Cheetah Mobile (CMCM.US): The AI Robotics Boom and Profit Confirmation Signal a Valuation Discount Waiting to Be Rectified

![]() 11/25 2025

11/25 2025

![]() 581

581

Since the start of 2025, Chinese assets have demonstrated a steady upward trajectory, with overseas-listed Chinese concept stocks accumulating gains exceeding 27%.

Among these, Cheetah Mobile (CMCM.US) has outstripped the broader index, registering a 38% annual gain. Nevertheless, this relative stock strength has not translated into a commensurate valuation adjustment. Currently, its market capitalization stands at a mere $200 million, significantly lagging behind its net cash position. As of June 30, 2025, Cheetah Mobile boasted approximately $280 million in net cash, underscoring its pronounced undervaluation.

The crux of the issue lies in the market's failure to fully appreciate the company's business transformation. Cheetah Mobile has successfully established a dual-business structure, integrating a stable and profitable internet core segment with a rapidly expanding AI and robotics business.

The profit models and growth trajectories of these two segments differ markedly, necessitating independent valuations to accurately reflect their intrinsic worth.

Given this disconnect between cognitive perception and actual value, the following analysis leverages highlights from the Q2 2025 earnings report to scrutinize Cheetah Mobile's true investment potential across three dimensions: fundamental validation, valuation estimation, and the drivers behind the current discount.

