High-end riders' niche business and hidden concerns behind Shansong's IPO

![]() 09/25 2024

09/25 2024

![]() 605

605

The ceiling of one-on-one dedicated delivery services has caused Shansong to lose a larger market; with an IPO looming, why is the path to independence becoming more difficult?

Following Dada's IPO in 2020 and SF Express City's IPO in 2021, the instant logistics industry welcomes its third pre-IPO enterprise.

Recently, Shansong initiated the PDIE (Pre-Deal Investor Education) program, which is seen as an important step before the IPO. If Shansong successfully goes public, it will mean that three enterprises in the instant logistics industry have gone public in nearly four years.

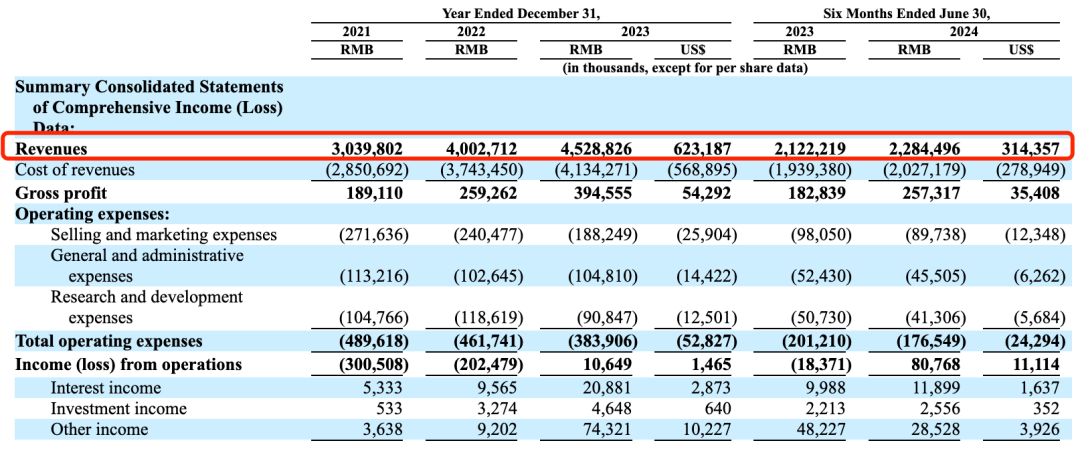

The prospectus shows that from 2021 to the first half of 2024, Shansong's revenue reached 3.04 billion yuan, 4.003 billion yuan, 4.529 billion yuan, and 2.284 billion yuan, respectively, with corresponding net profits of -291 million yuan, -180 million yuan, 110 million yuan, and 124 million yuan.

Since turning profitable in 2023, Shansong appears healthier compared to Dada and SF Express City, which both listed at a loss.

However, regarding this profitability, Shansong stated in its prospectus that it was mainly due to an increase in government subsidies, which led to other income increasing from 9.2 million yuan in 2022 to 743.2 million yuan, while operating profits related to operating conditions were only 11 million yuan.

Regarding the recent wave of IPOs by third-party instant logistics enterprises such as Dada and SF Express in the past two years, some investors believe that it is mainly due to the rise of the instant retail consumption trend in recent years, which has brought more same-city delivery scenarios and driven up the industry's order volume.

Although the successive IPOs of third-party instant logistics enterprises seem lively, compared to the e-commerce express market, where "Si Tong Yi Da" (four private express companies and SF Express) once accounted for over 70% of the market share, these third-party instant logistics enterprises currently only occupy about 30% of the market share.

This also means that local lifestyle platforms represented by Meituan are still the absolute leaders in instant logistics. In a one-superpower-multiple-strong-players landscape, going public is merely the beginning for these third-party instant logistics enterprises, and it is difficult to say that the era of "Si Tong Yi Da" in the instant logistics industry has arrived.

Business of 2.7 million high-end riders

Unlike the e-commerce industry, where the early development model clearly distinguished between business flow and logistics, the express logistics industry quickly emerged and formed the "Si Tong Yi Da" landscape.

For the instant logistics industry, finding opportunities in the cracks is the destiny of every same-city delivery player.

When Dada was established in 2014, it positioned itself as a crowdsourced delivery service for food delivery, providing the most abundant fulfillment capabilities for the food delivery wars in 2015 and accumulating early user resources. After the food delivery wars ended, Dada seized the opportunity with JD.com's home delivery service and has since become an important part of JD.com's ecosystem.

