Hongbo Stock's Former Boss Cashed Out Billions and Left the Scene. What Should the 1.7 Million Shareholders Do?

![]() 07/01 2024

07/01 2024

![]() 498

498

As early as March this year, Bowang Finance published an article titled "A-share companies frequently receive 'attention letters' for cross-border computing power, are they 'riding the trend' or having 'real deal'?" pointing out that "for enterprises with traditional industries as their main business, choosing to cross-border into 'playing' with computing power under conditions such as lacking technology, talent, supply chain, and customer resources, carries significant risks."

Less than three months after the article was published, Hongbo Stock (002229.SZ), which was hailed by many "gurus" and "retail investors" as an AI computing power star stock, stumbled due to its cross-border move into "playing" with computing power.

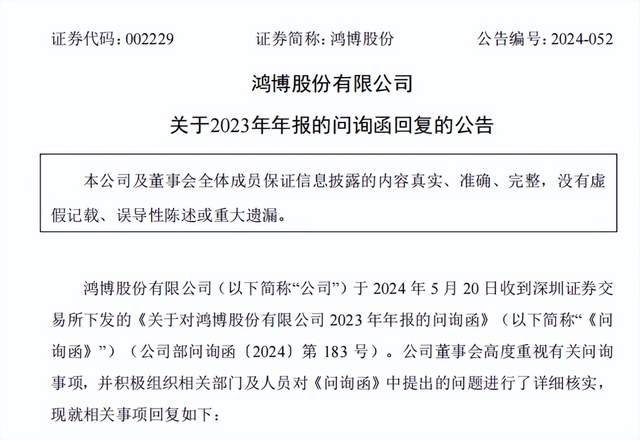

On June 8th this year, Hongbo Stock released an "Announcement on the Reply to the Inquiry Letter Regarding the 2023 Annual Report." Among them, the company admitted in its response to relevant inquiries from the Shenzhen Stock Exchange that its three important contracts signed with NVIDIA in the early stage were difficult to continue to perform smoothly.

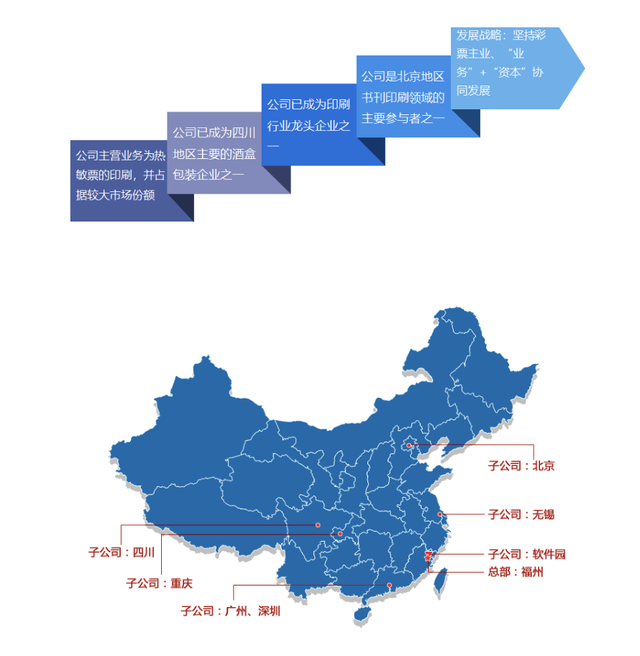

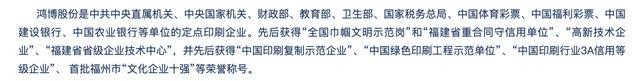

As a leading printing company since its establishment in 1999, Hongbo Stock introduces on its official website: "The company's main business is secure printing and is a secret carrier replication licensed unit recognized by the National Security Bureau. It has rich experience in the production and management of secret-related products and is one of the leading companies in China's lottery printing industry. It was listed on the SME Board of the Shenzhen Stock Exchange in May 2008... Since its listing, the company's business layout has developed from a single secure printing to the coordinated development of multiple businesses, completing a strategic layout across the country."

Image source: Hongbo Stock official website

It further states on its official website that the company is a designated printing enterprise for China Sports Lottery, China Welfare Lottery, China Construction Bank, Agricultural Bank of China, and other units. From this, it can be seen that as a company that could undertake these "high-end" printing businesses at the time, its "printing industry leader" status was not just a name.

