How Should We Interpret the Diversification in the Commercial Aerospace Industry?

![]() 01/15 2026

01/15 2026

![]() 504

504

Since late November 2025, the commercial aerospace sector has witnessed a remarkable 90% surge, outperforming all other sectors in the A-share market. However, starting from January 13, the sector has experienced a divergence in performance, with a select few leading companies continuing their upward trajectory while the majority have seen a significant decline.

Looking ahead, the pivotal questions are: Which segments within the commercial aerospace industrial chain truly possess high entry barriers and long-term value? Who will emerge as the ultimate victors in this industry's growth cycle?

【Behind the Boom】

Over the past month and a half, nearly 30 companies in the commercial aerospace sector have witnessed their stock prices double, marking a capital bonanza.

The primary catalyst for this rally stems from the listing plans of leading domestic and international commercial aerospace companies.

In early December, Elon Musk confirmed that SpaceX intends to go public as early as mid-2026 or by the end of the year, with an estimated valuation of around $1.5 trillion and a potential fundraising scale exceeding $30 billion. In July 2025, SpaceX's valuation in the primary market was approximately $400 billion.

This indicates that in just a few months, SpaceX's valuation has multiplied several times over, sending a clear signal to global markets, including the A-share market: the space industry holds immense potential.

Following closely, Landspace, often hailed as the "Chinese version of SpaceX," received approval for its IPO on the Science and Technology Innovation Board (STAR Market) in late December, with plans to raise 7.5 billion yuan. Shortly before, Landspace's Zhuque-3 carrier rocket successfully launched, with its first and second stages separating smoothly and delivering satellites precisely into their predetermined orbits.

However, the catalyst merely ignited the market. The deeper underlying logic lies in the Sino-U.S. competition for commercial space resources, suggesting a comprehensive acceleration in the commercialization process.

To this end, the domestic policy landscape has also provided a series of supports, shifting from early encouragement of exploration to systematic advancement. Measures such as explicitly including commercial aerospace in the "15th Five-Year Plan" as a strategic emerging industry, facilitating financing and listings for related companies on the STAR Market, and establishing specialized agencies for commercial aerospace by regulatory bodies have further fueled market expectations for accelerated industry commercialization.

