Big fund investment, SMIC, Yangtze Memory supplier, what is the quality of Xingfu Electronics?

![]() 09/30 2024

09/30 2024

![]() 618

618

Image: Hubei Xingfu Electronic Materials Co., Ltd. factory, source: company website

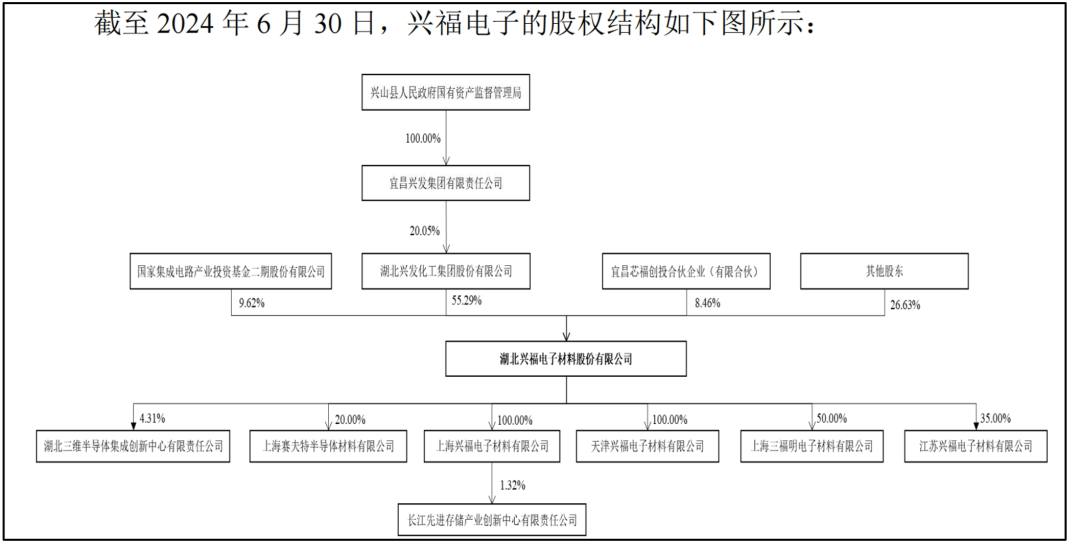

"A-split-A" refers to the act of a company already listed on the A-share market spinning off its holding company for independent listing. After the introduction of the new "National Nine Policies," the regulation of spin-offs has become stricter, with more than 20 "A-split-A" processes terminated within the year. On September 27, 2024, the Shanghai Stock Exchange Listing Review Committee approved the listing application of Hubei Xingfu Electronic Materials Co., Ltd. (hereinafter referred to as "Xingfu Electronics"). According to the prospectus, Xingfu Electronics is a holding subsidiary of the Shanghai Stock Exchange main board listed company Xingfa Group (SH:600141), holding 55.29% of the shares before the issuance. Given the stringent regulatory environment, what is the quality of Xingfu Electronics, which has successfully passed the review?

01

Small Giant in Wet Electronic Chemicals

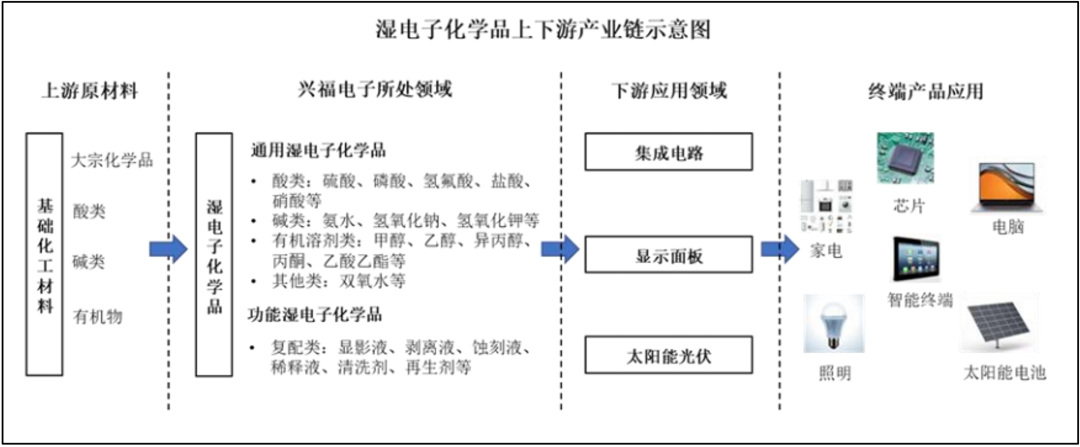

Wet electronic chemicals, also known as ultra-pure electronic chemicals, are a branch of electronic chemicals and are the various liquid chemical materials used in the wet process of microelectronics and optoelectronics. They are critical basic chemical materials in the electronic information industry. The upstream is the basic chemical industry, using bulk chemical commodities as raw materials, while the downstream is the electronic information industry, with major applications in integrated circuits, display panels, and solar photovoltaics.

