Surpassing the Software, SaaS, and AI Eras: Adobe Emerges as Silicon Valley's Pinnacle of Evolutionary Success

![]() 11/17 2025

11/17 2025

![]() 546

546

Introduction: Adobe's legendary odyssey exemplifies how a tech company navigates industry cycles and sustains growth through relentless evolution.

Author: Wang Jian | Production: Lishi Business Review

Amid the global digital economy surge, few companies have redefined their identity as radically as Adobe. From its 1982 inception as a design software pioneer, Adobe revolutionized printer-computer communication with PostScript and PhotoShop, cementing its status as a global creative design titan.

Today, Adobe transcends its "design software" label, evolving into a creative and marketing SaaS powerhouse with a 40.8% net profit margin—double the SaaS industry average of 20–30%. Its stock price has soared nearly 1,000-fold since its 1986 IPO, reaching a $138.6 billion market cap.

Over five decades, Adobe transformed from a tool provider to an ecosystem architect, pioneering a second growth phase that redefines tech industry resilience.

1. From Lab Outcasts to Industry Standard Setters

In 1982, engineers at Xerox’s Palo Alto Research Center were stunned when John Warnock and Charles Geschke abruptly resigned. Both were computer visionaries: Warnock developed Interpress, the precursor to PostScript, while Geschke, his supervisor, possessed acute technological foresight.

For two years, they urged Xerox to commercialize Interpress, only to face management indifference. Xerox, fixated on copiers, dismissed the technology as too risky and lacking short-term returns.

"I realized my life’s work—Interpress—was fascinating yet unknown to others," Geschke recalled. "For an engineer, that was unacceptable."

Disillusioned, Warnock and Geschke left Xerox to launch Adobe, named after a creek behind Warnock’s home. Marva Warnock designed the iconic red-and-white "A" logo.

Their mission: Make PostScript the "Mandarin of the digital world," enabling seamless text and graphic rendering across devices. Printers at the time were like dialect speakers, requiring laborious debugging for complex outputs. Adobe’s vision promised efficiency.

Adobe’s ascent began in 1983 when Steve Jobs, after a PostScript demo, offered $5 million to acquire the company. Rejected, he settled for a $2.5 million stake and five years of licensing fees, making Adobe Silicon Valley’s first profitable startup.

The gamble paid off. Apple’s 1985 LaserWriter, powered by PostScript, dominated the market, generating $80 million in royalties for Adobe. Though their partnership later saw friction, PostScript’s success cemented Adobe’s industry-standard status. Adobe went public in 1986, accelerating its global expansion.

2. The Perfect Fusion of Technological Innovation and Strategic M&A

Adobe’s evolution from printing tech to creative software giant is a tale of innovation and strategic acquisitions.

PostScript laid the foundation, but Adobe recognized designers’ need for digital tools. In 1986, Warnock observed his wife sketching curves, contrasting sharply with the jagged edges of contemporary computer graphics. This inspired him: Could PostScript’s precision translate to screens?

Early computer graphics suffered from low resolution (320×200 pixels) and poor rendering, forcing designers into a tedious "computer → printer" debug cycle. Adobe’s solution: 18 months of R&D yielded two breakthroughs:

- Vector Graphics Algorithms: Replaced pixel-based rendering with mathematical formulas, ensuring crisp graphics at any resolution.

- Pen Tool: Mimicked real-pen control via "anchor points + handles," enabling precise curve adjustments.

While competitors like Aldus’s FreeHand relied on pixel drawing, Illustrator’s PostScript compatibility and intuitive design captured 35% of the professional market in its first year, becoming the industry standard by 1989. Today, 90% of global designers use Illustrator, with its Pen Tool remaining the gold standard.

Adobe’s disruptive streak continued in 1988 when Thomas Knoll, a University of Michigan doctoral student, demonstrated an image-processing program to Adobe. His demo seamlessly merged a seascape with a beach photo, creating the iconic "Jennifer in Paradise." Adobe signed a distribution deal, invested in R&D, and launched PhotoShop 1.0 in 1990, revolutionizing image editing.

By 2023, Adobe dominated 84% of the image tech market, with PhotoShop commanding 90% of professional editing software—far outpacing rivals like Autodesk.

Adobe also pioneered software standards. In 1993, it introduced PDF, solving cross-platform document compatibility issues. By offering Acrobat Reader for free and monetizing professional versions, Adobe made PDF the global electronic document standard while building a paid user base.

