Li Jinfei takes over Meituan's hotel and travel business, and the 'Super Member' is about to shake up the travel industry

![]() 09/29 2024

09/29 2024

![]() 554

554

Meituan is still filling gaps in its 'Super Member' system.

The 'Super Member' program, which was previously only available for hotel bookings, is likely to soon expand into attractions, train and plane tickets, homestays, car rentals, travel packages, and other major travel segments.

On September 27, Meituan's core local business division issued an internal email announcing a new round of organizational restructuring.

The 'Core Local Business/Hotel & Travel' division was established, encompassing the Accommodation Business Unit, Ticketing & Vacation Business Unit, and Homestay Business Unit, with Li Jinfei appointed as head of Hotel & Travel.

The 'Core Local Business/Healthcare Business Unit' was also established, encompassing the former Medical Business Unit and related industries from the former Comprehensive Business Unit, with Li Xiaohui appointed as head of the Healthcare Business Unit.

Both new managers report to Wang Puzhong, CEO of Meituan's 'Core Local Business' division.

According to incomplete statistics, this is the sixth organizational restructuring at Meituan this year. Despite the frequency of changes, the logic behind each adjustment is straightforward: streamline the overall structure to better serve Meituan's 'Super Member' system.

Meituan's 'Super Member' program originated from its food delivery membership system. Since March 2024, Meituan has established a new S-level project team to extend the value of Super Members beyond food delivery and into on-site services, integrating the membership systems for both. In May, the new Super Member system began internal testing with select merchants and users.

On July 4, the revamped 'Super Member' system was officially launched, covering various categories such as food delivery, group dining, hotel accommodations, leisure activities, beauty and wellness, and family health.

It is evident that the incubation and evolution of the new 'Super Member' system have been closely intertwined with Meituan's internal adjustments this year.

From the user perspective, the most significant change to the 'Super Member' program is the transformation of Meituan's original 'Member Red Packet' into the 'Super Member Savings Wallet.' Users can purchase the right to use N number of no-threshold coupons for the next 31 days simply by spending money.

Before the upgrade, the Super Member Savings Wallet was only available for food delivery. After the upgrade, it became accessible across multiple Meituan platforms. In addition to food delivery coupons, users can now enjoy coupons for various entertainment and dining experiences.

Before the upgrade, the maximum expansion amount for the Super Member Savings Wallet was 20 yuan. After the upgrade, while the maximum expansion for food delivery coupons remained at 20 yuan, merchants could set their own upper limits for other categories, with a maximum of 100 yuan.

The 'Super Member' program employs a membership + subsidy model, creating a psychological incentive for users. The more coupons they use, the more Meituan 'loses,' but also the more they save for themselves.

From an operational and product perspective, the 'Super Member' program simultaneously achieves user acquisition, activation, and retention, ultimately driving increased usage frequency. As users engage more frequently, they are more likely to try additional services, boosting the overall efficiency of the system.

Under this strategic layout, Meituan aims for synergies. Originally limited to its hotel business, the 'Super Member' program is now under the leadership of Li Jinfei, who oversees the entire travel segment, previously divided among three separate business units. Clearly, 'Super Members' are not content with just hotels; they aspire to strengthen cooperation with upstream and downstream industries to better meet consumers' diverse needs across lodging, transportation, and travel.

The same logic applies to the Healthcare Business Unit. By leveraging the synergies between on-site and at-home services, the unit aims to complement additional consumer healthcare scenarios. Notably, both Li Xiaohui and Li Jinfei have backgrounds in product management.

A friend in the hotel industry shared that the incremental value of 'Super Member' orders is quite evident. 'Super Members' represent Meituan's core high-spending users, who tend to place orders frequently and demonstrate high loyalty. For users accustomed to consuming across multiple Meituan categories, incorporating additional categories into the membership program significantly enhances its value.

Several travel industry insiders note that Meituan's 'Super Member' program effectively leverages its user base and conversion capabilities across food, clothing, shelter, and transportation. Currently, Ctrip is facing significant challenges, and it is anticipated that over the next three to five years, Meituan's user base will evolve, attracting more high-net-worth individuals and steadily eroding Ctrip's market share.

In fact, Wang Xing set the tone for Meituan's organizational adjustments during the second-quarter earnings call. He emphasized the importance of achieving synergies across various business segments, such as identifying consumer needs across different categories and integrating them to facilitate cross-selling.

One of Meituan's most crucial organizational adjustments this year occurred in mid-to-late April, when it abolished the concepts of On-Site Business Group and At-Home Business Group, consolidating them under the new 'Core Local Business' division led by Wang Puzhong.

The rationale behind Meituan's creation of the 'Core Local Business' division is straightforward.

The local services market is fiercely competitive.

Due to Meituan's well-established delivery network built over the past decade, new players find it challenging to compete directly in the 'At-Home Business' segment. Consequently, competitors are targeting the 'On-Site Business' segment as a breakthrough.

In particular, the highly effective conversion rates achieved through the content-driven, low-price strategy have shown the potential to bypass user reviews and acquire customers directly.

TikTok, for instance, has been allocating more resources to its on-site dining and entertainment businesses since late last year.

Xiaohongshu (Little Red Book) began testing group-buying features last year, initially recruiting a group of on-site dining merchants and service providers.

Kuaishou, on the other hand, launched a billion-yuan platform subsidy program and poured traffic into group-buying consumption in third-tier and lower-tier cities.

In March of this year, TikTok also underwent an internal restructuring of its local services division. The previous parallel departments for on-site dining, on-site comprehensive services, and travel were reorganized into three regional divisions (North, Central, and South) and an NKA department serving national chain merchants, based on geographical locations.

