TikTok Shop battles fiercely in the US market, dormancy and acceleration of content-driven e-commerce

![]() 09/25 2024

09/25 2024

![]() 508

508

Can TikTok Shop's content-driven e-commerce bring a new growth miracle to global merchants?

Author: Liang Liang, Huashang Taolue

Cross-border e-commerce is redefining the global e-commerce landscape.

In the past five years, China's cross-border e-commerce market has grown more than tenfold, enabling tens of millions of Chinese merchants to sail overseas and building a global commercial network linked by core e-commerce platforms.

This is an unprecedented commercial network that has and continues to rapidly transform the global trade and consumption landscape. The network is constantly evolving and diversifying, from price to value, from commodities to brands, and from scale to individuality.

The rules and landscape of global e-commerce are also changing as a result, with content-driven e-commerce centered on value delivery and individual interests becoming a new growth engine. This is particularly evident in the fiercely competitive US e-commerce market.

TikTok Shop, with its vast user base and strong content leadership, has become the biggest driver and beneficiary of this new growth under this backdrop.

[Battling in the US: An Unmatched Explosion]

As the second-largest e-commerce market globally, the US boasts a sophisticated e-commerce system, high e-commerce penetration, and strong spending power, making it the primary target for cross-border e-commerce players.

Even amid a global slowdown in consumer spending, the US e-commerce market continues to grow.

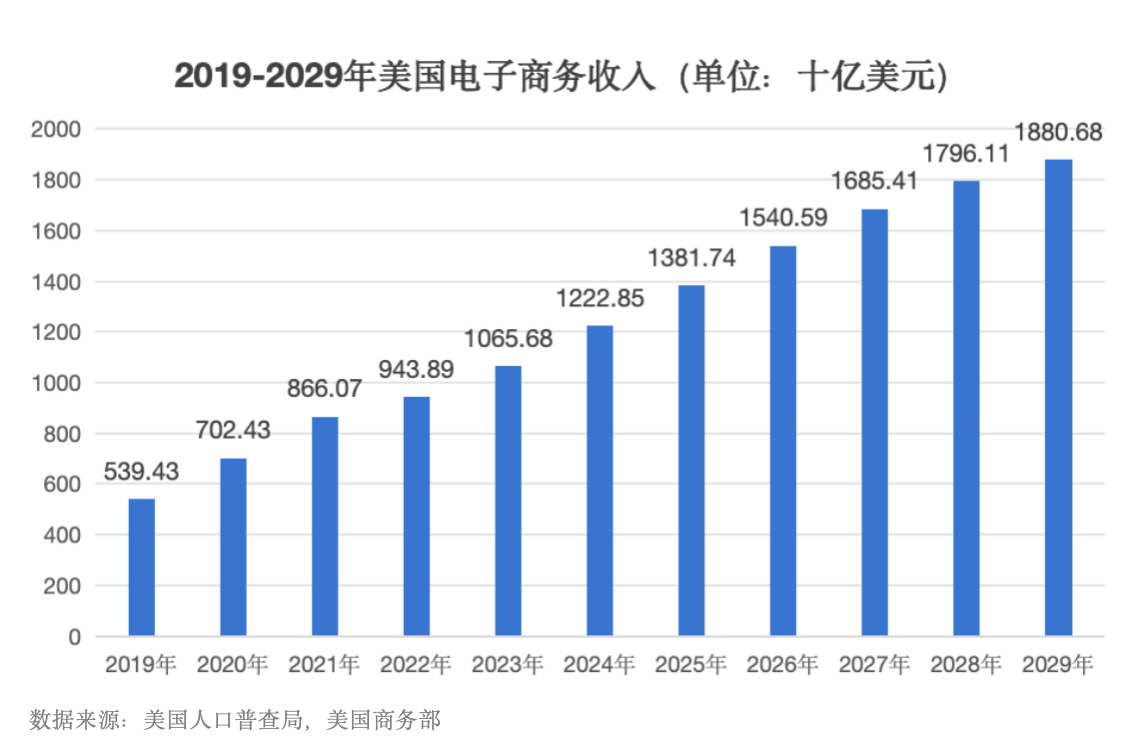

According to MarketplacePluse and Stocklytics data, the US accounts for 19% of global e-commerce GMV, with a projected average annual compound growth rate of 11.82% for B2C e-commerce from 2024 to 2028, ranking first globally.

