Parsing QuantGroup (Part 1): Severalfold Increase in Capital Injection Aiming for IPO? How Long Can QuantGroup's "Consumption Map" Story Continue?

![]() 07/24 2024

07/24 2024

![]() 566

566

Lanjing News, July 23 (Reporters Huang Yujie and Zhang Shuwei) Recently, Beijing QuantGroup Technology Co., Ltd. (hereinafter referred to as "Beijing QuantGroup") has experienced a change in its registered capital, increasing from RMB 50 million to RMB 200 million, marking a threefold increase. The capital injection was subscribed by the controlling shareholder, Quantum Digital Technology Co., Ltd. (hereinafter referred to as "Quantum Digital").

Quantum Digital and its wholly-owned subsidiary Beijing QuantGroup are both integrated affiliated entities of QuantGroup Technology Co., Ltd. (hereinafter referred to as "QuantGroup"). In May of this year, QuantGroup submitted its third listing application to the Hong Kong Stock Exchange.

Zhou Hao, the founder of QuantGroup, received support from Tang Ning, the founder and CEO of CreditEase, in his entrepreneurial endeavors.

In 2011, Tang Ning, who was Zhou Hao's senior at school, extended an olive branch and invited him to return to China to join CreditEase's risk control team. Zhou Hao declined and instead returned to China the following year to join a cross-border e-commerce company as CMO.

With both e-commerce and financial backgrounds, Zhou Hao founded QuantGroup, blending the two experiences. Amidst the fierce competition among e-commerce players, QuantGroup's user data stood out. From 2021 to 2023, the average revenue per user (ARPU) of QuantGroup's e-commerce platform "Yangxiaomai" reached a staggering RMB 14,800, calculated by dividing the transaction value by the number of paying users, "towering" over e-commerce giants such as Taobao and JD.com. According to data, as of the end of 2022, the ARPU of the top four e-commerce platforms was RMB 5,902.

