5PE's Weibo, the cheapest big internet?

![]() 09/19 2024

09/19 2024

![]() 557

557

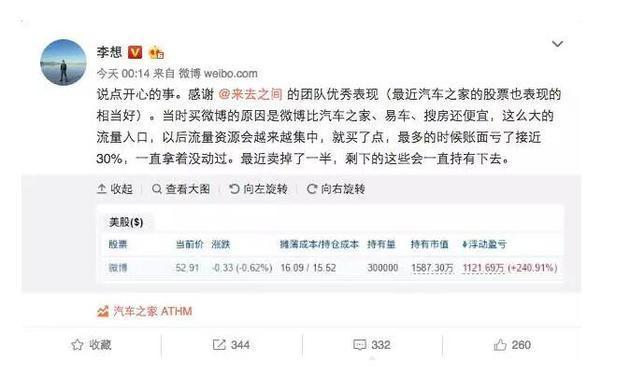

Li Xiang, the ideal CEO, known as the "King of Weibo" by his peers in the automotive industry, enjoys posting on Weibo, which serves as a platform for him to exert influence and promote his ideas. However, after the MEGA incident, he has become much more low-key.

Apart from posting on Weibo, he has also invested in it himself. In 2016-2017, he earned several times his initial investment on Weibo, amounting to tens of millions of dollars, and even posted on Weibo to thank the CEO of Weibo.

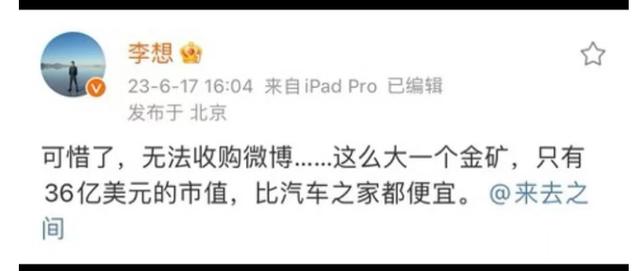

Last year, he again posted on Weibo that he believed the stock price of Weibo was undervalued. At that time, Weibo's market value was US$3.6 billion, once again cheaper than his own AutoHome.

More than a year has passed since then, but the "undervaluation" has not ended. Weibo's market value has halved to just US$1.8 billion, while AutoHome's market value stands at US$3.5 billion.

Is Weibo even more undervalued now?

I. Gradually Ruining a Good Hand

At that time, Weibo was still called Sina Weibo and was considered a winner among the many social media platforms. The reward for this is that "Weibo" has now become synonymous with Sina Weibo.

In 2007, "Twitter" became popular worldwide, and tweeting became a trend. With Twitter's success, domestic internet imitators began to take action.

Wang Xing's "Fanfou" was the first to strike, and its user base grew rapidly. By the first half of 2009, Fanfou had surpassed one million users. However, due to online censorship, Fanfou was required to address inappropriate content and was eventually shut down in July of the same year. It gradually resumed operations on November 25, 2010.

By the time Fanfou re-emerged, the world had changed significantly.

During this period, portal websites such as Sina, NetEase, Tencent, and Sohu all launched their own microblogging services. Sina Weibo, in particular, acted swiftly and seized the first-mover advantage, attracting a large number of users, including many former Fanfou users.

In early 2010, Sina Weibo launched its API open platform, allowing users to post on Sina Weibo through other software, making it convenient and efficient. Simultaneously, it invited celebrities to join and leveraged their influence to drive user growth. In 2010, Sina Weibo had 50 million active users.

Among other microblogging platforms, Tencent Weibo was the biggest competitor. Tencent invested heavily in Tencent Weibo but was nine months slower than Sina Weibo. In the internet industry, the winner takes all, and Sina Weibo's leading position captured users' minds, while Tencent Weibo gradually declined and announced its cessation of operations in 2020.

As the winner of the microblogging wars, Sina Weibo seemed to have triumphed. However, the losers in those wars have all grown and thrived in other areas, while Weibo appears to be stuck.

Of course, Weibo also had its glory days. Through the influx of celebrities and the launch of commercialization, coupled with Alibaba's investment and cooperation, Weibo's market value surpassed Twitter's in 2016. Subsequently, within less than two years, it surpassed the US$30 billion mark.