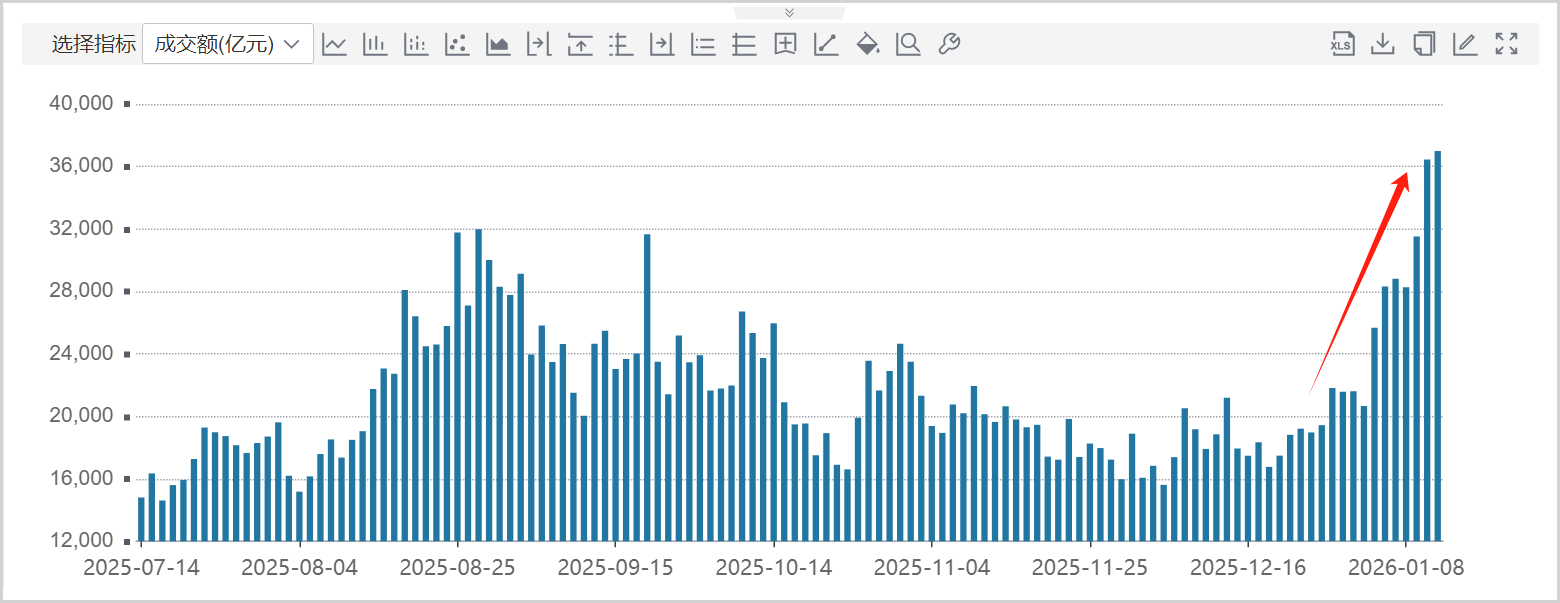

Additionally, the boom in the commercial aerospace sector has been buoyed by the overall liquidity in the A-share market. Especially since December, the average daily trading volume across the market has climbed from approximately 1.6 trillion yuan to nearly 3.7 trillion yuan, reaching a historical high. This ample liquidity has provided a solid foundation for the rise of technology sectors such as commercial aerospace.

▲Trend chart of A-share market trading volume. Source: Wind

For the capital market, commercial aerospace is at a critical juncture, transitioning from thematic investment to growth driven by prosperity. Before large-scale commercialization is achieved, most companies remain in the conceptual stage, with uncertainty surrounding their future ability to deliver performance.

However, the trend of industry development remains unchanged, and eventually, a group of companies with solid capabilities will emerge. So, which segments have the highest barriers? Which companies possess the technical prowess to break through?

【High Barriers and Accelerated Commercialization】

The commercial aerospace industrial chain is relatively extensive, with the upstream primarily encompassing satellite and rocket manufacturing, involving key components such as engines, structural parts, specialty materials, and chips. The midstream covers launch services and ground equipment, while the downstream focuses on satellite application services, including satellite internet, remote sensing, navigation, and other scenarios.

From a value distribution perspective, the upstream segment accounts for approximately 30%, lower than the downstream application services. However, it boasts the highest technical barriers and represents the core area where future super-leading companies may emerge, particularly in rocket R&D and manufacturing.

The R&D cycle for commercial carrier rockets often spans several years or even decades, requiring substantial and sustained investment from conceptual design, technological breakthroughs, prototype fabrication, to multiple flight verifications. This entails significant financial commitment and high R&D risks, collectively forming the entry and operational barriers of the industry.

Currently, domestic companies like Landspace have made significant breakthroughs in rocket payload capacity and propulsion systems. As a medium-lift liquid reusable carrier rocket, Zhuque-3 achieved its first orbital flight in December 2025, aiming for first-stage recovery and benchmarking against SpaceX's Falcon 9 and domestic models like the Long March 12A.

Reusable technology is a pivotal link for commercial aerospace to achieve commercialization. Only when rockets transition from disposable to reusable can launch costs be significantly reduced, thereby supporting the demand for large-scale satellite constellations.

Notably, Landspace is the first domestic company to master liquid oxygen-methane engine technology and successfully achieve orbital insertion.

Compared to the liquid oxygen-kerosene used in Falcon 9, liquid oxygen-methane offers advantages such as virtually no carbon deposition, better cooling performance, and self-pressurization capabilities, making it a cleaner, more maintainable, and future-oriented technological route. If Falcon 9 validates rocket reusability, then Landspace aims to achieve more economical and efficient reusability through the liquid oxygen-methane path.

Therefore, whether it's rocket recovery or new fuel technologies, the goal is to minimize costs and increase launch frequency, thereby accelerating the commercialization process. This has fundamentally altered the development logic of commercial aerospace.

Evidently, the core materials, components, and rocket development segments in the midstream and upstream represent the most technology-intensive, capital-intensive, and industrially influential parts. High barriers also imply that once large-scale applications are realized, these segments may offer more substantial profitability.