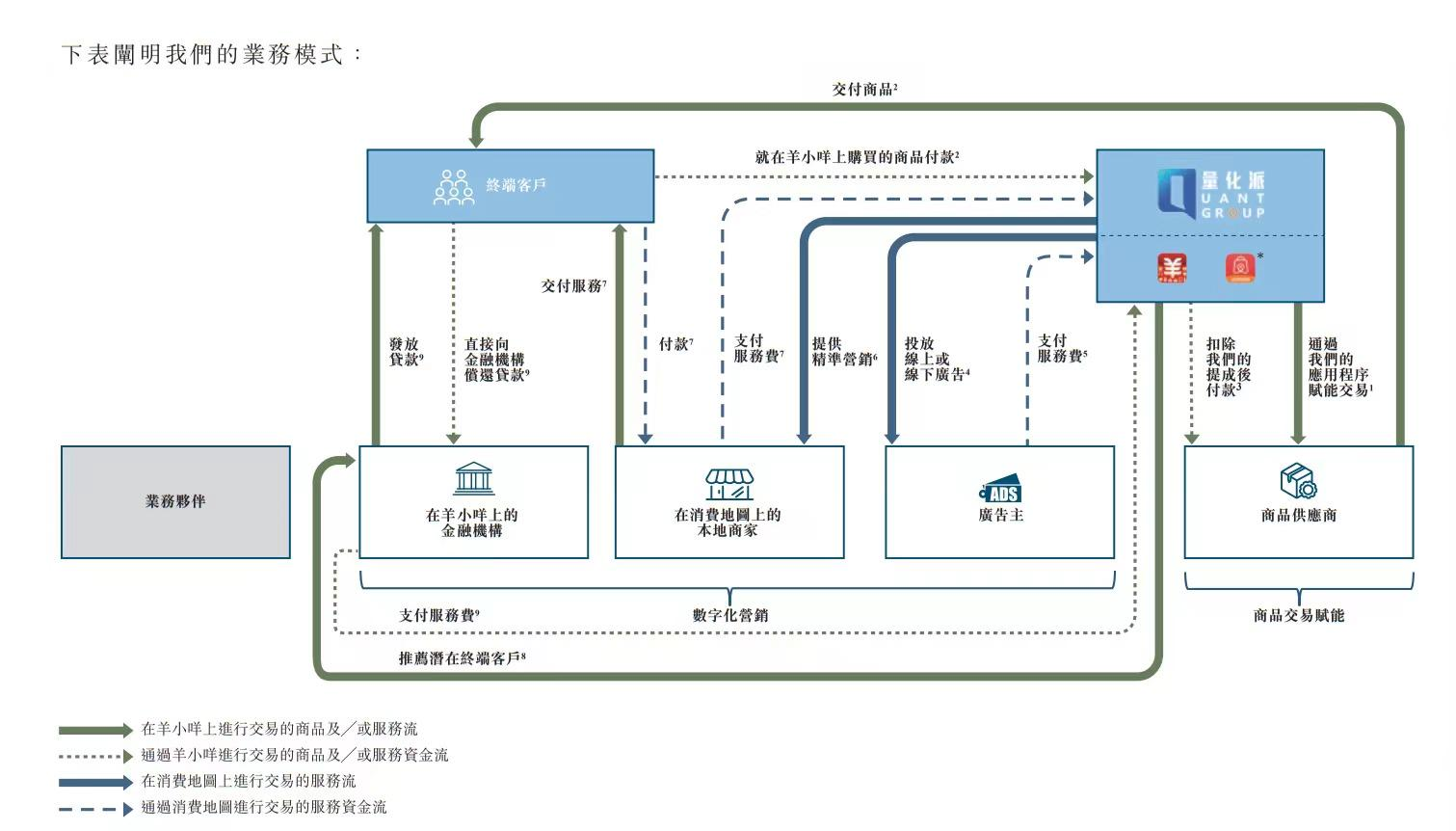

On the other hand, with only 156 employees, QuantGroup is on its fourth attempt at an IPO. Over the past decade, QuantGroup's core businesses have been Yangxiaomai and the Consumption Map. Among them, the Consumption Map clearly embodies QuantGroup's ambition for a listing, outlining the prospects of local services and growth, while Yangxiaomai serves as an intermediary product for its cash loan business transformation, which has also "mutated" by integrating with e-commerce operations. Lanjing News' "Parsing QuantGroup" series focuses on QuantGroup's businesses, attempting to analyze the industry's current state and transformation issues.

Multiple Consumption Map Partners Claim "Never Heard Of It"

Have you used the "Consumption Map"? However, QuantGroup has already earned over RMB 200 million with this product in a year.

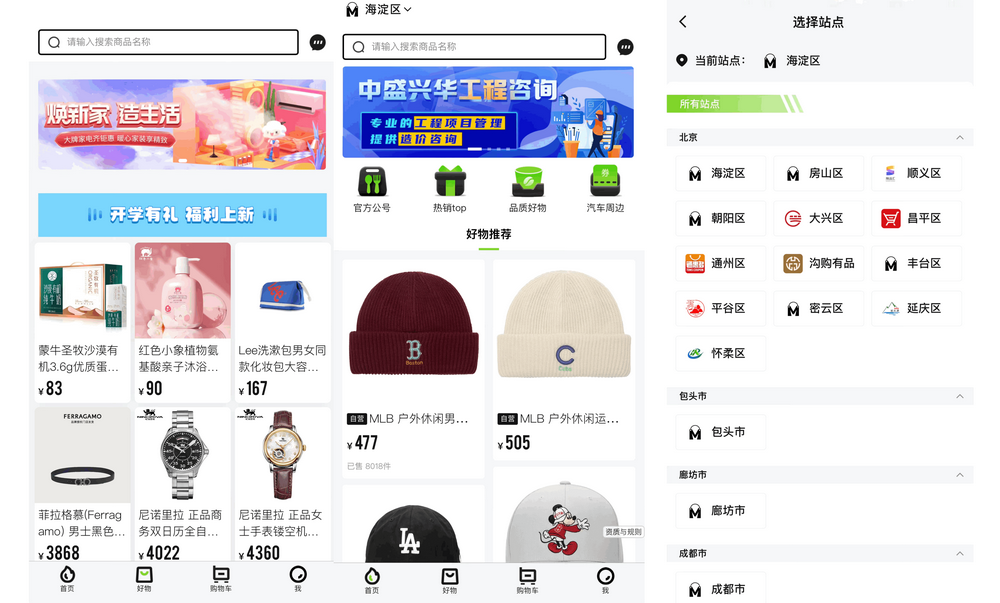

The Consumption Map is a platform that QuantGroup intends to focus on, launched in the second quarter of 2022, primarily in the forms of WeChat Mini Programs and apps. The main feature of the Consumption Map is promoting local services such as car sales, catering, and entertainment, offering related consumption vouchers or coupons.