I. Fundamental Transformation: Dual Breakthroughs in Revenue Growth and Loss Reduction

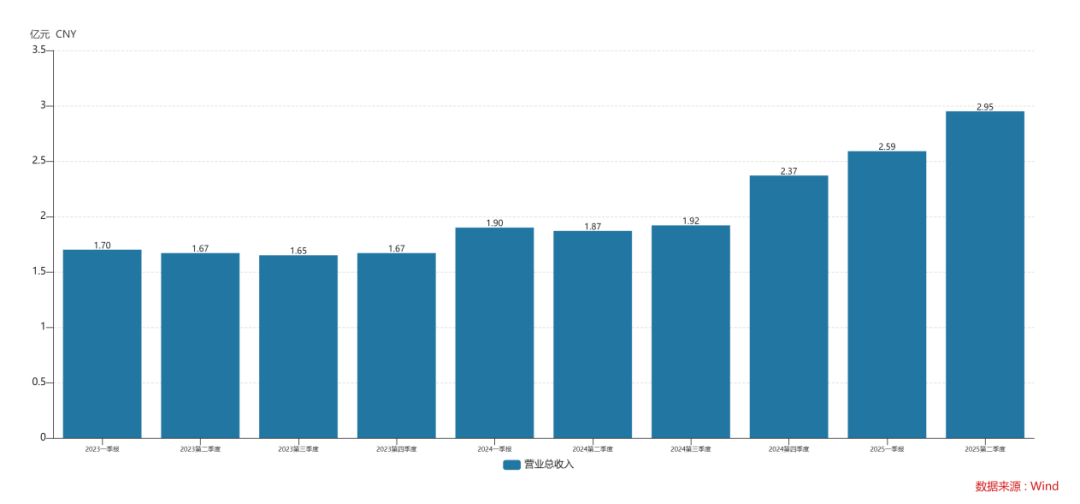

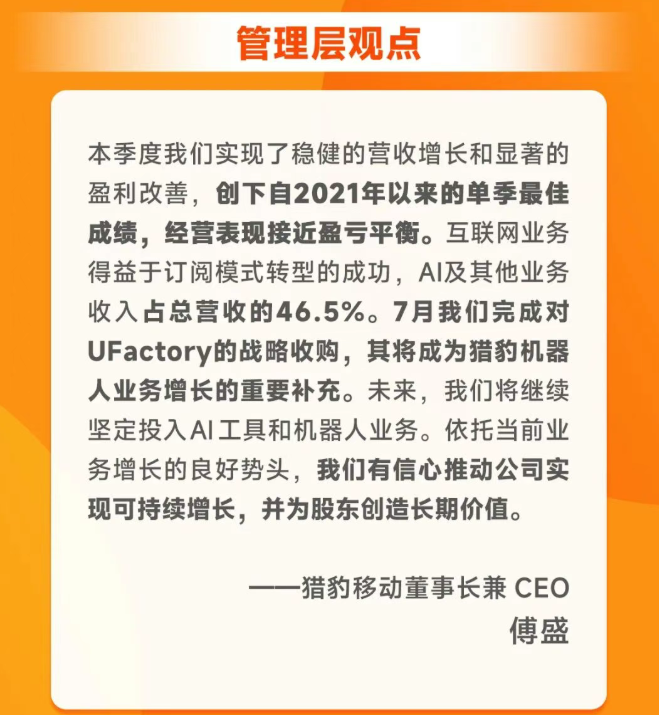

Q2 2025 marked Cheetah Mobile's strongest quarterly performance in recent memory, achieving dual breakthroughs in accelerated revenue growth and sustained loss narrowing. This improvement is indicative of sustainable structural and business model upgrades rather than mere short-term fluctuations.

1. Revenue: Dual-Engine Driven Growth Momentum

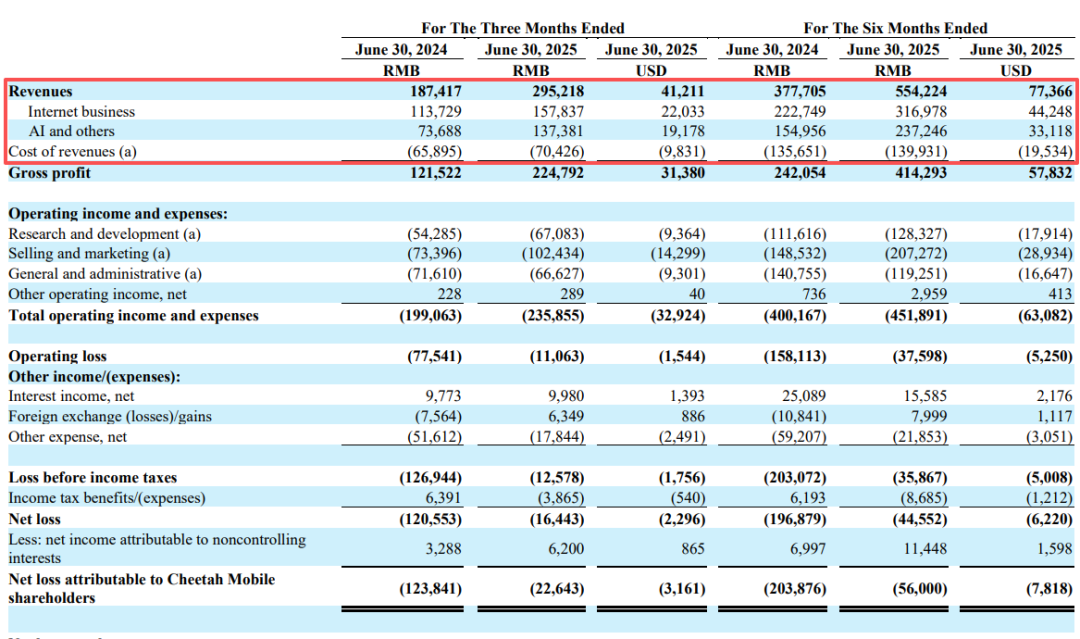

The company reported Q2 revenue of RMB 295 million, representing a 57.5% year-over-year (YoY) increase (accelerating from Q1's 36.1%) and a 14% quarter-over-quarter (QoQ) rise, showcasing robust growth. The core drivers include synergistic contributions from both the internet and AI/other businesses, forming a "stable foundation + high-growth engine" dual-drive model.

Internet revenue reached RMB 158 million (+38.8% YoY), propelled by a successful business model shift from traditional advertising to subscription-led monetization. Subscription revenue now accounts for over 60% of internet revenue, significantly enhancing cash flow stability and forming the cornerstone for sustained profitability.

AI and other businesses (including robotics) delivered explosive growth, emerging as the second growth curve. Revenue hit RMB 137 million (+86.4% YoY), with its revenue share rising from 38.6% in Q1 to 46.5%.

Notably, domestic voice robotics revenue surged 100% YoY in Q2, fueled by client repurchases and new customer acquisition in the domestic market.

