Qiniu Intelligent, which broke on the first day of listing, is it "useless" even with Alibaba's backing?

![]() 10/17 2024

10/17 2024

![]() 451

451

After the "aborted" listing in the United States in 2021, Qiniu Intelligent launched its fourth assault on the capital market in September this year. It has finally succeeded in landing on the Hong Kong stock market as desired.

On October 16, a milestone moment, on the first day of listing on the Hong Kong Stock Exchange, Qiniu Intelligent did not receive the good news it most wanted. The issue price was HK$2.75, but the opening price today was only HK$1.6, a decrease of 41.8% from the issue price.

It is reported that Qiniu Intelligent was established in 2011 and is one of the earliest platforms in China to provide audio and video cloud services. It mainly provides audio and video PaaS services (MPaaS) and application platform as a service (APaaS). It is one of the few companies in China with comprehensive and high-performance MPaaS products and integrated technical capabilities covering all aspects of audio and video business.

So why hasn't Qiniu Intelligent, which entered the market early and has technological backing, gained favor from the capital market?

Continuous losses are currently the biggest problem

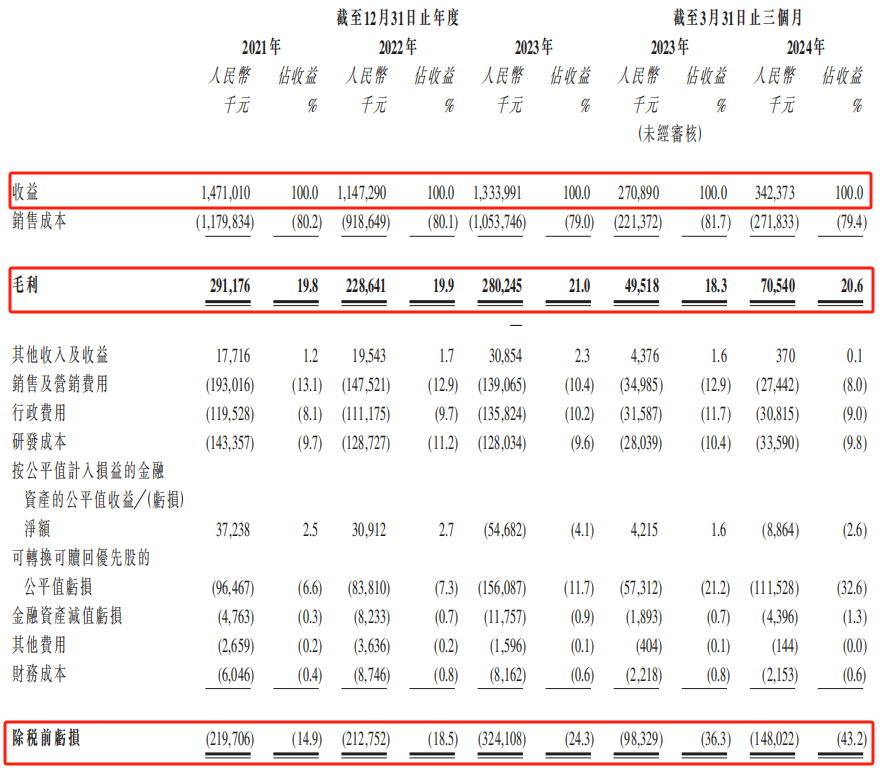

The prospectus shows that from 2021 to 2023, Qiniu Intelligent achieved revenues of RMB 1.471 billion, RMB 1.147 billion, and RMB 1.334 billion, respectively. Revenue in the first quarter of 2024 was RMB 342 million, an increase of 26.2% from RMB 271 million in the same period last year.

Source: Prospectus

In terms of revenue, iResearch data shows that in 2023, Qiniu Intelligent's total revenue accounted for 1.5% of the entire audio and video cloud service market. It is also China's third-largest audio and video PaaS service provider with a market share of 5.8%; and China's second-largest audio and video APaaS service provider with a market share of 14.1%.

Despite relatively stable revenue performance and a leading position in niche segments, the shortcoming in profitability is more apparent. From 2021 to 2023 and the first quarter of 2024, Qiniu Intelligent achieved gross profits of RMB 291 million, RMB 229 million, RMB 280 million, and RMB 70.54 million, respectively; gross margins were 19.8%, 19.9%, 21%, and 20.6%, respectively.

The gross margin is increasing, but it is also "depleted" due to losses. The prospectus shows that from 2021 to 2023, Qiniu Intelligent incurred losses of RMB 220 million, RMB 213 million, and RMB 324 million, respectively; and adjusted losses were RMB 106 million, RMB 119 million, and RMB 116 million, respectively.

In the first quarter of 2024, Qiniu Intelligent's intra-period loss even reached RMB 148 million, with a loss rate of 43.2%. Compared with an intra-period loss of RMB 98.33 million and an intra-period loss rate of 36.3% in the same period last year, it has increased significantly.