Image source: Hongbo Stock official website

Against the backdrop of the comprehensive arrival of digitization, Hongbo Stock, with its traditional main business declining, made a decision to transform its layout into the popular topic of "AI computing power," which is understandable.

However, while able to embrace NVIDIA's "leg," it was "stood up" halfway by this global market value myth creator, with multiple important contracts difficult to continue to perform... For Hongbo Stock's 1.7 million shareholders, it's more than just a "disclosure of secrets."

As the saying goes, "one stone激起千层浪" (one stone stirs up a thousand waves). Under the banner of "unity is strength" among the 1.7 million shareholders, they have indeed "drawn out" Hongbo Stock's unspeakable "secrets" and "stripped away" the "shells" that have shaken the capital market before and after, revealing the "cocoons" "lurking" behind the scenes of Hongbo Stock.

The "multi-dimensional impact" brought to Hongbo Stock has far exceeded the simple "breaking of a promise" by NVIDIA. So, what kind of "family scandals" and "insiders" have the 1.7 million shareholders uncovered about Hongbo Stock, the former industry leader in printing?

01

The former printing industry leader has changed from "You" to "Mao." Did the "You family" cash out in huge amounts, allowing a post-80s "capital believer" to pick up the slack?

A few days after the June 8th announcement, a report by Ifeng Finance (Storm Eye) uncovered the issues surrounding Hongbo Stock.

Image source: Screenshot of a Weibo trending topic

Perhaps, the You family of seven who cashed out in huge amounts did not expect that on the capital front, Hongbo Stock had already triggered waves of "turmoil" and even "earthquakes."

On June 25th, a report released by China Times pointed out that "last year, Hongbo Stock, as a 'computing power concept stock,' saw its share price soar due to its cooperation with NVIDIA, reaching a high of 45.29 yuan, with a near-sevenfold increase. However, in 2024, its share price has continued to decline."

"Tencent Self-selected Stocks WeChat Edition | Micro Securities" shows that as of June 26th, Hongbo Stock's share price has fallen to 11.06 yuan. And the fact that its share price has dropped by nearly 70% within the year is an indisputable fact.

Image source: Tencent Self-selected Stocks WeChat Edition | Micro Securities

So, why, in 2023, when computing power was extremely scarce and "as valuable as paper in Luoyang," did Hongbo Stock, which had embraced NVIDIA's "leg," see its plans fail to keep up with changes within less than a year, leading to multiple important contracts being difficult to continue to perform, and thus forming a "comprehensive" and "large-scale" "blow" to Hongbo Stock?

Not only has the share price taken a "roller coaster" ride and the market value evaporated by nearly 60%, but including its 1.7 million shareholders, authoritative media, industry experts, relevant lawyers, and even "吃瓜群众" (onlookers), all feel deeply "suspicious" about Hongbo Stock's multiple computing power contracts signed with NVIDIA "breaking promises," which is the "key" to tantalizing nerves.

Among them, what is particularly puzzling to all sectors is why, starting from high-end, high-margin printing businesses such as lotteries and being a leader in the printing industry, it has quietly changed its surname from "You" to "Mao"?

Opening the Hongbo Stock official website, what catches the eye is its "glorious" history and development strategy. But can "drawing on the strengths of many, daring to fight and win" win the market, the future, and regain the confidence of the 1.7 million shareholders in the capital market?

Image source: Hongbo Stock official website

Ironically, staying on its homepage for a few seconds, another "picture" automatically slides out, which is Hongbo Stock's "warm reminder" to investors to protect their rights and interests and prevent risks.

Image source: Hongbo Stock official website

What makes Hongbo Stock's 1.7 million shareholders and the industry even more "confused" is that the "You family" could have secured new development based on their solid "foundation" and "connections," but why did they stage a "drama" of cashing out 2 billion yuan (data cited from Changjiang Business Daily) and leaving the scene? Even according to a report by Ifeng Finance (Storm Eye), "a more complete statistic, in fact, the You family cashed out at least 3.1 billion yuan."

The疑点 (suspicion) of this "drama" is not the routine action of legal person changes, which is common sense, but how the huge cash-out "accompanying" the "name change" was "achieved" and how it could "go smoothly" and "leave gracefully"?

