【Industry In-Depth Research】AutoNavi Enters Meituan and Baidu's Core Territories: Is Jack Ma Set for a Showdown with Liu Qiangdong?

![]() 11/17 2025

11/17 2025

![]() 385

385

Author | Wuji Learn more financial information | BT Finance Data Pass The main text is 4,041 words long and is estimated to take 9 minutes to read.

Jack Ma's return to Alibaba isn't news, but the major moves he made afterward have drawn significant industry attention.

Recently, Ele.me rebranded to Taobao Flash Sales and began focusing on instant retail. AutoNavi Maps has received special attention from the entire Alibaba Group. Shortly after launching the world's first map-based AI, it was incorporated into Alibaba's highly confidential projects and subsequently introduced a merchant evaluation system—the Street-Sweeping Rankings—directly targeting Meituan's core business. AutoNavi's partnership with XPeng to jointly enter the Robotaxi (autonomous taxi) market has also taken Baidu by surprise.

According to multiple media reports, AutoNavi's Street-Sweeping Rankings were designated as a highly confidential project by Alibaba, leading to a three-month lockdown of public areas. Upon launch, it immediately penetrated Meituan's core market and swiftly expanded overseas. AutoNavi AutoSDK International's business footprint now spans over 170 countries and regions, including Europe, Southeast Asia, the Middle East, and South America, with full support for 19 major global languages, including English, Spanish, French, and German. This was previously Baidu Navigation's stronghold.

What caught Li Yanhong off guard was AutoNavi's quiet entry into the autonomous driving sector, which it views as a key future growth area. Autonomous driving is another major business segment for Baidu. AutoNavi has unleashed its full potential, offering end-to-end online navigation capabilities—from positioning, search, and map rendering to route planning—along with core data applications like offline navigation and ISA information broadcasting. In simple terms, it has launched a 'Navigation System Suite' tailored for Chinese automotive brands targeting overseas markets. AutoNavi's strong position within Alibaba, now the group's favorite, reflects a direct manifestation of Jack Ma's strategic realignment.

Alibaba's series of moves have drawn strong capital market attention. Since August 21, Alibaba's stock price has surged notably, rising from HK$115 to HK$156.8 at the close on November 12, a 36% increase. Entering 2025, Hong Kong stocks have climbed steadily from the first trading day's opening price of HK$80.45, achieving a total year-to-date gain of 95%. The latest market capitalization stands at HK$2.95 trillion. In the U.S., stocks rose from US$82.39 on the first trading day to US$157.91 at the November 12 close, a 92% year-to-date increase, with the latest market cap at US$376.8 billion.

1

Is AutoNavi Actually Alibaba's Strategic Linchpin?

AutoNavi Maps has long been positioning itself, boasting a massive user base that ranks among the top in China's mobile internet sector.

As of March 2025, AutoNavi Maps' monthly active users (MAU) reached 873 million, ranking fourth among Chinese mobile internet applications, trailing only WeChat, Taobao, and Alipay. This data underscores AutoNavi's enormous user foundation.

AutoNavi's user engagement has also been remarkable at specific times. For instance, on October 1, the first day of the 2025 National Day holiday, AutoNavi's daily active users (DAU) peaked at over 360 million. This means that more than 1 in 4 Chinese individuals used AutoNavi Maps that day. Additionally, its 'AutoNavi Street-Sweeping Rankings' feature attracted over 400 million users within just 23 days of launch, demonstrating strong user appeal and growth momentum.

One major reason Alibaba values AutoNavi so highly is that its own MAU growth has plateaued. QuestMobile revealed that Alibaba's MAU growth rate was 5.6% in September last year and slowed to 4.1% this year. While seemingly minor, the deceleration is undeniable. According to QuestMobile's 2025 Panoramic Ecological Traffic Autumn Report, Alibaba's monthly active users (deduplicated) reached 1.255 billion in August 2025, ranking second among Chinese internet companies. Tencent, Douyin, and Baidu had 1.266 billion, 1.182 billion, and 1.111 billion MAUs, respectively. Meituan, JD.com, and Pinduoduo had 902 million, 891 million, and 855 million MAUs, respectively.

In Q2 2025, China's total internet users stood at 1.123 billion, implying that Alibaba's 1.255 billion MAUs may include multiple accounts per user, making further growth challenging. Compared to JD.com and Pinduoduo's faster MAU growth, Alibaba's deceleration is understandable. However, AutoNavi's 870 million users could drive MAU growth, even at a slower pace, preventing declines.

