"The longest Double 11 in history", platforms find it harder to "achieve miracles with brute force"

![]() 10/17 2024

10/17 2024

![]() 569

569

This year's "Double 11" came as a surprise. Many users discovered that e-commerce platforms had already entered their preparation phase right after the National Day holiday.

On October 8th, Douyin was the first to launch its promotion, while Tmall and JD.com both coincidentally advanced their "Double 11" sales to the 14th. Following suit were platforms like Xiaohongshu, Kuaishou, and Bilibili.

It felt like everyone had agreed to take the test unprepared, but unexpectedly, someone snuck in to study ahead. The others, fearing they would be left behind, had no choice but to stay up late to catch up.

Of course, that's just a joke. After a lackluster "618", both platforms and merchants have high hopes for "Double 11". Everyone was keeping an eye on Taobao's "Double 11" progress, but unexpectedly, Douyin was the first to reap the benefits.

However, "Double 11" has evolved from a one-day sprint to a month-long marathon. How do platforms and merchants manage to sustain this "ultra-long battery life"?

1. E-commerce platforms jumpstart "Double 11"

As the e-commerce traffic dividend enters a bottleneck, it has become a consensus that big promotions are becoming increasingly difficult. Especially after a relatively underwhelming "618", both platforms and merchants have had to be more cautious in planning for "Double 11".

The most notable adjustment is that more and more platforms are choosing to loosen the "only refund" policy and no longer focus solely on the "lowest price." After "618," Taobao held a closed-door meeting with merchants, clarifying that it would de-emphasize the absolute low-price strategy, revert search weight distribution to GMV, and prioritize consumer experience, linking traffic logic to consumer satisfaction.

Major e-commerce platforms are also starting to place greater importance on "service quality." Even JD.com, which still emphasizes its "10 billion subsidy" program, has adjusted its traffic rules for search recommendations. Products need to fulfill one or more criteria such as price competitiveness or efficient logistics delivery to quickly activate traffic.

Just a year later, e-commerce platforms have shifted their stance and no longer aim to compete with Pinduoduo. After half a year of trials, everyone realizes that endless price wars do not drive industry growth. The never-ending competition ultimately harms platform interests.

However, not engaging in price wars doesn't mean e-commerce platforms have stopped "competing." Major platforms are all jumping the gun on "Double 11," making this year's event the longest in history.

E-commerce platforms are desperately extending their promotion periods. On one hand, there is anxiety over sales figures. Despite using all available tactics like "low prices," "only refunds," and "no pre-sales" during "618," sales still declined. StarChart data shows that total online sales during the 2024 "618" period reached 742.8 billion yuan, a nearly 7% year-on-year decline.

With a sluggish macroeconomy, waning consumer spending desire, and internet user growth peaking, the e-commerce market is shrinking. Platforms naturally want to prolong the battle to capture more "Double 11" benefits, even if it means jumping the gun to secure early sales.

On the other hand, extending promotion periods is also a recent trend in the e-commerce market. Not only are "618" and "Double 11" becoming longer, but festivals like Chinese New Year and Women's Day are also seeing longer promotional campaigns. For consumers, e-commerce promotions have become increasingly normalized.

In this context, achieving "absolute low prices" is difficult. For example, last year, there was a public spat between JD.com's procurement and sales department and Hausherr ovens over "platform lowest prices," which even trended on social media, revealing the pricing control tactics of platforms and brands.

Since so-called "lowest prices" may not exist, consumers are motivated more by the promotional atmosphere than actual savings during big sales events.