Here, let's bury a foreshadowing of the reasons for NVIDIA's "breaking promises." First, let's continue with how a post-80s "capital believer" named Mao Wei "picked up the slack" behind the huge cash-out of the "You family," allowing the You family to "succeed" in taking the money and "leaving the scene."

The "version" reported by Ifeng Finance (Storm Eye) is that around 2020, post-80s Mao Wei took over 22.33% of Hongbo Stock held by the "You family" through Yutai Holdings and Huiyi Trading, at a cumulative price of 1.113 billion yuan.

Image source: Ifeng Finance

From this, Hongbo Stock's "surname change" is equivalent to the "You family" directly "showing the code" and collecting 1.113 billion yuan in "real money." Prior to this, the "You family" had already cashed out a cumulative total of 1.43 billion yuan.

The former printing industry leader, through little-known capital operations, changed its surname from "You" to "Mao" and "renamed itself," easily completing the "glamorous transformation" of Hongbo Stock from its founder, the "You family," to being considered a "pick-up" by the post-80s "capital believer" Mao Wei, and thus becoming the actual controller of this traditional listed company.

And this is just the beginning of Hongbo Stock's cross-border "playing" with the popular topic of AI computing power, with its share price even surging nearly 10 times last year.

02

Cross-border computing power "miscalculation" is expected, "You" is understandable for money, but is "Mao" really "picking up the slack"?

Behind NVIDIA's "standing up" Hongbo Stock, there is actually "something strange going on."

Because, although Hongbo Stock was once a leading printing company and was hailed by investors as a "new aristocrat" in computing power, how could it, "with what ability," sign multiple contracts with NVIDIA ahead of even some major domestic internet companies or "well-funded" car manufacturers?

By carefully studying the original document content of the announcement released by Hongbo Stock, the truth may have been roughly revealed.

Image source: Screenshot of the original document of Hongbo Stock's announcement

On page 5 of the original document of the announcement, namely the third part of the Shenzhen Stock Exchange's inquiry - "The annual report shows that at the end of the reporting period, your company signed significant sales contracts with Beijing Jingneng International Holding Co., Ltd. and Beijing Baichuan Intelligence Technology Co., Ltd. for the procurement of equipment for the construction of smart computing centers and AI cloud services, with total contract amounts of 999.682 million yuan and 1.3824 billion yuan, respectively."

"As of the end of the reporting period, Beijing Baichuan Intelligence Technology Co., Ltd. still had a contract amount of 1.3824 billion yuan that had not been fulfilled, with a fulfillment progress of 0%. At the same time, your company signed a significant procurement contract with Ziguang Xiaotong Technology Co., Ltd. for some equipment required for the AI innovation empowerment center, with a total contract amount of 494.0594 million yuan, and the contract has not been fulfilled. Please have the accountant verify and issue a clear opinion."

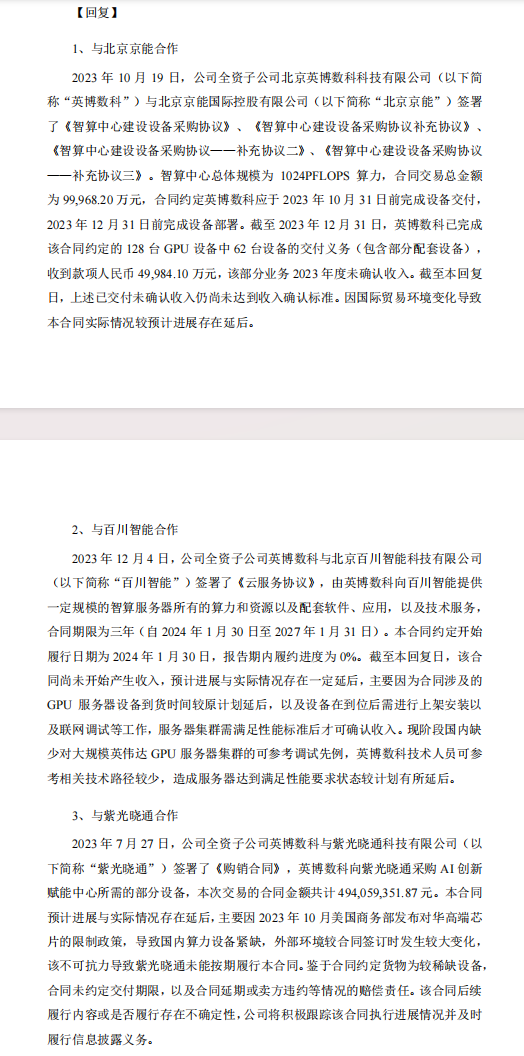

After Hongbo Stock provided detailed explanations regarding its cooperation with Beijing Jingneng, Baichuan Intelligence, and Ziguang Xiaotong, combining the contract signing time, contractual performance arrangements, and the latest performance progress, the focus is precisely on the "risk reminder" that follows.