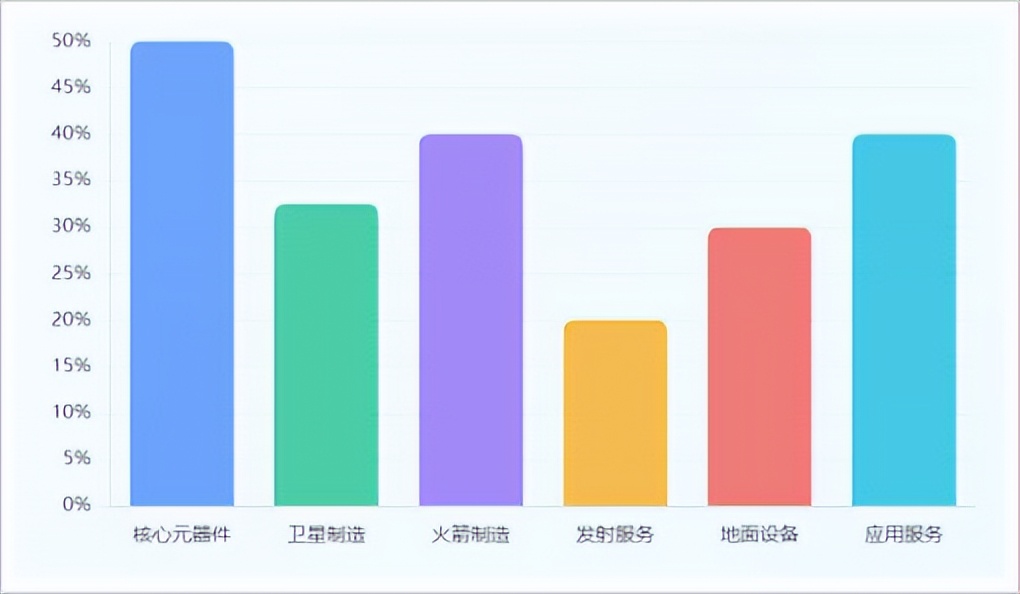

According to data from the Aerospace Information Bureau, the gross profit margins for core components and rocket manufacturing currently stand at around 50% and 40%, respectively, making them the most profitable segments in the industrial chain.

▲Gross profit margin performance across various segments of the commercial aerospace industrial chain. Source: Aerospace Information Bureau

Therefore, companies that master these key technologies and products are also expected to receive greater valuation premiums.

【Who Will Be the Big Winners?】

In recent years, driven by both policy and capital, the Chinese commercial aerospace market has continued to grow.

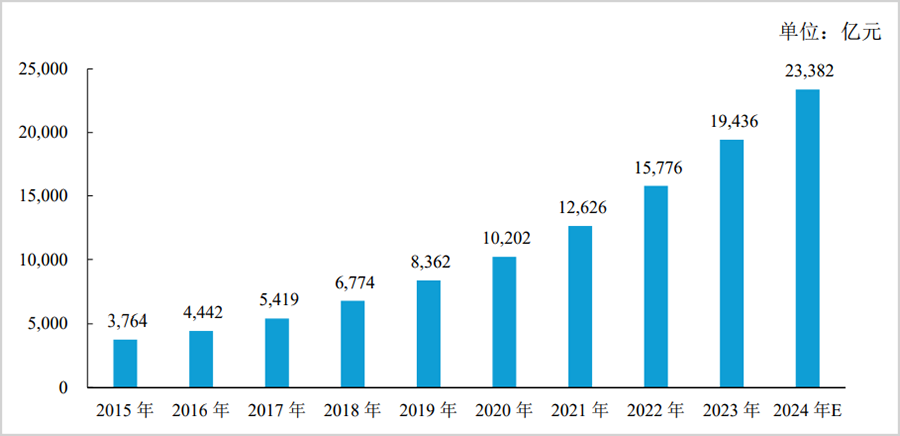

According to data from the China Investment Research Institute, the Chinese commercial aerospace market is expected to reach a staggering 2.3 trillion yuan in 2024, with an average annual growth rate exceeding 20% from 2017 to 2024. Furthermore, according to forecasts by the Forward Industry Research Institute, this figure could soar to 8 trillion yuan by 2030.