A cultural media company in Beijing (a former partner of the platform) told Lanjing News that the Consumption Map was similar to "Dianping" (a popular Chinese review site) in its early stages.

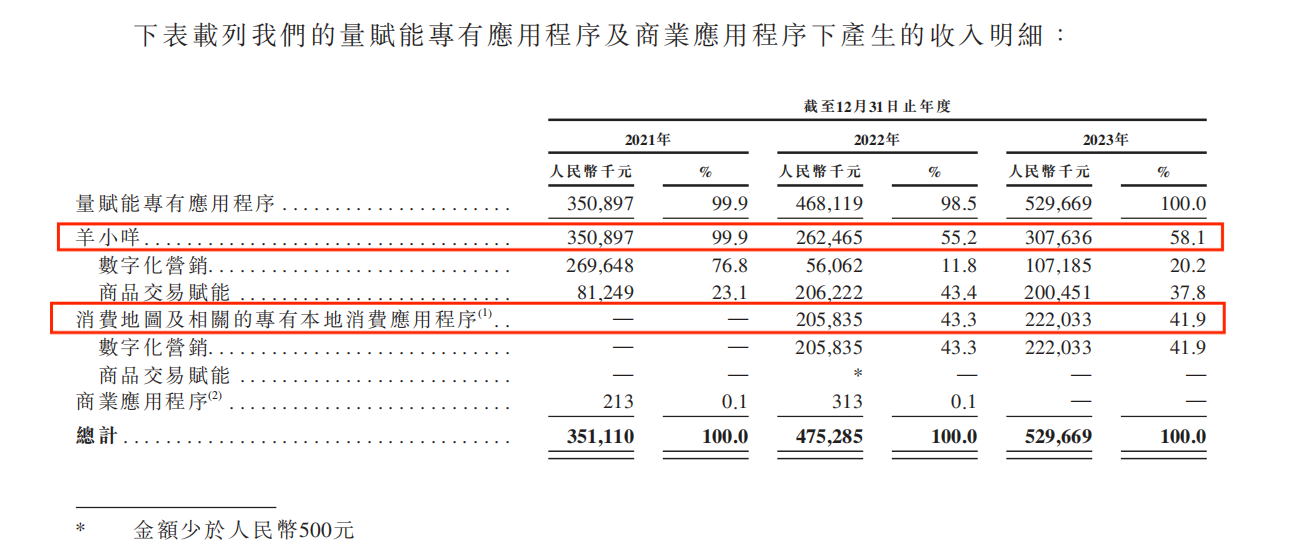

Financially, the Consumption Map has performed strongly, contributing over 40% of QuantGroup's revenue in just two years since its launch, catching up with "Yangxiaomai," which has been operational for many years. From 2022 to 2023, QuantGroup recorded investments of RMB 206 million and RMB 222 million through the Consumption Map, accounting for 43.3% and 41.9% of total revenue, respectively.

Over the past two years, the average monthly active users on the Consumption Map increased from 62,300 to 81,000, with annual registered users of 257,000 and 557,000, and annual transaction values of RMB 421 million and RMB 322 million, respectively. According to data from Qimai, the cumulative downloads of the Consumption Map are 45,700, with only 1 download in the last 30 days, potentially contributed by a Lanjing News reporter.