Image source: Screenshot of the original document of Hongbo Stock's announcement

The original text of the "risk reminder" in the announcement is, "The actual performance of the above contracts has failed to meet the contractual or original planned progress. The contract amounts are large and the performance period is long. During the contract performance process, there may be uncertainties or risks in legal, regulatory, policy, performance capability, technology, market, and other aspects. At the same time, it may also face risks brought about by significant changes in the external macro environment and other force majeure factors, which may result in the inability of the contract to be performed normally. Please investors pay attention to investment risks."

At this point, Hongbo Stock's 1.7 million shareholders began to engage in intense discussions and various investigations on various social platforms, financial communities, etc., regarding Hongbo Stock's leading position, which once had the "diamond drill" to "undertake" high-end printing businesses, behind the scenes.

In fact, in the article published by Bowang Finance three months ago, there are two paragraphs that may be the "substantive internal causes" behind Hongbo Stock's "dilemma."

"In the long run, will computing power continue to be a super trend that grows along with AI? It can be asserted that AI will continue to heat up and take root and flourish in almost all industries. However, as an infrastructure, computing power will become a 'traditional industry' in a new era after the contradiction between supply and demand of chips and computing power is resolved. At that time, how will these A-share companies that have cross-border computing power continue? Chase the next hot spot, or ALL IN in this cross-border move?"

In the article, Bowang Finance also tried to give a reminder to listed companies that are "riding the trend" of computing power but have no "real guns": "Can they simultaneously achieve rapid progress and specific implementation of AI computing power layout while pursuing hot spots and crossing hot topics? If they cannot deeply implement this major strategic decision on cross-border layout, then..., can outsiders really digest this piece of computing power 'delicacy' that cannot be separated from the support of core technology and strong supply chain resources?"

Looking at the current situation, Hongbo Stock, which has failed to taste the "delicacy" of AI computing power, may have behind its inability to perform multiple important contracts with NVIDIA precisely because it has the ambition to "ride" computing power but lacks the strength to "play" AI technology services.

In addition, there is an intriguing "drama." Sorting through reports from authoritative media such as Changjiang Business Daily, China Times, and Ifeng Finance, it can be seen that this "trap" or "collapse" of Hongbo Stock is not just due to a lack of AI technology capabilities.

03

With a downturn in its main business and difficulty finding incremental growth, betting on full-stack AI, can it "save" Hongbo or make shareholders lose less?

The downturn in the printing business is not surprising. However, after the post-80s new actual controller Mao Wei took over Hongbo Stock from the "You family," many "propaganda reports" about him as a young "entrepreneur" may have made him genuinely feel that he had "picked up the slack."

As a WeChat public account related to the printing industry, "Packaging Zone" published an article titled "A post-80s Entrepreneur Starts from Scratch and Now Controls 'Fujian's First Printing Stock'" on March 1st, 2022, stating that at the age of 37, Mao Wei took over as Chairman and General Manager of Hongbo Stock, an A-share listed company, and became "the classic case of the first private enterprise in the Kaifeng section of the Henan Free Trade Zone to merge and acquire an A-share listed company."

In fact, similar "tweets" about Mao Wei have flooded the internet since the transformation of "You" to "Mao" at Hongbo Shares. As a new controller, this "entrepreneur" born in the 1980s is indeed eager to seek various "new increments" and "new curves" for Hongbo Shares.

And the reason why it was able to secure a large order from NVIDIA last year, which made "Maoshi" shine for a while and the stock price of Hongbo skyrocketed, was simply due to the help of "benefactors".

According to a report by the Daily Economic News on April 20, 2024, "Hongbo Group is able to stand on the computing power trend precisely because of the business of InBev Digital, and Zhou Weiwei is a key figure in the company's ability to connect with Nvidia."

