Market value shrinks, profits decline, and executives are leaving in droves. Is Wondershare still worth looking forward to?

![]() 10/30 2024

10/30 2024

![]() 529

529

Author: Sifanxing

Source: Bowang Finance

AI is the latest trend, and the hype is intense.

In the past three years, AI stocks in the U.S. stock market have soared, with the share prices of AI companies like NVIDIA increasing by tens of times. Microsoft and NVIDIA have both surpassed a market value of USD 3 trillion. Similarly, in China, the technology-related sectors in the A-share market have also surged ahead, with stocks like Kunlun Tech and Wondershare experiencing meteoric rises. According to iFinD data, Wondershare's share price surged from less than RMB 30 per share at the end of 2022 to a high of RMB 172.1 per share, marking an increase of over 450%.

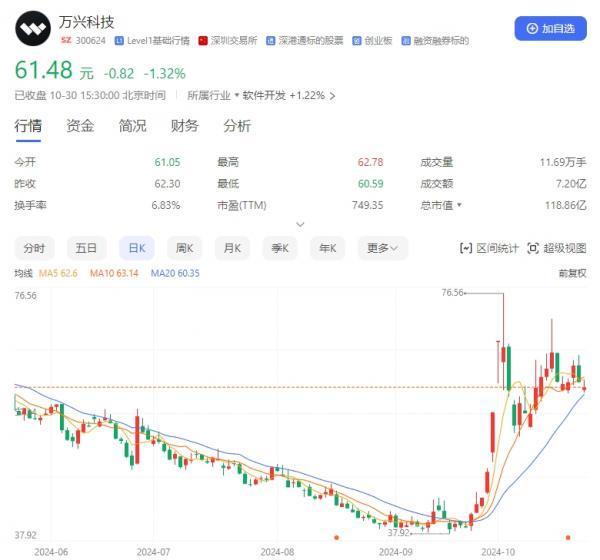

However, speculative hype eventually fades. From mid-2023 to mid-September 2024, Wondershare's share price plummeted from a high of RMB 123.06 per share to RMB 37.92 per share, a decline of over 65%, and its market value evaporated by more than RMB 16 billion. As of the close on October 29, the share price was RMB 62.3 per share, with a market value of RMB 12.045 billion, still nearly half its peak value.

According to the third-quarter report for 2024, Wondershare's basic earnings per share were -RMB 0.03, and its weighted average return on equity was -0.42%. While share price fluctuations can be influenced by sentiment in the short term, for a listed company, performance is the ultimate test of its share price over the long term. Can Wondershare truly withstand the perpetual test of the market?

01

Performance under pressure, gross margin declines, and selling expenses continue to rise

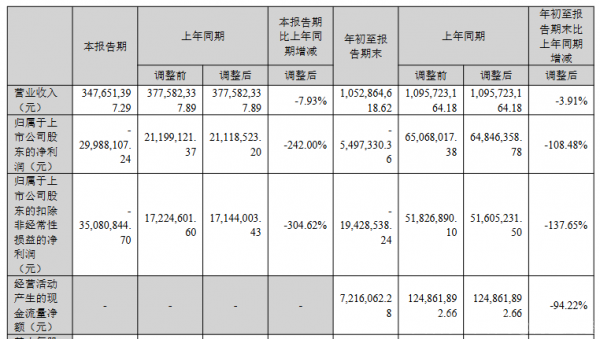

On October 25, Wondershare released its third-quarter report, reporting revenue of RMB 1.05 billion for the first three quarters, down 3.9% year-on-year, and net profit attributable to shareholders of -RMB 5.497 million, down 108.5% year-on-year. Deducting non-recurring items, net profit was -RMB 19.429 million, down 137.7% year-on-year.

Meanwhile, revenue for the third quarter was RMB 350 million, down 7.9% year-on-year, with net profit attributable to shareholders of -RMB 29.988 million, down 242.0% year-on-year. Deducting non-recurring items, net profit was -RMB 35.081 million, down 304.6% year-on-year.

The company has swung from profitability to losses, with significant declines in performance and weak growth potential. Wondershare attributed this to declining gross margins and increased R&D investments.

Financial reports show that the company's gross margin for the first three quarters was 93.7%, a decrease of 1.5% year-on-year. According to iFinD data, there are around 20 listed companies in the A-share market with gross margins exceeding that of Kweichow Moutai, most of which are pharmaceutical companies, followed by a small number of IT companies, including Wondershare.

Despite having a higher gross margin than Kweichow Moutai, Wondershare is not profitable and is instead mired in losses. The essence of this lies in the rising marketing costs, with massive advertising expenditures underlying its ultra-high gross margins. Coupled with intense market competition, the difficulty in acquiring traffic and promoting products has increased, and the rise in marketing investments has further compressed profit margins.

From Q3 2020 to Q3 2024, Wondershare's selling expenses accounted for 45.1%, 46.9%, 49.2%, 48.8%, and 53.1% of gross profit, respectively, indicating a sustained increase. In the first three quarters, the selling expense ratio, administrative expense ratio, and R&D expense ratio were 55.7%, 11.4%, and 29.1%, respectively, with a combined increase of 7.3% over the same period last year.