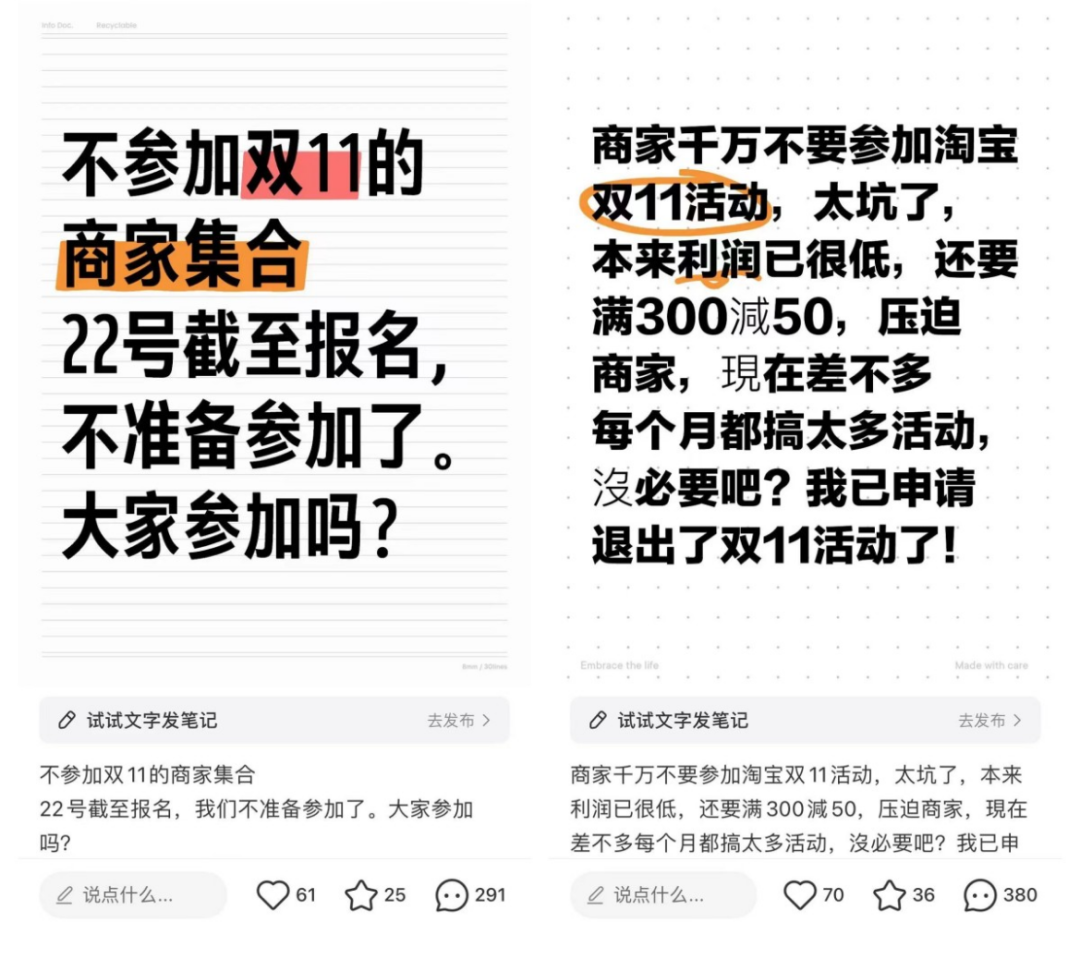

Therefore, for both consumers and merchants, an "ultra-long Double 11" may not be welcomed. Some merchants say they used to participate only in the second wave of "Double 11" promotions, but this year they must participate throughout the entire month-long event, straining their resources for subsidies.

Similarly, many social media platforms are also seeing posts advising consumers against excessive spending. Since promotions occur year-round, it may be wiser to wait until products are actually needed before buying, as discounts may not vary significantly.

2. Promotions are judged by quality, not duration

As e-commerce platforms, they naturally want to extend "Double 11," but whether merchants and consumers are motivated depends more on "service quality" than "service duration."

Therefore, in addition to adjusting their "low-price strategies" and extending "Double 11" periods, major e-commerce platforms have introduced more highlights this year.

Firstly, e-commerce platforms are "tearing down walls" between themselves. In September, Taobao and WeChat took a historic step by successfully completing payment integration. Additionally, Taobao will connect to JD.com Logistics in early October.

This means this year's "Double 11" will break the siloed approach of past events, with platforms sharing core resources like payment and logistics. Interoperability between e-commerce platforms has become a new trend.

In fact, as the e-commerce industry enters a mature phase, traditional platforms face growth bottlenecks and competition from short video and live streaming e-commerce. This has prompted Taobao, JD.com, and Tencent to lower barriers and focus on enhancing user experience. Only by fostering industry-wide growth can platforms sustain their own progress.

