as long-form video have lost opportunities to attract new users and drive revenue in Douyin's super traffic pool, and their channel layout over the years has also been halved.

Taking Youku as an example, its Douyin official flagship store has accumulated 5.74 million followers and 110 million likes, many of which are iOS users.

We also found through querying Chanmama data that without the support of iOS users' spending, the live streaming room views and sales of many virtual digital products on Douyin have plummeted.

Taking Baidu Cloud's official flagship store as an example, from mid-May to the present, the peak of its live streaming sales performance occurred on May 15th and May 18th, with each broadcast attracting around 510,000 views and estimated sales of between 1 million and 2.5 million yuan.

However, after the removal controversy on May 24, Baidu Cloud's official flagship store has launched several live streams, with viewership dropping by 2-4 times and sales falling below 1 million yuan.

To some extent, the high Apple tax is also one of the burdens that have contributed to the long-term losses of long-form video platforms in the past.

Taking iQIYI as an example, from 2019 to 2022, it accumulated losses of 23.5 billion yuan and barely turned a profit in 2023, with a net profit of 1.95 billion yuan that year.

In 2023, iQIYI's membership revenue was 20.3 billion yuan, its largest source of revenue. Assuming that a quarter of its membership revenue was contributed by iOS users, it means that iQIYI paid up to 1.5 billion yuan in Apple tax that year.

Not only iQIYI, Tencent Video, Mango TV, and others, but also the gaming industry, as a digital paid industry, is even more typical.

Because iOS users typically have stronger spending power, they are also the main contributors to gaming revenue. Previously, third-party agency Sensor Tower disclosed that League of Legends Mobile players' spending on the App Store accounted for 84.2% of total revenue, while Google Play players' spending accounted for only 15.8%.

In the Chinese market, while both Android and iOS charge commissions for the gaming industry, due to Android manufacturers opening up third-party downloads and payments, top game developers with sufficient traffic can choose to bypass official app markets by guiding users to download and recharge through other channels, avoiding commissions.

For example, popular games like Genshin Impact from Mihoyo are not available on official Android app markets, and users can download and recharge through channels such as its official website, and Mihoyo does not need to pay any commission to Android manufacturers.

However, iOS does not allow third-party downloads and payments, so game developers like Genshin Impact cannot avoid paying the 30% Apple tax.

"If Apple is unhappy one day, many industries will experience a major earthquake"

Apple, with its lofty image, is somewhat double-standard - while willingly reducing taxes and paying fines in markets like the European Union, the United States, Japan, and South Korea, it arrogantly "increases taxes" and easily wins in China.

As Apple's second-largest revenue source country and third-largest revenue source region globally, the "Apple tax" paid by Chinese developers is the highest standard globally - 30% and 15%, almost twice as expensive as the European Union and 4 percentage points more than South Korea.

According to a report by third-party data statistics agency Sensor Tower, in 2023, the "Apple tax" brought Apple about 22.34 billion U.S. dollars in global revenue, equivalent to about 160.8 billion yuan, of which the Chinese market contributed around 48 billion yuan, accounting for more than a quarter.

According to its first-quarter financial report this year, Apple's gross profit margin percentage for its services revenue reached a high of 74.6%, which includes a significant amount of Apple tax.

Apart from the highest tax rate and easy profits in the Chinese market, Apple has also continued to expand its tax base and achieve substantial "tax increase" expansion by pressuring e-commerce platforms to remove virtual digital products, from gaming to education and training to paid knowledge content.

Taking education and training as an example, on September 1, 2019, the education and training company "GeniusU" published an article on its official account stating that due to Apple requiring it to cancel WeChat and Alipay payment channels and switch to Apple IAP payment while paying an additional 30% "Apple tax," GeniusU has been forced to remove its app from the Apple App Store. After the app was relisted, Apple users would pay 30% more for courses purchased through the app.

Faced with Apple's "easy win," Chinese iOS users who have long been reluctant to be scapegoats have long held grudges.

In February 2021, Apple user Jin sued Apple for alleged abuse of market dominance. On May 29 this year, the Shanghai Intellectual Property Court ruled in the first instance that Apple does indeed have market dominance in the Chinese software market.

APP developers are also burdened - top platforms like iQIYI, Tencent Video, Mango TV, and others earn less and lose more, and a large number of mid-to-long-tail developers are also not lightly burdened.

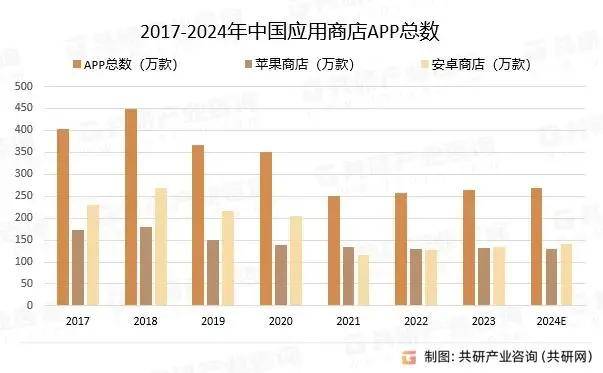

According to a report by Gongyan Net, the total number of apps in Chinese app stores has continued to decline from over 4 million to around 2.5 million since 2017; in terms of revenue scale, Chinese app store user spending reached 52.06 billion U.S. dollars in 2023, marking the first year-on-year decline in total revenue since 2018.

Some overwhelmed developers have begun to take risks and resort to cheating to avoid the Apple tax.

An industry insider from the gaming industry revealed to "Finance Story Collection" that some game developers bundle virtual rights products with physical products for sale. "For example, if a user wants to buy virtual items or has a chance to draw a character card, the game developer can simultaneously bundle a physical product for bundled sales, claiming that what they are selling is not a virtual product" to circumvent the Apple tax. However, this approach also carries risks, and once verified, the app may be removed.

In response to Douyin's removal of various virtual products, some merchants have also been forced to find other solutions.

For example, a merchant selling financial education courses on Douyin told "Finance Story Collection" that they plan to package course rights into books or physical cards to cope with the removal controversy.

However, this approach, first, increases the difficulty of traffic diversion and conversion and requires repeatedly explaining to iOS users during live streaming; second, the company needs to additionally pay for traffic diversion, logistics, and other costs. "Because our standard course price is over 5,000 yuan, which is relatively expensive, so this cost is still manageable."

Such uneasy days are not easy for merchants.

A big V in the paid knowledge field complained in a short video, "Have you ever thought about this question? If Apple is unhappy one day, many industries will experience a major