16 years later, "Singles' Day" is overturned and restarted

![]() 10/24 2024

10/24 2024

![]() 703

703

Will you buy during this year's Singles' Day?

This year's "Singles' Day" is destined to be different from previous years.

On the eve of "Singles' Day", Alibaba and Tencent finally ended their 11-year-long "mutual blocking", and Taobao officially announced that WeChat Pay could be used for shopping, reconnecting the two giants; in addition, it is rumored that JD.com will also officially integrate Alipay payments, expected to be launched on the eve of "Singles' Day". Beyond payments, Tmall and Tmall.com have also integrated JD Logistics for the first time, allowing platform merchants to choose JD Logistics as their service provider, while JD Express has also integrated into Cainiao's system.

This year's "Singles' Day" opens a new chapter amidst change. The interconnection of leading platforms has unleashed unprecedented positive news for this year's "Singles' Day"; this is also a rare lively moment amidst the current cooling enthusiasm for e-commerce promotions.

The frontline of this year's "Singles' Day" has been extended once again.

Based on the published timelines of various e-commerce platforms, this year's "Singles' Day" may last for 26-34 days, compared to just 22-24 days in 2023. The actions of these platforms also indicate that this year's "Singles' Day" has become the earliest and longest-running in history.

Source: Weibo screenshot

In addition to extending the event period, various e-commerce platforms have also unveiled their "trump cards" one after another.

Beyond cross-store discounts, individual product discounts, and platform vouchers, Tmall will invest an additional RMB 30 billion in consumption vouchers and red envelopes to boost transactions this year. According to Tmall's official announcement, this year's "Singles' Day" will offer the largest subsidies and the most red envelopes ever.

JD.com's "Singles' Day" campaign continues to focus on the strategy of "cheap and good," with cross-store discounts of RMB 50 off for every RMB 300 spent, combined with platform subsidies of RMB 20 off for every RMB 200 spent; Pinduoduo, which has traditionally been "low-key," has also launched its first "RMB 10 billion consumption voucher" campaign this year and upgraded its "Super Doubled Subsidy" policy.

Source: Canstockphoto

However, the biggest change in this year's "Singles' Day" lies in the interconnection between platforms, marking the first time that high walls have been broken down.

With Alibaba and Tencent announcing the end of their over-a-decade-long "mutual blocking," Tencent has reached into e-commerce scenarios that Alibaba considers its "lifeblood," while Alibaba may leverage WeChat's vast user base to potentially bring new growth opportunities to Taobao.

Not only has WeChat opened up to Taobao, but "old rivals" Alibaba and JD.com have also opened up to each other; according to "Qujiexieshangye," the system integration between JD Logistics and Taobao/Tmall platforms is nearly complete, with full preparations underway for "Singles' Day promotions," and many Taobao users have already experienced the convenience brought by JD Logistics.

Source: Canstockphoto

"This interconnection has brought new growth to JD Logistics' business, and Alipay will also generate more revenue from JD.com," said Zhuang Shuai, an expert in the retail e-commerce industry and founder of Bailian Consulting. Logistics and payments are industrial services that primarily support Taobao/Tmall and JD.com's respective e-commerce businesses, mutually promoting growth.

It can be said that this year's "Singles' Day" is the "most open in history," and may become a watershed moment for China's e-commerce and even the entire internet industry.

Industry insiders believe that as barriers between platforms gradually diminish, the competitive landscape in the e-commerce market may usher in a new round of adjustments; competition will increasingly focus on core elements such as product quality, price advantages, and service experience, rather than simply price wars. For consumers, this is undoubtedly good news, as it means they can find higher-value products and services among a wider range of options.

Zhuang Shuai also noted, "Large companies are already in a competitive stage within an existing market, each with a need for new growth and improved profitability. Rather than blindly competing, leveraging each other's strengths and complementary development is the correct approach."

It is undeniable that as low-price promotions become commonplace, consumers' novelty and excitement about "Singles' Day" are gradually waning.

