The cheapest chip stock Yingfang Micro's hopes for a turnaround were dashed by an insider traitor

![]() 10/30 2024

10/30 2024

![]() 638

638

On October 29, Yingfang Micro, affectionately known by investors as the "cheapest chip stock," held an online "investor briefing on the termination of a significant asset reorganization." At the meeting, the company responded to questions from investors regarding the "latest developments in the suspected insider leak case" and "the reasons behind multiple planned acquisitions and whether the acquisition plans would be restarted."

Two years ago, in August 2022, Yingfang Micro pledged to actively pursue measures to acquire a 49% stake in Shenzhen Huaxinke Technology Co., Ltd. (hereinafter referred to as "Huaxinke") and a 49% stake in WORLD STYLE TECHNOLOGY HOLDINGS LIMITED (hereinafter referred to as "World Style"). On October 25, 2024, the company held a board meeting to terminate this significant asset reorganization.

In recent years, acquiring Huaxinke and World Style has been seen as crucial to Yingfang Micro's sustained profitability. Now, with the termination of this acquisition, investors' hopes have once again been dashed.

01

Three Failed Attempts to Acquire Remaining Shares of Target Companies

On October 25, Yingfang Micro announced that the board of directors had approved the termination of the issuance of shares to purchase assets and raise supporting funds, as well as related transactions.

According to the disclosure, this transaction referred to Yingfang Micro's original plan to acquire a combined 49% stake in both Huaxinke and World Style from Shaoxing Shangyu Yuxin Equity Investment Partnership (Limited Partnership) and Shanghai Ruichen Communication Equipment Partnership (Limited Partnership) through the issuance of shares and cash payments. Simultaneously, the company planned to raise supporting funds by issuing shares to up to 35 specific targets, including Zhejiang Shunyuan Enterprise Management Co., Ltd. (hereinafter referred to as "Zhejiang Shunyuan").

However, the personnel involved in this reorganization were issued a "Case Notification" by the China Securities Regulatory Commission (CSRC) for suspected insider trading. As the case is still pending, the reorganization was subsequently terminated.

This was not Yingfang Micro's first attempt to acquire Huaxinke and World Style. As early as September 2020, it acquired a 51% stake in Huaxinke and a 51% stake in World Style through its wholly-owned subsidiary, making them its subsidiaries.

This move helped Yingfang Micro turn a profit and regain its listing status after a series of losses.

Encouraged by this success, Yingfang Micro launched three consecutive acquisition attempts for the remaining shares of the targets in subsequent years.

In April 2021 and at the end of November 2021, Yingfang Micro attempted to acquire the remaining shares of the targets twice, but both attempts failed.

The first failure was due to the Mergers and Acquisitions Restructuring Committee's belief that Yingfang Micro had not adequately demonstrated that the transaction would not harm the legitimate rights and interests of shareholders of the listed company. The second failure was due to Yingfang Micro's voluntary termination of the transaction due to the lengthy process and changing economic environment.

In early November 2023, Yingfang Micro launched its third acquisition attempt, which also ended in failure, leading to the situation described at the beginning of this article.

Regarding the failure of this reorganization, Yingfang Micro stated that Huaxinke and World Style are subsidiaries consolidated in the company's financial statements, and the acquisition of their remaining equity would not directly affect the company's consolidated revenue.

Regarding whether the company can turn a profit this year after terminating the significant asset reorganization, Yingfang Micro stated that it would "actively expand downstream customers and improve overall operational capabilities."

However, this response failed to convince investors. Especially considering the company's recent performance and the contribution of its main business, Yingfang Micro has not yet given the outside world hope for sustainable growth.

02

Persistent Violations and Losses

Financial reports show that in the first three quarters of 2024, Yingfang Micro achieved revenue of 2.927 billion yuan, an increase of 24.16% year-on-year, but suffered a net loss of 37 million yuan, a decrease of 3.91% year-on-year. Specifically, the company achieved revenue of 1.083 billion yuan in the third quarter, an increase of 16.43% year-on-year, but suffered a net loss of 14 million yuan, a significant decrease of 114.18% year-on-year.

