Consumption declines and creativity dries up, no one is 'addicted' to games anymore

![]() 10/07 2024

10/07 2024

![]() 429

429

After the brief frenzy caused by "Black Myth" in the gaming industry, a series of problems in this sector have not been resolved.

Recently, a survey revealed that the total gaming consumption time of internet users decreased by 2.2% in the second quarter of 2024. Notably, even the flagship products of leading game developers suffered, with Tencent's "Honor of Kings" and "Game for Peace" experiencing a 9% and 21% decrease in total gaming hours, respectively.

NetEase also reported a 14% year-on-year decline in total gaming hours, with the popular game "Party Animals" experiencing a stunning 56% drop despite being released during the summer vacation period. Despite the emergence of "Black Myth," the gaming market has seen an overall decline from its heyday.

In the first half of this year, the number of domestic game users reached 674 million, with a year-on-year growth rate of just 0.88%. Across various survey reports, gaming users' willingness to pay, login frequency, and average session duration have all declined. It seems that fewer people are "addicted" to games, which the industry has long desired as a "healthy" outcome, but the current state of the industry is a mixed bag.

Games are becoming increasingly boring

Gaming consumption once held a significant share in internet entertainment, but today, fewer people are spending entire nights glued to their screens, shelling out vast sums for virtual rewards. Why are fewer people obsessed with games? Various explanations have been offered, including the impact of alternative entertainment content and declining consumer desire.

Moreover, a crucial factor is that the global gaming market is gradually losing its innovative spark.

"Games have become boring" is a common refrain among gamers who have abandoned the gaming world. Take "Honor of Kings" as an example. According to a report by Aurora Mobile, over 40% of the game's lost users were long-term players who had been active for over a year. The reason? They simply grew tired of the game.

The novelty and challenge of playing the same game for an extended period diminish significantly. Yet, when players seek alternatives, they often struggle to find new games that captivate them in the short term. As innovation wanes, homogenization becomes the norm in the gaming industry. "Party Animals," once a hit among schoolchildren, has lost its luster due to an influx of similar games.

After "Party Animals" popularized party-style games, many game developers followed suit. Tencent released "Yuanmeng Zhixing," while Leiting Games launched "Funny Fighter," XD.com introduced "Party Stars," Giant Network Group offered "Among Us," Yostar Games unveiled "PomPom Party," and Lilith Games debuted "Life Party," among others.

Indeed, the gaming industry has struggled to shake off its tendency to copy and mimic. As market growth obstacles mount, the consequences of this imitation become increasingly apparent. For instance, in 2024, "Black Myth" emerged as a beacon of hope for the global gaming market, reigniting interest in games with Chinese cultural themes.

Statistics show that the number of games incorporating traditional Chinese cultural elements has nearly tripled in the past five years. Games infused with poetry, ink painting aesthetics, and martial arts have become proven content formulas for game developers.

Currently, several games in pre-release stages, such as "Yi Wen Lu: Lun Hui," "Shadow Blade Zero," and "Yan Yun Shi Liu Sheng," are all embracing traditional cultural themes. However, many game developers merely slap on popular cultural elements without offering substantial innovation, relying on marketing gimmicks or nostalgia to lure players. Once players realize this, they lose interest, leading to countless failed products.

In 2024, only "Black Myth" emerged as a cultural icon. Other games fared less well; "Gu Long Feng Yun Lu" garnered just a 56% positive rating on Steam, "Next Station: Jianghu II" received muted feedback due to its unfinished state, and "Zhao Yun Zhuan: Yun Han Teng Long" failed to capitalize on its Three Kingdoms IP.

Over the past few decades, China has produced numerous games that stand out for their cultural elements. Early efforts demonstrated a certain level of content creation prowess, such as the martial arts mechanics in "Xia Ke Xing" (2015) and the ink painting-inspired swordplay in "Shuo Jian" (2016).

"Chu Liu Xiang" (2018) featured an open world with millions of dynamically generated storylines, while "Taiwu Hui Juan" (2018) offered high levels of freedom through character customization and randomly generated maps. "Yong Jie Wu Jian" (2021) drew upon Chinese martial arts and employed motion capture technology from real martial arts masters.

In other words, the gaming industry once pursued content-driven excellence. However, as the sector faced increasing pressure to survive, the business model of content-driven high traffic was severely challenged. Many game developers lost patience with production costs and timelines, instead focusing on buying traffic.

