"618" of the "New E-commerce" Era, a Different Kind of Fun

![]() 06/17 2024

06/17 2024

![]() 675

675

Who's still looking forward to 618?

14 years ago, JD.com held its third "618" sales promotion, marking the beginning of the e-commerce "618" model. At that time, there were no live streamers shouting "lowest price on the internet" every day, nor complex promotional mechanisms and extended pre-sales periods; it was simply straightforward discounts, member specials, free shipping, and reward points.

Four years ago, 618 reached its peak; however, with the rise of live streaming e-commerce and content platforms like Xiaohongshu and Douyin attempting to transform into e-commerce, there are more and more players in the e-commerce arena, and the rules of "e-commerce festivals" have become increasingly complex, with longer pre-sales periods... Gradually, everyone seems to have lost patience with e-commerce festivals and sales promotions.

This year's "618" sees both old and new e-commerce players adopting different strategies. Some have canceled pre-sales to bring 618 back to its essence, while others are targeting specific categories to try and gain an edge. With traditional e-commerce still dominating, do the "new e-commerce" players still have a chance?

01. The Confrontation between Old and New E-commerce

This year's "618" is a bit different.

Traditional e-commerce platforms have begun to "cancel pre-sales." Tmall and JD.com have both announced the cancellation of 618 pre-sales and started selling in-stock products, a move that has indeed won the favor of many consumers tired of long pre-sales periods.

Source: Weibo Screenshot

Vivian (pseudonym), a once-loyal e-commerce festival shopper, bid farewell to e-commerce festivals due to issues with the final payment after pre-sales being higher than the actual advertised price. "At the time, I was waiting in a super big streamer's live room to buy a toner recommended by a friend. The price was very clear on the poster and during the streamer's explanation, but after paying the final payment, I found that the total price was more expensive than advertised, and I didn't get a refund after reporting it."

There are many consumers like Vivian who have encountered problems with final payments, delivery times, returns, and refunds during the pre-sales process, and the complexity of deposit and final payment processes and promotional policies have invisibly increased the difficulty of consumption.

Therefore, traditional e-commerce's cancellation of pre-sales is seen as another attempt to please consumers after the introduction of the "only refund" function. Of course, another reason is that as streamers on new content e-commerce platforms like Douyin and Kuaishou shout "lowest price on the internet" every day, people are starting to feel tired of discounts. At this time, shortening the duration of e-commerce festivals can actually increase people's sensitivity to prices.

Source: Canned Stock Images

Unlike the "old e-commerce" players, "new e-commerce" players are still searching for their "identity" during e-commerce festivals, such as Douyin's focus on low prices, Xiaohongshu's buyer culture, and Bilibili's reliance on KOLs.

Douyin's strategy for this year's 618 still revolves around its low-price positioning. In addition to various streamers hosting 618 special events in their live rooms, Douyin also has its own 10 billion yuan subsidy for 618. "Qujie Shangye" found that Douyin's 10 billion yuan subsidy is mainly focused on daily necessities, similar to Pinduoduo, such as kitchen paper, female sanitary napkins, paper towels, men's razors, summer quilts, and other products. In addition, Douyin also has "618 Magic Coupons" that can be used for discounts in designated live rooms.

Source: Douyin Screenshot

"This year, the festive atmosphere of 618 sales promotions on various e-commerce platforms is not particularly obvious, but a few Douyin merchants I follow have indeed started offering discounts." Said a consumer. Due to her fitness habits, this consumer follows some sports brands and has found that both domestic niche and mainstream sports brands have recently offered discounts, though not to a significant extent. "Clothes that cost over 200 yuan are about 10-20 yuan cheaper than usual, roughly a 10% discount."

Xiaohongshu found the "e-commerce buyer" route after Dong Jie and Zhang Xiaohui gained popularity through live streaming and continued this route for this year's 618. When "Qujie Shangye" opened Xiaohongshu's 618 page, it first displayed a coupon for discounts, followed by a showcase of "popular buyer groups." Aikoko, who was live streaming at the time, was showing a red dress from the designer brand Redlabel. Entering the live room reveals that users are constantly sending gifts to the streamer, and the comment section is filled with inquiries about clothing sizes and requests to show other products.

Source: Xiaohongshu Screenshot

Most of the other popular live rooms on Xiaohongshu also focus on designer brands, with prices slightly higher than Douyin's and occasionally featuring celebrity-endorsed products.