Looking at its current market value of a mere US$1.8 billion, which is almost negligible compared to its past heights, it is truly lamentable.

Changes and turning points do not happen overnight. They stem from both environmental changes and internal issues within Weibo itself.

Initially, Weibo's strategy was sound.

Weibo established vertical interest communities and supported KOLs to expand its influence in different fields, enhancing its overall commercial value and attracting advertisers. Despite its potential for effective marketing, it primarily relied on celebrity marketing, which proved to be insufficient. Later, a platform emerged in this space called Xiaohongshu (Little Red Book).

Before and after Alibaba's investment, Weibo considered venturing into e-commerce. In 2015, Weibo launched "Weibo Showcase," which combined Weibo's social system with Alibaba's e-commerce system. If developed further, it could have led the way in social e-commerce. However, Weibo again took a superficial approach, generating revenue by directing traffic to Alibaba and ending there. Later, Pinduoduo's social group-buying, Douyin's interest-based e-commerce, and Kuaishou's trusted e-commerce emerged, areas where Weibo could have excelled but failed to capitalize on its advantages, becoming merely a traffic-directing tool for Alibaba and earning a stable income.

What's most unfortunate is short videos. Weibo pioneered short video features with Miaopai and Xiaokaxiu embedded within its platform. Fueled by celebrity traffic, these features gained rapid popularity. However, they were not given enough attention and were viewed merely as entertainment features within Weibo, failing to break through traffic ceilings. When Miaopai and Xiaokaxiu were booming, Kuaishou's traffic was still low, and Douyin was just starting.

Today, giants have emerged in several areas that Weibo once explored. With its social traffic and first-mover advantage, Weibo was restricted by its existing strengths and outdated thinking.

The new giants, supported by algorithmic recommendations, possess stronger competitiveness.

However, Weibo remains solely a microblogging platform.

Concurrently, public opinion supervision has become stricter. The entertainment celebrities that Weibo once showcased are now mostly inactive accounts managed by teams, turning Weibo into a business platform for them. Weibo often serves as a backdrop for others' success.

Many people miss the days when Weibo was filled with real people.

Weibo still has some influence, but its primary functions now seem to be checking trending topics and reporting, making it a platform for gossip and criticism. Today, Weibo is rife with hostility and confrontation, easily stirring up controversy due to its open discussion format. To date, Weibo has yet to devise an effective solution to this issue. Prominent figures like Luo Xiang and Dong Yuhui have even opted to leave Weibo altogether.

Weibo tacitly allows celebrities to inflate their data and engage in artificial popularity boosts, with the platform rife with bot accounts and automatic follows to make the numbers look better. Often, genuinely valuable comments are buried beneath the surface.

Weibo has consistently chosen short-sighted profit-making strategies over long-term user experience.

Ruining a good hand may sum up Weibo's journey over the years.

II. Value Analysis

Weibo is aware of the importance of its content ecosystem.

Therefore, in recent years, Weibo has reinvigorated its efforts in vertical content, but these efforts have yet to yield significant overall improvements. Without significant changes, the market perceives Weibo as lacking a future, and even with 600 million monthly active users (MAUs), the platform is deemed of little value.

Weibo's valuation pales in comparison to that of platforms like Xiaohongshu and Bilibili, which have far fewer MAUs. Bilibili is valued at approximately US$6.5 billion, while Xiaohongshu, based on funding rounds, is valued at nearly US$20 billion.

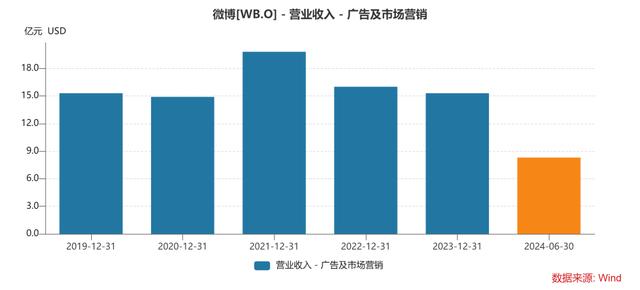

Weibo's performance highlights its weaknesses. Advertising accounts for over 85% of its revenue. In recent years, not only has Weibo's advertising revenue failed to grow, but it has also declined. Advertising revenue in 2023 remained flat compared to 2019. Although value-added service revenue was not disclosed for the first half of this year, combined revenue still declined by 2.42% year-on-year. While macroeconomic factors played a role, the bigger issue lies in advertisers' reluctance to favor Weibo.