This year, gaming companies have generally increased their marketing budgets, even for casual games. In the first half of 2024, ten casual games reportedly spent tens of millions on promotion, with five exceeding the billion-yuan mark. Yet, aggressive buying of traffic has failed to reverse the gaming industry's sluggishness.

The overnight success of "Black Myth" reaffirmed the power of game content to engage users. Unfortunately, the gaming industry has long since lost its focus on content, opting instead for imitation and follow-the-leader strategies.

The gaming market is no longer profitable

The past two years have been tumultuous for the gaming industry. In the first half of this year, 89 listed Chinese game developers reported revenue declines, with over 60% experiencing falling incomes. This outcome was anticipated as addictive game mechanisms gradually disappeared, leading to a growing number of "rational" gamers.

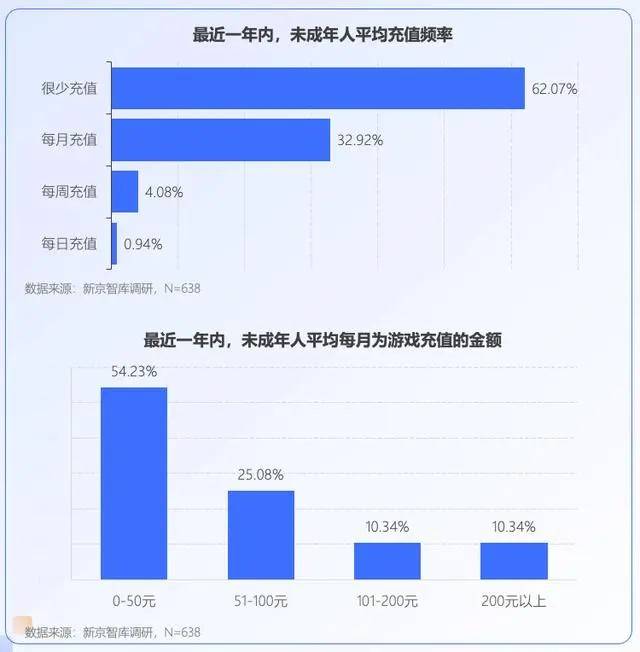

Gaming consumption has waned across demographics, from heavy-spending minors to middle-aged male gamers and even female players once viewed as the industry's hope. According to Sensor Tower, in-app purchases in the mobile gaming market declined by 2% in 2023.

Faced with a looming downturn, game developers are taking action.

Firstly, many game companies are cutting costs and improving efficiency, a common strategy in response to revenue slumps. However, in the marketing-driven environment, research and development (R&D) budgets are often the first to be cut. Data shows that over 60% of game developers reduced their R&D budgets in 2024, including established players like 37 Interactive and Perfect World.

Reducing R&D budgets to ease revenue pressure is akin to drinking poison to quench thirst.

Take Perfect World as an example. In the first half of 2024, its R&D expenses fell short of 1 billion yuan, with a quarter-on-quarter decrease of 5.82 percentage points in R&D expense ratio. This misguided "self-rescue" strategy led to a 38.12% year-on-year decline in operating revenue, totaling 2.76 billion yuan in the first half of 2024.

Of course, the dwindling enthusiasm of gamers is another significant factor contributing to the industry's struggles. In response, some game developers have resorted to price wars, mirroring broader consumer market trends. In September, "Genshin Impact" initiated its first price cut in four years, followed by "Three Kingdoms: Strategy Edition," "Ni Shui Han," and "Ming Chao," which also embraced value-for-money strategies.

Even casual games have offered steep discounts, with some advertising "10% off" deals to attract players. However, the effectiveness of price wars remains uncertain, especially as global gaming prices appear to be on the rise rather than falling.

According to incomplete statistics, the prices of equipment and accessories in "Octopath Traveler: Champions of the Continent" increased by 20% last year, with the most expensive set rising from 99.99 euros to 119.99 euros. Similarly, in-app purchases in "League of Legends: Wild Rift" and "Mario Kart Tour" also rose, as did prices for console games like "Princess Peach's Superstar Saga," "Luigi's Mansion 2," and "Donkey Kong Country Returns HD."

Undeniably, pricing differences in the global gaming market stem from various factors, including business models, industry environments, and player spending habits. "Black Myth's" global popularity has showcased the spending power of overseas gamers, prompting Chinese game developers to explore overseas markets, particularly lucrative ones. For instance, the Middle East, known for its heavy gamer spending with an average customer value of $270, has seen a 17% average semi-annual growth rate in mobile game buyouts.