At the time, the travel industry interpreted this as TikTok abandoning the OTA model. In reality, TikTok's adjustment resembled the Amoeba business model, where the company is divided into small collectives, each with its own regional responsibilities, interconnected resources, and independent accounting.

The most time-consuming aspect of sales work is travel time. By dividing regions, sales staff can increase their visit efficiency. Whether discussing a foot massage package or a steak dinner, the sales process remains largely similar. Differences across sub-industries can be quickly resolved through brief exchanges among sales staff.

It is evident that TikTok is no longer focused on individual gains and losses but rather on the bigger picture, preparing for a long-term battle.

Meituan recognizes this trend as well.

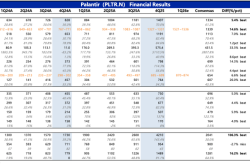

According to Meituan's second-quarter financial report, revenue reached 82.3 billion yuan, a year-on-year increase of 21%. Operating profit was 11.26 billion yuan, up 138.8% year-on-year. Adjusted EBITDA was 15 billion yuan, a 95.2% increase from the previous year. Specifically, the 'Core Local Business' division generated 60.68 billion yuan in revenue, up 18.5% year-on-year, with operating profit increasing by 36.8% to 15.2 billion yuan.

In fact, many competitors' 'surprise attacks' on Meituan have ended, and Meituan must now devise strategies for the long haul.

Currently, Wang Xing's top priorities are for Wang Puzhong's 'Core Local Business' division to become more profitable and for Guo Wanhuai's new business segment to reduce losses.

Wang Puzhong faces the challenge of not only defending his turf but also overcoming competitors' content-driven, low-price strategy. His solution is the 'Super Member' program.

Prior to launching the 'Super Member' program, Wang Puzhong consulted with multiple firms, studying precedents such as Taobao's 88VIP, JD.com's PLUS membership, and Costco's membership model. He ultimately decided to pilot the 'Super Member' program within the at-home segment, targeting high-net-worth users.

The 'Super Member' program serves as a 'highway' for traffic, directing users to the on-site segment. By integrating on-site and at-home services and offering new traffic sources and engagement strategies, the program aims to increase merchants' transaction orders, paid GTV, conversion rates, and new customer acquisition.

The suitability of integrating on-site and at-home services has long been recognized within the industry. Group-buying and food delivery services inherently overlap in terms of supply, fulfilling similar consumer needs through different fulfillment methods. However, the industry has struggled to find an effective bridge between these segments.

On-site services present a unique challenge as an 'open-loop' business. The requirement for on-site verification often leads to order splitting by merchants. This is particularly prevalent in the hotel accommodation sector, where higher commissions incentivize merchants to split orders. To some extent, the 'Super Member' program addresses this pain point.

On a broader level, Meituan's organizational adjustments in terms of talent appointments are well-aligned with industry development trends and highly targeted.

The local services market has entered its second half.

Meituan no longer lacks coverage of physical stores; instead, it focuses on optimizing products based on existing resources to deliver a more compelling business narrative.

For instance, in the travel segment, Guo Qing, who led Meituan's travel business during the first half, was more sales-oriented. As the market enters its second half, Li Jinfei, with a stronger product management background, has taken over.

Similarly, Wang Puzhong, CEO of the 'Core Local Business' division, has a product management background and a distinguished track record at Meituan.

He was the first employee of Baidu Waimai and later joined Meituan as the Senior Product Director for Food Delivery Logistics. Currently, he is the youngest member of Meituan's core decision-making team, the S-team. He led Meituan to emerge victorious in its competition with Ele.me and Baidu Waimai and later solidified Meituan's position in the instant retail market with its Flash Delivery service.

Last year, Meituan Flash Delivery's GTV approached 150 billion yuan, nearly triple that of JD.com's home delivery service.

An interesting anecdote is that to compete with Meituan, JD.com recruited former Meituan Vice President and Travel Business Leader Guo Qing to head Dada Nexus. Guo Qing reportedly instructed Dada Nexus to fully benchmark Meituan Flash Delivery in terms of organizational structure.

Moreover, as the local services market enters its second half, Meituan finds itself in an era of oversupply, with an abundance of available stores. Consumers now demand a curated supply chain, akin to what Amazon, Costco, and Sam's Club offer in the supermarket industry. Many industry investors and internal executives at Meituan share the consensus that there is an urgent need for a comprehensive membership system that can connect Meituan's various business segments.

However, the service attributes of various industries within the local services market vary widely, and many cannot reuse the same backend systems. Different businesses such as cinemas, foot massage parlors, food delivery, hotels, group dining, grocery retail, and wholesale all require unique systems. Furthermore, these businesses are at different stages of development, with varying development goals, performance metrics, and profit models, making it challenging to implement a comprehensive cross-business membership system.

As a result, it is inevitable that more 'silos' will be removed, the organizational structure will be flattened, and integration and data sharing across categories will be prioritized.

In this context, Wang Puzhong's 'Super Member' program and 'Core Local Business' division bear significant responsibilities. Could Xiaoxiang Supermarket, Meituan Select, and Meituan Bike eventually be incorporated into the 'Super Member' program? As the program diversifies, could it evolve into a comprehensive discount system for dining, entertainment, and other experiences, similar to American Express, VISA, or Mastercard?

This is something that Ctrip's James Liang once attempted but failed to achieve.

In this light, Meituan's travel business is but one service segment within the broader 'Super Member' ecosystem. Whether it operates as one of three key drivers or stands alone depends on how effectively it contributes to the efficiency of 'Super Members.'