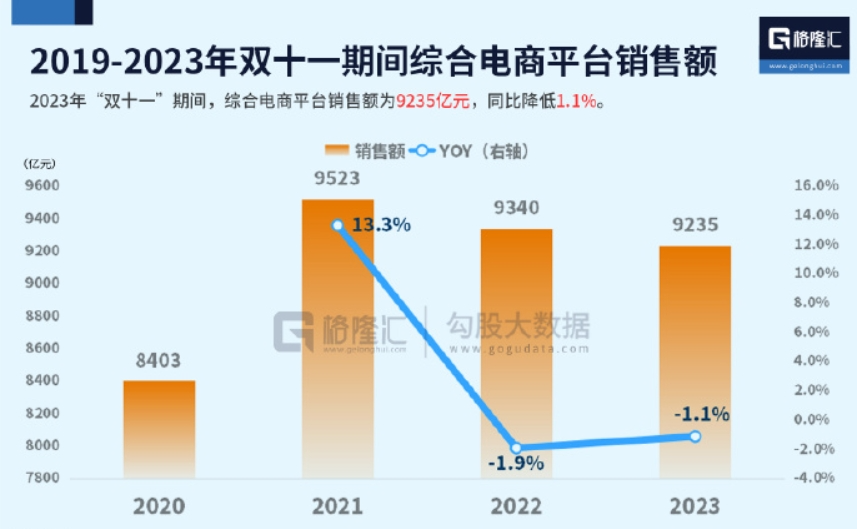

As low-price competition among e-commerce platforms intensified in 2023, "Singles' Day" directly sparked a climax of low-price competitions across the entire internet; however, even so, the overall transaction volume during this year's "Singles' Day" did not achieve significant growth.

Source: Gelonghui

By 2024, "Singles' Day" has reached another "crossroads."

Today, live e-commerce has long been the focus of "Singles' Day," with top livestreamers contributing significant GMV and acting as key traffic drivers.

However, after years of development, the spectacle of internet celebrities shouting in their livestreams has become less effective at opening consumers' wallets, and the live e-commerce industry is entering a new turning point. Especially on the eve of this year's "Singles' Day," several top livestreamers, including Sanzhiyang and Dongbeiyujie, encountered setbacks, leading to a severe "trust crisis" in the live e-commerce industry; how to sustain the healthy development of the live e-commerce ecosystem has become an urgent issue for the industry to address.

Source: Weibo screenshot

Not only are consumers beginning to "disenchant" with top livestreamers, but merchants and brands are also gradually losing their fascination with them.

"Live e-commerce has transitioned from an entertainment-focused model to a new stage of quality-driven livestreaming," said Yuan Yuan, General Manager of Taobao Live Store Broadcasting. A quality-driven livestreaming model that integrates professional anchors, branded product offerings, and high-quality platform services has become the mainstream in the industry.

In her view, the widespread "cooling off" of top livestreamers has made more and more merchants realize that the "pulse-style selling" approach is not sustainable in the long run, but rather to pursue more stable and long-term growth. "Both users and merchants should no longer overly pursue internet celebrity anchors for product promotion. While collaborating with top livestreamers can bring short-term business growth for merchants, it does not significantly contribute to user retention or long-term business growth," she said.

Source: Canstockphoto

For platforms, the entry of new anchors naturally means new growth, but for livestreaming anchors, the field is becoming increasingly crowded.

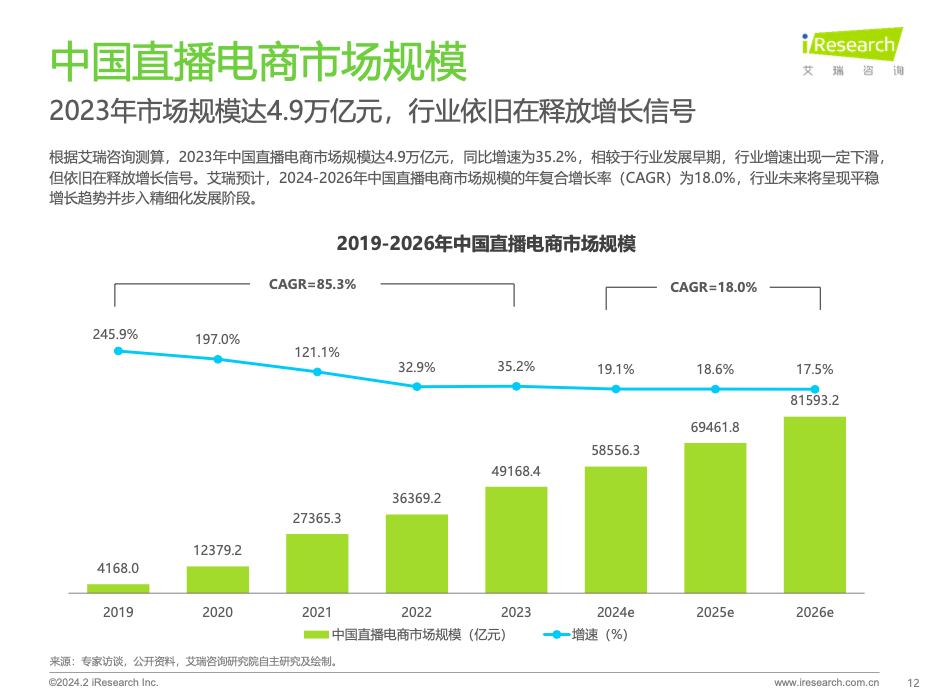

According to research data from iResearch Consulting, compared to the early stages of industry development, the growth rate of China's live e-commerce market is expected to decline between 2023 and 2026, with the industry entering a stage of stable growth and Refinement development in the future.