As digital technologies proliferated, Adobe shifted from standalone products to ecosystem building.

3. Strategic M&A Paves the Way: From Creative Tools to Ecosystem

By the 1990s, desktop publishing emerged, and Adobe faced competition from Aldus’s PageMaker. Recognizing the limits of internal R&D, Adobe turned to strategic acquisitions.

In 1994, Adobe acquired Aldus for $440 million, gaining PageMaker and consumer tools like PhotoDeluxe. This expanded Adobe’s reach to the mass market while leveraging Aldus’s global sales network to boost overseas revenue to 50%.

Facing the internet boom, Adobe acquired GoLiveSystems in 1997 for web design tools and Macromedia in 2005 for $3.4 billion. Macromedia’s Dreamweaver and Flash integrated seamlessly with Adobe’s suite, creating a closed-loop workflow from creation to web presentation.

The 2008 financial crisis hit Adobe hard, with revenue dropping 18% due to piracy and reduced tool purchases. CEO Shantanu Narayen saw an opportunity: "The cloud will transform our business."

Adobe "cloudified" tools like PhotoShop and Illustrator, launching Adobe Creative Cloud (ACC) via a subscription-based SaaS model. This addressed a critical gap: Traditional software couldn’t track post-deployment data, leaving marketers to rely on guesswork.

In 2009, Adobe acquired Omniture for $1.8 billion, integrating its SiteCatalyst platform to track user behavior and conversion funnels in real-time. This merged creative production with data-driven marketing, offering clients a full-process solution.

Firstly, from a technical standpoint, Omniture's data analysis interface was seamlessly integrated into Creative Cloud. This integration empowered designers to incorporate 'data tracking tags' into their materials during the export process, with deployment data automatically flowing back to the 'performance analysis panel.' Subsequently, a 'creative optimization module' was incorporated into SiteCatalyst, enabling marketing teams to directly send adjustment requests to designers based on data insights. The modified materials were then synchronized in real-time with the deployment system. In terms of the business model, Omniture transitioned from a 'pay-per-traffic' pricing scheme to a subscription model, which was bundled with Creative Cloud packages. This bundled offering provided a 25% price reduction compared to purchasing the services separately.

Through this strategic integration, Adobe successfully evolved from a 'creative tool provider' to a 'creative + data service provider.' By 2011, 40% of Creative Cloud's enterprise customers had also subscribed to Omniture services. On average, these customers spent 60% more annually compared to those who only purchased creative software, laying a solid foundation for Adobe's SaaS (Software as a Service) transformation.

At the 2011 Adobe MAX Global Creativity Conference, CEO Shantanu Narayen made a groundbreaking announcement: the decade-old Creative Suite would undergo a complete upgrade to a Creative Cloud subscription service.

This transition marked a shift from one-time payments (with individual software packages costing thousands of dollars) to a monthly subscription model, with prices ranging from $9.9 to $52. The new model introduced cloud-native features such as 100GB of cloud storage, cross-device synchronization, and real-time collaboration capabilities. These features enabled designers to seamlessly switch between computers, tablets, and smartphones, enhancing workflow flexibility.

However, as a traditional software company, Adobe's journey toward SaaS was fraught with challenges.

4

The SaaS Transformation Battle: From Product Sales to Ecosystem Closure

Externally, many long-standing users resisted the 'pay-forever' subscription model. Professional designers expressed concerns about cloud data security, while enterprise clients faced the need to overhaul their procurement processes. Consequently, the market response to Adobe's transition was initially lukewarm.

Internally, Adobe encountered significant resistance as well. The sales team experienced high turnover rates due to changes in commission structures. Internal data revealed an 18% attrition rate among core sales talent in 2012, with some departing for competitors like Autodesk. Meanwhile, the R&D department voiced complaints about the need to overhaul long-established development processes, including legacy system upgrades and cross-departmental collaboration restructuring. These internal challenges left investors cautious.

These pressures quickly became evident in Adobe's financial performance. From 2012 to 2014, the company experienced three consecutive years of revenue decline. Net profit plummeted from $830 million to $270 million, and stock prices fluctuated amid investor skepticism.

Despite these pressures, Adobe's management team persisted in promoting the benefits of the new model. They highlighted that individual users could achieve a 70% cost reduction under the subscription model. Additionally, software updates accelerated from every 18 months to a monthly schedule, and enterprise clients received dedicated technical support.

