Countdown to the End of New Energy Vehicle Purchase Tax Exemption: Automakers Roll Out Guarantee Policies to Stabilize Market. Will You Seize This Golden Opportunity?

![]() 11/20 2025

11/20 2025

![]() 597

597

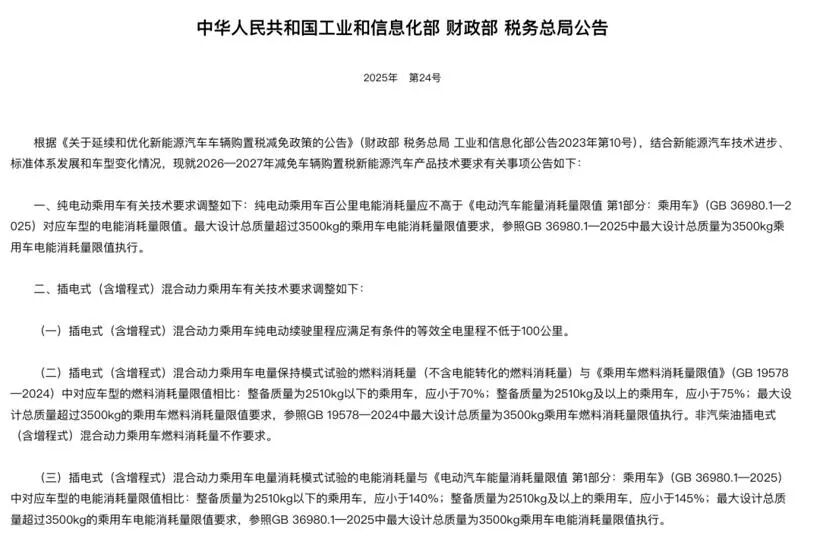

As 2026 looms on the horizon, the Chinese new energy vehicle (NEV) market is poised to enter a pivotal new phase. According to a prior joint announcement by the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Taxation Administration, from January 1, 2026, the 11-year-long purchase tax exemption policy for NEVs will be replaced by a "50% reduction" policy, with a maximum tax exemption of 15,000 yuan per NEV passenger vehicle.

The NEV purchase tax exemption policy, which has been in effect since September 2014, has played a pivotal role in propelling the growth of the NEV market. Now, as the policy winds down, it is set to have a profound impact on consumers and the entire industry landscape.

Purchase Tax Calculation: The True Cost of Procrastination

For the average consumer, the most tangible impact of the purchase tax policy adjustment will be felt in the form of altered vehicle purchase costs. Under the current policy, purchasing an NEV means a complete exemption from purchase tax. However, starting in 2026, consumers will be responsible for paying half of the purchase tax.

Specifically, the purchase tax is calculated by multiplying the vehicle's tax-exclusive price by 10% and then by 50%, with a cap of 15,000 yuan per vehicle in tax exemption. This implies that purchasing a 200,000-yuan NEV will necessitate an additional tax payment of approximately 10,000 yuan from next year onwards. For models priced above 300,000 yuan, the actual purchase tax payable will be even higher due to the exemption cap. For instance, a 400,000-yuan model, which would have been exempt from 25,000 yuan in purchase tax under the previous policy, will still require a 10,000-yuan tax payment under the 50% reduction policy.

What if you place an order for a vehicle this year, but the delivery date falls in 2026? Will you end up paying extra unnecessarily?