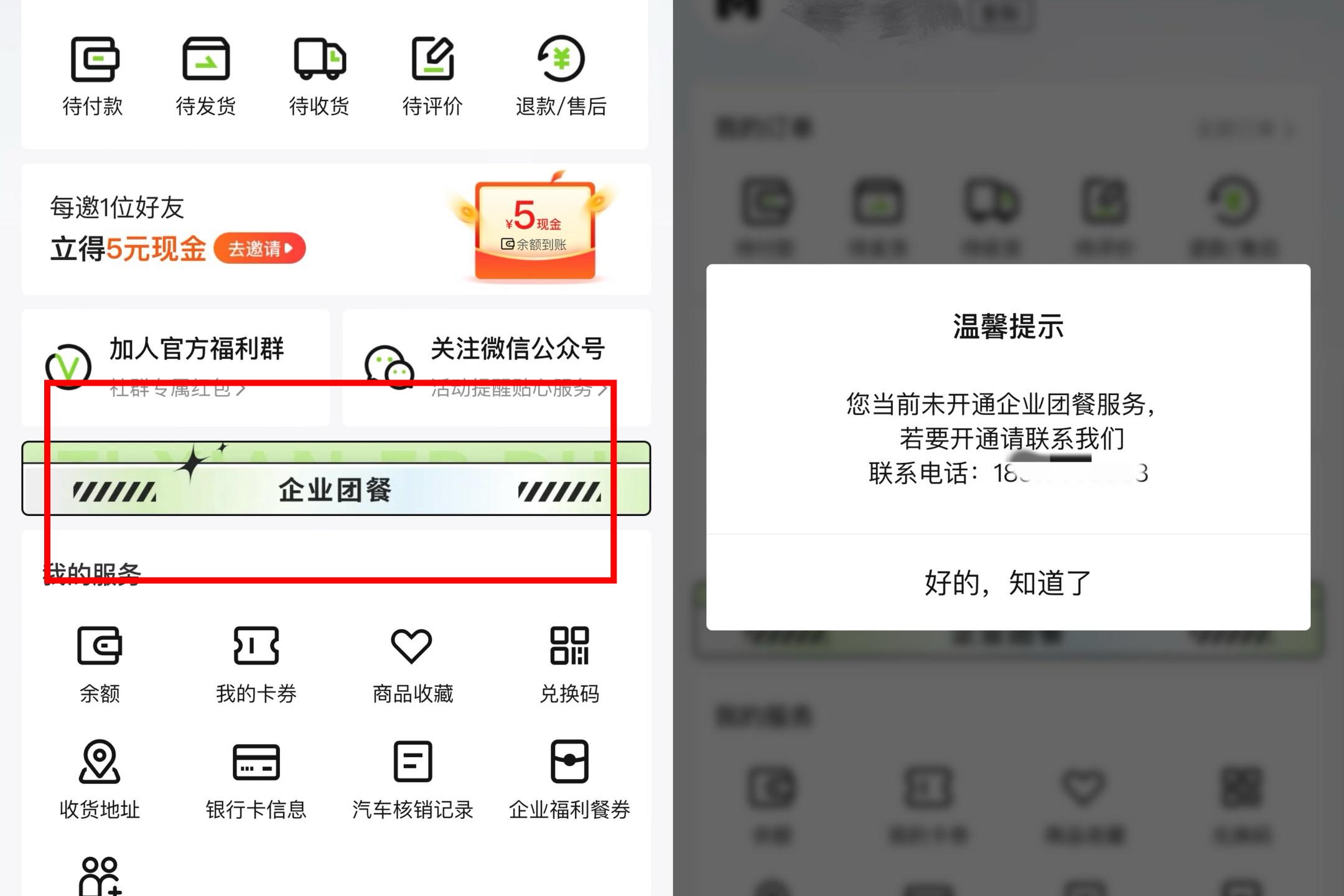

In 2023, the Consumption Map attempted to deliver small-scale "takeaways," but the business appears to have stagnated. "Their boxed lunch business failed," said an industry insider. Currently, the "Corporate Group Meals" window can still be seen in the Consumption Map app, but when Lanjing News called the contact number for business inquiries, the other party said they had dialed the wrong number and were not related to the Consumption Map.