Statista predicts that the US e-commerce market will continue to expand at a compound annual growth rate of 8.99% between 2024 and 2029, potentially reaching $1.88 trillion by 2029. By then, the number of e-commerce users is expected to reach 333.5 million, with a user penetration rate of 97.1%.

Over the past few years, Shein and Temu have emerged as two of the most popular shopping sites in the US by leveraging aggressive low-price strategies to attract customers.

Behind the rise of these two apps are domestic merchants producing high-quality, low-cost products. Domestic merchants covet the less competitive niche markets overseas, while reliable Chinese sellers and supply chains are also sought after by platforms.

Faced with the challenge from Chinese platforms, Amazon, the home turf player, has had to adopt Chinese business innovation models, including following suit with low-price strategies and opening up its supply chain solutions to Chinese sellers late last year, adopting a "fully managed" model similar to that of Temu and AliExpress.

Interestingly, cross-border platforms like Temu are also learning from Amazon, leveraging a semi-managed approach to attract high-quality merchants from the latter.

While it's not difficult for Amazon, with its proficiency in supply chain management, and Chinese platforms, which have emerged from the competitive e-commerce landscape, to mimic each other, it ultimately remains a game played under the old paradigm.

Only by changing the rules of the game and reshaping the market landscape can new opportunities arise for merchants.

As shelf e-commerce battles rage on, a new force has suddenly emerged in the US market: content-driven e-commerce, a model that shelf e-commerce platforms struggle to mimic quickly. Content-driven e-commerce is rising rapidly in the US.

Just one year after its full launch in the US, TikTok Shop has shown strong momentum, becoming a new growth pole for merchants – with content-driven GMV soaring by 557%, daily paying users tripling, and the number of content creators growing tenfold. The number of active e-commerce influencers in the US has maintained a quarterly growth rate of over 70%.

[Irreplaceable: A New Formula for Driving the US Market]

Although content-driven e-commerce is still in its infancy in the US, its potential is evident.

As the most developed consumer ecosystem, the US has a natural foundation for content-driven e-commerce, providing a strong foundation for TikTok Shop's layout:

First, the US market is vast, with a large number of internet users and consistently high consumption levels globally. The active and engaged user bases of social media platforms like TikTok, Instagram, and Facebook are more receptive to new things, creating a favorable user ecology for content-driven e-commerce development.

Second, the US market offers a wide range of global products, backed by sophisticated logistics, payment services, and diverse channels. Moreover, the US has had TV shopping since the 1980s, and consumers are highly receptive to interactive, content-driven shopping experiences.

Third, the US boasts a mature KOL and influencer ecosystem with a large base of loyal followers. Their entry into live streaming or short video shopping effectively stimulates purchasing desires and drives sales conversions.

The current US e-commerce industry has reached a point where both merchants and consumers crave fresh elements. Merchants seek new growth avenues beyond price competition, while consumers demand more personalized and diverse offerings.