To expedite its recovery, Adobe leveraged its popular Acrobat document service, integrating it deeply with cloud services. This integration offered free features such as electronic signatures and cross-device editing. Not only did this move solidify PDF's status as an industry standard, but it also naturally guided users into the new cloud service ecosystem through frequent document processing scenarios.

In reality, Adobe's primary objective in transitioning to cloud services was to construct a SaaS ecosystem driven by both creativity and data. This ecosystem would enable creative designers to clearly observe the marketing effectiveness data generated by their designs. Simultaneously, marketing teams could optimize deployment strategies in real-time based on creative content.

Adobe's new SaaS-based ecosystem finally began to shine in 2014. Subscription revenue surpassed 50% of total revenue, with Creative Cloud contributing 62%, Document Cloud 23%, and Experience Cloud 15%. By 2016, revenue grew by 21% year-over-year to $5.85 billion, signaling Adobe's successful emergence from a challenging period.

By 2018, Adobe had largely completed its transformation from a software developer to a SaaS service provider. Subscription revenue soared from 10% in 2010 to 90%. The average user lifecycle extended from 2.3 to 4.7 years, annual recurring revenue (ARR) exceeded $10 billion, and enterprise customer retention reached 88%, far surpassing the SaaS industry average.

More importantly, Adobe's long-planned 'Three Clouds' architecture took shape. Creative Cloud focused on content creation, Document Cloud managed document workflows, and Experience Cloud drove marketing technology, forming a complete and interconnected ecosystem.

After completing its SaaS transformation, Adobe set its sights on the broader digital marketing battlefield.

In 2018, Adobe invested $4.75 billion to acquire Marketo, a B2B marketing automation company, followed by a $1.68 billion purchase of the e-commerce platform Magento. Including previous acquisitions, Adobe had invested over $10 billion in marketing technology, building a comprehensive industry chain that spanned from data analysis and user profiling to marketing automation.

Leveraging Adobe's strong 'technical integration' capabilities, these acquired software solutions quickly aligned. For instance, materials created in Photoshop by designers could be directly imported into the Experience Manager system for management. Meanwhile, marketing data from A/B testing could be instantly fed back to Creative Cloud for content optimization.

This multi-dimensional marketing model enabled Adobe to maintain an absolute leading position in the creative and marketing technology sector. In 2022, the company held a 27.9% market share, far exceeding Salesforce's 18.3%. Adobe surpassed Salesforce, a CRM software service provider, as the preferred service provider for Global 500 companies.

Facing the advent of the AI era, Adobe made a forward-looking strategic move in 2016 by launching the Sensei AI platform. This platform enhanced the efficiency of tools like Photoshop and Premiere by 40% through workflow optimizations.

The success of this seven-year transformation was driven by Adobe's precise market insights and agile business model innovation. By cloudifying software tools, Adobe not only reduced user costs but also increased update frequency and improved user experience. This transformation not only reshaped the software industry's business rules but also established Adobe as a global benchmark for traditional companies transitioning to cloud services.

Today, Adobe is no longer just a software company specializing in design tools. Through technological innovation, it has redefined the boundaries of creativity and marketing, becoming an industry giant capable of precisely delivering creative inspiration to target users.

5

Continuous Evolution in the AI Era

As generative AI swept across the globe, Adobe was well-prepared thanks to years of technological accumulation.

