From 'Boundless Cosmic Expanse' to 'Tangible Performance': The Emerging Paradigm of Commercial Space in 2026

![]() 01/12 2026

01/12 2026

![]() 505

505

Reflecting on 2025, China's commercial space sector has witnessed an unprecedented year of growth. This year, the China National Space Administration (CNSA) established a dedicated commercial space division and launched the inaugural phase of the National Commercial Space Development Fund, with a substantial investment of 20 billion yuan, signaling the advent of a specialized regulatory framework for China's commercial space endeavors.

Concurrently, the capital market has responded enthusiastically. On November 26th, the Shanghai Stock Exchange unveiled the 'Shanghai Stock Exchange Guidelines for the Application of Rule 9 on Issuance and Listing Review - Application of the Fifth Listing Standard for Commercial Rocket Enterprises on the STAR Market,' which, for the first time, delineated detailed criteria for commercial rocket enterprises seeking to apply the fifth listing standard.

This year, the industry has transitioned from the nascent '1 to N' phase into full-scale development. According to the 'China Commercial Space Industry Research Report,' since 2025, China has executed 87 space launches, with 23 of them conducted by private commercial rocket enterprises, successfully deploying 324 spacecraft into orbit.

As 2025 draws to a close, 2026 is poised to be another pivotal juncture for the evolution of China's commercial space industry.

01. Orbital Rivalry: The Scarcity of Frequency and Orbital Resources for Low-Earth Orbit Satellites

Looking ahead to 2026, 'orbital rivalry' may emerge as the defining term for commercial space. Among the myriad development avenues in commercial space, low-Earth orbit (LEO) satellite internet stands out as the most promising direction. Compared to high-orbit satellites, LEO satellite internet enables global coverage through extensive networking, characterized by low transmission latency, minimal link loss, lightweight single-satellite mass, simple structure, flexible launch options, and relatively low manufacturing costs. Its large-scale and flexible deployment capabilities make it the current focal point of satellite internet construction.

Moreover, the frequency and orbital resources for LEO satellites are becoming increasingly scarce, adhering to the 'first come, first served' principle. According to the International Telecommunication Union's (ITU) 'Radio Regulations,' near-Earth orbits and frequencies are allocated based on this principle. The relevant orbital parameters of the satellite system to be constructed and the required radio frequencies must be declared to the ITU at least 2 to 7 years in advance. In principle, different satellite systems should utilize distinct frequencies to prevent signal interference caused by adjacent frequencies.

Against this backdrop, high-quality orbital resources are becoming scarce, while the Ku and Ka communication frequency bands primarily utilized by LEO satellites are gradually reaching saturation. Orbits and spectrums have evolved into critical strategic resources that nations are vying to secure to gain a competitive edge.

Furthermore, according to the 'IMT Framework and Overall Objectives for Development Towards 2030 and Beyond,' 6G emphasizes six major application scenarios: immersive communication, ultra-high reliability and low latency, massive communication, ubiquitous connectivity, integrated sensing and communication, and integrated communication, intelligence, and computing. However, ground infrastructure is significantly impacted by environmental factors and struggles to achieve comprehensive global coverage. Therefore, to realize the integration of space and ground, the Internet of Everything, and ubiquitous connectivity in the 6G era, there is an urgent need for the integrated application of satellite internet and 5G/6G to jointly construct an integrated space-air-ground information network system.

Faced with this scenario, China's two major constellations—China Star Network (GW) and Qianfan Constellation (G60)—are accelerating their networking efforts. According to the ITU's spectrum occupancy rules and the promotion requirements of the National Development and Reform Commission's new infrastructure initiative, the domestic implementation of a thousand-satellite deployment has a rigid window period from 2026 to 2027. CITIC Construction Investment's research report predicts that by 2026, China's major satellite internet projects, such as the Qianfan Constellation and GW Constellation, will gradually enter an accelerated launch phase. From a specific planning perspective, the China Star Network GW Constellation plans to deploy a total of 12,992 satellites, including 6,080 satellites in the GW-A59 sub-constellation distributed in very low Earth orbits below 600 km, and 6,912 satellites in the GW-A2 sub-constellation distributed in near-Earth orbits at 1,145 km. The Qianfan Constellation aims to achieve 324 satellites in orbit by mid-2026, increasing to 648 by the end of the year, and targets a global networking goal of 15,000 satellites after 2030.

02. Performance Delivery: High Certainty in Upstream Satellite-borne Phased Array Antennas and Communication Payloads

Accompanied by the intensive launch of satellites, 'performance delivery' may emerge as the second defining term for commercial space in 2026.