However, overseas competition is just as fierce as domestic. In the first half of this year, 30 of the 80 gaming companies that disclosed overseas revenues reported a total of 47.091 billion yuan, with 46% experiencing negative growth. Clearly, merely shifting environments is not a sustainable strategy for game developers.

What the gaming industry truly needs is to enhance its core competitiveness.

It's worth noting that the decline in the gaming industry's profitability reflects a broader trend of shrinking commercial value in internet entertainment. As gamers become more frugal, game developers must explore alternative monetization strategies. Increasingly, game creators are tapping into new revenue streams for their products.

Ad-based monetization is a prime example.

Public data shows that ad revenue as a percentage of total mobile casual game revenue in China increased from 26% in 2022 to 37% last year. Globally, struggling game developers are boosting their ad revenues, with titles like "Last Day on Earth: Survival," "Blocky Roads," and "My Perfect Hotel" adopting ad-based monetization models.

However, as always, successful monetization hinges on the quality of the product itself. While 2024 blessed the gaming industry with "Black Myth," the next big thing remains to be seen.

How far are we from "sustainable revenue"?

Admittedly, leading global game developers have maintained their industry positions for decades, largely thanks to the enduring appeal of their flagship games. Nonetheless, in recent years, even classic titles have lost some of their luster, as evidenced by "Honor of Kings," "Game for Peace," and "Party Animals."

Since 2024, several beloved games have announced their closure.

In September, "ArcheAge," hailed as "the world's first third-generation MMORPG," officially shut down after over a decade online. Similarly, the seven-year-old mobile version of "Chinese Paladin 5" ceased operations in August. "Food Fantasy," which debuted in 2019 and featured top-tier voice actors, also concluded its run this year. "Pokémon Quest" announced its termination in February 2025, and data shows that over 30 games ceased operations in the first nine months of 2024 alone.

Once, a single classic game could sustain an entire development team. Now, however, game lifecycles are shrinking at an alarming rate. The goal of "sustainable revenue" has always been present in the gaming industry, and today, developers worldwide are pursuing excellence, with the long-tail effect of games becoming crucial.

In China, it's not just Tencent and NetEase that rely on flagship games; companies like Xishanju (behind "Sword Online 3"), Happy Elements (creators of "Happy Fish"), NetDragon Websoft (developers of "Aion"), and Changyou.com (publishers of "New Tian Long Ba Bu") also thrive on their representative titles, despite relative obscurity.

So, how can game developers sustain the impact of their products over the long term? The industry has gleaned some insights:

Firstly, continuous innovation is key. Take NetDragon's "Aion" as an example. Launched in 2006, the game's IP revenue still grew 12.4% year-on-year to 3.4 billion yuan in 2023, with flagship PC game revenue up 14% to 2.9 billion yuan. Over its 17-year lifespan, "Aion" has continuously updated its gameplay, introducing new classes, dungeons, cross-server features, Evolved Pets, and Album systems, among others. Endless novelty is the only way for an old game to retain its user base.

Secondly, the global gaming market is becoming less tolerant of product failures. Many games that shut down this year had been online for less than six months, highlighting the need for developers to stay attuned to market trends and adjust their product positioning accordingly. "Black Myth: Wukong" exemplifies this approach, with frequent market testing before its release.

In 2020, the game debuted with a 13-minute gameplay trailer, followed by a second trailer in August 2021, which not only improved upon the first but also introduced the Unreal Engine 5.

Thirdly, the power of IP has been amplified time and again in gaming circles. In July 2024, four games on Gama Data's first-month revenue estimate list surpassed 100 million yuan, with three being IP adaptations. "Black Myth's" success has reignited faith in the value of IPs among game developers.

However, compared to overseas IP powerhouses, China still lacks original game IPs. In response, many developers have embarked on acquisition sprees, with CMGE announcing the full acquisition of the global IP rights to "Chinese Paladin" in September, which temporarily boosted the company's share price. Nonetheless, past attempts to leverage the "Chinese Paladin" IP have been largely unsuccessful.

It remains unclear how far struggling game developers are from achieving "sustainable revenue," but one thing is certain: the dream of the gaming industry remains alive. Even if silence prevails for now, someone will undoubtedly strive to continue the legacy of gaming myths.

Dao Zong You Li is a new media outlet focusing on internet and technology trends. This article is original and may not be reproduced without proper attribution.