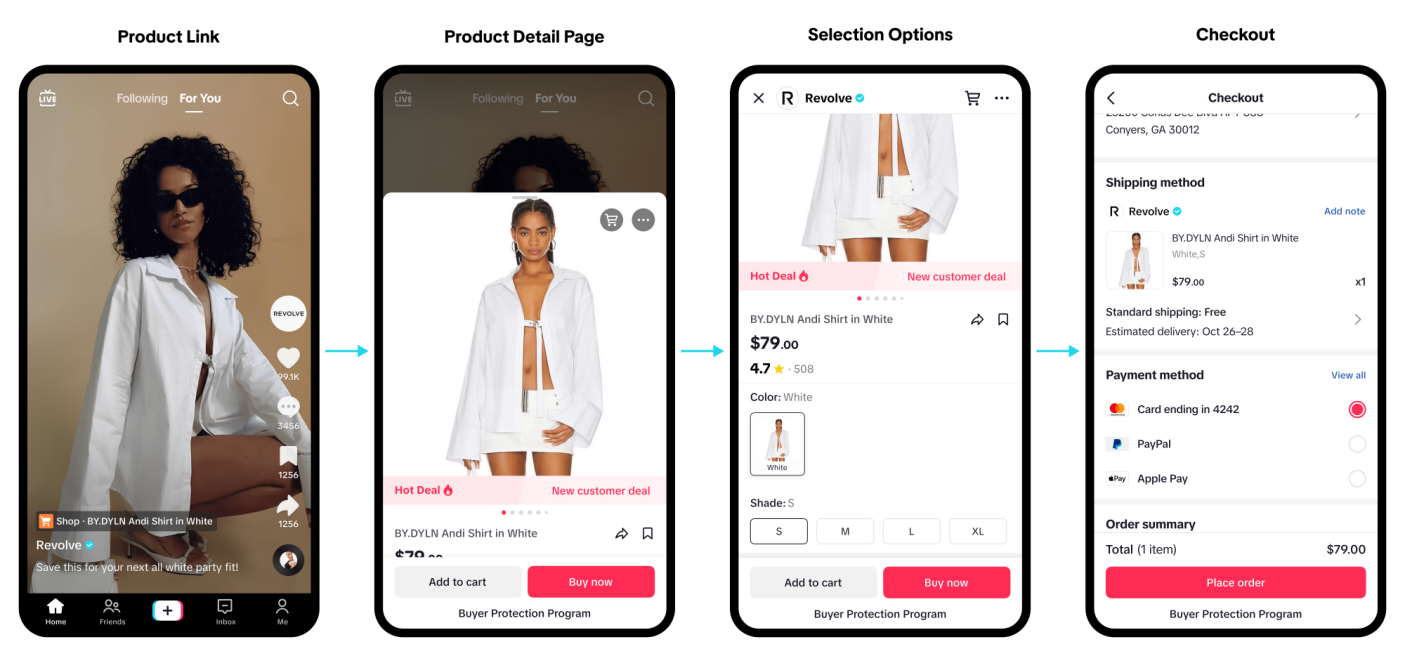

For TikTok Shop merchants, the conversion funnel of content-driven e-commerce is unique and fills the gap in traditional e-commerce consumption scenarios.

Unlike Temu, Amazon, Walmart, or eBay, which cater to known shopping demands (discovery, consideration, and purchase), TikTok Shop understands the correlation between user attention and consumer behavior. Its content-driven e-commerce not only stimulates new consumption demands (interests), providing growth momentum for established brands but also presents explosion potential for niche categories/long-tail products.

This means TikTok Shop opens up an infinite game of matching emerging demands for domestic merchants, avoiding excessive price wars.

TikTok Shop's task is to find a new formula for growth in the US by adapting to local conditions. The key lies in establishing the "infrastructure" – making users enjoy content-driven e-commerce and forming shopping habits; screening and retaining high-quality merchants through experience and platform strategies; and strengthening influencer cultivation and consistently producing quality content.

Currently, TikTok has 170 million monthly active users in the US, spending an average of two hours on the platform daily. A vast amount of user-generated content is related to products, with the hashtag #tilktokmademebuyit alone generating 75.8 billion impressions, attracting numerous users to participate in product recommendations and engagement.

