Jinghe Integration successfully verifies 28nm logic chip: China's semiconductor industry claims another victory!

![]() 10/23 2024

10/23 2024

![]() 686

686

Recently, many A-share listed companies have disclosed their third-quarter earnings forecasts. Among the 200 companies that have announced their forecasts, the proportion of positive expectations has reached 83%. The semiconductor industry, which has attracted much attention, has also shown a notable recovery. Leading companies such as Jinghe Integration, Well Lead Electronics, Rockchip, and others have announced that their net profits for the first three quarters increased by more than 300% year-on-year. Is this the dawn of a golden age for China's domestic chip industry?

01, Behind the Surge in Earnings: Continuously Climbing Market Position

Currently, there is an undesirable trend on the internet regarding discussions about domestic semiconductors. Some blindly exuberate, proclaiming China as the best in the world, while others dismissively sneer, valuing only Japanese, European, and American products. This article aims to provide a factual and rational perspective on the true level of China's semiconductor industry.

According to the Global Times, Yonhap News Agency reported on the 22nd that China's semiconductor supply chain continues to play a pivotal role. Specifically, China Mainland and South Korea have a high degree of integration in memory semiconductor exports, with a ratio of 2.94, while China Mainland and Taiwan have a high degree of integration in system semiconductor exports, with a ratio of 1.52.

Jeong Hyung-gon, the chief researcher at the Korea Institute for International Economic Policy, emphasized that China's market share in the general-purpose semiconductor market continues to increase, and its position in the semiconductor demand market will also be temporarily maintained. South Korea needs to manage its cooperative relationship with China well. The Semiconductor Industry Association (SEMI) stated that China Mainland will invest over $100 billion in the semiconductor industry over the next three years.

What is China's position in the semiconductor industry? Wouldn't it be more credible to hear it from a semiconductor powerhouse like South Korea than from a self-promoting salesperson? Even arrogant South Korea is paying increasing attention to cooperation with China's semiconductor industry chain, which is actually a positive signal indicating that China's semiconductor industry is indeed on a continuous upward trajectory.

Let's take a closer look at the performance of some companies within the semiconductor industry to gain a more intuitive understanding of this recovery:

According to Jinghe Integration's forecast, its net profit for the first three quarters of 2024 is expected to range from RMB 270 million to RMB 300 million, representing a year-on-year increase of 744.01% to 837.79%. Rockchip's earnings forecast shows a significant year-on-year increase in revenue and net profit for the first three quarters. Companies like Allwinner Technology and SmartSens Technology have also achieved profitability, turning around from losses.

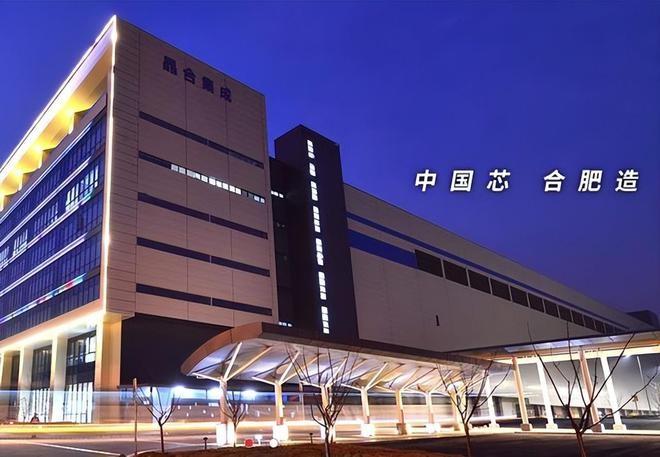

Founded in 2015, Jinghe Integration is one of the fastest-growing semiconductor companies in recent years. In China Mainland, it ranks third in market share after SMIC and Huahong Group, and is ranked among the global top 10 foundries. Backed by Hefei, a venture capital hub, it is Anhui's first 12-inch wafer foundry, specializing in display driver chips and CIS chips, covering mature processes ranging from 55nm to 150nm.

