Tianfu Communication Takes Further Action in 'Singapore, Malaysia, Thailand': Control Shifts to SuperX, with the Real Competition Lying Beyond NVIDIA

![]() 02/13 2026

02/13 2026

![]() 407

407

On the evening of February 11, 2026, SuperX (NASDAQ: SUPX) announced that its wholly-owned subsidiary had inked a joint venture agreement with Tianfu International Investment Pte. Ltd., a fully-owned Singaporean subsidiary of Suzhou Tianfu Optical Communication Co., Ltd. (300394.SZ). The two entities will jointly establish a joint venture named SuperX Optical Communications Pte. Ltd.

A Significant Leap in Global Expansion

Under the terms of the agreement, SuperX will emerge as the largest shareholder of the joint venture, with operations spanning major global markets. The joint venture will concentrate on developing global next-generation one-stop optical connectivity solutions for AI data centers (AIDC), aiming to tackle the escalating bottlenecks in high-speed interconnection and data transmission within large-scale AI computing clusters.

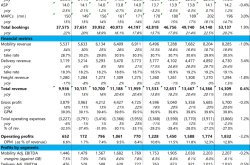

The announcement sparked a robust market response. On February 12, Tianfu Communication's shares opened significantly higher, oscillated upwards throughout the session, peaked at 333.79 yuan per share, and closed at 330.00 yuan per share, surging 14.38% in a single day to reach an all-time high and secure the top spot on Wind's hot stock list for the day.

Image Source: Wind

By the market close that day, the company's total market capitalization had soared to 256.547 billion yuan, pushing its valuation to new heights with a trailing twelve-month price-to-earnings ratio (TTM P/E) of 140.00 times.

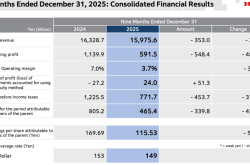

Tianfu Communication's total trading volume on February 12 reached 15.386 billion yuan, including 4.380 billion yuan in trading volume via the Shenzhen-Hong Kong Stock Connect, ranking second in Shenzhen Stock Connect trading volume.

Juling Data reveals that on February 12, northbound capital transactions totaled 289.659 billion yuan, accounting for 13.52% of the total trading volume across both markets, marking a periodic peak in capital pursuit of the AI optical communication sector.

Top 10 Stocks Traded via Shenzhen Stock Connect

Image Source: Wind

This cross-border joint venture is seen by the market as a significant leap in Tianfu Communication's global expansion.

Leveraging SuperX's full-stack AI infrastructure capabilities and overseas customer resources, combined with its own optical component technology strengths, the company aims to seize the core track in the AI computing power era.

However, amidst the simultaneous surge in stock price and market sentiment, whether this "overseas alliance" signifies a strategic breakthrough or mere capital-level hype remains to be calmly analyzed.