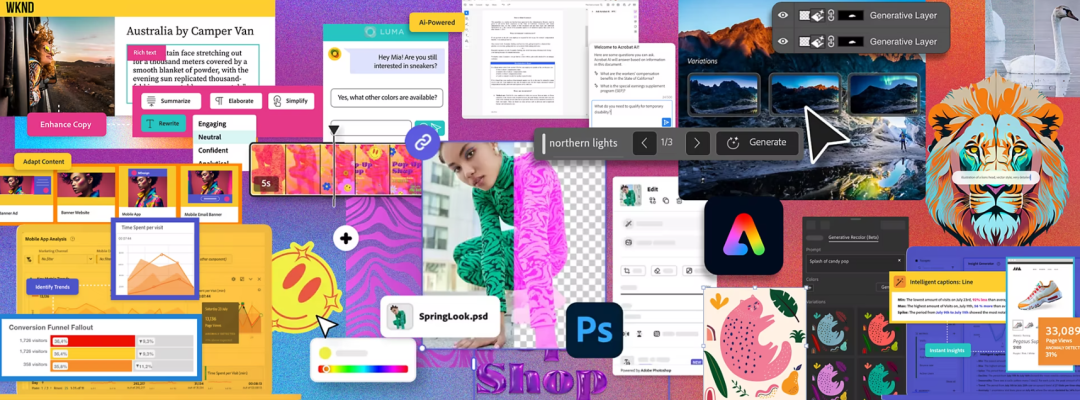

This SaaS giant, which initially started as a creative tool provider, demonstrated forward-thinking strategic planning in the AI era. Through technological innovation and ecosystem integration, Adobe deeply embedded artificial intelligence into the entire creative and marketing workflow, opening a new chapter of 'creativity + AI.'

In March 2023, Adobe officially unveiled its generative AI graphics model, Firefly, at the MAX conference, instantly capturing industry attention.

Unlike other AI tools, Firefly was born with Adobe's 'DNA.' Built on the company's vast library of licensed images, this large model could generate high-quality creative assets such as images, graphics, and illustrations while perfectly avoiding copyright disputes, a major pain point in the industry.

More critically, Adobe did not launch Firefly as a standalone tool. Instead, it embedded the model into its existing product ecosystem, eliminating the 'tool-switching cost' for professional creators. This integration enabled designers to truly experience the joy of 'AI in the creative process.'

For example, in Photoshop, if a designer needs to add a 'summer beach background' to a fashion poster, they can simply input a description (e.g., 'sunny tropical beach, white fine sand, blue sea, coconut trees, realistic style') in the 'generative fill' panel. Firefly will then automatically match the poster's lighting style to generate the background. The generated material can be directly modified with the 'brush tool,' addressing the pain points of traditional AI tools, such as 'style mismatch and inability to edit.'

Behind this powerful technological implementation lies Adobe's deep collaboration with Amazon Web Services (AWS) for enhanced computing power. Leveraging AWS's elastic computing capabilities, Firefly's model training scale expanded 20-fold, meeting various enterprise-level customization needs on demand.

Moreover, Firefly's enterprise services allow brands to train exclusive (proprietary) models based on their own styles and product features. These models generate content that precisely matches the brand's tone. For instance, when integrated with AI, the Adobe Experience Platform enables brands to analyze user data in real time, generate marketing plans using natural language, and optimize creative directions based on audience preferences for AI-generated content's colors and styles, further boosting efficiency.

By May 2025, Firefly had surpassed 12 million monthly active users, with 90% converting from Photoshop and Illustrator and a user retention rate exceeding 85%.

Meanwhile, over 5,000 enterprises worldwide had adopted Adobe's AI solutions, with AI-related business revenue accounting for 15% of total revenue, becoming a new growth engine.

Financial data further underscores Adobe's success.

Adobe's Q2 2025 revenue reached a record $5.873 billion (up 11% year-over-year), with a net profit of $1.691 billion, fully validating its AI strategy.

From PostScript's language revolution to Creative Cloud's cloud migration, from Photoshop's pixel magic to Firefly's generative AI, Adobe's nearly five-decade practice proves that the true competitive advantage lies not in technology itself but in the ability to transform technology into an ecosystem.

As its founder, John Warnock, said, 'Innovation is not about predicting the future but creating it.'

Adobe's story is not only the best interpretation of 'disruptors never rest on their laurels' but also offers a crucial lesson for all enterprises:

In the digital age, companies must either become 'wave makers' reshaping the rules or risk being swept away as bystanders. Only those daring to 'revolutionize themselves' can sustainably navigate historical cycles.

Chinese Literature:

[1] Adobe's 2024 Fiscal Year Revenue Reaches $21.51 Billion, Up 11% Year-Over-Year [J]. Jiemian News, 2024-12-12.

[2] Adobe's Development History, Core Businesses, Competitive Strengths, and Financial Analysis [R]. Future Think Tank, 2024-04-17.

[3] Creative Marketing Giant Adobe 'Expands Its Territory' in the Generative AI Era [J]. TMTPost, 2024-12-31.

[4] In-Depth Report on the Computer Industry: Lessons from Overseas Tech: Adobe (Part 1) – Path to Growth [R]. Xiaoniu Industry Research, 2025-05-23.

[5] A Model for Software Giants Embracing AI: How Adobe Completed Its 'AI Transformation' Step by Step [J]. Tencent News, 2023-07-02.