▲Chinese commercial aerospace market size from 2015 to 2024. Source: China Investment Research Institute

Faced with such a trillion-yuan blue ocean, which companies are poised to become the core beneficiaries?

Firstly, leading companies like Landspace.

Landspace's business spans upstream subsystems (rocket body structure, propulsion systems, control systems, etc.), midstream rocket development and assembly, and launch services. It independently possesses capabilities across the entire chain, from R&D and manufacturing to testing and launch.

This means the company can autonomously control core segments and technologies like rocket development, reducing external dependencies and effectively controlling costs, thereby constructing a strong operational "moat." On the other hand, the company has entered the supply chains of downstream leading clients such as China Satellite Network and Yuanxin Satellite, both of which plan to build low-Earth orbit satellite constellations exceeding 10,000 satellites, indicating substantial future demand.

Additionally, besides Landspace, at least 10 domestic commercial aerospace companies, including Galactic Energy, Space Pioneer, CAS Space, and i-Space, have intensively initiated IPO processes. However, most of these competitors adopt liquid oxygen-kerosene or hybrid solid-liquid technical routes, with their current mainstay or successfully launched models primarily being small to medium-sized rockets.

In contrast, Landspace focuses on medium to large-lift carrier rockets (the core tools for executing large-scale, high-density constellation launch missions), potentially offering superior competitiveness in terms of technical routes and cost reduction.

Secondly, core suppliers behind leading companies that specialize in technological breakthroughs in specific high-barrier segments will also reap the benefits of industry growth.

From Market Cap Observer's perspective, there are currently two primary supply chain systems in the market: one is the "SpaceX Chain" formed around SpaceX, akin to the Optimus Chain in humanoid robots.

Currently, SpaceX has confirmed three A-share listed companies as its suppliers in China: Tongyu Communication, Sunway Communication, and Re-Sound Tech.

Specifically, Tongyu Communication's MacroWiFi products have passed SpaceX interface certification, enabling direct signal interaction between ground terminals and Starlink satellites. In the future, if Starlink terminals expand into the consumer market, Tongyu Communication, as its antenna module supplier, is poised to achieve rapid growth based on its existing certifications and order foundation.

Sunway Communication became a supplier of high-reliability RF and antenna components for SpaceX as early as 2022. The company has publicly declared its satellite business as its "second growth curve," although it is still early for it to become a performance pillar. Additionally, Re-Sound Tech provides high-end thermal insulation materials required for rockets and has confirmed supplies to SpaceX, although the current impact on its performance is minimal.

The other is the domestic supplier chain centered around Landspace, akin to the "Unitree Chain" in humanoid robots.

Landspace's local supply chain involves numerous companies, including those specializing in engine components, rocket-borne sensors, high-end forgings, and more. However, there are few exclusive or core suppliers with substantial technical prowess, primarily including Sirui New Materials and Plattech, among others.

Specifically, Sirui New Materials is an exclusive supplier to Landspace, with its products applied in rockets such as Zhuque-3. The company possesses core products and technologies for liquid rocket engine thrust chamber liners, filling a domestic gap. In particular, its nano-crystalline copper alloy material significantly enhances high-temperature resistance, occupying approximately 90% of the domestic liquid oxygen-methane engine thrust chamber market and facing limited global alternatives.

Turning to Plattech, it can 3D print metal rocket engine components, a technology that shortens development cycles and reduces costs. Currently, the company has become a core partner of Landspace, mass-producing liquid oxygen-methane engine components for it.

Undeniably, whether it's the SpaceX Chain or the Landspace Chain, the core suppliers behind them have generally doubled in value during this rally, with their valuations at high levels. The key to maintaining these high valuations in the future lies in technological breakthroughs and whether the commercialization process can achieve the expected scale.

Looking ahead, the journey of commercial aerospace towards the vast expanse of space has just begun. The capital market possesses foresight and discovery capabilities. Years from now, this current boom may be regarded as a symbolic starting point marking the industry's true transition from concept to realization, from theme to growth.

Disclaimer

The content of this article pertaining to listed companies is based on the personal analysis and judgment of the author, derived from information publicly disclosed by these companies in accordance with their legal obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms). The information or opinions presented in this article do not constitute any investment or other commercial advice. Market Cap Observer does not assume any responsibility for any actions taken based on this article.

——END——