From food delivery to JD.com retail, Dada seized the opportunity to fill in the gaps for giants. As players in instant retail, Shansong grew by capitalizing on the one-on-one dedicated delivery market that early local lifestyle platforms like Meituan were too busy to attend to.

Shansong believes that compared to the common third-party food delivery crowdsourced delivery enterprises in the industry, its business is just one link in the food delivery platform process, and the right to speak always lies with the food delivery platform. Transportation capacity is mainly deployed within a three-kilometer radius of customers. Customers are highly sensitive to price, and once competitors in the industry initiate subsidy competitions, they can easily steal users, making it difficult to establish real corporate barriers. There are many same-city express companies that have gone bankrupt due to their food delivery business. Focusing on the one-on-one dedicated delivery model can meet the needs of brand merchants and users who pursue high-quality services, thereby building business barriers and user stickiness while maintaining price competitiveness.

Therefore, since its inception, Shansong has focused on one-on-one dedicated delivery services, which differs from the one-to-many model of food delivery platforms. The essence of this service model is to elevate user experience and service quality to the highest priority, enabling the platform to respond faster, pick up and deliver quicker, and provide a better service experience. To obtain this capability for one-on-one differentiated services, Shansong offers riders higher average income per order. According to Shansong's prospectus, revenue for the full year 2023 was 4.529 billion yuan, with rider compensation and incentive expenditures totaling 3.975 billion yuan, and the total number of orders for the year was 270.7 million.

Based on this, it can be roughly estimated that under the Shansong model, the average income per order for riders is approximately 14.68 yuan. In the food delivery model, according to data from Wang Xing's internal letter on Mid-Autumn Festival, 7.45 million riders received over 80 billion yuan in compensation, and Meituan's total number of instant delivery orders in 2023 reached 21.9 billion. Roughly estimating, the average income per order for Meituan riders is about 3.65 yuan. From 14.68 yuan in the Shansong model to 3.65 yuan in the food delivery model, the average income per order for riders differs by nearly four times. The willingness to pay more for riders stems from the fact that the essence of the Shansong model is a business of time, where those with high time costs pay for it. Being able to earn money from time is precisely Shansong's business moat: "speed." The prospectus shows that from 2021 to 2023, Shansong's order volume was 159 million, 213 million, and 271 million orders, respectively, with fulfillment times gradually decreasing to 35 minutes, 31 minutes, and 29 minutes per order.

However, to achieve faster delivery, Shansong has also incurred higher labor costs. As of this year, Shansong's platform has registered 2.7 million riders. From 2021 to 2023, Shansong's compensation and incentives paid to riders accounted for 90.5%, 90.3%, and 87.8% of revenue for the corresponding periods, respectively. For comparison, Meituan pays its riders approximately 70% of its food delivery revenue, which is nearly 20 percentage points lower than Shansong. However, despite the higher average income per order, it is not easy for riders to earn money with Shansong, especially since compared to the high-frequency business scenario of food delivery where multiple orders are delivered at once, the volume of one-on-one dedicated deliveries is much lower. Data shows that in the first half of this year, Shansong completed 138 million orders, with each active rider completing 9.3 orders per day. Meituan riders' daily order volume is mainly distributed between 20 and 40 orders, far exceeding the order volume in the Shansong model.

For Shansong's 2.7 million registered riders, this business of high-end riders clearly has more supply than demand. Meanwhile, as the market matures, the niche comfort zone of one-on-one dedicated delivery is also facing increasing competitive pressure.

02 The ceiling trouble of niche businesses

In its prospectus, to highlight its market position, Shansong has identified a niche comfort zone for itself.

From a business positioning perspective, Shansong has carved out a separate "on-demand dedicated express service market" within the instant logistics market. Shansong ranks first in this market with a 33.9% market share, followed by UU Paotui, which also focuses on dedicated delivery services, with a 5.4% share.

The reason for this distinction lies in Shansong's adoption of dedicated one-on-one delivery without order pooling, and its primary customer base in the C-end market. As a result, Shansong has positioned itself as the SF Express of the instant logistics industry, offering higher per-order prices and faster delivery times.

However, the ceiling of one-on-one dedicated delivery services has caused Shansong to miss out on a larger market. According to a report by Citibank, food delivery accounts for 60% of the instant logistics market, while local retail and e-commerce, as well as local lifestyle services, account for only 25% and 15%, respectively. In these areas, there are even fewer consumption scenarios that require one-on-one dedicated delivery services.