Not only did revenue fail to translate into profits, but losses actually intensified. Yingfang Micro did not disclose the specific reasons for this in its financial reports. In fact, losses have long been a persistent issue for Yingfang Micro.

As an established A-share listed company, Yingfang Micro's predecessor was Tianfa Shares, which was listed in 1996. At that time, its main business included liquefied petroleum gas, oil products, and automobile sales.

From 2001 to 2002, Tianfa was placed under delisting risk warning due to consecutive losses for two years. Fortunately, it managed to turn a profit in 2003. However, this respite was short-lived, as Tianfa incurred losses for three consecutive years from 2004 to 2006 and was suspended from trading in May 2007. In the same year, the company's actual controller Gong Jialong was placed under criminal investigation for alleged job encroachment, misappropriation of funds, and loan fraud, leading creditors to apply for asset reorganization of Tianfa.

At this time, Chen Yantiao's Shanghai Shunyuan Enterprise Investment Development Co., Ltd. acquired 70.7483 million shares of Tianfa through judicial auction, becoming the new controlling shareholder and renaming the company "Shunyuan Real Estate Development Co., Ltd.," with its main business shifting to real estate development and operation.

In December 2012, the renamed Tianfa regained its listing status.

Chen Yantiao's involvement failed to turn the tide. In 2014, the company initiated share reform, which was completed with Yingfang Microelectronics becoming the new controlling shareholder and Chen Zhicheng succeeding Chen Yantiao as the new actual controller. The company's securities abbreviation was changed to "Yingfang Micro," and its main business shifted from real estate development to chip-related businesses.

Under Chen Zhicheng's leadership, Yingfang Micro continued to struggle with persistent losses. According to Wind data, from 2015 to 2019, Yingfang Micro achieved net profits of -12 million yuan, 23 million yuan, -315 million yuan, -170 million yuan, and -206 million yuan, respectively, totaling a loss of 703 million yuan over five years.

In 2018, Chen Zhicheng was arrested on suspicion of bill fraud, and his shares in the listed company were auctioned off. One of the buyers was Zhejiang Shunyuan, whose shareholding ratio increased to 14.7%, making it Yingfang Micro's new largest shareholder. According to Tianyancha, Zhejiang Shunyuan is the holding company of former Chairman Chen Yantiao.

However, Zhejiang Shunyuan is not the controlling shareholder, and Yingfang Micro has since been in a state without a controlling shareholder or actual controller. Due to consecutive losses from 2017 to 2019, Yingfang Micro was once again suspended from trading in April 2020.

During this period, Zhejiang Shunyuan, as the largest shareholder, worked tirelessly to get Yingfang Micro back on track. One of the most crucial initiatives was the acquisition of 51% stakes in both Huaxinke and World Style, which became new pillars of Yingfang Micro's performance and helped the company return to profitability.

Financial reports show that from 2020 to 2022, Yingfang Micro achieved net profits of 10.1193 million yuan, 3.2377 million yuan, and 14.9047 million yuan, respectively, marking three consecutive years of positive net profits. In August 2022, with the help of the acquired targets' performance, Yingfang Micro regained its listing status.

However, similar to the first scenario, Yingfang Micro's performance quickly deteriorated after regaining its listing status. In 2023, the company suffered a net loss of 60.0575 million yuan, a significant decrease of 502.94% year-on-year.