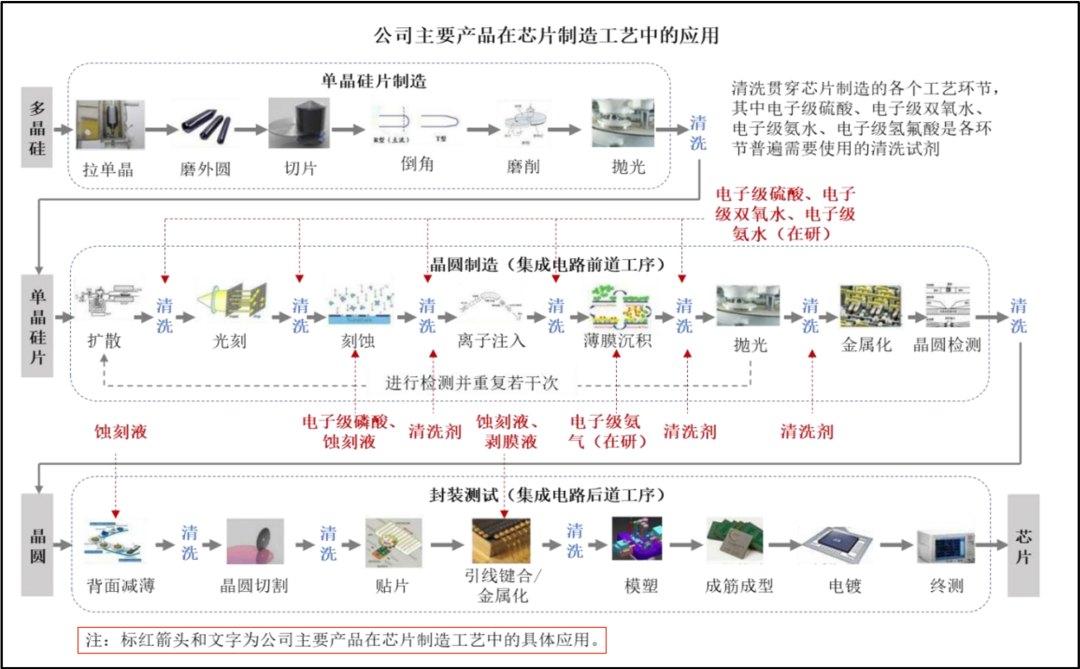

"General-purpose Wet Electronic Chemicals": These are liquid chemical materials used in the wet process of microelectronics and optoelectronics. They can be divided into acids, bases, and organic solvents based on their properties. "Functional Wet Electronic Chemicals": These are formulated or compounded chemicals that meet the special process requirements in manufacturing. They are made by mixing high-purity electronic chemicals (or combinations of multiple electronic chemicals) with organic solvents, chelating agents, surfactants, and other additives. Xingfu Electronics was established in 2008 and has been primarily engaged in the research, development, production, and sales of wet electronic chemicals since its inception. Its main products include: · General-purpose Wet Electronic Chemicals: These are the company's primary source of revenue, accounting for 74.24% of revenue in the first half of 2024. Products include electronic-grade phosphoric acid, electronic-grade sulfuric acid, and electronic-grade hydrogen peroxide, primarily used in etching and cleaning processes for 8-inch and 12-inch wafer manufacturing. Downstream customers include domestic manufacturers such as SMIC, Yangtze Memory, Huahong Group, and CXMT, as well as internationally renowned integrated circuit companies such as TSMC, SK Hynix, Globalfoundries, and UMC. · Functional Wet Electronic Chemicals: These are an expansionary source of revenue, accounting for 13.79% of revenue in the first half of 2024. Products include 60 different formulations such as silicon etchants, metal etchants, cleaning agents, developers, stripping solutions, and regenerants, primarily used in wafer manufacturing and packaging for integrated circuits, as well as cleaning and etching processes for TFT-LCD display panel manufacturing. Downstream customers include domestic and international companies such as SMIC, Yangtze Memory, BYD Semiconductor, Tianhong Technology, Shenzhen China Star Optoelectronics, and IRICO Group in the integrated circuit and display panel industries.

From an industry competition perspective, European, American, Japanese, and Korean companies rely on their first-mover advantage, offering a diverse range of products and relatively advanced technology. Domestic companies account for only about 9% of the global market share in wet electronic chemicals for integrated circuits. Xingfu Electronics is one of the leading domestic producers of wet electronic chemicals for integrated circuits, enjoying a significant market share and brand influence within the industry. According to the prospectus, from 2021 to 2023, Xingfu Electronics' domestic market share for electronic-grade phosphoric acid used in wafer manufacturing was 39.25%, 55.79%, and 69.69%, respectively, ranking first in China's semiconductor industry for three consecutive years. In terms of SEMI G5-grade electronic-grade sulfuric acid, Xingfu Electronics' market share was 9.97%, 18.25%, and 31.22%, respectively, placing it in the first tier domestically.

