After two years of Quick Dog Taxi going public, Huolala is still striving for an IPO in Hong Kong

![]() 10/29 2024

10/29 2024

![]() 535

535

This article is written based on public information and is intended for information exchange only and does not constitute any investment advice.

Produced by | IPO Group, Corporate Research Lab

Two years after Quick Dog Taxi's listing in Hong Kong, Huolala, the 'big boss' in the urban logistics industry, is still working hard towards an IPO. On October 2, Huolala's parent company, Lala Technology, submitted its prospectus to the Hong Kong Stock Exchange for the fourth time.

In the first half of the year, Huolala continued the trend of turning losses into profits that began in 2023.

In the first half of 2024, Huolala generated revenue of US$710 million, a year-on-year increase of 18.2%; net profit was US$184 million, and adjusted net profit was US$213 million.

Behind Huolala's profitability lies the possible transfer of risks to drivers and the increase in driver membership fees and commissions.

Furthermore, over the past three years, Huolala's founder Zhou Shengfu has cashed out RMB 1.6 billion.

On the fourth submission to the Hong Kong Stock Exchange, founder Zhou Shengfu has already cashed out RMB 1.6 billion

In the domestic closed-loop freight market, Huolala holds an absolute leading position and continues to expand its lead.

According to Frost & Sullivan data, in terms of closed-loop freight GTV (Gross Transaction Value), Huolala's domestic logistics GTV was US$4.24 billion in the first half of 2024, with a market share of 66.6%, an increase of 5.6 percentage points from a year ago.

The second to fourth players in the domestic closed-loop freight industry are DiDi Freight, Fuyou Truck, and Quick Dog Taxi, with market shares of 9.9%, 7.3%, and 0.7% respectively, totaling 17.9%, far behind Huolala.

It is quite embarrassing that Quick Dog Taxi, with a market share far lower than Huolala, completed its IPO in Hong Kong as early as June 2022 and earned the title of the 'first urban freight company' listed in Hong Kong.

In fact, Huolala's IPO plans were not late.

In June 2021, foreign media reported that Huolala had secretly submitted a draft registration statement to the U.S. Securities and Exchange Commission, seeking to raise at least US$1 billion, but nothing came of it thereafter.

It was not until March 2023 that Huolala first submitted its listing application to the Hong Kong Stock Exchange. After three submissions and three failures, this is Huolala's fourth submission to the Hong Kong Stock Exchange, awaiting a hearing.

It is worth mentioning that from March 2021 to December 2022, Huolala's founder Zhou Shengfu transferred partial equity in Huolala to external parties, with transaction considerations of US$40 million, US$25 million, and US$100 million, respectively, totaling US$165 million.

In February 2023, Huolala repurchased 1.14 million ordinary shares from Zhou Shengfu at a price of US$57.57 per share, for a total value of approximately US$65.72 million.

Based on this calculation, Zhou Shengfu has "cashed out" approximately US$231 million, equivalent to approximately RMB 1.63 billion.

Increasing commission rates on members to improve monetization, achieving profitability in 2023

From a performance perspective, during the reporting period, Huolala's revenue grew steadily and achieved full-year profitability for the first time in 2023.

From 2021 to 2023, Huolala's revenue was US$850 million, US$1.04 billion, and US$1.33 billion, respectively, with a compound annual growth rate of 25.6%; net profit was -US$2.09 billion, -US$90 million, and US$970 million, respectively.

In the first half of 2024, Huolala generated revenue of US$710 million, a year-on-year increase of 18.2%; net profit was US$184 million, compared to -US$32.997 million in the same period in 2023.

One of the main reasons for Huolala's turnaround is the adjustment of its monetization model.

Previously, according to LatePost, Huolala's membership system has undergone three adjustments since 2016, evolving from no commissions to partial commission exemptions, and finally to all members participating in commissions in 2021. These changes have reduced driver income.

Under the mixed monetization model, the higher the membership level, the lower the corresponding commission rate.