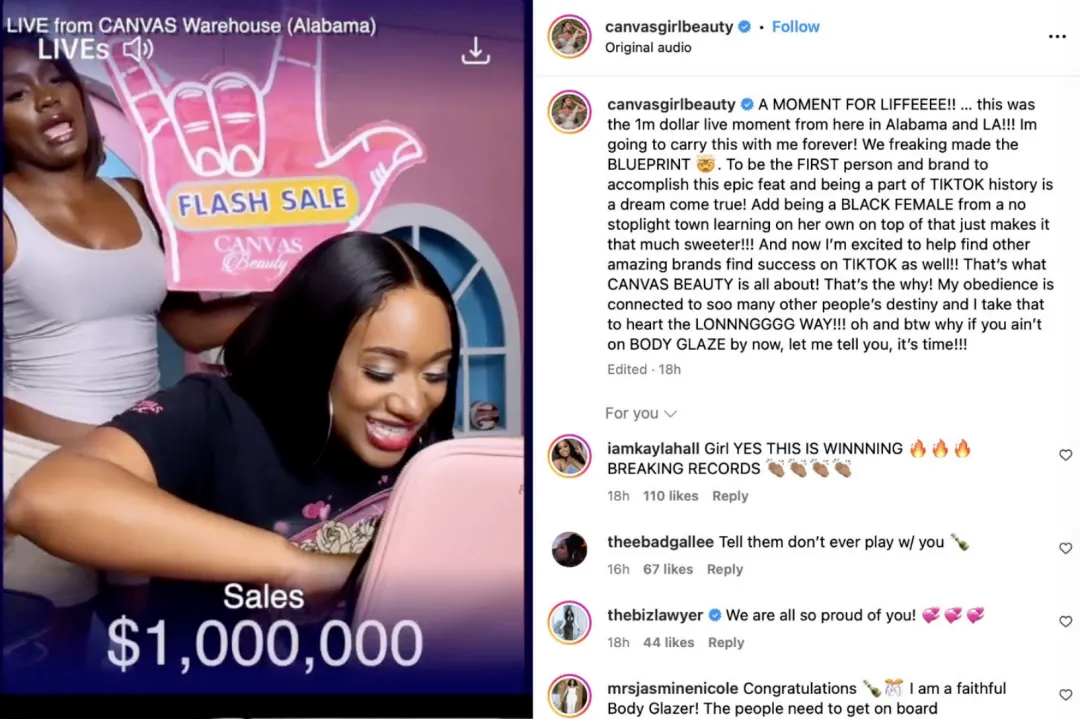

Meanwhile, over the past year, TikTok Shop has seen multiple "million-dollar" live streaming rooms emerge in the US, with merchants achieving remarkable results. For instance, during the back-to-school season, Pop Mart shattered cross-border brand live streaming sales records with a single-session GMV exceeding $280,000.

From optimizing user consumption experiences, strengthening influencer development, to providing comprehensive operational support for merchants, TikTok Shop's early deep layout has significantly shortened the growth cycle for merchants on the platform. In just one year, it has become a top 1 to top 3 GMV contribution channel for many merchants.

Taking the hair care tools brand TYMO BEAUTY as an example, TikTok Shop has emerged as an essential new sales channel. Since its launch last year, sales have continued to climb, with total brand sales projected to triple or more in 2024.

"TikTok Shop is a highly efficient platform where brands can establish a holistic brand-sales ecosystem on TikTok. It facilitates brand promotion, content-driven engagement, and sales conversions while building audience assets," said Wu Charlie, Overseas Brand Director of TYMO BEAUTY.

On the influencer front, encouraging changes are underway.

Overseas top influencers' live streaming experience and understanding are gradually catching up with domestic standards, narrowing the gap.

Many MCN agency heads report that influencers are no longer passively accepting merchant collaborations but actively participating in product content creation, supply chain management, and providing valuable suggestions. This two-way interaction significantly enhances the efficiency of US influencers in product recommendation and sales.

