From Patent Litigation to TRANSSION's "Hidden Worries of a King"

![]() 07/25 2024

07/25 2024

![]() 628

628

Confidence is more important than gold!

Edited by Junyi

Fengpin: Wendao

Source: Shoucai - Shoucai Finance and Economics Research Institute

The mobile phone market is always filled with smoke and gunpowder. Besides the apparent wave of price wars on the surface, the invisible competition behind it is equally intense. This is true for TRANSSION, known as the "King of African Phones," which is currently embroiled in patent disputes.

On July 12, according to foreign media IP fray, Qualcomm is suing TRANSSION in the Delhi High Court for infringing on four non-standard essential patents. This move aims to protect Qualcomm's patents and help restore a fair competitive environment for all its licensees.

On July 15, affected by this news, TRANSSION's share price fell by nearly 10% at the opening and ultimately dropped by nearly 5%, erasing over RMB 4.4 billion in market value in a single day.

That night, TRANSSION announced that its directors and relevant executives planned to increase their shareholdings within six months from July 16, 2024, with the increase ranging from RMB 10.8 million (inclusive) to RMB 14 million (inclusive).

With real money and sincerity, the market also responded positively, with the share price rising for four consecutive trading days from July 16 to 19, closing at RMB 82.58. However, it then turned downwards again, closing at RMB 75.92 per share on the 24th.

Whether this can reverse the low share price remains uncertain. After all, over a longer period, the company's share price has been fluctuating downwards since the end of April, shrinking by about 40% in three months from its high of RMB 125.84 on April 18; its market value has dropped by over RMB 70 billion, currently standing at less than RMB 90 billion.

One cannot help but wonder, besides this lawsuit, what other "hidden worries of a king" does TRANSSION, which dominates one corner of the market, face?

1

Caught in Patent Disputes Again

According to China Business News, Qualcomm claims that TRANSSION has consistently refused to obtain a comprehensive license from Qualcomm. Although some recent products have signed licensing agreements, the vast majority of products remain unlicensed and are still infringing on Qualcomm's valuable patent portfolio.

In response, TRANSSION stated that it has signed a 5G standard patent licensing agreement with Qualcomm and is fulfilling it. TRANSSION believes that it is unfair for some patent holders who do not own or own only a small number of patents in certain countries to demand high global unified licensing fees. However, it will continue to negotiate with Qualcomm on patent issues to reach a final result.

Each side holds its own view, and it is not for us to judge who is right or wrong, but time will tell. However, it is clear that as the defendant, TRANSSION is in a relatively passive position.

If we extend the timeline, lawsuits between Qualcomm and mobile phone companies are not uncommon. Qualcomm has engaged in "patent wars" with Apple and Meizu, both of which ended with Qualcomm receiving compensation. For example, in 2016, Qualcomm sued Meizu, which had not signed a 3G/4G technology patent licensing agreement with Qualcomm, and Meizu ultimately accepted Qualcomm's patent licensing terms.

Regardless of TRANSSION's chances of winning, some investors have questioned its core technology by browsing stock forums, saying things like "Without core technology, it just won't work" and "No wonder it can be so cheap, it turns out it hasn't paid patent fees before"...

These remarks may be biased, but they serve as a wake-up call for TRANSSION: As a global leader in mobile phones, how deep is its core moat? Are there any strategic missteps or misjudgments?

In fact, similar lawsuits are not the first. According to the Time Weekly, in addition to Qualcomm, TRANSSION also faces intellectual property lawsuits filed by Philips in India. According to the Financial Times, Nokia is also pressuring TRANSSION to pay patent fees. Earlier, in September 2019, just before TRANSSION Mobile's IPO, Huawei accused TRANSSION of patent and copyright infringement, although the claim amount was small and both parties reached a settlement, it was an early warning for TRANSSION.

One cannot help but wonder why TRANSSION keeps facing patent accusations and what shortcomings need to be addressed.

2

How Much Impact, and Where is the Bottleneck?

Let the objective data speak. The financial report shows that in 2023, TRANSSION invested RMB 2.256 billion in R&D, accounting for only 3.62% of revenue. According to the Yangtze River Business Daily, the median R&D rate of A-share companies listed on the STAR Market is 12.2%.

By the end of 2023, TRANSSION had obtained a total of 3,882 patents, of which only 995 were invention patents, a significant gap compared to some top competitors. According to the Chief Executive Magazine, Huawei has reached 100,000 patents; OPPO currently has 22,843 authorized invention patents and 21,149 published invention patents; Vivo's parent company Vivo Mobile also has 29,320 patents.