The report revealed that "Hongbo Corporation is one of the leading enterprises in China's lottery printing industry, with its main business unrelated to computing power. In August 2022, Hongbo Corporation established a wholly-owned subsidiary, Yingbo Digital, and appointed Zhou Weiwei as the General Manager of Yingbo Digital, fully responsible for the establishment, technological research and development, team building, and business development of Yingbo Digital. In April 2023, Hongbo Corporation announced the appointment of Zhou Weiwei as the Vice President of Hongbo Corporation, responsible for the company's business in the artificial intelligence AI sector."

The Daily Economic News also reported that "Zhou Weiwei has publicly stated that she was the first to contact Nvidia. It is precisely the three words' Nvidia 'that have opened up the path of Hongbo Corporation's computing power as a' bull stock '."

However, according to the original document "Announcement on Dismissal of Vice General Manager of the Company by Hongbo Shares" released by the author on April 20, 2024, downloaded from the Shenzhen Stock Exchange, "After review by the Nomination Committee of the Board of Directors, the Board of Directors has agreed to dismiss Ms. Zhou Weiwei as Vice General Manager, which will take effect from the date of approval by the Board of Directors. After the dismissal, Ms. Zhou Weiwei will no longer hold any position in the company, and this dismissal will not have a significant impact on the company's daily production and operation activities. As of the disclosure date of this announcement, Ms. Zhou Weiwei holds 850000 shares of the company, accounting for 0.17% of the total shares of the company."

There are multiple versions in the industry and in the public, as to why a single announcement would "dismiss" a "benefactor". But for the struggling Hongbo Group, in fact, a more serious challenge is that this early leading printing company and last year's computing power bull have long been in a state of no actual controller.

According to an article published by Huaxia Times on June 25th, on February 28th of this year, Hongbo Shares issued a low-key announcement stating that the company had changed to a state of no controlling shareholder and no actual controller. In other words, Mao Wei, born in the 1980s, as a "believer in capital" in the eyes of industry insiders, can either "hold on" or "withdraw" at any time.

On June 21, after the "East Window Incident", on the interactive platform of Hongbo Group, its board secretary emphasized that artificial intelligence related businesses are the company's future strategic development direction, and the company will continue to concentrate resources and efforts around the market positioning of general artificial intelligence full stack service providers. "However, for specific current and future plans, the company may need more time and resources to develop and disclose."

Regarding this, investors who have gone from complaining to gradually calming their emotions and regaining rationality in their judgment, took the opportunity to ask about the 24 technical personnel and research and development expenses of InBev Technology, a subsidiary of Hongbo Corporation, for the year 2023, which amounted to 5.8227 million yuan. "Assuming that all 24 people are R&D personnel, the per capita R&D expenses are only 2426000 yuan. After deducting R&D expenses such as materials and equipment, it is expected that the annual salary of R&D personnel will be less than 150000 yuan. Why is it so low?"

In fact, in terms of the R&D investment and team size of the whole AI stack self research, whether it is a big Internet factory or an enterprise busy with intelligent driving or chip self research and other related fields, it can be called a "big wizard" in terms of investment and team building.

According to an interview with Associate Professor Liu Chunsheng from Central University of Finance and Economics by Huaxia Daily, on the one hand, the absence of actual controllers may lead to a lack of clear guidance on a company's strategic direction and operational decisions, thereby affecting the company's main business. In the absence of effective management, the company's main business may face difficulties, and new businesses with cross-border layout may not be able to bring expected profits.

On the other hand, the professor bluntly stated, "Hongbo Group is currently facing significant risks and uncertainties. Factors such as the absence of actual controllers and difficulties in its main business make the company's future development full of variables. For investors, this uncertainty may bring significant investment risks."

From the above, it can be seen that the main business is declining, the increment is difficult to find, "benefactors" are being dismissed, and "leak pickers" are also "leaving" like the founding family... In such a situation, which capital institution would "transfusion" or recommend "new benefactors" to Hongbo Group, which has to ALL in the entire stack of AI self-developed?

Therefore, will the future development strategy of Hongbo Group and its subsidiary InBev Digital Technology, as mentioned by the Secretary of the Board, be able to "save" Hongbo Group or will it result in 170000 shareholders losing "a few taels of silver" less? The answer to this may be self-evident.