"ByteDance can't jump anymore, and its boss is now China's richest man

![]() 10/30 2024

10/30 2024

![]() 484

484

From the perspective of its "original sin", Zhang Yiming's first pot of gold and the exponential growth of his assets afterward do not seem to carry a mysterious aura that "should not be shared with outsiders." However, identifying Zhang Yiming's "weaknesses" is not particularly difficult.

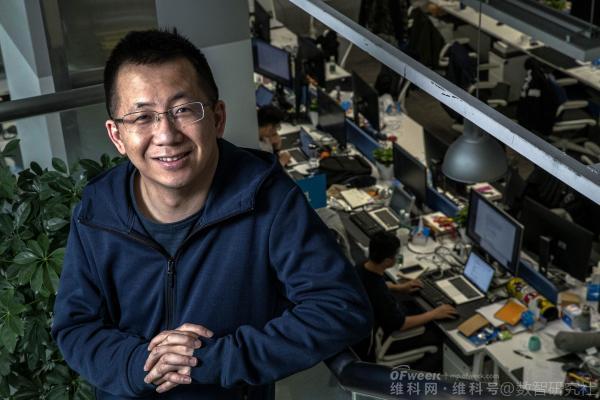

ByteDance, which seems unable to "jump" anymore, experienced a double decline in revenue and net profit in the first three quarters of 2024. It faces challenges such as slowing domestic advertising revenue growth, the emerging impact of geopolitics on TikTok's revenue, and the early high-investment stage of the large model industry, with no short-term returns in sight. Nevertheless, these factors did not prevent ByteDance's founder Zhang Yiming from ascending to the throne of China's richest man.

The Hurun China Rich List, recently released by Hurun Research Institute, shows that Zhang Yiming, with a personal fortune of 350 billion yuan, has surpassed Nongfu Spring founder Zhong Shanshan to become China's richest man for the first time.

However, on both the Bloomberg Billionaires Index and the Forbes Real-Time Billionaires List, Zhong Shanshan remains China's richest man, followed by Pony Ma, Zhang Yiming, and Colin Huang, among others.

In fact, due to significant fluctuations in the capital market between August and October 2024, there were several changes in who topped the lists of China's richest individuals on both Bloomberg and Forbes. On the Forbes Real-Time Billionaires List, Zhang Yiming briefly ascended to the throne of China's richest man in mid-September. However, with the rebound of Chinese stocks at the end of September, Zhang Yiming's first stint as China's richest man lasted only half a month.

ByteDance can't jump anymore

ByteDance boasts star products such as Douyin (TikTok's Chinese counterpart), TikTok, and Toutiao, with Douyin still expanding rapidly in e-commerce and local services, now becoming ByteDance's largest source of revenue. Overseas, ByteDance focuses on TikTok as its core business, while also expanding into gaming and enterprise services.

In recent years, as internal and external environments have changed, ByteDance has faced increasing pressure from both domestic and international markets. In the domestic market, established competitors have relentlessly pursued ByteDance in short video and live streaming, while Meituan poses a threat in local services. In e-commerce, ByteDance must contend with Alibaba, JD.com, and Pinduoduo.

In the first three quarters of 2024, ByteDance's quarterly advertising revenue growth in China slowed from around 40% to less than 17%. Over the past two quarters, ByteDance has also failed to meet its Objectives and Key Results (OKR). In terms of Douyin e-commerce, sales growth declined from over 60% at the beginning of the year to less than 20% in September.

To combat slowing advertising revenue growth, ByteDance has increased subsidies to merchants to stimulate enthusiasm for advertising. Since 2024, Jumei Engine has invested over 10 billion yuan in merchant subsidies, with subsidies across the entire platform exceeding 30 billion yuan. However, despite the subsidies, growth has not accelerated, instead increasing business costs.

In the popular large model sector, ByteDance's Doubao faced significant losses of around $5 billion in 2024. In the highly competitive domestic large model sector, Doubao's hard costs may reach $8.5 billion in 2024. To maintain market share and industry position, continued "burning money" is necessary in the large model sector.