Since entering 2024, Jinghe Integration has made significant breakthroughs. In August, it broke the industry monopoly by successfully trial-producing a domestically produced 180-megapixel full-frame CMOS image sensor. Based on Jinghe Integration's self-developed 55nm process technology, this CIS chip aims to enter the high-end DSLR camera market in collaboration with SmartSens Technology. In October, Jinghe Integration's 28nm logic chip passed functional verification, and its 28nm OLED driver chip is expected to enter mass production in the first half of 2025.

It is worth noting that Jinghe Integration's gross margin for the first half of 2024 reached 24.43%, far exceeding that of SMIC and Huahong Semiconductor, highlighting the advantages of Jinghe Integration's specialized processes and precise market positioning.

Founded in 2001, Rockchip is one of China's established chip design companies. Over the past two decades, the company has focused on the design of system-on-chip (SoC), analog circuit chips, and the development of multimedia image algorithms and system software, gaining industry recognition. It has established a presence in the automotive electronics, consumer electronics, and industrial sectors.

Founded in 2007, Allwinner Technology is a prominent enterprise specializing in the design of intelligent application processor SoCs, high-performance analog devices, and wireless connectivity chips. Headquartered in Zhuhai, the company has R&D centers or branches in Shenzhen, Hong Kong, Xi'an, Beijing, and Shanghai. It continues to invest heavily in R&D for new chip products, smart in-vehicle devices, and robot vacuum cleaners.

In the semiconductor manufacturing sector alone, the continuous growth of leading companies like Jinghe Integration, Huahong Group, and SMIC has driven up demand for semiconductor equipment and special materials, boosting suppliers' performance. On the domestic supply chain side, this includes but is not limited to renowned upstream companies such as Northern Microelectronics Equipment Corporation (NMEC), Advanced Micro-Fabrication Equipment Inc. (AMEC), ACM Research, EtchTech, Topsil Semiconductor, Topsil Semiconductor, and many others.

Of course, enhancing performance and earning profits are not the only goals. The full rise of domestic semiconductors carries deeper significance.

02, The Opportunity of Domestic Substitution in the Semiconductor Industry!

China is not only the world's largest consumer market for smart cars and new energy electric vehicles but also the largest consumer market for semiconductors globally. However, there is a notable gap in localization for some key semiconductor manufacturing equipment and materials, which has provided ample opportunities for European and American companies like ASML, Lam Research, AMAT, and KLA-Tencor.

In particular, ASML, the giant in lithography equipment, contributed over 40% of its global market performance in the first two quarters of this year to the Chinese market. Other American semiconductor equipment giants like Lam Research and AMAT have also profited handsomely in China. However, this trend began to reverse in the third quarter.

As the United States, Japan, and the Netherlands have tightened restrictions on the export of semiconductor equipment to China, companies like ASML have inevitably seen their performance impacted. Especially in lithography equipment, ASML expects its market share in China to decline to around 20% by next year, with LAM, AMAT, and KLA-Tencor facing similar difficulties.

For us, this is both a challenge and an opportunity. By successfully replacing key imported equipment with domestic alternatives, we can ensure the stability of our semiconductor industry. This urgent need for substitution presents a golden opportunity for the rise of domestic manufacturers.

Policy support has also been continuously strengthened. The first phase of the National IC Industry Investment Fund was established in 2014 with a registered capital of RMB 98.7 billion. The second phase was established in 2019 with a registered capital of RMB 204.2 billion, and the third phase was established on May 24, 2024, with a registered capital of up to RMB 344 billion. As of 2024, the fund has heavily invested in 37 semiconductor companies, demonstrating the country's strong support for the development of the semiconductor industry.

These investments cover the entire semiconductor supply chain, including equipment, design, wafer fabrication, packaging and testing, and materials, providing significant assistance and confidence for the development of domestic semiconductors. This is China's advantage – the ability to concentrate resources to achieve great things!

Of course, it is crucial for companies to improve their own capabilities rather than rely solely on state support. For example, SMIC, Huahong Group, and Jinghe Integration need to continue advancing their advanced process technology to secure more orders. Meanwhile, companies like AMEC and NMEC need to continue their efforts in the field of CCP high-end etching equipment.