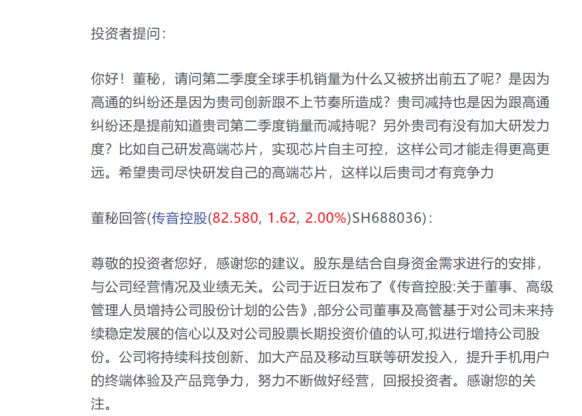

In the mobile phone industry, where competition is increasingly intense and product power is a core factor, the above gap is naturally not a plus. When facing a phased decline in sales in the second quarter of 2024, investors asked about R&D on interactive platforms, reminding the company to develop high-end chips and achieve independent controllability to go higher and further. The board secretary also replied that it was important to continue to increase R&D innovation.

The 2023 financial report also admitted: "Due to the uncertainty of obtaining standard essential patent licenses, it cannot be ruled out that the company may be sued by third-party patentees, nor can it be ruled out that cost increases cannot be eliminated by raising product prices."

Focusing on financial data, since its listing, TRANSSION Mobile's financial reports have annually listed a patent royalty accrual item in the estimated liabilities. The balance of the estimated liabilities from 2019 to 2023 was RMB 996 million, RMB 1.43 billion, RMB 2.21 billion, RMB 2.548 billion, and RMB 3.158 billion, continuing to grow, reaching RMB 3.323 billion by the end of the first quarter of 2024.

Industry analyst Wang Yanbo believes that if estimated liabilities continue to rise, it may lead to excessive debt accumulation in the future, requiring vigilance against risks such as default, which in turn could affect business operations and lead to a vicious cycle.

Not too much to ask. From 2021 to 2023, TRANSSION's cash flow fluctuated, with figures of RMB 4.039 billion, RMB 1.979 billion, and RMB 11.89 billion, respectively; it then fell to -RMB 108 million in the first quarter of 2024.

Returning to this patent dispute, according to the National Business Daily, relevant staff from TRANSSION's securities department stated that the two companies had not reached an agreement on 3G, 4G, and other patents, and the impact of the lawsuit was mainly in the Indian market.

India is one of TRANSSION's important markets and one of the fastest-growing regions for global smartphone sales. According to IDC statistics, from 2020 to 2023, TRANSSION's smartphone market share in India reached 5.1%, 7.1%, 6.4%, and 8.2%, respectively.

If TRANSSION loses this lawsuit, the resulting impact on its reputation and sales cannot be underestimated. Xia Hailong, a lawyer from Shanghai Shenlun Law Firm, pointed out that if found guilty of infringement, it may face risks such as compensation liability, damage to market reputation, and product bans, which could negatively affect its business and financial performance in the Indian market.

3

High Performance Growth VS Hidden Worries of the Ceiling

Shareholder Reduction and Questions about the New Moat

It's not too much to say. The better the situation, the more one should be prepared for danger.

In 2023, TRANSSION's revenue reached RMB 62.295 billion, a year-on-year increase of 33.69%, with net profit attributable to shareholders of RMB 5.537 billion, a year-on-year increase of 122.93%. In the first quarter of 2024, revenue was RMB 17.443 billion, up 88.1% year-on-year; net profit attributable to shareholders was RMB 1.626 billion, up 210.3% year-on-year.

This high performance growth is inseparable from its impressive market share. According to IDC data, TRANSSION holds over 40% of the smartphone market in Africa, firmly occupying the top position. In the South Asian market, it ranks first in Pakistan with over 40% market share and first in Bangladesh with over 30% market share. In 2023, TRANSSION ranked fifth in the global smartphone market, behind Apple, Samsung, Xiaomi, and OPPO.

However, like two sides of a coin, high performance growth does not mean there are no hidden worries.

For example, although total sales increased significantly in 2023, they have not yet returned to 2021 levels. From 2019 to 2023, sales were 138 million, 174 million, 197 million, 156 million, and 194 million units, respectively.

It is worth noting that with high market share in Africa and intensifying competition, we need to be vigilant about the subsequent growth "ceiling." From 2019 to 2023, Africa contributed revenues of RMB 19.005 billion, RMB 22.452 billion, RMB 24.238 billion, RMB 20.633 billion, and RMB 22.064 billion, with revenue shares of 77.25%, 60.70%, 49.94%, 44.93%, and 35.98%, respectively, showing a continuous decline.

Of course, TRANSSION has made sufficient efforts to expand in Asia and other regions, but its profitability is not as good as the African market. Taking gross margin as an example, it reached 30.97% in Africa in 2023, while it was only 21.11% in Asia and other regions.

TRANSSION's position as the top player in Africa is due to its unique approach and first-mover advantage accumulated through lower prices. According to the National Business Daily, TRANSSION's shipping price is around RMB 500, with a retail markup of 30% to 40%, resulting in a final market price of approximately RMB 600 to RMB 700.

However, in recent years, many domestic mobile phone manufacturers have stepped up their globalization efforts, and TRANSSION faces increasing competition. According to Cailian Press, TRANSSION's growth rate in the African smartphone market in 2021 was already lower than that of Samsung and Xiaomi. In its core market of South Africa, OPPO and Vivo are rapidly gaining ground, with growth rates of 466% and 328%, respectively.