In comparison, the proportion of selling expenses to gross profit for the established office software company Kingsoft is only around 25%, with a significantly higher return on selling expenses than Wondershare. Thus, improving advertising effectiveness and reducing promotion costs have become top priorities for Wondershare going forward.

In fact, to date, over 90% of Wondershare's revenue comes from overseas markets. Due to its relatively low overseas recognition, the company relies heavily on Google Ads for marketing, requiring substantial promotion to reach users. This marketing approach fails to generate exponential growth, lacks independent and controllable channels, and has no substitutes. As the company expands and faces long-term suppression from Google against domestic enterprises, operational risks will further increase.

02

Homogenized competition, weak product competitiveness makes breakthrough challenging

A closer look reveals that the front-end product deficiencies are also significant constraints behind the weak marketing performance and declining gross margins.

Wondershare is the A-share listed company with the broadest product coverage, largest revenue, and highest degree of globalization in China's digital creative software sector, serving customers in over 200 countries and regions worldwide, with a cumulative global user base of over 1.5 billion. It considers itself the "Chinese version of Adobe."

According to its official website, Wondershare's main products are divided into four categories: video creation, graphic design, document creation, and utility tools. The product categories are relatively diverse, with core products including Filmora, Virbo, Wondershare Office Suite (PDF, flowcharts, design), and Wondershare Filmora Scrn.

In the past two years, the company has primarily focused on the video creation product market, with revenue accounting for around 64% of its total revenue. Its current flagship product, "Virbo," is positioned as an AIGC "real person" short video marketing tool for overseas markets. This is a video production tool based on AI digital human technology that can quickly create virtual humans with different appearances and product integrations in multiple languages and personas.

Filmora integrates with ChatGPT to generate video scripts with one click using its text generation capabilities. Mockplus is a tool for product design that connects demand analysis, product design, delivery, test cases, data analysis, and more. Additionally, there's EdrawMind...

Looking back at the history of internet development, from the text era to the image era and now the video era, the entire internet content ecosystem is evolving towards more advanced, efficient, and intelligent information carriers. The rise of emerging industries has provided opportunities for many companies to take off.

However, challenges coexist with opportunities. While Wondershare has a diverse range of products, most have not reached top-tier levels. To date, there are no breakout AI products. Overall, the software barriers are not very high, making it difficult to penetrate high-end markets and form a lasting impression in the market.

Furthermore, due to the low barrier to entry for short video tool development, a large number of homogenized apps have emerged in the market, turning the sector into a fiercely competitive red ocean. In the multimedia software market, Wondershare faces strong competition from companies like Adobe and CyberLink. With weak product competitiveness, the competitive pressure is significant.

03

Goodwill looming, operating cash flow down 94.22%

To expand its business portfolio, Wondershare has made several acquisitions. From 2019 to 2021, it strategically acquired EdrawMax, Mockplus, and Gexiang Technology, ultimately forming a multi-product matrix.

These acquisitions have also exposed the company to goodwill risks. In the third quarter, Wondershare's goodwill amounted to RMB 316 million, accounting for 24.8% of its net assets. Judging from the current financial statements, the acquired businesses have not significantly contributed to the company's performance, suggesting a high risk of goodwill impairment.

Additionally, the company's latest asset-liability ratio was 16.30%, an increase of 1.77 percentage points from the previous quarter and 0.46 percentage points from the same quarter last year.

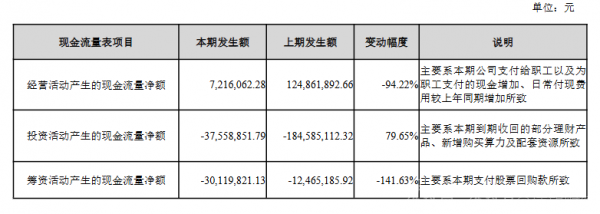

During the reporting period, the company's net cash inflow from operating activities was RMB 7.2161 million, a decrease of RMB 118 million or 94.22% from the same period last year.

Amid performance losses, the company's ability to generate cash flow is concerning, and financial risks are on the rise.

It is worth mentioning that as early as 2023, controlling shareholder Wu Taibing aggressively reduced his shareholdings when the share price was high. According to statistics, throughout 2023, Wu Taibing and his concerted action persons, such as Suqian Xingyi and Suqian Jiaxing, reduced their shareholdings and cashed out more than RMB 583 million. Furthermore, since 2024, several core executives, including Vice President and Chief Financial Officer Sun Chun, and Directors and Audit Committee Members Zhu Wei, have resigned from Wondershare.

From an expectations perspective, the frequent turnover of core management and the controlling shareholder's pessimistic attitude towards the company's development prospects have cast a shadow over Wondershare's future.

END

Catching the trend does not automatically guarantee success. From the beginning, there have been voices in the market questioning whether Wondershare is merely riding the AI hype wave and that its actual value does not match its share price and valuation. Whether it will succumb to the trend, stumble, or find a balance and prove its worth amidst the AI boom remains to be seen. The test continues.