Advertisers are increasingly concentrating their resources on high-traffic, high-conversion platforms. Despite having 600 million MAUs, Weibo is seen as a low-conversion platform with high traffic but low user value. Unless significant discounts are offered, advertisers may find it more valuable and rewarding to invest in high-conversion platforms, even if they cost more.

What sets Weibo apart from other platforms is its lack of algorithmic recommendations, relying primarily on search and follow functions. The "people-find-content" model is outdated in the internet age, where "content-finds-people" algorithms are now mainstream.

Platforms like Douyin, Kuaishou, and Xiaohongshu, which employ algorithmic ad delivery models, exhibit higher monetization efficiency and stronger content ecosystems and user stickiness. While Weibo has attempted algorithmic recommendations, they often seem unclear and cluttered with advertisements. Additionally, Weibo's topic format can sometimes backfire if comments and shares are not carefully controlled in advance.

Weibo's current decline makes it difficult to envision a bright future for the platform. Maintaining the status quo may already be considered a decent outcome.

The 600 million MAUs could be a treasure trove if effectively utilized, but they are worthless if left untapped. When Weibo fails to ignite market imagination, the value of these 600 million MAUs becomes fixed.

For a mature company with limited growth potential, its value can initially be assessed through its balance sheet.

Weibo boasts ample cash reserves, with US$1.922 billion in cash and US$916 million in short-term investments, far exceeding its market value of US$1.8 billion.

However, its liabilities are also substantial, including US$1.063 billion in long-term loans, US$800 million in short-term loans, and other liabilities, totaling US$3.689 billion in overall liabilities.

On the asset side, items such as goodwill, long-term investments, receivables, and other non-current assets may not fetch their full value upon liquidation, often resulting in discounts. After deducting liabilities, the remaining net assets may be less than US$1 billion (rough estimate), in addition to the platform itself.

In other words, if Weibo were to undergo a strict liquidation based on current assets, its current market value may not necessarily be underestimated.

Based on current market valuations, deducting approximately US$1 billion in net assets, the platform itself may be valued at around US$700-800 million, equivalent to just over US$1 per MAU from a traffic perspective, which appears undervalued.

An enterprise capable of effectively leveraging Weibo's 600 million MAUs might be willing to pay a premium for its acquisition. However, if Weibo continues to earn only modest profits, the market will overlook its substantial user base, even if it reaches 1 billion MAUs.

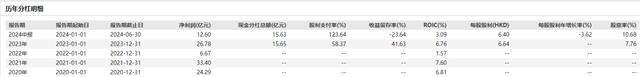

For Weibo, unable to make significant progress, distributing its cash reserves may be a wiser choice.

Weibo's operating cash flow remains robust, significantly exceeding its net profit, positioning it as a profitable internet company capable of supporting high dividend payouts.

In recent years, the company has also initiated dividend payments, offering US$0.82 per share, resulting in a current dividend yield exceeding 11%. From a dividend yield perspective, this is attractive, but it remains unclear whether future dividends will remain stable. If dividends remain stable, the share price is likely to stabilize.

Conclusion

After its heyday, Weibo's performance has been lackluster. Despite holding traffic and being an early entrant in multiple fields, it has consistently fallen short.

Weibo's issue lies in its narrow-minded focus on survival and quick wins rather than broader strategic thinking. It has paid insufficient attention to and exploration of user needs, prioritizing revenue-generating features like VIP tiers over user experience and engagement.

Enriching its content ecosystem, identifying new growth areas, and competing effectively with other internet platforms are crucial considerations for Weibo. Leaving it merely as a platform for gossip and criticism is a significant waste of its potential.