Starlink Satellites Reduce Orbital Altitude, Further Heightening the “Space Resource Race”

![]() 01/06 2026

01/06 2026

![]() 609

609

Every significant move by Elon Musk's SpaceX garners substantial attention from the global aerospace sector. Recently, SpaceX announced its plan to lower the orbital altitude of thousands of Starlink satellites as a measure to mitigate collision risks. This decision has ignited widespread discussions within the industry, with numerous experts expressing concerns that it will intensify the competition for orbital resources.

4,400 Starlink Satellites to Shift to Lower Orbits Under the Pretext of Minimizing Collision Risks

Michael Nichols, the Vice President of the Starlink program, stated that the company is launching a comprehensive reorganization plan for its satellite constellation. This entails reducing the altitude of all satellites currently operating at approximately 550 kilometers to around 480 kilometers. The objective is to relocate satellites to a less congested orbital layer, diminish collision risks, and facilitate faster de-orbiting and atmospheric burn-up in the event of anomalies or failures, thereby minimizing space debris. It has been disclosed that approximately 4,400 Starlink satellites will undergo this orbital altitude reduction by 2026.

Nichols emphasized that, in addition to creating a relatively safer and more manageable space environment for satellite operations, this adjustment is closely linked to the solar activity cycle. Solar activity follows an approximate 11-year cycle, with its intensity directly influencing the density of Earth's upper atmosphere. The next solar minimum is anticipated in the early 2030s. As this period approaches, the density of the upper atmosphere will decrease, leading to longer natural orbital decay times for satellites at the same altitude. By lowering the orbital altitude, the orbital decay time, which could extend beyond four years during the solar minimum, can be reduced to just a few months, thereby increasing the orbital decay rate by over 80%.

Moreover, theoretically, reducing satellite orbital altitudes can decrease latency. However, since not all latency is attributable to satellite distance, the improvement in latency resulting from a 70-kilometer orbital altitude change is minimal.

Overall, Low Earth Orbit (LEO) is becoming increasingly crowded. A recent study by researchers from the Massachusetts Institute of Technology (MIT) indicates that many satellites may soon operate in orbital regions that are already too congested for safe long-term operations.

In 2019, roughly 13,700 objects (including satellites and various debris) were orbiting Earth at altitudes below 2,000 kilometers in LEO. By 2025, this number had surged to 24,185, marking a 76% increase. It is projected that by the end of 2029, around 70,000 satellites may inhabit LEO, representing a more than fivefold increase from 2019.

In 2019, only 0.2% of Earth-orbiting satellites were compelled to perform more than 10 collision avoidance maneuvers per month. By early 2025, this proportion had soared sevenfold to 1.4%. Although this number may appear low, it implies that over 300 satellites are dedicating significant time to evading debris and other spacecraft.

Different satellite operators employ varying thresholds for implementing collision avoidance mechanisms. NASA spacecraft typically initiate avoidance maneuvers when the collision risk exceeds one in 10,000, whereas SpaceX adopts a more cautious approach, utilizing its autonomous space avoidance system to steer clear of objects with risks exceeding one in 3.3 million.

The new study suggests that satellite operators can optimize the utilization of available space by reducing launches into already crowded orbits and coordinating constellation operations to synchronize satellite orbits rather than having them cross paths. However, coordinating constellation operations among satellite operators seems impractical at this stage. Therefore, SpaceX's proactive strategy of lowering orbits to alleviate space congestion and collision risks is a viable solution under the current circumstances.

Intensified Competition for Limited Resources Poses Challenges to Satellite Internet Development

SpaceX's proactive move to lower orbits and mitigate collision risks can be viewed as a passive and relatively short-term response. MIT researchers believe that congestion in the 400-600 kilometer orbital region will become more pronounced. While Starlink's current reduction to a 480-kilometer orbit may temporarily alleviate congestion, increased launches of various spacecraft in the future are likely to lead to congestion in this orbit as well. From this perspective, it underscores the lag in existing international space regulations and the intensifying competition for limited orbital resources.

Starlink is currently the fastest-growing satellite service operator globally. After merely five years of commercial operations, Starlink has connected over 9 million users, with over 4.6 million new users added in 2025 alone.