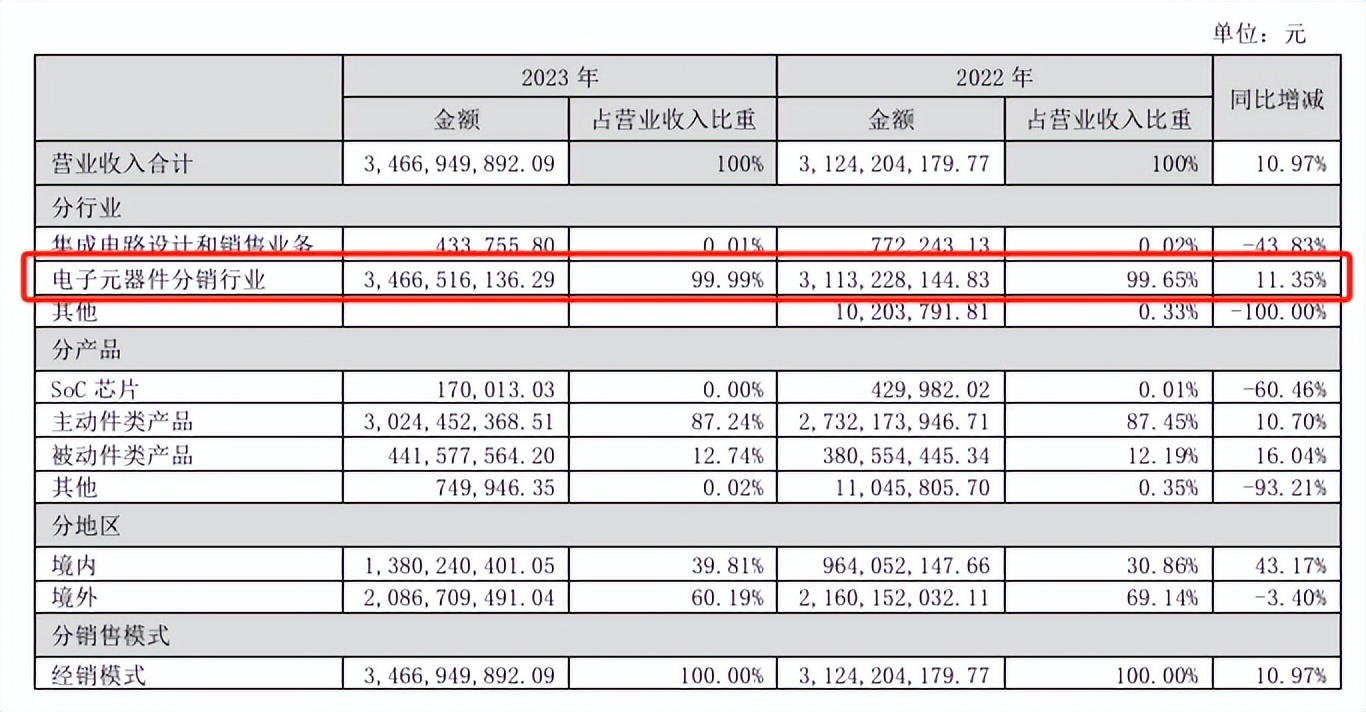

In terms of business segments, Yingfang Micro is primarily divided into two sectors: integrated circuit design and sales, as well as electronic component distribution. In 2023, the company's electronic component distribution business generated revenue of 3.467 billion yuan, accounting for 99.99% of total revenue. This proportion was similarly high at 99.6% in 2022.

Image source: Yingfang Micro's 2023 Annual Report

According to disclosures, Yingfang Micro's electronic component distribution business is primarily driven by the acquired Huaxinke and World Style. These two companies have established long-term and close partnerships with many large and well-known suppliers and customers, such as Goodix, Samsung Electro-Mechanics, Xiaomi, O-Film Tech, and Longqi Technology.

In other words, Yingfang Micro's growth potential is closely tied to Huaxinke and World Style.

Now, with the reorganization hopes dashed once again, combined with its heavy reliance on the electronic component distribution business, lack of core R&D capabilities, and persistent losses, Yingfang Micro faces the risk of a third "suspension of trading."

In response to inquiries from Yuanmedia regarding the forced termination of the significant asset reorganization due to suspected insider trading by company personnel, as well as frequent violations and perennial losses, Yingfang Micro had not responded as of press time.