Making a Bid for 200,000 Satellites: China's Domestic Starlink Is on the Horizon!

![]() 01/16 2026

01/16 2026

![]() 499

499

According to the official website of the International Telecommunication Union (ITU), in December 2025, China officially submitted an application to the ITU, seeking frequency and orbital resources for over 200,000 satellites.

Among these, more than 190,000 satellites are proposed by the newly established Radio Innovation Institute.

It's reported that Musk's Starlink currently has around 10,000 satellites in orbit.

Hence, it's almost a given that the planned deployment of 200,000 satellites isn't for conventional purposes like meteorology or agriculture, but rather exclusively for satellite internet.

China's Qianfan constellation already has over 100 satellites in orbit and has carried out real-world tests of 4K video streaming and WeChat calls in locations such as Malaysia and Kazakhstan. Although the number of its in-orbit satellites is merely one percent of Starlink's, once technical verification is successful, large-scale launches will swiftly follow.

For a considerable period, Starlink technology, which has been touted as a game-changer for 5G, is now set to be vigorously pursued by China as well.

It's crucial to note that even Musk himself has never claimed that Starlink could replace telecommunications operators. He has publicly stated on multiple occasions that Starlink serves as a valuable complement to telecommunications operators, and this indeed holds true. Due to issues related to channel resource occupation, Starlink's primary target customers are not users concentrated in large cities but rather those residing in remote areas or working in the wilderness, particularly seafarers.

A single Starlink satellite can support hundreds to 2,000 concurrent connections. In large and medium-sized cities like New York (with a population size comparable to that of a provincial capital city in China), relying on Starlink for network services would necessitate thousands of satellites for directional support.

By the end of 2025, the global number of 5G base stations is projected to exceed 15 million, with China accounting for 45% (6.57 million), the United States for 22% (3.3 million), and the European Union for 12% (1.8 million).

Clearly, Starlink and 5G base stations are not mutually exclusive but rather complementary.

The same principle applies to China's development of satellite internet. There are still numerous remote areas where installing 5G base stations is challenging, and many outdoor workers require a domestically produced alternative to Starlink to achieve coverage.

01

Who is the Radio Innovation Institute?

The Radio Innovation Institute was established on December 30, 2025, through a collaborative effort by seven entities: the National Radio Monitoring Center, the Administrative Committee of the Xiong'an New Area in Hebei Province, the Hebei Provincial Department of Industry and Information Technology, China Satellite Network Group Co., Ltd., Nanjing University of Aeronautics and Astronautics, Beijing Jiaotong University, and China Electronics Technology Group Corporation.

Apart from regulatory and research institutions, there are really only two entities capable of operational management: China Satellite Network Group and CETC Group.

Our focus lies on publicly traded companies.

Among them, CETC Group boasts over a dozen listed subsidiaries.

China Satellite Network Group Co., Ltd. and China Satellite (listed on the A-share market) are not the same entity. The former is abbreviated as China StarNet (not yet listed), while China Satellite, formally known as China Dongfanghong Satellite Co., Ltd., is affiliated with China Aerospace Science and Technology Corporation.

Xingkongjun delved into the business scopes of CETC's listed companies and roughly identified 11 with satellite-related operations: Eastcom, CETC Digital, CETC NetSec, Glotech, Si Chuang Electronics, Tianao Electronics, Potevio Science and Technology, CETC Chip, Dongxin Peace, Laisi Information, and Guobo Electronics.

The most intriguing among them is Eastcom.

On one hand, Eastcom is a controlled subsidiary of CETC, possessing the opportunity and capability to participate in the vast satellite network construction. On the other hand, Eastcom is a partner of China StarNet, involved in ground station maintenance for low-Earth-orbit satellite constellations. The company stated on an investor interaction platform that it expanded the 'StarNet Satellite Internet Network Maintenance Project' in 2023.

02

New Growth Drivers for Eastcom

Since the 2025 annual report has not yet been released, we can forecast the full-year performance based on Eastcom's third-quarter report for 2025.