In terms of market coverage, as of the first half of this year, Shansong, which focuses on serving high-value customers willing to pay for time, currently covers more than 290 cities, primarily in first- and second-tier cities. In contrast, SF Express City and Dada cover nearly 2,000 major cities each.

Not only has Shansong missed out on the largest segment of the instant logistics market, but it also faces challenges in its niche segment.

On the one hand, in terms of average order value, Shansong's average revenue per order fell below 17 yuan in 2023 and further decreased to 16.5 yuan in the first half of 2024. In contrast, in 2021, the average order value was as high as 19.2 yuan.

The decrease in average order value is attributed to the emergence of similar competitors in the market and the increasing price sensitivity of customers.

Benefiting from the diversification of market demand, the demand for instant delivery services has gradually expanded from urgent documents and small items to daily commodity delivery. Consequently, many similar services have emerged in the market, such as Dada, SF Express City, and UU Paotui.

This means that even when paying for time, customers can choose more cost-effective dedicated services tailored to different scenarios, categories, and needs. For example, in many cases, when delivering flowers, food, fresh produce, or other items, customers may not require such urgent one-on-one delivery services and may opt for more cost-effective options instead of solely pursuing speed.

On the other hand, regarding delivery quality, while Shansong focuses on one-on-one dedicated delivery, it still relies on crowdsourced riders for fulfillment. Therefore, it does not have a significant competitive advantage over other similar enterprises in terms of service quality and brand strength.

03 Instant logistics players struggling for independence

At the end of 2021, during the media communication conference marking SF Express City's IPO, its CEO Sun Haijin discussed the development potential of the instant logistics industry, stating, "Research institutions indicate that by 2025, the daily order volume in the instant logistics industry will catch up with today's daily volume of e-commerce express packages."

Based on the development logic of the express delivery industry, Sun believes that China's express delivery industry is enormous and has given rise to some very large companies. Therefore, he has absolute confidence in the instant logistics industry as well.

However, this confidence did not bring good fortune to SF Express City. On its first day of listing, SF Express City's share price fell below its IPO price, with a drop of nearly 10% at one point.

Two years after its IPO, SF Express City has recently been included in the Stock Connect program, and its first-half financial report for August showed a net profit of 62.17 million yuan, an increase of 105% year-on-year. This has led to a surge in the company's total market value to over 10 billion yuan. Nevertheless, this is still some way off from its initial market value of 13 billion yuan at the time of its IPO.

It is evident that even within the logistics sector, different industry characteristics mean that the development logic of "big industries fostering big companies" does not apply to the instant logistics industry.

Compared to the express delivery industry, the instant logistics industry has weaker economies of scale, and an increase in scale does not necessarily lead to a reduction in rigid labor costs.

Taking Meituan riders as an example, according to research by Chen Zhaolin, an analyst at Southwest Securities, when Meituan's daily order volume was 3 million in 2020, the cost per order was 2 yuan. However, as the daily order volume increased to 30 million, the cost per order also rose to nearly 7 yuan, failing to decrease despite the increase in scale.

Without the ability to achieve economies of scale and diminish marginal costs, mainstream instant logistics players often rely on platform ecosystems.

For instance, Didi Chuxing launched its Didi Express delivery service, Gaode Maps introduced its "Gaode Instant Delivery" service in cities like Beijing, Wuhan, Hangzhou, and Changsha, and Hello Bike announced the official launch of its delivery and errand service earlier this year—all of which are supplementary local services based on well-established platform ecosystems.

Even for instant logistics players that have successfully gone public, it is difficult to claim full independence to a certain extent. Dada Group is backed by leading investment institutions and retail giants such as JD.com, Sequoia China, Walmart, and DST, which have continuously increased their holdings in the company over the past six months, making it a key player in JD.com's home delivery service.

Based on its cooperation with SF Express's e-commerce logistics, SF Express City has successively become the hourly delivery service provider for platforms like Douyin and Kuaishou. In the platform competition, Shansong, which has yet to form strategic partnerships, will face the same challenge as SF Express City even after its IPO: how to acquire more instant logistics business flow?

Moreover, it is intriguing to note that even the so-called "Si Tong Yi Da" landscape in the express delivery industry has been reshaped in recent years by logistics enterprises such as Cainiao and J&T Express, which are backed by e-commerce platforms.

It is clear that as two critical links in commodity circulation, the front-end business flow is increasingly dominating the back-end logistics. Under this industry trend, even after going public, these so-called third-party instant logistics enterprises can hardly claim full independence.