In contrast, Bilibili seems to have not yet found the most suitable entry point for 618 among the "new e-commerce" players. On the Bilibili Business Dynamics official account, Bilibili also released a 618 sales promotion plan for streamers, offering traffic rewards to UPs who participate in video or live streaming sales during the period from May 20th to June 20th.

Source: Bilibili Screenshot

However, during the same period, compared to other leading platforms, Bilibili did not stand out in terms of platform activity positioning or data performance.

Consumer experience, purchase reasons, and event positioning: both old and new e-commerce players are continuously trying to update their strategies in these three areas during this year's 618.

02. Who's Buying from "New E-commerce"?

New strategies naturally bring new results.

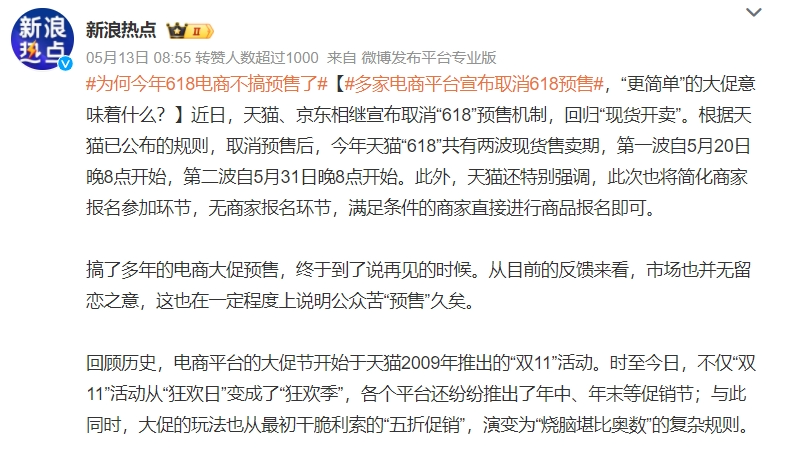

This year's 618, new strategies like traditional e-commerce canceling pre-sales have clearly paid off. Data released by "Analysys" shows that in the first week of the event, the average DAU of traditional e-commerce users led by Alibaba and JD.com increased by about 20% compared to last year; while the average DAU of content e-commerce users like Douyin and Kuaishou increased by around 5%. This also indirectly indicates that this year's new strategies of traditional e-commerce have captured the hearts of consumers to a certain extent.

Source: Analysys Screenshot

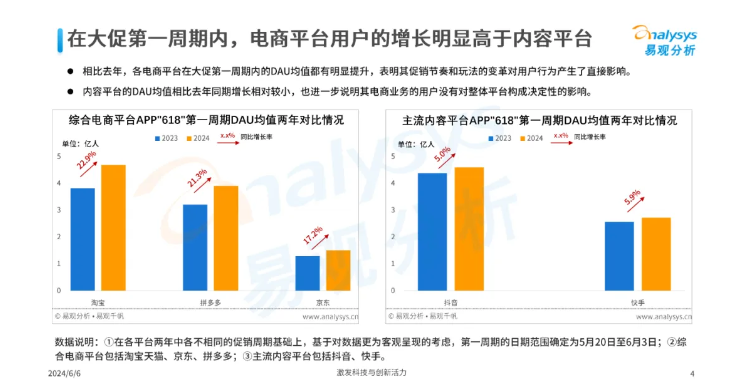

However, in terms of the overall transaction volume and growth rate, Douyin still performed well. In terms of the total transaction volume, Taobao and Tmall still dominate with a share of 47.6%; Douyin almost caught up with JD.com, slightly lagging behind JD.com's 17.9% with 17.4%, and surpassing Pinduoduo's 13.2%. As for year-on-year growth in transaction volume, Douyin led traditional e-commerce with a 30.2% year-on-year growth rate; in comparison, Taobao and JD.com's growth rates were 14.6% and 9.5%, respectively.

Source: Analysys Screenshot

While traditional e-commerce platforms remain the "mainstay," various e-commerce platforms are also delving into vertical areas and exploring their unique advantages.

"I used to only buy things on Taobao, but now I've gradually realized that JD.com, Pinduoduo, Douyin, and Xiaohongshu each have their own charm." Said a heavy e-commerce consumer, voicing the sentiments of many.

