Why do most of the stock prices of loan facilitation platforms surge, yet their price-to-book ratios are still less than 1

![]() 10/10 2024

10/10 2024

![]() 656

656

Author | Yao Li

Source | Zero One Think Tank

Following China's introduction of a package of policies to support the economy and capital markets, Chinese stocks, including A-shares, rallied accordingly. Overseas-listed loan facilitation platforms were no exception. In the past two weeks (since September 23), U.S.-listed loan facilitation platforms have generally experienced significant gains of over 20%, with the largest gains exceeding 100%.

Due to the "shortcomings" in the compliance attributes of their core businesses, the valuations of listed loan facilitation platforms have long been mismatched with their robust financial performance, with price-to-book ratios mostly below 1 and price-to-earnings ratios in the single digits, far below the valuations of technology stocks. Some U.S.-listed loan facilitation platforms have even seen their share prices approach or even fall below the delisting threshold of $1 per share.

Despite multiple rounds of regulatory reforms and aggressive share repurchases in the secondary market in recent years, neither has fundamentally changed the low valuation of loan facilitation platforms in the secondary market.

Since 2023, the loan facilitation industry has experienced a "slowdown and quality improvement" to release risks accumulated during the previous period of rapid growth and alleviate operational pressures caused by the slowdown in macroeconomic growth (see Zero One Finance article "New Trends in Loan Facilitation: Rising Delinquencies and Slowing Expansion"). Prior to this round of share price increases, the share prices of listed loan facilitation platforms had been hovering at relatively low levels for an extended period.

This share price recovery may indicate that the release of industry risks is nearing completion and growth is expected to resume. In fact, in the second-quarter earnings reports, some platform executives expressed their renewed focus on growth as asset quality improves (see Zero One Finance article "The Dilemma of Loan Facilitation: To Contract or Expand?").

With the economic stimulus policies implemented since the end of September, listed loan facilitation platforms are also poised for valuation recovery.

Table 1: Share Price Increases of Listed Loan Facilitation Platforms in the Past Two Weeks (September 23 to October 7, 2024)

Source: Eastmoney.com, Zero One Think Tank

01

Price-to-Book Ratios Mostly Below 1

This article reviews the secondary market performance of eight overseas-listed loan facilitation platforms and finds that despite a wave of gains, six of the platforms still have price-to-book ratios below 1, including LexinFintech (NASDAQ: LX), CreditEase Technology (NYSE: FINV), X Financial (NYSE: XYF), Yiren Digital (NYSE: YRD), Weixin Credit Tech (02003.HK), and Lufax Holding (NYSE: LU / 06623.HK).

Table 2: Secondary Market Valuations and Market Capitalizations of Overseas-Listed Loan Facilitation Platforms (as of October 7, 2024)

Source: Eastmoney.com, Zero One Think Tank

Regulatory reforms, revenue growth, and share repurchases have failed to change the long-term low valuations of these loan facilitation platforms. The author believes that the root cause lies in the unclear compliance attributes of their businesses, with core operations in a gray area. On the other hand, while regulators have taken action, they have not provided loan facilitation platforms with a clear "identity" to emerge from the gray area.

The financial rectification of platform finance, which began in mid-2021 and was announced as completed in mid-2023, involved cleaning up issues such as excessively high interest rates, illegal collection practices, and the disconnection of credit information. However, the core contradiction between the financial nature of their core business (bearing credit risk) and the prohibition on non-licensed financial activities remains unresolved, leaving their operations in a compliance gray area, which is the primary factor affecting their valuations.

Regarding the "sunshining" of loan facilitation platforms' identities, there have been discussions and expectations within the industry about issuing licenses or implementing filing management. However, based on current regulatory trends, the expectation of bringing them under financial supervision has waned.

Under the current regulatory framework, for loan facilitation platforms to achieve valuations comparable to technology companies, they need to complete a light-capital transformation of their business and cease bearing credit risk, thereby emerging from the compliance gray area.

02

The Differentiation of Qifutech

There have also been positive changes in the compliance attributes and valuations of loan facilitation platforms within the industry.

During the slowdown and quality improvement process in the industry since 2023, the business scale of Qifutech, a leading player, has begun to contract, but its valuation has risen from below 1 to above 1, with the current price-to-book and price-to-earnings ratios being the highest among the eight listed platforms. The author believes that in addition to relatively stable performance, its valuation advantage is also closely related to the stronger compliance attributes of its business structure.

Among listed loan facilitation platforms, Qifutech has undergone the fastest light-capital transformation, with relatively comprehensive disclosures. Since initiating its light-capital transformation in 2018, the proportion of Qifutech's light-capital business has gradually increased, accounting for 64.9% of facilitated loans and 65.8% of loan balances in Q2 2022.

As of the end of 2023, in addition to trust, small loan, and ABS businesses within the regulatory framework, the proportion of its "heavy-capital" businesses bearing credit risk was only 22.9%, indicating that about 20% of its business remained in the gray area. Compared to other platforms, its overall business compliance attributes are clearly stronger (see Zero One Finance article "Qifutech's Lending 'Technology': Reduced Guarantees, Increased Profits").

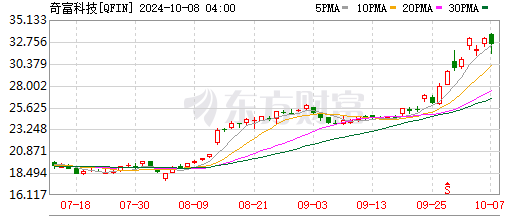

As early as August, Qifutech embarked on a rally with gains of over 20%. A second wave of gains began in late September, with a nearly 30% increase.

Figure 1: Share Price Trend of Qifutech