It is worth mentioning that China's IC packaging and testing have reached world-class standards, with the "three giants" of packaging and testing already renowned. However, continuous efforts are still needed in the localization of EDA software, such as achieving process coverage from 28nm to 14nm and even 7nm.

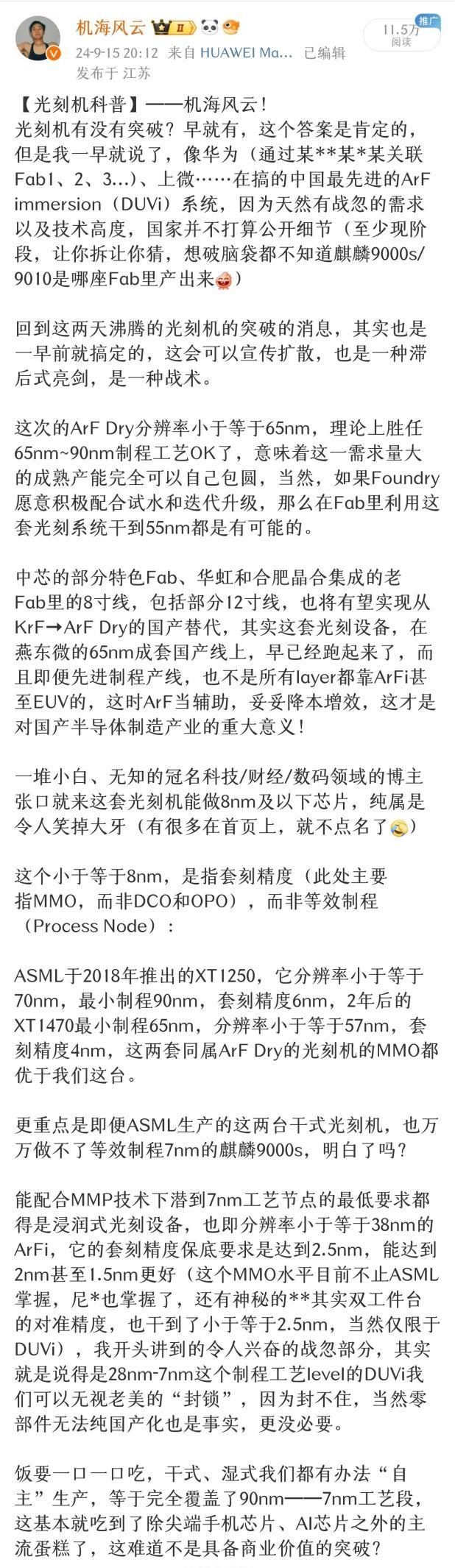

What is the current level of domestic lithography machine projects, which have garnered significant public attention?

According to industry analysts, China's domestic dry lithography machines have made notable breakthroughs and are capable of handling processes ranging from 55nm to 90nm with minimal issues. While the progress of immersion lithography machines has not been disclosed, it is possible that they are already undergoing validation on fabs, such as the SSA*** series led by Shanghai Microelectronics Equipment (Group) Co., Ltd. (SMEE). However, there has been no official confirmation regarding the specific progress of this 28nm lithography machine, and it is not necessary to delve too deeply into the details.

In summary, while there is still a gap between China and the Netherlands, the United States, and Japan in areas such as lithography machines, etching machines, EDA software, and photoresist, it is evident that China's domestic semiconductor industry chain is already capable of securing substantial orders for mature process technologies.

With profit as a foundation, there will be more investments in talent and R&D, potentially leading to technological breakthroughs. It is believed that with time, domestic semiconductors will secure a place in advanced process technologies.

Reference Materials:

Latest Report from South Korea: China's Semiconductor Supply Chain Still Plays a Pivotal Role – Huanqiu.com

Over 80% of Third-Quarter Earnings Forecasts Are Positive, Indicating a Continuously Improving Industry Climate – Securities Times

Some images sourced from the internet