Alibaba's Q1 2025 financial report showed revenue of RMB 247.7 billion, up 1.82% YoY, and net profit of RMB 40.65 billion, up 66.66% YoY. While revenue growth slowed significantly to under 2%, the 66.66% net profit increase—excluding assets like Sun Art Retail and Intime—indicates solid core business performance, with a 10% YoY increase.

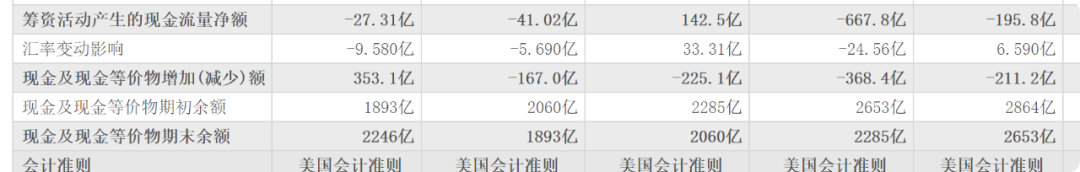

While the numbers look impressive, operating cash flow plummeted from RMB 33.64 billion to RMB 20.67 billion, a 39% drop. Cash and cash equivalents stood at RMB 224.6 billion, down RMB 40.7 billion from RMB 265.3 billion a year earlier.

Where did this substantial sum go? Industry analysts point to instant retail, cloud computing, and AutoNavi Maps as major investment areas. Cloud computing, a fiercely contested field, has seen heavy investments from Baidu, ByteDance, Huawei, and Tencent, compelling Alibaba to follow suit. Fortunately, the cloud intelligence segment delivered promising results, with Q1 revenue of RMB 33.398 billion, up 26% YoY. The success of AutoNavi and instant retail will now be pivotal for Alibaba's future.

2

Why Has AutoNavi Suddenly Risen to Prominence?

AutoNavi has recently demonstrated strong momentum in both capital markets and product innovation. Its solid Q1-Q3 performance is directly tied to product and technological breakthroughs. In August 2025, AutoNavi Maps launched the world's first map-based AI native agent, 'Teacher Xiaogao,' leveraging spatial intelligence to transition from 'connection' to 'comprehension,' supporting natural language interaction, multimodal perception, and proactive decision-making.

In November 2025, AutoNavi announced its entry into the Robotaxi sector, partnering with XPeng to offer L4 autonomous driving services and pioneering a 'platform + mass production' model, further expanding its ecological influence in intelligent driving. This move marks AutoNavi's transformation from a 'map navigation tool' to an 'intelligent mobility service platform,' a strategic shift that broadens its business scope and creates synergies with its core map navigation services, enhancing overall competitiveness.

AutoNavi positions Robotaxi as a strategic project aimed at expanding its global market through autonomous taxi services and becoming a key future growth driver. This marks AutoNavi's upgrade from a traditional map service provider to a spatial intelligence platform, extending its AI capabilities across borders through aggregated Robotaxi services.

The collaboration between AutoNavi and XPeng Motors forms a 'mobility platform + factory-installed mass-produced Robotaxi' model, where XPeng provides technical support and mass-produced vehicles, while AutoNavi contributes a dispatch platform, high-definition maps, and user traffic, targeting the creation of the world's largest Robotaxi aggregation platform. This partnership accelerates XPeng's technological commercialization while offering AutoNavi ecological synergies and user expansion opportunities. AutoNavi's deep expertise in map data, navigation technology, and location services provides unique technological and ecological advantages for its Robotaxi venture. Its vast national user base and platform traffic offer user entry advantages, ensuring foundational support for path planning, positioning, navigation, and scenario recognition for autonomous vehicles.

AutoNavi's entry coincides with the accelerated global commercialization of Robotaxi, positioning it to compete with Didi, Baidu, and other giants for mobility market access and driving shifts in the autonomous driving industry landscape. By integrating resources through an aggregation platform, AutoNavi aims to secure a foothold in the autonomous mobility sector.

Benefiting from policy support under the 'Beijing-Tianjin-Hebei Collaborative Action Plan for Promoting the Beidou (BeiDou) Spatiotemporal Industry,' AutoNavi has achieved BeiDou industry collaboration, with strategic partnerships and policy dividends becoming increasingly prominent. The plan aims to create a BeiDou spatiotemporal industry cluster exceeding RMB 200 billion by 2027. As a leader in spatiotemporal information processing, AutoNavi is poised to benefit continuously. Cross-industry collaborations are deepening, with AutoNavi's spatial intelligence aligning with partners in smart cars, smart glasses, and robotics under the 'AMAP-AI Inside' strategy, driving technological adoption across multiple scenarios. AutoNavi's Robotaxi entry signals a major upgrade in its mobility services, and if it overcomes technical, policy, and operational barriers while leveraging its platform and data strengths, it could achieve breakthroughs in intelligent mobility.