As of August, the overall number of content creators on TikTok Shop has grown more than tenfold year-on-year, becoming a crucial driver of content ecosystem prosperity. Concurrently, the number of active e-commerce influencers in the US has maintained a quarterly growth rate of over 70%, with influencers' willingness and ability to monetize accelerating.

Data indicates that influencers contribute nearly 80% to TikTok Shop's GMV in the US. Influencers with content production and sales capabilities are gradually demonstrating their commercial monetization potential and the value of TikTok Shop's content-driven e-commerce.

Behind the "explosive effect" lies TikTok Shop's subtle transformation of US consumption habits, shortening the path from "being influenced" to actual purchases. Local users' preference for TikTok Shop's content-driven shopping continues to strengthen, with daily paying users tripling.

According to an eMarketer report, as of February this year, 81.3% of TikTok Shop purchases were made by existing customers, proving that content-driven e-commerce fosters shopping loyalty rather than relying on impulse buying through stimulation.

The explosive growth of TikTok Shop in the US demonstrates that the ecosystem of users, influencers, and merchants is well-integrated – users enjoy sharing, merchants love selling, and influencers profit from product recommendations. The conversion funnel and new formula based on content-driven e-commerce have proven effective.

[Better Access, Smoother Explosion]

Localization is the best path for global product development. TikTok Shop understands this well and recognizes that significant "infrastructure" investments and local adaptation are necessary for better localization. Content-driven e-commerce is inherently a path requiring meticulous cultivation, with a vast content repository that's difficult to replicate and more likely to accelerate growth.

Beyond nurturing the ecosystem, TikTok Shop continuously iterates and optimizes, addressing unique "bottlenecks" and "blockages" in the US market. By focusing on content localization, it accelerates the growth flywheel – from daily user accumulation, content precipitation, merchant governance, logistics, and other "infrastructure" to tackling each promotional node during the year-end sales season, continuously improving the "content-engagement-consumption" ecosystem and enhancing the experience.

Matching the right influencers with suitable merchants is crucial for developing content-driven e-commerce, both domestically and internationally.

In the US, influencers value the e-commerce experience and empowerment of MCN agencies, an area where Chinese agencies excel, laying the foundation for a two-way engagement on TikTok Shop. TikTok Shop is also actively assisting Chinese agencies in going global, bringing advanced product recommendation methodologies and mechanisms to local influencers.

Simultaneously, TikTok Shop leverages operational and traffic strategies to promote more influencer live streaming. Amanda, a US influencer, shared her initial live streaming experience, where she initially struggled with platform tools and engagement but gradually mastered the "tricks" of live streaming with TikTok Shop's training support. Leveraging commission-free and free shipping policies, she doubled her sales within a few months.

Following the development path of content-driven e-commerce, early influencer product recommendations naturally transition to a balance of influencer recommendations and merchant live streaming. Therefore, TikTok Shop also emphasizes shaping the overall content environment, guiding merchants into content creation, account setup, and adapting to localized content and engagement strategies.

For instance, TikTok Shop aided the swimwear brand LovelyWholesale by deeply analyzing market data, precisely positioning trending products, and rapidly producing high-quality short video content. Utilizing the platform's influencer matrix, it increased commission rates for key products, igniting influencer enthusiasm and significantly boosting content engagement and sales conversions, exceeding 1,200 daily sales.

Meanwhile, logistics and other sales channels are also being improved. In preparation for the upcoming peak sales season, TikTok Shop's logistics system is continuously upgraded. TikTok Shop's overseas warehouses in the US now cover five major regions, offering three-day delivery services and optimal pricing and after-sales services to merchants.