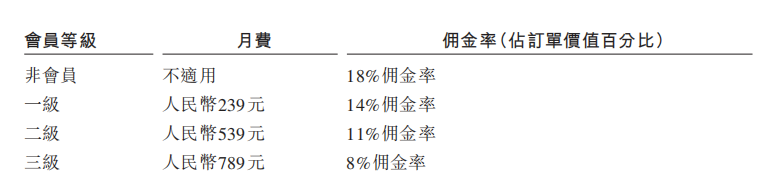

Taking Shenzhen as an example, at the end of 2022, Huolala offered three membership levels to drivers in Shenzhen, with monthly fees of US$189, US$489, and US$739, respectively, corresponding to commission rates of 14%, 11%, and 8%, respectively. Non-members faced a commission rate of 18%.

After switching to the mixed monetization model in 2021, Huolala's revenue structure changed significantly, with a decline in the proportion of membership fees and an increase in the proportion of commission income, leading to a substantial improvement in monetization rates.

From 2021 to 2023, Huolala's commission income ratio increased from 5.7% to 33.3%, while the proportion of membership fees declined from 42.1% to 24.4%. The monetization rate of domestic freight platform services increased from 7.6% to 10.3%.

Regarding the change in monetization model, Huolala stated that generating revenue through a combination of driver membership fees and commissions enables the company to effectively convert GTV growth into revenue growth and offers drivers different membership and commission rate options to maximize their earning potential.

While increasing revenue and monetization rates, Huolala is also committed to reducing expenses.

From 2021 to 2023, Huolala's sales and marketing expenses were US$674 million, US$198 million, and US$179 million, respectively, with sales and marketing expense ratios of 79.7%, 19.1%, and 13.4%, respectively, all showing significant declines.

Huolala's sales expenses are primarily subsidies to consumers and drivers. While charging commissions from drivers, Huolala has reduced subsidies to them.

It is difficult to confirm whether drivers' profits have been maximized, but the platform has achieved profitability through this approach.

Lack of strict supervision over overloaded orders, shifting risks to drivers

Balancing the relationship between the platform and drivers is a long-standing challenge for Huolala and a key area of regulatory focus.

In November 2022, Huolala drivers spontaneously stopped accepting orders for three days, attracting widespread social attention. The fuse was lit by Huolala's lowering of freight rates, but the underlying, long-standing contradiction was the gradual increase in commissions, leading to reduced driver income.

In November 2023, at a regular press conference held by the Ministry of Transport, relevant officials mentioned the need to "urge major internet road freight platform enterprises such as Manbang Group, Huolala, Quick Dog Taxi, and DiDi Freight to reduce excessive commission rates or membership fee caps."

In April 2024, Quick Dog Taxi announced that it would reduce the maximum commission rate for drivers on its platform in Beijing from 16% to 10%, with the commission rate for drivers with top service quality rankings further reduced to 8%, making it the first urban freight company to reduce its maximum commission rate this year.

In the first half of 2024, Huolala's freight platform service monetization rate was 9.7%, a decrease of 0.6 percentage points year-on-year. Huolala attributed this in part to the company's strategic adjustment of fees charged to a small number of drivers to strengthen cooperation with them.

Judging from Huolala's explanation, the platform has not made large-scale or regional concessions.

Taking Shenzhen as an example, at the end of 2023, Huolala maintained the same commission rates for non-members and members of different levels in Shenzhen, but increased the monthly membership fees for all levels by RMB 50, with the membership fees for each level changing to RMB 239, RMB 539, and RMB 789, respectively, and remaining at these levels until the end of June 2024.

The conflict between Huolala and drivers is not limited to commissions but also involves the platform shifting risks.

In June 2024, according to a report by China National Radio, many freight drivers complained about overloading issues on freight platforms such as Huolala and Manbang's Yunmanman.

For example, the Huolala platform specifies a permitted load capacity of 1.5 to 2 tons for a 4.2-meter medium-sized truck. However, some shippers choose to load more than 10 tons of cargo into this type of vehicle, and the platform does not effectively regulate this.

What puzzles drivers even more is that when they choose to reject overloaded orders, the freight platform deducts "behavior points" from their accounts.

After the report was broadcast, Huolala stated that it would verify each overloaded case and correct any misjudged overloaded orders, restoring behavior points for drivers.

For the freight industry, nothing is more important than safety. By violating drivers' interests and ignoring their safety, the platform will pay a higher price in the event of an accident.

For Huolala, maintaining a healthy triangular relationship among drivers, users, and the platform is crucial for sustainable development.