02

Cyclical Perspective: Increasing Volume and Decreasing Prices in Core Business

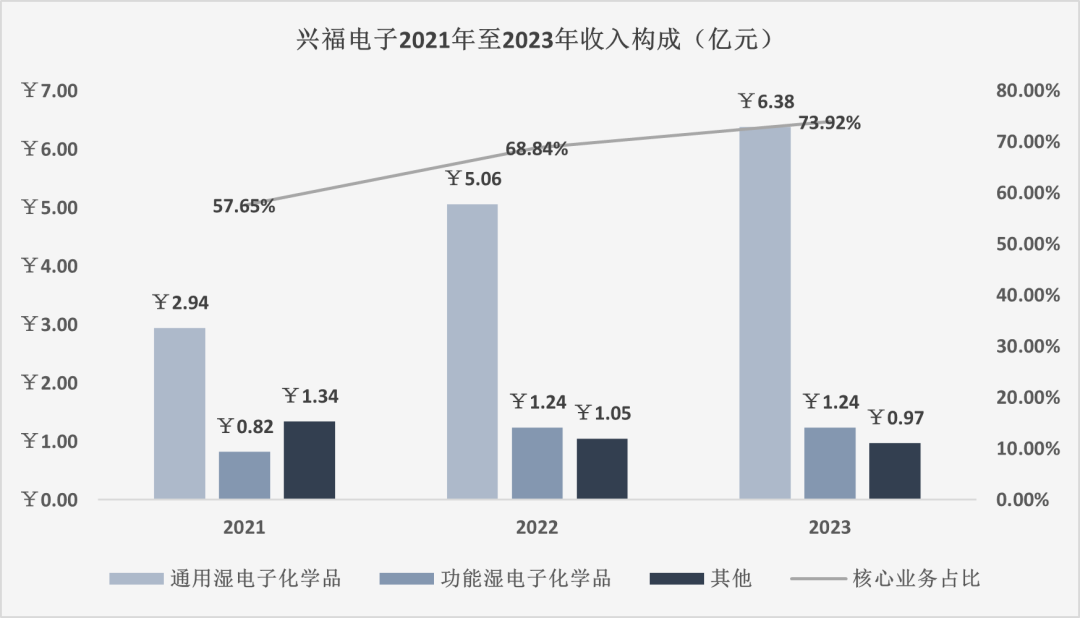

According to the prospectus, Xingfu Electronics' revenue increased from 510 million yuan in 2021 to 859 million yuan in 2023, with a compound annual growth rate of 29.78%. The core business, "General-purpose Wet Electronic Chemicals," saw revenue grow from 294 million yuan to 635 million yuan over the same period, with a compound annual growth rate of 46.96%, and its share of total revenue increased from 57.65% to 73.92%. However, an in-depth analysis reveals that Xingfu Electronics experienced a cyclical fluctuation during the IPO reporting period, with changes in the growth logic of its core business, which is also the root cause of the significant year-on-year decline of 28.77% in net profit to 104 million yuan in 2023.

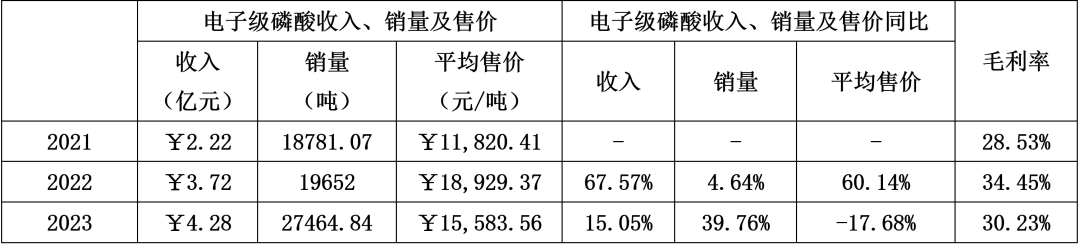

Taking electronic-grade phosphoric acid as an example (this business accounted for 49.82% of revenue in the first half of 2024): from 2021 to 2023: (1) Revenue was 222 million yuan, 372 million yuan, and 428 million yuan, respectively; (2) Sales volume was 18,700 tons, 19,600 tons, and 27,500 tons, respectively; (3) Average selling price was 11,800 yuan/ton, 18,900 yuan/ton, and 15,600 yuan/ton, respectively. In other words, the revenue growth in 2022 was primarily driven by a substantial increase in average selling price, mainly due to a sharp rise in upstream raw material prices and strong downstream demand, resulting in a higher price increase than cost increase (gross margin increase). In contrast, the growth driver for 2023 revenue was the significant increase in sales volume, while the slowdown in growth was due to the weakening of average selling prices following raw material prices and the drag of low-end capacity in the initial stages of new production line commissioning (gross margin decline). Electronic-grade sulfuric acid, on the other hand, relied on increased sales volume to drive performance growth from 2021 onwards, with average selling prices continuing to decline.