In addition, the growth in Qiniu Intelligent's fair value losses is also significant. It reached RMB 156 million in 2023, an increase of 86.2% year-on-year; and by the first quarter of this year, this figure had climbed to RMB 111 million, accounting for up to 32.6% of total losses.

Behind the continuous increase in losses, high sales costs are the main reason. The prospectus shows that from 2021 to the first quarter of 2024, Qiniu Intelligent's sales costs were RMB 1.179 billion, RMB 918 million, RMB 1.053 billion, and RMB 272 million, respectively, accounting for 80.2%, 80.1%, 79%, and 79.4% of total revenue, respectively, with consistently high proportions.

Among them, although sales and marketing expenses have gradually declined, from RMB 193 million in 2021 to RMB 139 million in 2023, and the proportion has also declined from 13.1% to 10.4%, administrative expenses have also increased synchronously, from RMB 119 million in 2021 to RMB 135 million in 2023, and the proportion has increased from 8.1% to 10.2%.

It is particularly noteworthy that while sales costs remain high, R&D investment is also quietly shrinking. It has declined from RMB 143 million in 2021 to RMB 128 million in 2023.

On the whole, Qiniu Intelligent still needs to work hard to overcome the challenge of losses. Although the current share price performance is a feedback and prediction of past performance and future performance trends, in the long run, Qiniu Intelligent's future path will not be too difficult.

User retention rate exceeds 90%, is Qiniu Intelligent "accumulating strength for a springboard"?

As a "pioneer" in the field of cloud computing solutions, Qiniu Intelligent has long surpassed the threshold of RMB 1 billion in total revenue, earning the title of a "unicorn".

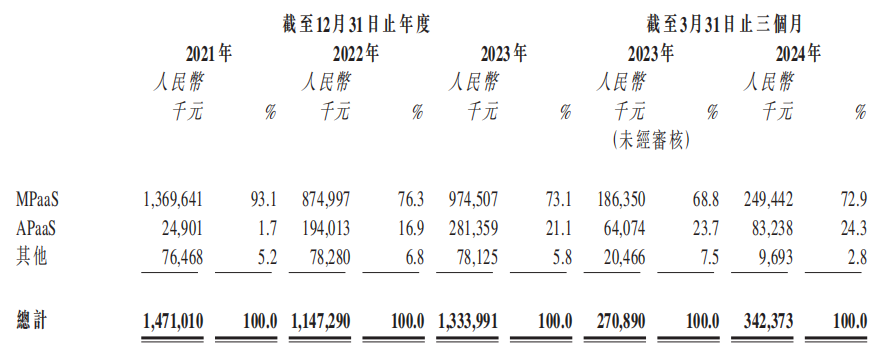

In terms of business distribution, Qiniu Intelligent's main products and services are divided into two major segments: one is the MPaaS business for customers with strong development capabilities, and the other is the APaaS business suitable for beginners in development.

Source: Prospectus

Among them, the MPaaS business dominates. The prospectus shows that from 2021 to 2023, MPaaS business revenue accounted for 93.1%, 76.3%, and 73.1% of total revenue, respectively.

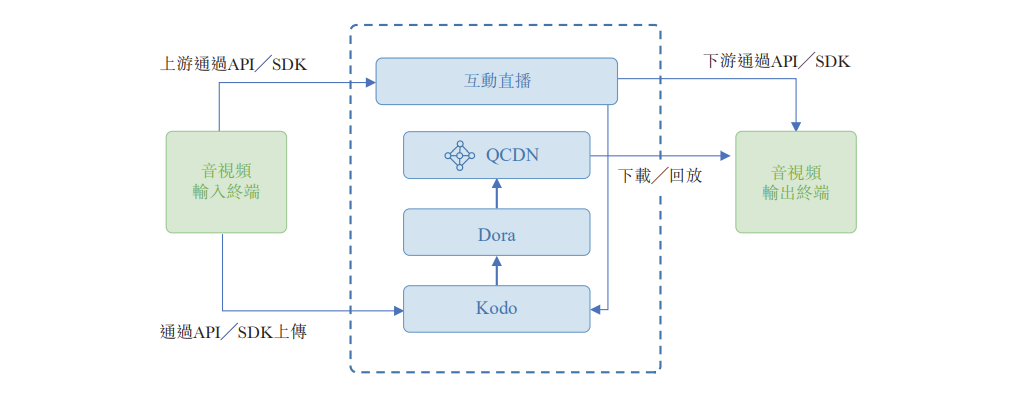

It is reported that as of now, Qiniu Intelligent has launched a total of four major MPaaS audio and video solutions, namely QCDN, a proprietary content delivery network for accelerating content distribution; Kodo, an object storage platform for storing content; interactive live streaming products; and Dora, an intelligent media data analysis platform.