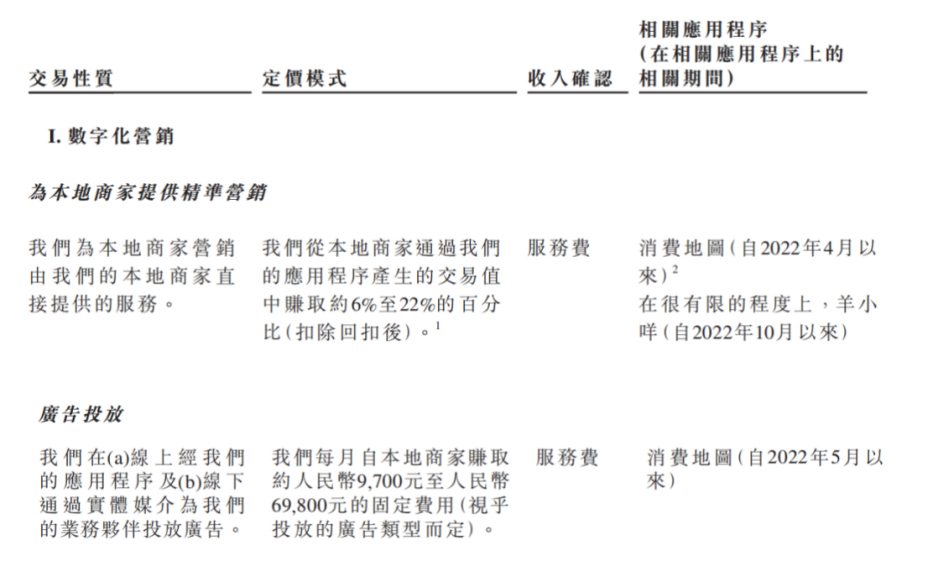

The Consumption Map primarily generates revenue through digital marketing services, including precision marketing and advertising placement for local businesses. In other words, the Consumption Map markets for businesses and charges a marketing fee, earning approximately 6% to 22% of the transaction value generated from marketing.

The pricing model for advertising placement is a fixed fee ranging from RMB 9,700 to RMB 69,800 per month from local businesses. Lanjing News understands that based on the fixed service fee characteristic of the Consumption Map's business model, it should be standardized traffic cooperation rather than non-standardized advertising placement.

Taking Dianping, which the Consumption Map is benchmarked against, as an example, the majority of its fees for individual merchants' listings, displays, and traffic range from hundreds to a couple of thousand yuan per month. Comparing the traffic disparity between the Consumption Map and Dianping, and considering that the Consumption Map's fees are several times more expensive than Dianping's, its business model is worthy of scrutiny.

From the perspective of corporate costs, taking a 500 square meter physical store on the B2 floor of Poly Times Plaza as an example, its publicly advertised monthly rent is RMB 100,000; while a popular 50 square meter store in the Grand Gateway 66 Shopping Mall has a monthly rent of RMB 75,000. The cost of cooperation with the Consumption Map is almost on par with the largest component of offline store costs—rent.

Most Revenue Comes from the Automotive Industry

According to the prospectus, among the precision marketing services provided by QuantGroup to local businesses, most of the revenue comes from transactions with local automotive businesses, amounting to RMB 162 million and RMB 182 million in 2022 and 2023, respectively.

The model works by users obtaining automotive consumption vouchers from the Consumption Map and redeeming them at local businesses. A portion of the voucher value is then allocated to the Consumption Map as a service fee based on an agreed-upon percentage. Each automotive consumption voucher charges RMB 3,000 or RMB 5,000, accounting for approximately 50% to 100% of the voucher's face value. As of the end of 2022 and 2023, the redemption rates for automotive consumption vouchers were as high as 99.97% and 100%, respectively.