Domestic operations face growth bottlenecks. Looking overseas, TikTok stands out as the brightest star. In terms of monthly active users (MAU), TikTok's MAU surged from over 55 million in January 2018 to 700 million in July 2020 and currently stands at over 1.5 billion.

Behind the impressive MAU figures lies a consistently high download rate. In the first half of 2024, TikTok was downloaded 488 million times, the second-highest download volume since its launch in May 2017. Currently, TikTok has been downloaded over 5 billion times in total. In the United States, Thailand, Japan, and various Western European countries, TikTok consistently ranks first in downloads.

Behind TikTok's success lies geopolitical risks. On August 14, 2020, then-U.S. President Donald Trump "ordered ByteDance to sell or divest its TikTok operations in the United States within 90 days." In early September, TikTok had selected buyers for its operations in the United States, New Zealand, and Australia, with potential deals valued at around $20-30 billion, involving buyers such as Microsoft, Walmart, and Oracle. However, in June 2021, after Joe Biden became president, he rescinded Trump's ban on TikTok. While TikTok has not been banned in the United States, this uncertainty affects the expectations of TikTok's merchants and advertisers. In terms of performance, advertising revenue was revised downward from $12 billion to around $10 billion in 2022. In the first three quarters of 2024, TikTok's e-commerce gross merchandise volume (GMV) fell short of expectations for several consecutive months.

With slowing advertising revenue growth, heightened geopolitical risks, and substantial investments in large models, ByteDance's revenue and net profit growth have once again entered a downward channel. This slowdown has also impacted ByteDance's valuation.

Numerai Research found that ByteDance's valuation in private equity markets was approximately $400 billion in 2021. In 2022, its valuation dropped to $300 billion, and in 2023, it fell further to $223.5 billion.

Being the richest man is not easy

If it weren't for Nongfu Spring founder Zhong Shanshan's involvement in Wahaha's Zong Qinghou "death hoax" in the first half of the year, which significantly impacted sales and share prices, it would have been uncertain who would be China's richest man in 2024. To date, Nongfu Spring's share price has declined by over 33% in 2024, leading to a 24% decrease in Zhong Shanshan's fortune on the Hurun Rich List.

After experiencing online backlash, Zhong Shanshan no longer cherishes the title of China's richest man, which has become a "hot potato." According to Numerai Research, becoming the richest man in China necessitates accepting scrutiny from all aspects of society regarding one's identity, personality, and more. Naturally, this scrutiny is magnified exponentially in the mobile internet era.

Furthermore, the title of "China's richest man" has become synonymous with stirring up controversy, creating divisions, and causing trouble. Especially in an environment of contracting demand, supply shocks, and weakened expectations, stories of countercyclical wealth growth elicit envy. Ordinary business actions and life experiences can easily be distorted under negative sentiments, triggering controversies and putting the "richest man" in the spotlight.

Zhong Shanshan, who has been China's richest man for four consecutive years, understands this all too well.

Before Zhong Shanshan, several previous richest men in China have provided negative examples to the market. Today, Xu Jiayin, who is currently imprisoned, was China's richest man in 2017. Perhaps the belief in the curse of being China's richest man began with him.

For Zhang Yiming, his stint as China's richest man is also not easy. Although his first pot of gold and subsequent exponential asset growth do not seem mysterious from an "original sin" perspective, identifying his "weaknesses" is not difficult.

Online, Zhang Yiming is not only the founder of ByteDance and China's newest richest man but also labeled as "the world's largest drug lord." According to some analyses, the drug market has evolved from physical stimulation to mental control, with short video products like TikTok, represented by Douyin, completely captivating the minds of teenagers.

Nonetheless, despite the challenges, Zhang Yiming must still strive to be the best he can be. In the business world, people inherently have high expectations of the richest man, which is understandable. However, for ByteDance at present, both domestic and international operations face varying degrees of growth bottlenecks and troubles.