Ali and ByteDance: One Battlefield, Two Strategies

![]() 01/07 2026

01/07 2026

![]() 595

595

Source | Bohu Finance (bohuFN)

Recently, Volcano Engine was officially unveiled as the exclusive AI cloud partner for the 2026 Spring Festival Gala. The Doubao Large Model is set to engage in in-depth collaboration, introducing a host of AI-powered interactive features.

In China, the sponsors of the Spring Festival Gala have always carried a unique significance. From the early days of liquor (baijiu, Chinese white liquor) and real estate to the later era of internet "red packet wars," companies willing to invest heavily in sponsoring the Gala often signal a strong ambition for growth.

The AI boom has already been felt by the general public, let alone those at the forefront of the industry.

In just one year, the former "AI Six Dragons" have taken divergent paths. Zhipu and Minimax have welcomed initial public offerings (IPOs), each valued at around HK$50 billion. Yuezhi'anmian is still in the process of securing new rounds of financing, having recently raised $500 million with a valuation of approximately $4.3 billion (about RMB 30 billion).

In contrast, major corporations have recently stepped up their investments in AI large models with even greater vigor. Alibaba and ByteDance have been the most proactive. Alibaba has shown unprecedented enthusiasm and importance for AI, officially announcing an investment of over RMB 380 billion over the next three years to construct cloud and AI hardware infrastructure, with the possibility of additional investments. ByteDance, while not publicly disclosing much, has taken numerous practical actions. According to the Financial Times, ByteDance plans to allocate RMB 160 billion to AI in 2026.

This is likely why the previously circulated, albeit flawed, image of the "Alibaba Qianwen All-Staff Meeting" garnered such widespread attention. Of course, the image was AI-generated, but the competition had already commenced.

01 Alibaba's All-Out Offensive

Alibaba's investment direction in large models has always been clear: to become the "water, electricity, and coal" of the AI era.

At the 2024 Cloud Town Conference, Wu Yongming stated, "Alibaba Cloud has built a significant amount of AI computing power in the past year but still cannot meet the strong demand from customers. Moving forward, Alibaba will rebuild AI-advanced infrastructure for the future."

In September of this year, multiple media outlets reported that Alibaba is developing its own AI chips. This move not only fills the computing power gap left by restricted procurement of NVIDIA H20 chips but also enhances the "sense of security" for AI infrastructure.

Through the deep integration of self-developed chips with Alibaba Cloud, Alibaba aims to fundamentally reduce inference costs and improve response speeds, thereby constructing a long-term, controllable technological foundation for its "cloud + AI" strategic closed loop.

However, this path of "building bridges and laying roads" from the underlying hardware also entails heavier capital expenditures and longer return cycles. Alibaba is willing to be the "pioneer," betting on the commercial prospects of "AI redoing everything."

For Alibaba, such stories are not unfamiliar. Alibaba Cloud became the leader in China's cloud computing market by capitalizing on the mobile internet entrepreneurial wave. Now, it has simply replaced the protagonist from "mobile apps" to "AI-native applications."

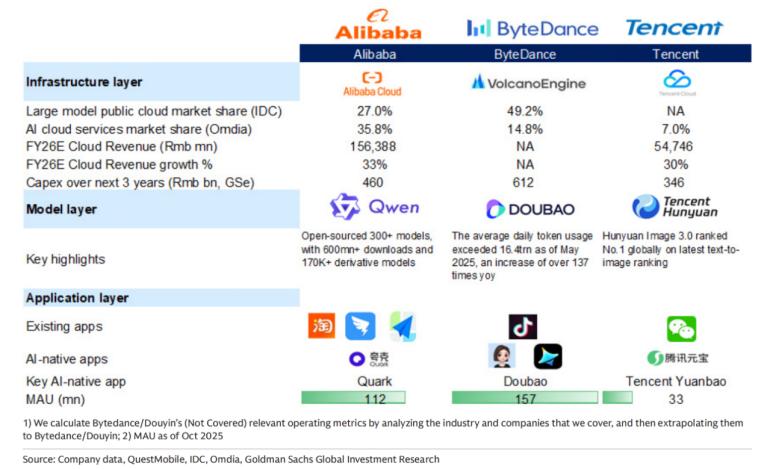

According to Goldman Sachs' latest China Internet analysis report, Alibaba leads in external AI cloud revenue at the enterprise level, with a market share of 35.8%, followed by ByteDance at 14.8% and Tencent at 7%.