Furthermore, in the first quarter of this year, more than half of Qiniu Intelligent's MPaaS business customers purchased two or more MPaaS audio and video solutions simultaneously. This indicates that the growth potential of Qiniu Intelligent's MPaaS business segment should not be underestimated.

Source: Prospectus

Upon closer inspection, the MPaaS business is primarily supported by four major projects: QCDN, Kodo, Dora, and interactive live streaming. Among them, QCDN and Kodo are the most solid pillars. In the first quarter of this year, the combined revenue of these two projects accounted for 96.5% of the total revenue of this business.

According to the prospectus, the gross margin of MPaaS increased from 17.3% in 2022 to 19.3% in 2023, primarily due to the improved efficiency of QCDN and Kodo operations after the company adjusted its infrastructure layout and redeployed some servers. Moreover, the company's total revenue in the first quarter of this year increased by 26.4% year-on-year, partially due to the contribution of MPaaS products, especially QCDN and Kodo.

Turning to the APaaS business, its audio and video solutions adopt a "1+N" model, allowing for flexible application in diverse scenarios through a single platform. The solutions focus on five major application scenarios: social entertainment, video marketing, video conferencing, intelligent new media, and the metaverse.

Currently, the revenue sources of the APaaS business are mainly concentrated in social entertainment and video marketing. In the first quarter of this year, the combined revenue of these two projects accounted for 87.7% of the total revenue of this segment. From 2021 to 2023, the proportions of video marketing and video conferencing projects in total revenue continued to grow.

Particularly noteworthy is that in 2023, the number of paying APaaS customers of Qiniu Intelligent increased significantly by 135% compared to the same period last year. In the same year, the retention rate of paying customers for this business was also as high as 87.9%, and further increased to 93.7% in the first quarter of this year.

During the reporting period, the number of new APaaS business customers upgraded from the original MPaaS business was 159, 322, 459, and 275, respectively, increasing year by year. The number of new APaaS business customers adopting APaaS audio and video solutions has gradually increased, and the average revenue contribution has also increased significantly.

The two core businesses are "vying to be first," both showing strong momentum. Perhaps Qiniu Intelligent's "main event" has yet to begin.

"Complex" relationship, leading to a better "future"

In addition to the support of its core business, Qiniu Intelligent also has a powerful "backer." Upon closer inspection of the prospectus, we find that among the investors, there is also the presence of the "Alibaba Group" in the form of Taobao China.

From the current shareholding structure, Taobao China is Qiniu Intelligent's second-largest shareholder with a shareholding ratio of 17.69%, second only to the company's founder Xu Shiwei (who holds a 17.96% stake in Qiniu Cloud).

As one of the internet giants, Alibaba, behind Taobao, is also involved in cloud services, and its subsidiary Alibaba Cloud is currently one of the largest cloud service providers in China.

The two parties are both competitors and partners. As the saying goes, "the moon is the first to be seen by those near the water." The interactions between the two parties are also very close. Taobao China is both a customer and a supplier of Qiniu Intelligent.

In 2021, Taobao China was one of Qiniu Intelligent's major customers, contributing RMB 30.901 million in revenue, accounting for 2.1% of total revenue. During the same period, Taobao China was also one of Qiniu Intelligent's major suppliers, with cumulative procurement transactions amounting to RMB 374 million.

However, considering factors such as the listing, the transaction amounts between the two parties have declined significantly in recent years. Qiniu Intelligent's sales to Alibaba Cloud decreased from RMB 30.901 million in 2021 to RMB 421,000 in 2023; and procurement transactions from Alibaba Cloud also decreased from RMB 374 million in 2021 to RMB 37.398 million in 2023.

In response, Qiniu Intelligent stated that since 2017, the two parties have established a long-term cooperative relationship and have understood each other's operations, quality control, and specific requirements over the years. It is expected that this cooperative relationship will continue.

With the support of this "complex relationship," Qiniu Intelligent has honed its skills.

It is reported that Qiniu Intelligent's four major MPaaS audio and video solutions have surpassed 4.6 billion minutes of daily audio and video playback in the first three months of this year, far exceeding the industry standard of 1 billion minutes.

As of March this year, Qiniu Intelligent had accumulated over 1.51 million registered users, with over 640,000 active users. In addition, among the top 20 Chinese audio and video app downloads in 2023, as many as 15 operators used Qiniu Intelligent's solutions, nearly "dominating" the list.

Moreover, according to the prospectus, approximately 38% of the net proceeds raised from Qiniu Intelligent's IPO will be used to penetrate and consolidate the occupancy rate of application scenarios in the APaaS business and to develop and expand the customer base. This means that the core business will continue to make significant progress with the support of subsequent funding.

Four years later, Qiniu Intelligent has finally landed on the capital market. This is its first step and the starting point of its long journey ahead. We will wait and see if Qiniu Intelligent can turn things around and become profitable in the future.

Source: Hong Kong Stock Research Institute