High Growth Falls Short of Expectations

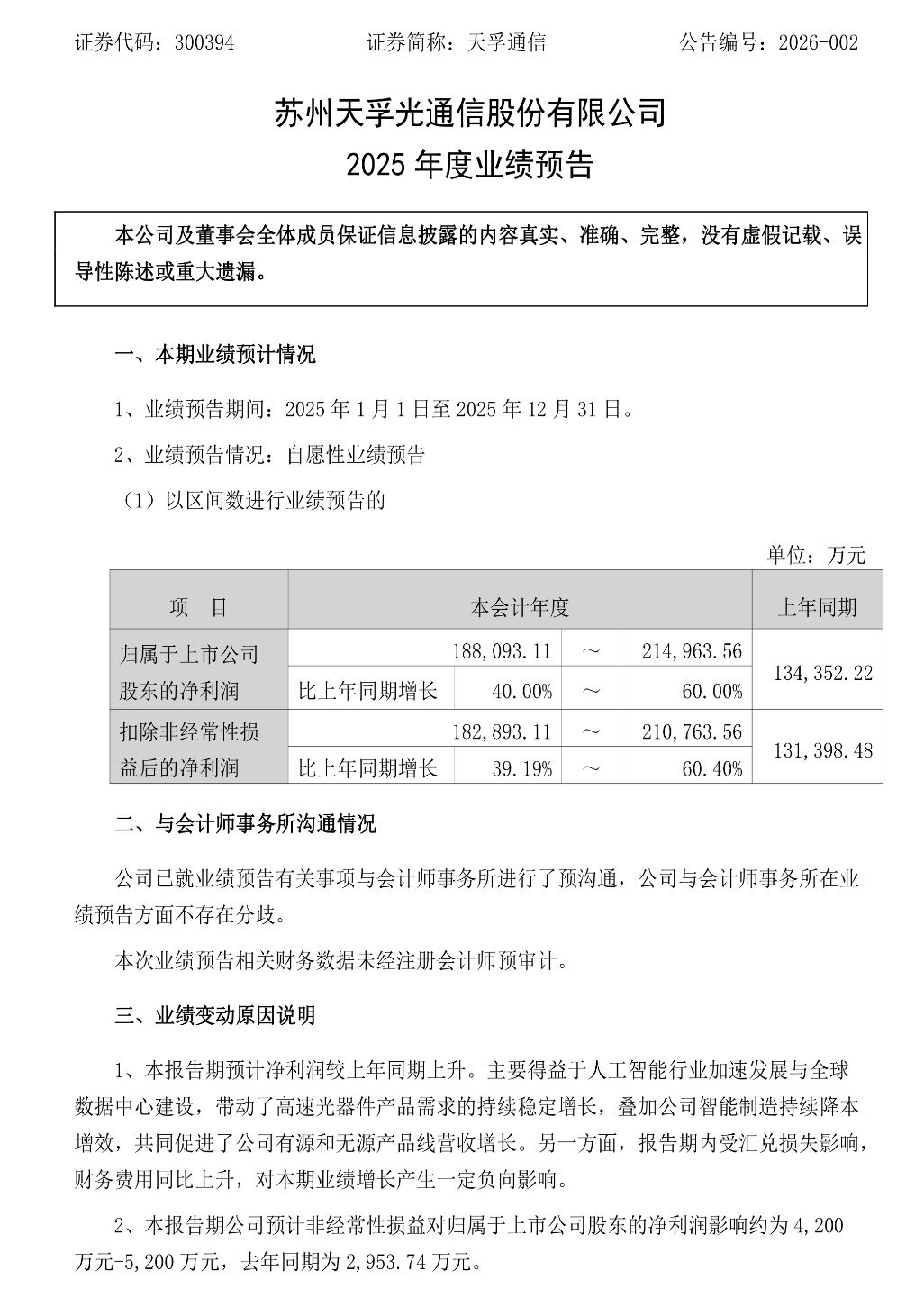

Financially, Tianfu Communication delivered a strong performance. The company's 2025 annual performance preview indicates that full-year net profit attributable to shareholders is expected to range from 1.881 billion yuan to 2.15 billion yuan, representing a year-on-year increase of 40%—60%.

Net profit excluding non-recurring items is expected to range from 1.829 billion yuan to 2.108 billion yuan, up 39.19%—60.40% year-on-year, with non-recurring gains and losses impacting approximately 42 million yuan to 52 million yuan.

Image Source: Tianfu Communication Announcement

In the first three quarters of 2025, the company's revenue reached 3.918 billion yuan, up 63.63% year-on-year, with net profit attributable to shareholders at 1.465 billion yuan, up 50.07% year-on-year. Both revenue and net profit growth in the third quarter exceeded 75%, indicating strong momentum.

Its financial structure remains robust, with an asset-liability ratio of just 16.45% and a gross margin maintained at a high level of 51.87%, significantly surpassing industry averages in profit quality.

Nevertheless, this high growth did not fully meet market expectations, as the upper limit of the forecasted net profit still fell short of multiple institutional estimates. Coupled with persistent foreign exchange losses dragging on financial expenses, it led to voices of "high growth falling short of expectations."

The core logic supporting performance stems from the AI computing power boom and global data center construction, driving sustained demand for high-speed optical components. Active devices have become the primary growth driver, while smart manufacturing further enhances cost efficiency.

However, behind the high growth lie concerns over reliance on a single sector, an excessively high overseas revenue proportion, and customer concentration, all posing potential risks for future development.

Deeply Tied to Multiple Top Cloud Providers

From its current status and product value, Tianfu Communication stands in the global top tier of optical component providers, serving as an irreplaceable "shovel seller" in the AI supply chain.

As a core enterprise in NVIDIA's supply chain, the company is one of the few globally capable of stable mass production of 1.6T optical engines, with a FAU optical engine yield rate of 95%. It holds distinct supply advantages in CPO and NPO optical systems, deeply tied to multiple global top cloud providers.

Its product portfolio covers both active and passive components, widely applied in AI computing power, data centers, fiber-optic communications, and other scenarios, accelerating its transition from a component supplier to a system solutions provider.

In this collaboration with SuperX, the two parties have clear divisions of labor: Tianfu Communication provides technical support, R&D, mass production, and global supply chain capabilities, while SuperX introduces customer orders, customized requirements, and integrates the cooperative optical connectivity products into modular AI infrastructure for "plug-and-play" functionality, significantly shortening customer deployment cycles.

At the industry level, the AI computing power revolution continues to drive demand for optical connectivity. Microsoft, Amazon, Google, Meta, and Oracle allocated over 370 billion USD in capital expenditures in 2025, expected to surpass 470 billion USD in 2026. 800G and 1.6T products are entering mass production cycles, while new technologies like CPO open up incremental space, with domestic optical component manufacturers steadily increasing their global market share.

As an industry leader, Tianfu Communication fully benefits from the dual dividends of industry high prosperity and import substitution, with a clear and solid long-term growth logic.

High Iteration Risks and Trial-and-Error Costs

Amidst the euphoria, concerns over high valuations and expectations cannot be ignored. At the cooperative level, the joint venture is controlled by SuperX, leaving Tianfu Communication without decision-making power. There are uncertainties in future operational decisions, profit distribution, and technological leadership, even risking scenarios of "technology transfer, channel constraints, and working for others' benefit."

At the industry level, competition in the optical component sector remains fierce, with price war pressures emerging as multiple manufacturers expand production of 1.6T products. Technologies like CPO are still in early commercialization stages, carrying high iteration risks and trial-and-error costs.

The company's downstream is highly concentrated among North American cloud providers and core customers, making it extremely sensitive to external capital expenditure rhythms. Once the cycle peaks or demand slows, performance will face direct pressure.

At the corporate level, a high overseas revenue proportion, combined with accelerated global expansion, exposes it to persistent threats from geopolitics, trade barriers, and exchange rate fluctuations, with foreign exchange losses already evident in financial reports.

At the valuation level, the company's market capitalization has surpassed 250 billion yuan, with its P/E ratio at a historical high. Against a backdrop of slightly lower-than-expected earnings growth, any marginal weakening in industry prosperity could easily trigger a rapid valuation correction.

Tianfu Communication's long-term value ultimately depends on technological iteration, diversification of customer structure, global compliance operations, and the establishment of independent bargaining power, rather than short-term sentiment premiums driven by joint venture news.

In the high-volatility AI computing power sector, whether high growth can sustain, whether overseas expansion can truly break through, and whether control and interests can be balanced will be the core questions determining the company's future trajectory.