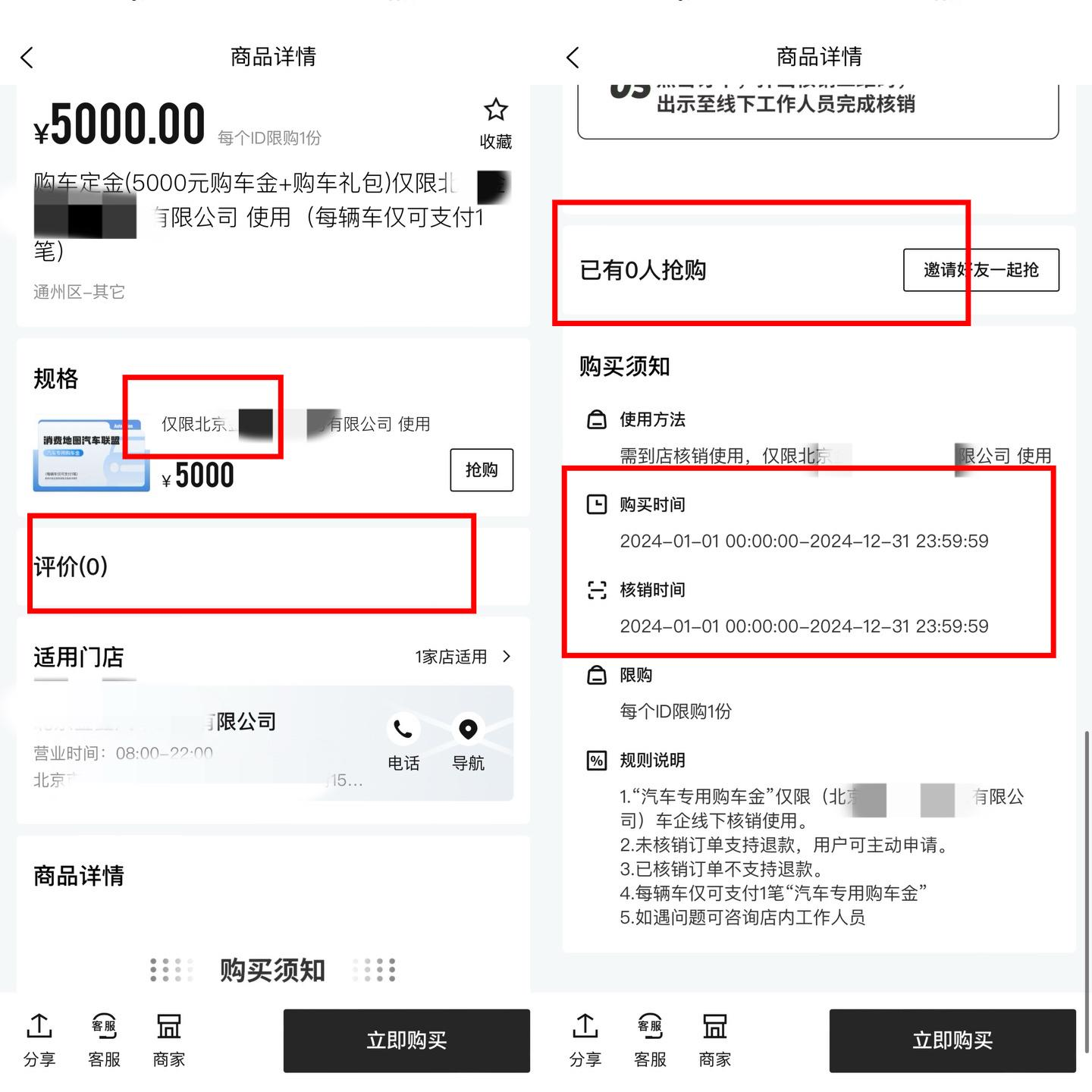

Lanjing News observed that currently, the Consumption Map platform displays services from 5 merchants in 2 regions offering "Consumption Map Auto Alliance Dedicated Car Purchase Funds" at a price of RMB 5,000, including RMB 5,000 in car purchase funds and a car purchase package. The purchase and redemption periods are both for the entire year of 2024 and are limited to use at specific companies.

However, the product details page of the Consumption Map does not specify the rules for using the RMB 5,000 car purchase funds. Therefore, Lanjing News called the five merchants where the funds can be used. One contact number was disconnected, and one staff member said they were unaware of it.

When asked about how to use the car purchase funds, a salesperson at an auto repair shop told the reporter, "I haven't heard of any cooperation with the Consumption Map." To further address the reporter's questions, the merchant's marketing department staff called back and said, "Our marketing team hasn't invested in the Consumption Map's vouchers. (Before) it might have happened, but our colleagues haven't invested in the Consumption Map recently."