Faced with the encroachment, TRANSSION needs to be vigilant about the failure of its competitive barriers and the current lack of high technological barriers. How to defend its existing market and expand into new ones to maintain sustained performance growth is a critical question.

TRANSSION's achievements today are inseparable from its founder, Zhu Zhaojiang.

Born in Ningbo, Zhejiang, in 1973, Zhu Zhaojiang joined Bird, a then-thriving mobile phone company, after graduating from university. In just three years, he became the sales champion in North China. In 2003, he was sent abroad to develop overseas markets and discovered potential business opportunities. In 2006, he resigned and came to Africa, where TRANSSION was born the same year.

In 2007, TRANSSION launched its first dual-SIM dual-standby phone, Tecno, and deeply partnered with agents in different regions, adopting a decentralized agent system to accelerate cash flow. As a risk compensation, TRANSSION ceded a significant amount of profit to agents. With a keen grasp of market demand and a low-price strategy, TRANSSION's products quickly gained success in Africa.

However, times have changed, and mobile phone technology continues to iterate. Compared to other domestic manufacturers, if TTRANSSION relies solely on price as its product advantage without a strong core technology, its moat will not be solid. As the market becomes more competitive, major manufacturers are focusing on cost-effectiveness, quality-price ratios, and patent wars. Without quickly forming a new moat, will TRANSSION be replicated, overtaken, or even defeated by its competitors? The outside world cannot help but scrutinize it.

According to the China Securities Journal, since mid-April, TRANSSION's share price has declined, but its controlling shareholder chose to reduce its holdings and cash out.

On May 23, TRANSSION announced that its controlling shareholder, Shenzhen TRANSSION Investment Co., Ltd., had reduced its shareholding by 8,065,652 shares, or 1% of the total share capital, through an inquiry transfer method, at an average transfer price of RMB 125.55 per share, realizing over RMB 1 billion in cash.

Over a longer timeline, this is not the first time that major shareholders have reduced their holdings. On April 20, 2023, TRANSSION disclosed that its second-largest shareholder, Yuanke Fund, had reduced its shareholding by 9.255 million shares, or 1.15% of the total share capital. Wind data shows that Yuanke Fund cashed out approximately RMB 1.02 billion on that day. This was the fifth round of share reduction by Yuanke Fund, which held 12.96% of TRANSSION's shares when it went public.

In addition, according to the China Securities Journal and Sina Finance, the company's internal employee stock ownership platforms have also been active in reducing their holdings. According to Wind data, the shareholding ratios of Chuanli Enterprise Management, Chuancheng Enterprise Management, and Chuanyin Enterprise Management, all employee stock ownership platforms, decreased from 2.76%, 2.13%, and 2.61% in the second quarter of 2023 to 2.12%, 1.53%, and 1.47%, respectively, by the end of the first quarter of this year.

Naturally, this is not conducive to market confidence. On the Shanghai Stock Exchange e-interaction platform, investors questioned, "Why has your company's share price been falling? You also announced a major shareholder reduction on May 17. Does your company not have confidence in its future business performance? Even your major shareholders are reducing their holdings at this time, making us wonder if there are problems with your company's performance?"

4

Form and Soul in Harmony

Can Effort Create Miracles?

Confidence is more important than gold. TRANSSION cannot afford to wait to address doubts and suspicions.

Facing various challenges and potential risks, Zhu Zhaojiang did not sit idly by. He realized that relying solely on the mobile phone business was no longer sufficient to meet market demands. It was necessary to broaden the product line and market scope, leading to the expansion into areas such as wearable devices, smart home appliances, and mobile internet.

Leveraging its smartphone business, Transsion Holdings developed various products and services, including the digital accessories brand Oraimo, the home appliances brand Syinix, and the after-sales service brand Carlcare. Additionally, they have developed intelligent terminal operating systems and application software platforms such as HiOS, itelOS, and XOS.

Striving to excel in both areas, Transsion Holdings clearly learned from past lessons and aimed for a holistic approach. This development path is reminiscent of Xiaomi's strategy, earning revenue not only from hardware but also from advertising services. Can they once again carve out a unique path, turn challenges into opportunities, and usher in a new wave of business success?

As of 2023, over 92% of Transsion Holdings' revenue still comes from mobile phones, with other business contributions remaining relatively weak. Clearly, the road to diversification is filled with lofty ideals but harsh realities, and Transsion Holdings needs to continue exploring. To maintain its dominant position in the mobile phone market and overcome patent obstacles, the company must significantly enhance its core innovation capabilities, unique research and development, and product quality-to-price ratio, ultimately achieving a transformative rebirth.

From this perspective, the current patent lawsuit could serve as a call to action for further improvement. Increasing stakes is merely a declaration of commitment; the true test lies in demonstrating product strength. Can they create miracles through bold actions and turn setbacks into opportunities?