3

Is an Instant Retail Showdown Imminent?

Ele.me's rebranding to Taobao Flash Sales directly reflects Jack Ma's determination to dominate instant retail. Ma understands that platformizing instant retail secures the next high-ground for traffic. With Liu Qiangdong and Wang Xing already heavily invested in instant retail, Ma is determined not to fall behind.

Consumers, spoiled by '45-minute home delivery' or even '30-minute home delivery,' quickly voice dissatisfaction on social media when platforms falter, causing significant reputational damage. As Liu Qiangdong enters instant retail through food delivery, Ma has already acted. In April, Taobao upgraded its 'Hourly Delivery' to 'Taobao Flash Sales.' In August, Alibaba restructured its business, integrating Ele.me and Taobao Flash Sales. In October, delivery riders' uniforms changed from blue to orange 'racing suits,' reflecting Ma's targeted strategy.

Financial analyst Xu Yi noted that Ele.me's rebranding signifies a strategic repositioning, fully integrating it as Taobao's instant retail fulfillment infrastructure. 'Alibaba's holistic integration of instant retail marks a new phase in its strategy,' Xu said. This adjustment resolves Ele.me's high independent customer acquisition costs while enriching user consumption scenarios, potentially driving Alibaba's new growth trajectory.

Sources close to Alibaba revealed that Ma places great importance on Alibaba Flash Sales, even personally requesting a same-day logo color change for Taobao Flash Sales. In Ma's view, AI and instant retail are his 'two aces,' with instant retail being critical for Alibaba's e-commerce foundation to achieve a second growth curve.

Ma's emphasis on instant retail stems from its massive market size. Ministry of Commerce data projects the instant retail market to reach RMB 1.5 trillion in 2025 and RMB 3.6 trillion by 2030, with a CAGR of 25%.

The expansion of '30-minute delivery' from dining to general merchandise represents a new battleground for platforms. Alibaba's August business restructuring into '1+6+N' segments reflects this, with instant retail as one of the four core businesses. The integration of Ele.me and Taobao Flash Sales signals a trend. Instant retail now transcends mere food delivery subsidies, evolving into a comprehensive ecological competition involving 'e-commerce supply chains + local stores + instant delivery.'

Despite the diminished hype around Double 11, platforms are intensifying their rivalry, particularly in instant retail. Meituan Flash Sales' 'Official Flagship lightning Warehouses' support brands' asset-light instant retail layouts, marking the first dual-channel (online + offline) participation in major promotions. JD.com also included instant retail in its Double 11 lineup, launching various activities to bolster the sector. Taobao Flash Sales introduced 'Taobao Convenience Stores' for chain brands, all vying for dominance in instant retail.

The 'Three-Way Battle' in instant retail features distinct strengths. Meituan leverages its strong local life traffic to solidify its lead. JD.com capitalizes on its robust supply chain and advantages in 3C digital categories. Alibaba's integration of Ele.me and Taobao Flash Sales combines Taobao's vast user base and merchandise with Ele.me's instant delivery capabilities, forming a competitive moat with both speed and product variety.

AutoNavi's recent aggressive moves, through 'Street-Sweeping Rankings' and AI agent 'Teacher Xiaogao,' extend user engagement from 'navigation needs' to 'consumption decisions.' For example, when users search for destinations, AutoNavi recommends nearby dining, hotels, and other instant retail services, creating a closed-loop experience of 'search-and-go, arrive-and-enjoy.' Currently, AutoNavi covers over 7 million restaurant locations nationwide, with daily navigations to lifestyle service destinations reaching 13 million. By driving traffic to instant retail and increasing user stay (dwell) time, AutoNavi enhances Alibaba's local life ecosystem. Alibaba plans to distribute over RMB 1 billion in subsidies through the 'Vibrant Store Support Plan' to attract in-store consumption. Meanwhile, AutoNavi's in-store services complement Ele.me's home delivery, forming Alibaba's 'omnichannel consumption platform' local life ecosystem.

Perhaps Ma's true focus on AutoNavi ultimately lies in instant retail.