Two merchants belong to the same company, which told Lanjing News that they had cooperated with the Consumption Map on car purchase funds in 2022. The other party asked the reporter, "Where did you find out about (the car purchase funds)? We've terminated our cooperation now, since 2023. Is the Consumption Map still using our company for display? I'll go ask the Consumption Map (to clarify)."

It's worth noting that it's already July 2024, and the car purchase funds with purchase and redemption periods starting from January 1, 2024, have a rating of 0 and no one has snatched them up on the Consumption Map app.

Multiple offline merchants that can redeem the "car purchase funds" vouchers offline are unaware of them.

In terms of advertising placement, Lanjing News learned through the Consumption Map app that less than 10 companies are displayed on the sliding advertisement page, all of which are local Beijing companies, including cultural media companies, engineering consulting firms, information technology companies, and technology trading companies.

Lanjing News called all the above-mentioned companies, and of the five companies contacted, two media companies said they had cooperated with the Consumption Map, with one stating, "They initially ran promotions, and we bought their services, but that was several years ago, and we're not cooperating now."

The other three said they had never heard of the Consumption Map program or platform and had never cooperated with it.

One company with a "special" name that includes "media" told Lanjing News during the first call, "We're an accounting company, and I'm not too familiar with the specifics. The Consumption Map should be our client, and we handle their tax reporting." However, when Lanjing News called the company again that afternoon to inquire about the specifics of tax reporting for the Consumption Map, the other party denied knowing the Consumption Map.

Goods Prices Doubled, Yet Sales Remain High

The prospectus states that as of December 31, 2023, QuantGroup had over 2,024 business partners on the Consumption Map.

From the survey results, none of the "business partners" displayed on the Consumption Map's advertising spaces, except for the cultural media company engaged in accounting services, indicated that they were currently cooperating with the Consumption Map.

Two years after its launch, the local services and advertising placement services that generated over RMB 200 million in annual revenue for the Consumption Map seem to have "disappeared" from the platform, and the platform's WeChat business account also displays "This user does not exist."

On the contrary, Lanjing News observed that a significant portion of the Consumption Map platform is dedicated to e-commerce-type product trading services.

QuantGroup also mentioned in its prospectus that it hopes to diversify the revenue streams on the Consumption Map, although this only accounts for a minimal portion. In 2022, revenue from product trading empowerment through the Consumption Map was less than RMB 500.