This year's 618, Liu Yan (pseudonym), a plant lover, switched from Taobao to Douyin. "Since the beginning of spring, I started trying to buy plants on various platforms like Taobao, Pinduoduo, Douyin, and JD.com, and ultimately chose several merchants on Douyin for frequent repurchases." Liu Yan was initially concerned about Douyin's imperfect after-sales service but found that after receiving two broken seedlings, refunds were smoothly processed, dispelling her doubts.

"The most important reason is that buying flowers on Douyin offers good value for money." Liu Yan said she bought four orchids from a live room specializing in orchid bases for an average price of 10-15 yuan. "There's no difference in quality compared to those priced at 30 or 40 yuan offline, and they all survived."

Source: Canned Stock Images

Fitness enthusiast Xiao Meng (pseudonym) started shopping on Xiaohongshu this 618. "Maybe because I often watch fitness bloggers, I recently came across some sports brand products. After comparing, I found that Xiaohongshu is about 10% cheaper than other platform flagship stores. Last year when Xiaohongshu live streaming was very popular, I noticed a streamer of a big blogger and found that some niche brands also had stores on other platforms and were even cheaper, so I had some doubts about Xiaohongshu. But this 618, the discounts are indeed quite good."

Source: Xiaohongshu, Taobao Screenshots

Relying on cost-effectiveness and supported by diversified positioning and services, domestic e-commerce platforms are gradually transitioning from a monopoly to a flourishing landscape. Of course, in today's environment where traditional comprehensive e-commerce platforms still occupy most of the market share, data shows that Xiaohongshu and Bilibili, two e-commerce players that started as content platforms, have not yet fully "joined the table," but the transition trend from comprehensive to segmented, from search to content, has already emerged in the entire e-commerce race.

03. Is There Still "Blue" in the Red Sea?

With more and more new e-commerce players emerging, user penetration has gradually reached its ceiling, which means that this track will become increasingly competitive.

It's inevitable that there will be "price wars." Nowadays, it seems almost embarrassing to launch a product without the "lowest price on the internet." However, prolonged price wars are not a good solution for either merchants or consumers. For merchants, continuously suppressing prices still has to be passed on to consumers, and in order to maintain a certain profit margin, there may be issues like poor product quality, substandard logistics, and delayed after-sales service.

Some merchants have their own tricks to achieve "lowest prices." One consumer said that when they wanted to buy a T-shirt this summer, they searched for keywords on Douyin and found a streamer promoting a certain fashion brand. The streamer introduced that the price was 149 yuan on Taobao's flagship store but only 99 yuan in the Douyin live room. Excited, the consumer placed an order but later found out that the brand's shipment volume on Taobao's flagship store was very low, and that price may have been set only to highlight Douyin's low price and encourage consumers to place orders.

"After gaining this experience, I'll always pay attention when watching live streams and have found that this is a common tactic to create low prices." Said the consumer.

Source: Canned Stock Images

Moreover, consumer demand is also changing. In addition to pursuing cost-effectiveness, more and more consumers are also starting to pursue quality. Many consumers say that with the improvement of after-sales service on platforms, although the "only refund" option has been introduced, they don't want to always apply for refunds. The essence of online shopping is to buy desired products; blindly pursuing low prices while ignoring quality and then using "hassle-free" refunds to cover up quality issues is not a long-term solution.

Therefore, both old and new e-commerce players are beginning to highlight their unique advantages. Some focus on categories, such as electronics for JD.com, women's clothing for Taobao, luxury brands for Tmall, agricultural products for Pinduoduo, and designer items for Xiaohongshu; while others focus on services, such as JD.com's logistics, Tmall's after-sales service, and Douyin's product showcases.

Source: Canned Stock Images

It has to be admitted that for "new e-commerce" players, there are not many opportunities left for them. After all, the three biggest pain points of e-commerce - categories, logistics, and after-sales service - have been largely addressed, making it difficult for "new e-commerce" players to find a "blue ocean" in segmented tracks based on positioning.

Therefore, "cultivating internal strength" has become a required course for e-commerce platforms; for example, combining AI algorithms for more precise recommendations and simplifying platform data systems to facilitate order placement and frequent purchases by merchants and users.

Overall, the 2024 618 is both quiet and intense. Both old and new e-commerce players need to "cultivate both internal and external strengths" if they want to continue moving forward.