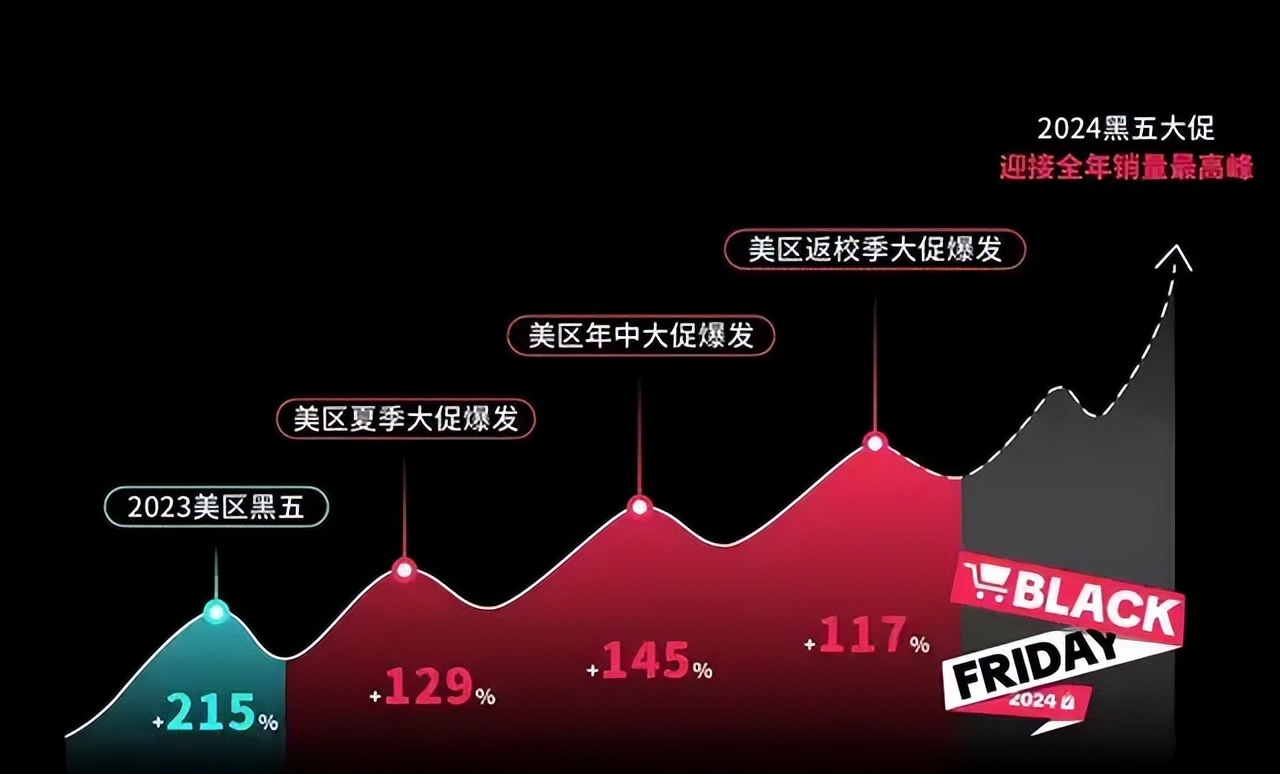

With the continuous improvement of the content ecosystem and sales channels, TikTok Shop is poised for even greater growth. Ahead of the upcoming "Black Friday," TikTok Shop has taken the lead in preparations, collaborating with local mainstream media and top celebrities for promotional campaigns, aiming for over 5 billion exposures during the event.

Based on content, TikTok Shop offers four key benefits through the Zeus Program, Super Brand Program, Mindset Category Program, and Explosive Product Incubation Program. These programs aim to help brands continuously incubate hit products and achieve sales explosions through quality influencer resources, increased traffic support, and other forms of assistance.

TikTok Shop is not only reshaping North American e-commerce but also influencing global shopping trends, becoming a pivotal force for global growth. The real dividend curtain has just opened, and now is undoubtedly the best time to enter the game.

——END——

Welcome to follow [HS Tactics]. Learn about the elites and read their tactics legends.

All rights reserved. No unauthorized reproduction is allowed

Some pictures come from the internet

If infringement is involved, please contact us to delete