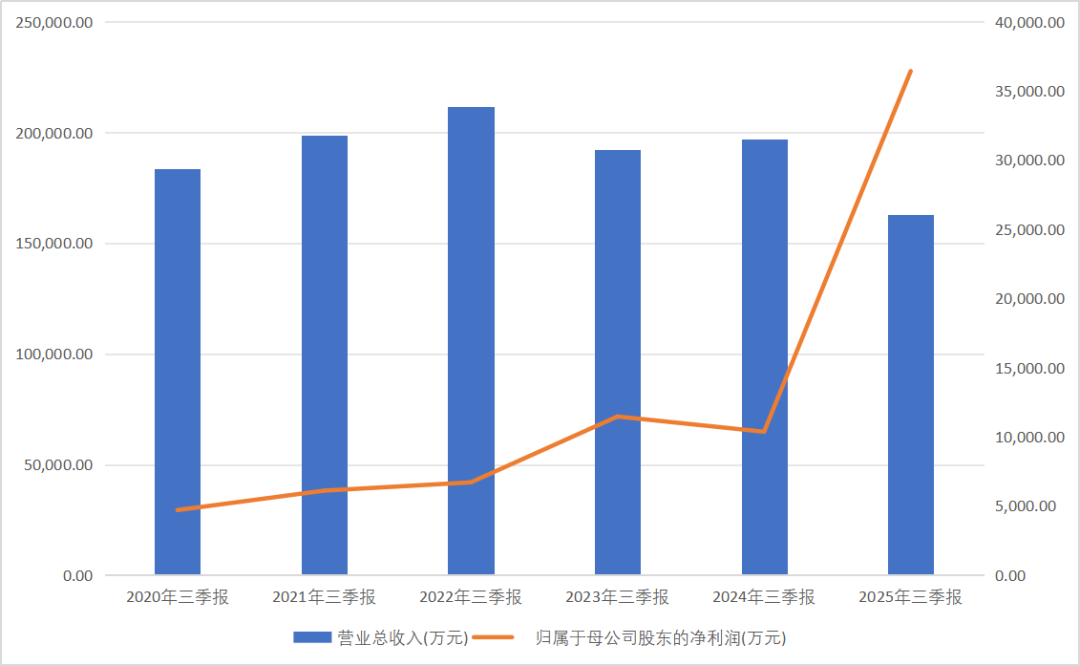

In the first three quarters of 2025, the company achieved a total operating revenue of 1.627 billion yuan, marking a 17.41% year-on-year decrease; net profit attributable to shareholders was 364 million yuan, showing a significant 251.54% year-on-year increase; and net profit excluding non-recurring items was 37.8694 million yuan, up 330.06% year-on-year.

Data Source: iFind

Notably, the performance in the third quarter alone was outstanding: main business revenue was 618 million yuan, down 6.96% year-on-year; net profit attributable to shareholders was 232 million yuan, up a staggering 1,418.64% year-on-year; and net profit excluding non-recurring items was 35.2735 million yuan, up 469.39% year-on-year.

From the data, it's evident that the company's performance showed significant growth in net profit, especially excluding non-recurring items, despite a decline in revenue, reflecting 'high-quality' development.

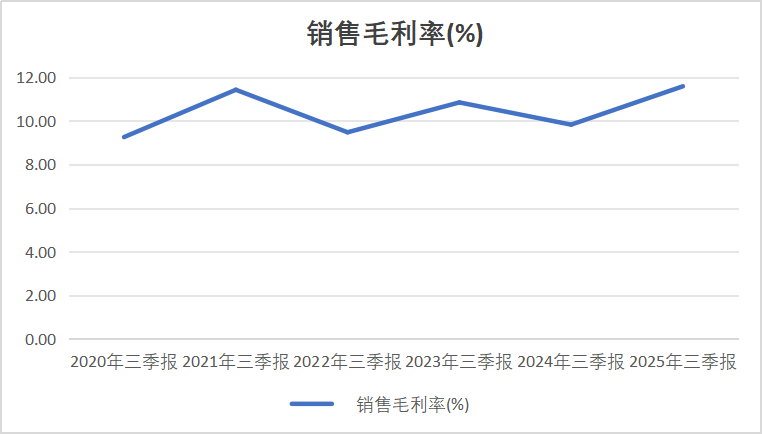

Upon closer examination of the company's business operations, Xingkongjun discovered that the main reason was the optimization of the operational structure, which led to an increase in gross profit margin.

Data Source: iFind

The gross profit margin increased by 17.92 percentage points year-on-year to 11.59%, with a higher proportion of high-margin businesses (such as satellite communication network maintenance and financial technology innovation projects) offsetting the contraction of traditional low-margin businesses.

The company's core business consists of three major parts, each with its own distinct characteristics.

Smart manufacturing is the company's largest revenue source, facing increased competition in the traditional electronics manufacturing industry, with a relatively low gross profit margin but strong business stability.

Information and communication (private networks + public networks + DICT) is the company's traditional area of strength, boasting a high gross profit margin and serving as the main source of profit. Leveraging its comprehensive ICT service qualifications, the company successfully secured the StarNet Satellite Internet Network Maintenance Project, entering the low-Earth-orbit satellite constellation construction sector and becoming a highlight of its performance and a key factor in its improvement.

Financial technology has a smaller revenue scale but is growing rapidly and is highly profitable. The company has achieved breakthroughs in the banking innovation sector, winning projects from several major state-owned and joint-stock banks, benefiting from the digital transformation and self-reliance substitution needs of the financial industry.

03

Caution on Asset Impairment Losses

For communication companies, which are typically capital-intensive industries, it's essential to remain vigilant about impairment losses.

In 2024, the company recognized asset impairment provisions totaling 112 million yuan, including -86,200 yuan for bad debt provisions on notes receivable, 15.7072 million yuan for bad debt provisions on accounts receivable, 50.1231 million yuan for inventory write-downs, 3.3247 million yuan for fixed asset impairment, 36.1008 million yuan for intangible asset impairment, and 6.846 million yuan for goodwill impairment, collectively reducing the total profit for the year by approximately 112 million yuan.

Since quarterly and semi-annual reports do not require audit by accounting firms, most publicly traded companies' finance departments may not be as rigorous when recognizing impairment provisions. Typically, impairment provisions are fully reflected in the audited annual report.

If the company recognizes significant asset impairment provisions (such as bad debt provisions on accounts receivable, inventory write-downs, etc.) in its 2025 annual report, it will directly erode net profit and may affect its full-year performance targets, rendering the impressive performance in the third-quarter report as mere window dressing.

Conversely, if the company's optimized operational structure results in significantly lower asset impairment provisions in 2025 compared to 2024, or even a reversal of impairment provisions, there is still room for the company's full-year performance to exceed expectations.

-END-

Disclaimer: This article is based on the public company attributes of listed companies and primarily relies on information disclosed by the listed companies in accordance with their statutory obligations (including but not limited to interim announcements, periodic reports, and official interaction platforms) as the core basis for analysis and research. Shiyu Xingkong strives for fairness in the content and viewpoints presented in the article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and Shiyu Xingkong assumes no responsibility for any actions taken based on the use of this article.

Copyright Notice: The content of this article is original to Shiyu Xingkong and may not be reproduced without authorization.