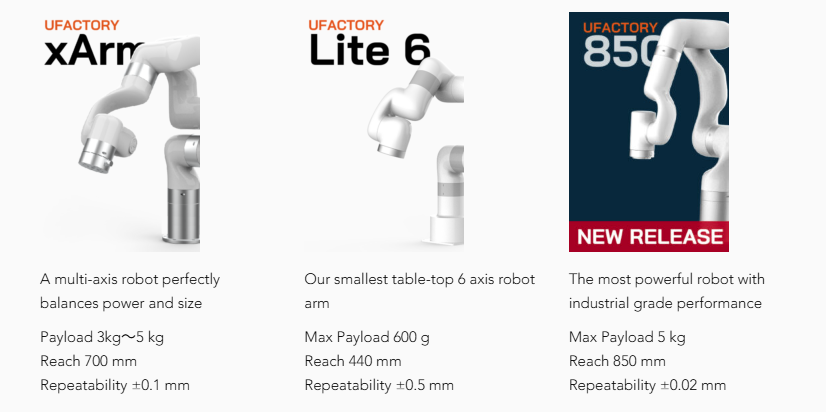

The company completed its acquisition of lightweight robotic arm enterprise UFACTORY ("Zhongwei") in July, with consolidation commencing in Q3.

According to earnings disclosures, Zhongwei generates annual revenue of tens of millions of RMB, primarily from overseas markets, while maintaining high profitability despite intense competition. Its overseas channels and profit base will further bolster Cheetah Mobile's growth certainty.

Management has explicitly targeted 100% YoY revenue growth for AI and other businesses in the second half of the year (H2), backed by clear and strong execution support.

2. Profitability: Significant Loss Reduction, Profit Inflection Point on the Horizon

Q2 GAAP operating loss narrowed to RMB 11.06 million (-85.7% YoY, -58.3% QoQ); Non-GAAP operating loss shrank to RMB 2.08 million (-96.7% YoY, -85.5% QoQ), clearly indicating a profit inflection point.

The CFO expressed confidence in achieving profitability in Q3, supported by a sustainable logic: stable internet profits provide cash flow to offset new business investments, while AI/robotics scale effects emerge. Q2 adjusted operating loss narrowed 62.8% YoY and 32.1% QoQ, reflecting continuous optimization.

3. Financials: Robust Cash Flow, Strong Safety Cushion

As of June 30, 2025, the company held RMB 2.02 billion in net cash and generated RMB 360 million in net operating cash flow, demonstrating strong "self-funding" capabilities. This provides ample funding for R&D and market expansion in new businesses while significantly reducing financial risks and creating a solid safety net.

Additionally, long-term investments reached RMB 790 million, further thickening asset reserves.

II. Valuation Estimation: Revaluation Potential Across Three Scenarios

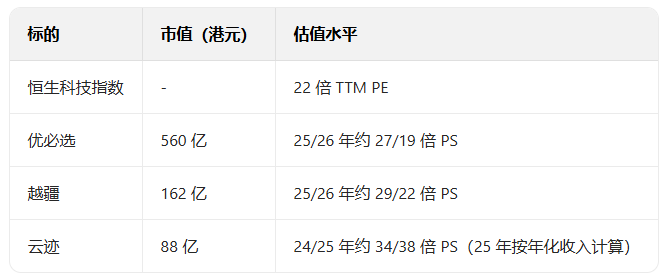

Given Cheetah Mobile's "net cash + stable internet + high-growth AI" structure, segmented valuation better reflects its undervaluation. The following estimates reference index and peer benchmarks (Wind data, as of November 20):

Key Valuation Parameters:

- Market Cap: $200M

- Net Cash: $280M (as of June 30, 2025)