Source: iResearch Consulting Report Screenshot

At the same time, in recent years, both government and platform authorities have continuously regulated and governed the chaos in live streaming and livestreaming sales through laws, regulations, and platform rules. On the one hand, regulations such as the "E-Commerce Law" and the "Measures for the Administration of Online Live Streaming Marketing (Trial)" have clarified the rights and obligations of live e-commerce entities, providing a basis for governance according to law; on the other hand, relevant regulatory authorities have intensified law enforcement in the live e-commerce sector, punishing violators and enterprises in accordance with the law, creating a deterrent effect.

Faced with the "trust crisis" in the live e-commerce industry, the supervision of regulatory authorities and platforms, as well as the implementation of new policies, provide strong support for reshaping industry order.

Unlike previous years, which focused primarily on "low prices," e-commerce platforms have put significant effort into optimizing user experience this year.

Judging from the currently announced information, the 2024 "Singles' Day" campaign places more emphasis on balancing the interests of merchants and consumers. E-commerce platforms such as Taobao, JD.com, and Douyin have successively introduced policies to help merchants reduce costs and increase efficiency, thereby "competing for merchants"; at the same time, they protect user experience, shifting from a "price war" to a "service war."

Source: Canstockphoto

In terms of merchant support, JD.com has proposed to help more than double the number of small and micro-merchants with daily sales exceeding RMB 10,000 during "Singles' Day" compared to the previous year, while also increasing the number of merchants with sales exceeding RMB 5 million by more than 50% year-on-year; Tmall will provide free "pay later" services to all participating merchants during "Singles' Day," invest RMB 30 billion in consumption vouchers and red envelopes, and allocate RMB 10 billion in purchase traffic to attract customers for merchants; Douyin E-commerce has introduced a series of cost-reduction measures for merchant shipping insurance, reducing shipping insurance costs by 10%-40% for eligible merchants or influencers, potentially saving merchants over RMB 4 billion annually.

On the user side, Pinduoduo announced that its "buy expensive, must compensate" policy will be upgraded to "buy expensive, double compensate," effective two days after the official start of "Singles' Day"; Douyin E-commerce offers discounts of 15% off immediately, official price reductions, and other benefits, and the platform also introduces services such as "hassle-free returns and exchanges" for clothing, "authentication before shipment" for jewelry, "return for damage" for fresh produce, and "trade-in for old" for home appliances, allowing consumers to place orders with peace of mind.

In the view of Cao Lei, Director of the E-commerce Research Center at the Network Economy Institute, the introduction of various support policies by e-commerce platforms during "Singles' Day" is conducive to reducing merchants' operating costs, attracting small and medium-sized merchants to join, and thereby optimizing the platform ecosystem. For merchants, reduced operating burdens lead to improved service efficiency and increased exposure opportunities; for platforms, optimizing the merchant ecosystem and increasing merchant diversity provides more choices for consumers, indirectly enhancing the consumer experience.

Source: Douyin E-commerce

In addition, it is worth noting that as the domestic market enters a stage of stock competition, domestic e-commerce platforms have extended the "Singles' Day" battle to overseas markets.

AliExpress has launched its "RMB 10 billion subsidy" program for "Singles' Day" recruitment of overseas brands. According to "Qujiexieshangye," this is the first time that AliExpress's RMB 10 billion subsidy program has participated in "Singles' Day," providing brand merchants with exclusive fields and Certainty in going out to sea solutions.

In major overseas markets, "Singles' Day" has emerged as a new superstar, with various e-commerce platforms and retail enterprises, as well as industries such as payments and logistics, all engaging in heated competition during this period.

Taobao Global stated that during this year's "Singles' Day," its overseas shipping zones will be expanded to 10 locations; JD International, thanks to its direct procurement and self-operation model, a nationwide network of bonded warehouses, and efficient logistics network, promises that 80% of popular products can be delivered the next day, with direct mail services also available for products sourced directly from countries such as Japan, France, and the United States.

In fact, some foreign media have already referred to "Singles' Day" as a "large-scale social collaboration on a global scale."

In October 2019, the renowned American project management research magazine "PM Network" selected the "50 Most Influential Projects in the World," with the "Singles' Day Shopping Festival" ranking sixth alongside the Internet, Apollo Moon Landing, and the Human Genome Project. The magazine noted that this shopping spree fundamentally changed people's shopping habits, blurring the lines between shopping and entertainment.

Source: Weibo screenshot

Going forward, what homework do e-commerce platforms need to do to achieve new growth for their own "Singles' Day"?

Cao Lei mentioned that after-sales service has become one of the key factors distinguishing platforms. "A good word-of-mouth effect is crucial for e-commerce platforms, especially now that we are in a stage of stock market competition, where users drive traffic."

Sustainable growth for "Singles' Day" must be based on a deep understanding of the market and its evolution. The core of this competition goes beyond simple price wars; e-commerce platforms must prioritize the real needs of consumers and continuously optimize products and services to maintain the vitality and growth of "Singles' Day."