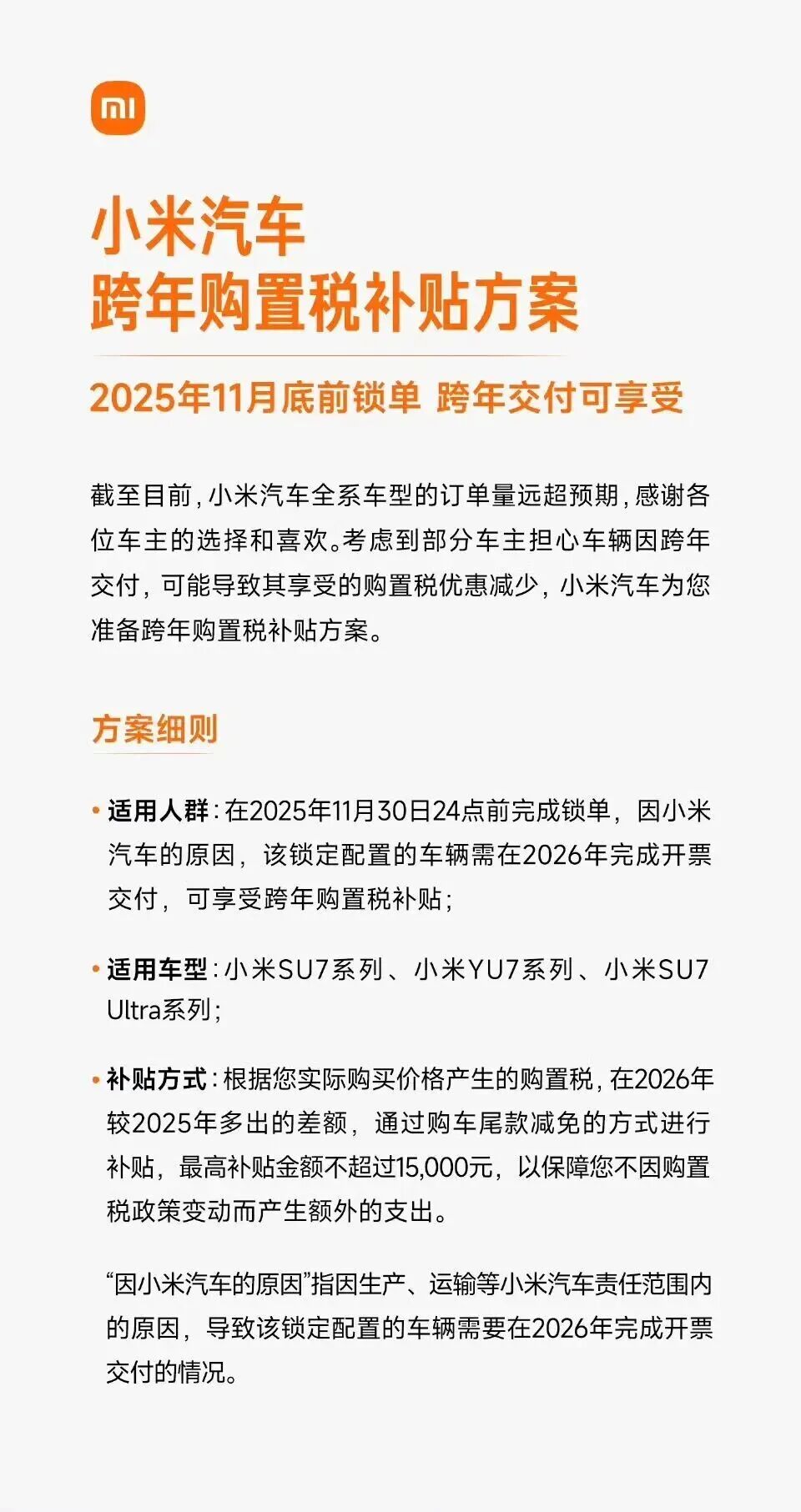

There's no need to fret excessively. Many automakers have recently unveiled "guarantee" policies, pledging to cover the difference caused by the purchase tax reduction. For example, NIO announced at the launch of the new ES8 that users who complete their orders by the end of 2025 and are scheduled for delivery in 2026 due to reasons attributable to the automaker will be eligible for a purchase tax subsidy of up to 15,000 yuan.

Li Auto has also rolled out a similar plan for its i6 model, while Xiaomi Auto offers a cross-year purchase tax subsidy for users who lock in their orders before the end of November. Brands such as Zeekr, Shenlan, and Luxeed have also joined this "guarantee" fray, alleviating consumer anxiety about vehicle purchases through tail payment reductions or subsidy coupons.