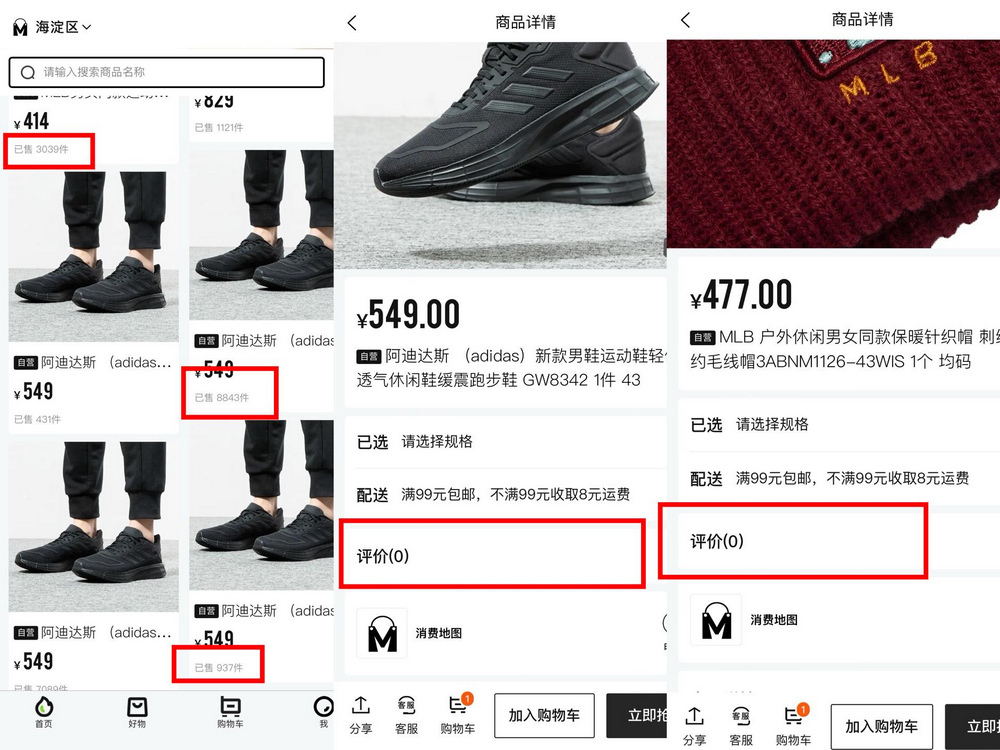

According to Lanjing News observations, products sold on the Consumption Map exhibit significant price premiums. For instance, a pair of men's shoes from a certain brand is priced at RMB 549 with no coupons available. In contrast, the same shoes are sold on an international self-operated store on another well-known e-commerce platform for an original price of RMB 429, dropping to RMB 342.95 after applying a coupon. Upon comparison, the Consumption Map's price is RMB 206.05 higher, representing a 60.08% premium.

Furthermore, a shoulder and neck massager of the same model from a certain brand is priced at RMB 3,378 on the Consumption Map, while the official flagship store on other e-commerce platforms sells it for RMB 1,999 (original price RMB 2,400), representing a 68.98% premium. Lanjing News compared the prices of five products (including watches, sneakers, knit hats, massage chairs, and rice cookers) on the Consumption Map and other e-commerce platforms, finding average premiums of approximately RMB 680 (18.47%, respectively, the same below), RMB 206.05 (60.08%), RMB 1,379 (68.98%), RMB 283.85 (147%), and RMB 708.1 (233%), with an average premium of RMB 651.4 and an average premium rate of 105.51%.

Nevertheless, despite the doubled price premiums on the Consumption Map, they do not seem to affect sales.

It can be seen in the app that some daily consumer goods such as grain, oil, and food, as well as water bottles, have sales of 38 units, while other products such as alcohol, knit hats, and sneakers can reach thousands of units sold. Taking the "new model of men's shoes from a certain brand" on the Consumption Map as an example, the sales of the four sizes are 431 units, 937 units, 7,089 units, and 8,843 units, respectively. Additionally, the sales of hats from another brand range from 3,039 to 8,018 units.

Almost all products on the Consumption Map, including those mentioned above with such high sales volumes, have no user reviews, while most products with thousands of transactions on platforms like Taobao, JD.com, or Pinduoduo have at least hundreds of reviews.

In the prospectus, QuantGroup also disclosed the cooperation model between the Consumption Map and its major client TasteCloud, where TasteCloud, as a government voucher partner, entrusts QuantGroup to distribute vouchers through the Consumption Map. QuantGroup charges local businesses a service fee of approximately 6% to 22% of the transaction value and shares a percentage of this with TasteCloud, ranging from 50% to 70%, until the businesses have been onboarded for 18 or 24 months.

According to platform disclosures, as of December 31, 2023, TasteCloud had introduced 1,302 local businesses to the Consumption Map, primarily automotive service providers. A merchant participating in an electric car consumption festival displayed on the Consumption Map told Lanjing News, "We only cooperate with the government and don't know what the Consumption Map is."

In 2022 and 2023, the cooperation between the Consumption Map and local businesses introduced by TasteCloud generated transaction values of RMB 386 million and RMB 320 million, respectively, with the Consumption Map earning RMB 198 million and RMB 219 million from these transactions, accounting for a significant portion of its total revenue.

It is reported that TasteCloud was introduced to QuantGroup in 2021 by Li Yan, the Executive Director and Chief Financial Officer of QuantGroup. Li Yan is a partner in Beijing Fengsheng Capital Management Co., Ltd. (holding a 99.7% stake), which is a shareholder in Jiaxing Fengsheng Erhao Equity Investment Partnership (Limited Partnership), which holds an 8.6% stake in TasteCloud.