Beyond cloud services, there are the models. Alibaba's Qwen series models are widely recognized as one of the strongest open-source models. Its latest Qwen3-Max ranks third in the global large model rankings, outperforming international top models like GPT-5 and Claude Opus 4.

Leveraging its model capabilities, Alibaba has begun launching multiple applications for consumers.

First, Kuake introduced a dialogue assistant feature, followed by Alibaba launching the Qianwen APP. Its sibling company, Ant Group, also accelerated its entry, launching "Lingguang" for office scenarios and "Afu" focusing on lifestyle services, fully covering users' diverse needs from search, creation to finance and daily interactions.

Alibaba seems to have found its AI path—not pursuing generic "smart chat" but deeply embedding its leading large model capabilities into specific scenarios to create "super tools" that truly solve real-world problems and provide clear value.

For example, Kuake's "AI Super Frame" can directly replace search boxes for decision-making. Lingguang transforms large model capabilities into productivity for workers. Afu attempts to build user trust in the sensitive but essential healthcare scenario.

Additionally, Alibaba has accelerated its layout in the smart hardware sector, launching the "Kuake AI Glasses" integrated into the Alibaba ecosystem, with sales exceeding 3,000 units in three days. It aims to penetrate users' daily lives through hardware, addressing its lack of consumer-facing traffic entry points.

Thanks to Alibaba's vast ecosystem and rich scenarios, Alibaba AI can seamlessly integrate into real-life scenarios such as payment, wealth management, and consumption, truly helping users "get things done."

02 From ByteDance to TokenDance

Tan Dai, President of Volcano Engine, believes that AI is like a marathon—there is no need to focus on the final goal in the early stages but rather on "early signals of success." The team's focus will be on product optimization, continuously validating whether the product is on the right development track through high-frequency interactions with customers and responding to market iterations.

For ByteDance, its vast content ecosystem can transform user behavior data into "data fertilizer," which in turn feeds model training and experience optimization. Therefore, ByteDance AI focuses more on usage volume than model parameter capabilities.

The core metric for measuring application scalability is Token.

On one hand, ByteDance leverages its "APP factory" nature to launch over 20 AI applications. On the consumer side, it offers the general-purpose smart assistant "Doubao," the emotional companionship virtual character app "Maoxiang," the AI video creation tool "CapCut," and the low-code intelligent agent platform "Kozi," among others. According to media personality Lan Xi, to maximize its advantages, ByteDance not only promotes Doubao through influencer channels but also cut off advertising for other AI products on Douyin-related platforms in 2024.

By the end of 2025, Doubao's daily active users (DAU) exceeded 100 million, becoming the first independent AI application in China to achieve this milestone.

On the enterprise side, ByteDance provides one-stop AI infrastructure services through Volcano Engine. According to China Entrepreneur Magazine, since the second half of 2025, Volcano Engine has begun to aggressively capture the market, targeting high Token-consuming products like AI hardware and AI toys. Meanwhile, Volcano Engine has also developed multiple enterprise applications to meet the demands of "Token-hungry" multimodal and Agent technologies.

According to official disclosures, Doubao Large Model's daily Token calls now exceed 50 trillion, second only to OpenAI and Google Cloud.

For ByteDance, AI also presents an opportunity to re-enter the hardware sector. Recently, ByteDance collaborated with hardware manufacturers to launch the "Doubao Phone," embedding large model capabilities directly into the phone's operating system, allowing direct access to system resources and all apps.

03 Conclusion

These two super companies have taken different paths, largely determined by their "DNA." It is probably too early to say which approach is more correct.

What is certain is that from Alibaba's self-developed chips to ByteDance's acquisition of computing power; from Alibaba's intensive launch of new products to Volcano Engine's appearance on the Spring Festival Gala stage, both companies continue to make saturated investments.

Meanwhile, Baidu, Tencent, and Deepseek remain in the game. This AI battle, currently dominated by Alibaba and ByteDance, could see new variables emerge at any moment.

Referenced Sources:

China Entrepreneur Magazine: "ByteDance is Becoming TokenDance"

The cover image and accompanying illustrations are copyrighted by their respective owners. If the copyright holders believe their works are unsuitable for public viewing or should not be used free of charge, please contact us promptly, and our platform will make immediate corrections.