These "guarantee" policies have, to a certain extent, stabilized market sentiment. According to data from the China Passenger Car Association, retail sales of new energy passenger vehicles reached 1.296 million units in September this year, marking a 15.5% year-on-year increase, with the penetration rate rising to 57.8%. Some analysts believe that the anticipation of purchase tax policy adjustments has prompted some consumers to accelerate their purchase plans. For those planning to buy a vehicle next year, understanding the guarantee policies of various brands is paramount. Different brands offer varying commitments and timelines, especially for brands with slower deliveries, necessitating careful comparison to make the most advantageous choice.

Technological Threshold Increase: Plug-in Hybrid Models Face a Range Breakthrough Challenge

In addition to purchase tax adjustments, the new policy also significantly raises the technological bar for NEVs. According to the announcement, plug-in hybrid (including extended-range) models must boast a pure electric range of no less than 100 kilometers to qualify for purchase tax exemptions. This regulation has a substantial impact on the 100,000-yuan plug-in hybrid market. For instance, some versions of the BYD Song family and the Geely Galaxy L7 previously had models with a pure electric range below 100 kilometers, which may not qualify for policy incentives in the future. Clearing inventory before the year-end has thus become a top priority.

Besides clearing inventory, adjusting product structures is also crucial. For example, BYD's recent new models have increased battery capacity, elevating the pure electric range of entry-level versions to over 100 kilometers to meet the new regulations. Meanwhile, extended-range models are also embracing the "large battery" trend. Brands like Li Auto and Seres are equipping their new generation models with higher-capacity battery packs, with pure electric ranges generally exceeding 200 kilometers. Additionally, the Leapmotor D19 boasts a pure electric range of 500 kilometers, surpassing that of many pure electric vehicles.

On the flip side, this reflects the policy's guiding role in product development. During the early stages of the NEV market, some automakers relied on low-range models to capture the low-price market. However, the future trend is technological innovation and energy efficiency improvement. For consumers, the increased range threshold means a further optimized user experience for plug-in hybrid models in the long run, which is a boon. Nevertheless, for some small and medium-sized automakers, the cost pressure from technological upgrades may pose additional risks.

Does the Policy Adjustment Necessitate a Transition Period?

The official implementation of the new purchase tax policy is slated for January 1, 2026, but this timeline has sparked considerable debate within the industry. Zhu Huarong, Chairman of Changan Automobile, previously stated at the World New Energy Vehicle Congress that a sudden policy shift at the year-end may lead to a concentrated purchase rush by consumers, causing a "pulsed" surge in market demand followed by a "cliff-like" decline. Such sharp fluctuations not only disrupt automakers' production plans but may also trigger industry chaos, such as excessive inventory buildup and intensified price wars, threatening the stable operation of the supply chain.

Drawing on past experiences, such events have indeed occurred frequently. For example, before the phase-out of NEV subsidies in 2022, there was a purchase rush, followed by a significant decline in sales in the subsequent months. Market fluctuations caused by policy changes not only affect automakers' normal operations but also put pressure on the supply chain. During the year-end sales push, automakers' orders for batteries, chips, and other components surge dramatically, placing immense capacity pressure on upstream suppliers. When the demand peak quickly subsides, the expanded capacity previously built to meet the peak will face the risk of overcapacity. Zhu Huarong, therefore, suggested that policy adjustments should include a transition period, such as gradually adjusting tax rates monthly starting from March 2026, to smooth market fluctuations and provide the supply chain with sufficient buffer time.

However, some argue that a clear timeline can compel automakers to accelerate their transformation. From the current responses of various companies, leading brands like NIO and Li Auto have demonstrated strong market adaptability. Moreover, with the NEV penetration rate steadily exceeding 50%, the industry indeed needs to shift from policy-driven to market-driven growth. After years of operation, the NEV industry has developed a certain level of resilience, and a swift return to market-driven competition may not be a bad thing.

Conclusion

The new NEV purchase tax policy is on the brink of taking effect, requiring consumers to carefully weigh purchase costs against technological upgrades, while automakers must balance market competition with profitability pressures. Whether it's calculating purchase taxes, raising range thresholds, or debating policy timelines, all reflect that China's NEV industry is transitioning from "policy nurturing" to "market independence." For consumers, seizing the final tax exemption window in 2025 or trusting automakers' guarantee commitments requires careful decision-making based on individual needs. For the industry, only through technological innovation and cost control can it continue to thrive in the market after policy support diminishes.