Secondly, user experience continues to improve. For example, Taobao's 88VIP program now offers unlimited returns with shipping included, while JD.com has lowered its free shipping threshold for regular users from 99 yuan to 59 yuan.

This year's "Double 11" promotions have also simplified rules. Taobao, JD.com, and Pinduoduo mainly offer discounts based on minimum purchase amounts or instant rebates, eliminating the need for complex promotional calculations.

Lastly, platforms are alleviating the burden on merchants. Over the past six months, by loosening the "only refund" policy and de-emphasizing extreme low prices, e-commerce platforms have responded to merchant needs and fostered a healthier business environment.

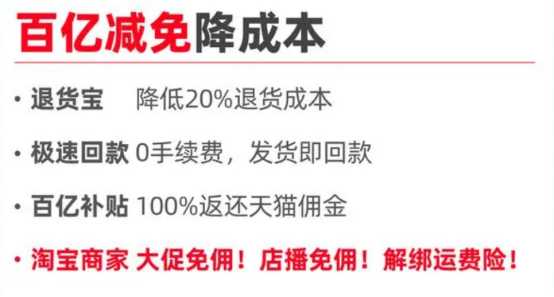

Therefore, this year's "Double 11" platforms prioritize both user and merchant experiences. For instance, Tmall has pledged to invest tens of billions of yuan to help merchants grow their businesses. Prior to this, Tmall eliminated annual fees, replaced them with a 0.6% basic software service fee, and introduced policies like zero-fee rapid refunds and full commission rebates under its "Billion Subsidy" program to ease merchant burdens.

JD.com offers merchants support with hundreds of billions of yuan in traffic subsidies, AI marketing tools, and discounted warehousing services through JD Logistics. In live streaming, JD.com has invested up to 1 billion yuan in resources, allowing merchants to experience services like JD's digital human live streaming for free.

Pinduoduo, often seen as consumer-biased, has introduced an exit mechanism for its "Buy Expensive, Get Compensated" service, giving merchants more options. Additionally, Pinduoduo has launched a "Billion Subsidy Reduction" plan, aiming to reduce fees for high-quality merchants by 10 billion yuan over the next year.

3. E-commerce platforms brewing change

After over a decade of development, "Double 11" has evolved from a "shopping spree day" to a "shopping spree festival" and now a "shopping spree season," returning to the essence of the retail industry.

As the internet industry grows, traffic dividends are being rapidly exploited. In addition to e-commerce platforms, seeding platforms, short video platforms, and live streaming rooms are also sharing the pie. "Promotions" are no longer the sole catalyst for sales spikes. Often, big influencers and bulk seeding can create bestsellers more effectively.

This requires e-commerce platforms to continuously innovate their service mechanisms, offering new stimuli to consumers through content, service, and logistics, rather than relying solely on straightforward "low prices."

For example, Taobao was the first to propose that live streaming e-commerce should evolve from an entertainment-focused model to a quality-driven stage. A quality live streaming model featuring professional hosts, branded products, and superior service is poised to become the norm.

This insight may stem from the increasing number of high-profile influencer scandals. As "big influencers + low prices" cease to be a universal sales driver, live streaming e-commerce will shift towards professionalism and quality.

Meanwhile, JD.com is leveraging its supply chain strengths. This year's "Double 11," JD.com Supermarket's live streaming room challenged Li Jiaqi's live room, offering an additional 10% discount on top of Li Jiaqi's prices.

JD.com attributes its ability to offer even lower prices to its highly efficient supply chain, which allows it to pass on savings to users and partners. Notably, JD.com has also introduced "immediate availability" for products, posing higher demands on its procurement and logistics systems.

If the e-commerce industry is poised for a new stage of development, this year's "Double 11" marks a crucial turning point. It represents the "optimal solution" arrived at by major e-commerce platforms after refining their policies following last year's "Double 11" and this year's "618." It leverages the strengths of each platform while balancing the interests of platforms, merchants, and consumers.

When e-commerce platforms no longer solely focus on GMV and instead strive to create a healthy market environment by moving away from intense competition, both platforms and merchants can pursue more sustainable growth.