Moreover, the functional wet electronic chemicals, an extension of the core business, stagnated, with 2023 revenue remaining flat at approximately 124 million yuan compared to 2022, and overall capacity utilization was severely insufficient.

03 State-owned Capital Control, Big Fund Investment, "Reduced Volume" for Listing Review

According to the prospectus, Xingfa Group is the controlling shareholder of Xingfu Electronics, holding 55.29% of the company's shares before issuance. Xingfa Group, in turn, is wholly owned by Yichang Xingfa Holdings, which is held by the State-owned Supervision and Administration Bureau of Xingshan County People's Government (holding 20.05%). Tracing back, the actual controller of Xingfu Electronics is local state-owned capital. Additionally, among the strategic investors introduced in December 2021, the National Integrated Circuit Industry Investment Fund (Phase II) invested 50 million yuan to hold a 9.62% stake in Xingfu Electronics.

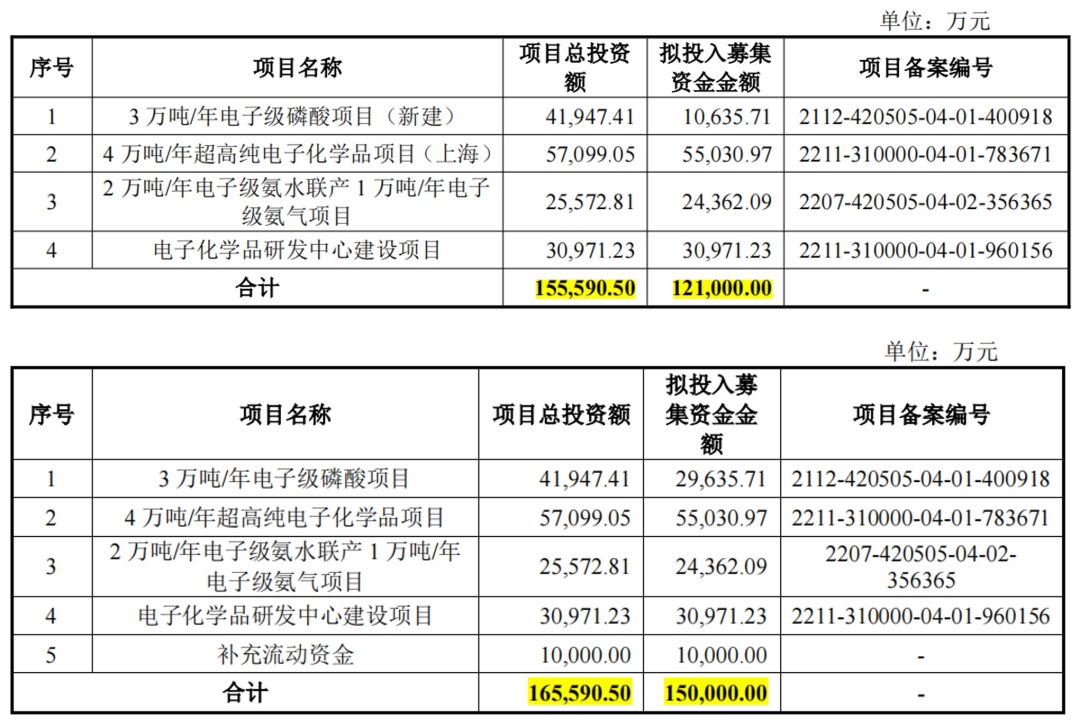

Since its application for listing on the STAR Market was accepted on May 9, 2023, Xingfu Electronics' IPO has been on hold for over a year. However, as circumstances have changed and under the stringent regulatory environment for spin-offs, Xingfu Electronics chose to "reduce volume" to improve its chances of passing the listing review: the proposed fundraising amount in the listing review draft was 1.21 billion yuan, 290 million yuan less than the application draft, with a 100 million yuan reduction in the capital replenishment requirement.

From the perspective of domestic substitution, the overall substitution rate of wet electronic chemicals for integrated circuits in China has increased from 35% in 2021 to 44% in 2023. Xingfu Electronics' significant increase in production capacity will indeed help address the "choking point" issue in China's semiconductor industry. However, in terms of both the company itself and the industry, significantly increasing production capacity in an environment of gradually weakening prices requires not only attention to downstream demand and digestion but also close monitoring of terminal price performance after capacity is released.