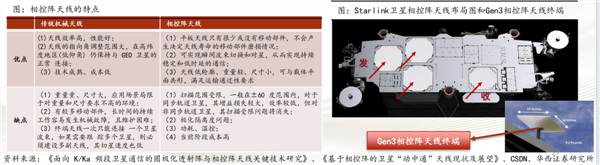

According to the 'Guidelines for the Promotion and Application of First(Set) Major Technical Equipment (2024 Edition)' jointly released by seven departments, including the Ministry of Industry and Information Technology, mobile phone direct-to-satellite communication satellites for low-Earth orbits are mandated to adopt full-digital phased array antenna technology with no fewer than 16 beams. The establishment of this technical standard provides clear guidance for the development of the relevant industrial chain.

Based on the aforementioned background, CITIC Securities assesses that against the backdrop of continuous upgrades in satellite platforms and payloads, niche areas such as satellite-borne phased array antennas and communication payloads will benefit the most, and it is anticipated that the relevant market will enter a rapid expansion phase.

Therefore, in the low-altitude satellite communication industrial chain, upstream core components are expected to become the primary beneficiaries. The reasons are as follows: First, there is a strong demand for these components, as both satellites and ground terminals rely on them. Second, there are high technical barriers, making it challenging for companies with a first-mover advantage to be swiftly replaced. Third, performance delivery is rapid, as component procurement precedes satellite manufacturing and launch, allowing for earlier reflection in corporate revenues.

In terms of related targets, Huaxi Securities identifies the following beneficiaries: AstroMap Measurement and Control (space situational awareness and digital simulation), Shanghai Hanxin (phased array antennas and terminals), Jiguang Xingtong (non-listed, laser payloads), Kesai Technology (non-listed, phased array antennas), CICT Mobile-U, Guobo Electronics (phased array T/R components), Zhenyou Technology, Disithink Technology (non-listed, phased array digital chips), etc.

03. Technological Breakthrough: The First Domestic Company to Fully Master Reusable Rocket Technology May Emerge

Faced with increasingly fierce competition for orbital and frequency resources and the pressing time window for networking, technological breakthroughs have become paramount to winning this space race. In particular, reusable rocket technology can significantly reduce launch costs and enhance deployment efficiency, making it an indispensable choice to meet the rapid networking needs of ten-thousand-satellite constellations.

From a cost perspective, the majority of rocket costs lie in the engines and rocket bodies, with the cost of the first-stage rocket body accounting for over 70%. If it can be recovered and reused, launch costs can be substantially reduced. On December 3, 2025, LandSpace launched the Zhuque-3 Yao-1 carrier rocket, which successfully entered orbit, marking the formation of real transport capacity by private rocket companies. Although the first stage ultimately experienced anomalies after ignition during the landing phase, and the recovery test was unsuccessful, this launch still holds milestone significance.

According to Soochow Securities' predictions, by 2026, China will master the core technology of rocket recovery, and launch costs are expected to decrease by 70% to 90%, propelling satellite orbit insertion into an 'airline-like' era.

In terms of related targets, Soochow Securities highlights the following for rockets: Aerospace Power (engines), Sirui New Materials (engine inner wall materials), Chaojie Shares (rocket body structural components), Shaanxi Huada (electrical connectors), Aerospace Information (rocket final assembly); for satellites: Shanghai Hanxin (G60 communication payloads), Shanghai Hugong (satellite final assembly), Gaohua Technology (sensors), Chengchang Technology (RF chips), Shanghai Harbour (energy systems), Zenith Technology (TR chips), Jiayuan Technology (communication security), Putian Technology (laser links), Dry Photonics (solar cells); for space computing power: Shunho shares, UCloud, Aerospace Information, Jiayuan Technology, Putian Technology, etc.

04. Conclusion

In summary, whether it is the competition for orbital resources, the maturation of the industrial chain, or breakthroughs in rocket technology, they all converge towards a grander human vision: space is no longer a distant frontier but an integrated network foundation and innovation engine for daily life.

Behind this race lies not only the interplay between commercial interests and national strategies but also humanity's profound pursuit of connectivity, exploration, and sustainable development. When satellites pave the way for global interconnection like stars, and rockets can traverse between heaven and earth like flights, we may be witnessing the prologue to a new era—technological breakthroughs are transforming the space economy from concept to reality, and each launch, each satellite, is reshaping humanity's perception of resources, communication, and collaboration.

However, while racing ahead, the imperative to construct an inclusive and sustainable space governance system that genuinely benefits the world with technological dividends will become a more profound proposition than simply occupying orbits. The vast expanse of the starry sky holds endless exploration; yet the path beneath our feet always stems from sober thinking about the future and a shared sense of responsibility.