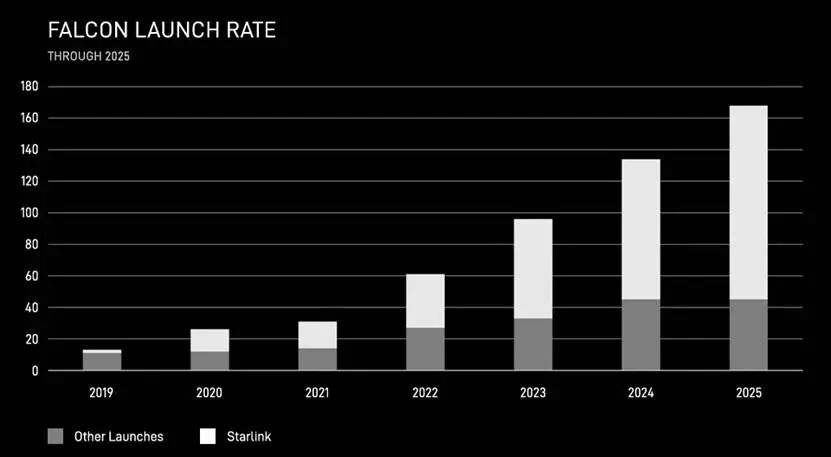

SpaceX has completed over 300 dedicated Falcon 9 rocket launches, all exclusively for the Starlink constellation. In 2025, SpaceX conducted over 120 dedicated Falcon 9 launches to deploy Starlink V2 Mini satellites. The new satellite version weighs 575 kilograms, a reduction from previous models, and incorporates optimized designs to address known vulnerabilities and failure points from earlier versions, significantly enhancing reliability. The reduced weight of each satellite enables Falcon 9 to carry more satellites per mission, injecting greater capacity into the constellation. In 2025, SpaceX launched over 3,000 V2 Mini optimized satellites, adding over 270 Tbps of capacity to the constellation. As depicted in the figure below, Starlink has dominated recent satellite launches.

Against the backdrop of Starlink's rapid development, domestic and foreign experts frequently compare China's satellite internet progress with that of Starlink.

Overall, China's satellite internet sector has transitioned from technical validation and initial construction to a phase of large-scale deployment and application exploration, extending from specialized to mass-market domains. In August 2025, the Ministry of Industry and Information Technology issued the "Guidelines on Optimizing Business Access to Promote the Development of the Satellite Communications Industry," setting a target of over 10 million satellite communications users by 2030 and proposing to "organize commercial trials for satellite IoT and support qualified enterprises in relying on low-orbit satellite IoT constellations."

In terms of constellation construction, China's satellite internet constellations are being developed through a combination of national leadership and commercial initiatives. On one hand, the national team, represented by China Satellite Network Group, is spearheading the construction of a globally covering low-orbit broadband satellite constellation and actively promoting the integration of satellite communications with 5G/6G. In 2025, it achieved the world's first mobile phone-to-satellite broadband video call directly based on the 5G NTN standard through new technology trial satellites. Meanwhile, local state-owned enterprises like Shanghai Yuanxin are also making progress, with an expected 648 satellites in orbit by the end of 2026. On the other hand, private enterprises have achieved significant breakthroughs. For example, Geely's Time and Space Dao Yu (Zhixing Daoyu) completed the global deployment of its Geely Constellation Phase I in September 2025, launching 64 satellites to achieve real-time global communication coverage except for the polar regions, becoming the first globally covering low-orbit satellite IoT constellation led by a private enterprise.

It is evident that China's satellite internet development has emerged as another key global force. Inevitably, the competition for orbital resources will intensify. SpaceX's move to lower orbits is seriously encroaching on the development space of subsequent countries and enterprises. According to International Telecommunication Union (ITU) regulations, orbital and frequency resources follow a "first-come, first-served" principle. With its first-mover advantage, Starlink has already occupied a significant amount of high-quality low-orbit resources, with over 10,000 satellites launched and more than 9,300 currently in orbit. If this trend continues, a scenario of "first-comers dividing space and setting rules" may emerge, with the "space resource race" in low-orbit resources posing severe challenges to satellite internet development. In the future, international regulatory coordination, accelerated constellation deployment, and expedited research and development of space debris removal technologies may be the primary ways to address this "space resource race."