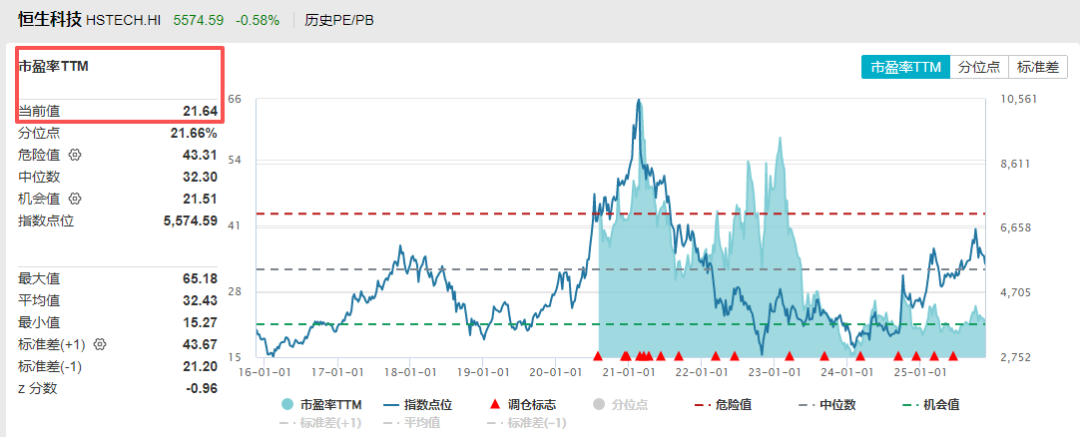

- Internet Business: Q2 operating profit RMB 22.25M, annualized RMB 89M (~$12.5M), referencing Hang Seng Tech's 22x PE

- AI/Other Businesses: Q2 revenue RMB 137M, annualized RMB 550M (~$77M), referencing peer UBTECH's 2026 19x PS (industry's lowest valuation)

Three-Scenario Valuation:

(1) Bull Case: Target Valuation $2.02B (+910% upside)

- Assumptions: Stable internet profits, AI/other businesses achieve H2 growth, market applies average valuations

- Internet: $12.5M × 22x PE ≈ $280M

- AI/Other: $77M × 19x PS ≈ $1.46B

- Plus net cash $280M → Total $2.02B

(2) Base Case: Target Valuation $1.19B (+500% upside)

- Assumptions: Market volatility, 50% discounts for both segments reflecting transitional conservatism

- Internet: $12.5M × 11x PE ≈ $140M

- AI/Other: $77M × 10x PS ≈ $770M

- Plus net cash $280M → Total $1.19B

(3) Bear Case: Target Valuation $740M (+270% upside)

- Assumptions: Excludes internet "cash cow" value, applies 30% of industry-low AI/robotics valuation

- AI/Other: $77M × 6x PS ≈ $460M

- Plus net cash $280M → Total $740M

Even excluding the internet's cash flow value, Cheetah Mobile retains significant revaluation potential through AI/robotics growth and net cash safety.

III. Triple Cognitive Biases in Capital Markets

Cheetah Mobile's undervaluation stems from three unresolved cognitive biases:

1. Lingering Historical Stereotypes

The market has yet to fully recognize the fundamental profit model shift. As discussed, the core internet business has transitioned to subscription, ensuring profit sustainability and cash flow strength. Meanwhile, AI/robotics losses are narrowing, and Zhongwei's consolidation from Q3 will add profit increments, shifting the growth narrative from "improvement" to "full delivery."

2. Underestimation of AI/Robotics Certainty

Markets often value AI firms based on "hit products" or consumer reach, while Cheetah Mobile focuses on B2B sectors like government, hospitality, healthcare, and elderly care, leading to an underestimation of its technical barriers and commercialization capabilities.

However, data validates certainty: Q2 domestic voice robotics revenue doubled YoY; Zhongwei is a rare profitable overseas-focused robotic arm firm, forming a "mobile + robotic arm + AI" tech ecosystem with Cheetah Mobile; management's explicit H2 AI revenue growth target of 100% further reinforces commercialization certainty.

3. Lagging Recognition of Transformation Logic

Since pivoting from "tool software" to "AI + robotics," some investors remain cautious due to "unverified transformation."

Yet investment hinges on capturing inflection points. Current data across revenue growth, loss reduction, and other metrics validate the transformation, with subsequent profit delivery and overseas order releases expected to serve as key catalysts for valuation correction.

Conclusion

Cheetah Mobile's investment thesis has shifted from "turnaround" to "growth confirmation": the internet business provides stable cash flow and profitability, while AI/robotics unlocks long-term growth potential, backed by $280M in net cash.

Despite its market cap falling below net cash, segmented valuations reveal significant revaluation potential across bull, base, and bear scenarios. This discount stems from market overreaction to historical biases, underestimation of new business certainty, and delayed recognition of transformation logic.

With Q3 results scheduled for November 26, validating profit delivery, AI growth targets, and Zhongwei's consolidation impact, cognitive biases will gradually correct, driving a new revaluation cycle for Cheetah Mobile — a stock offering "low valuation, strong safety net, and high growth."