Transsion's Performance Plummets! Can AI Help the 'King of Africa' Regain Its Glory?

![]() 11/01 2024

11/01 2024

![]() 594

594

When asked which Android phone brand is the 'king of the domestic market,' different users will give different answers. But when it comes to which phone brand is the 'king of the African market,' there is likely to be only one answer in everyone's mind - Transsion.

In 2006, Transsion entered the African market. With keen market insight and precise cost control, it quickly won the favor of local consumers through its deep localization strategy. In 2008, it launched its sub-brands TECNO, itel, and Infinix, which quickly occupied the market with high cost-effectiveness and features tailored to local needs, such as ultra-long standby time, night shooting optimization, and multi-SIM card support.

By 2014, Transsion's market share in major African countries such as Nigeria and Kenya had significantly increased, gradually consolidating its leading position in Africa. In 2017, Transsion successfully topped the African market, becoming the leader in the mobile phone market of multiple African countries, with a market share exceeding 50% in Nigeria, making it the 'king of the African market'.

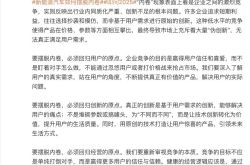

Image source: Leitech

However, in 2024, Transsion seems to be in trouble.

In 2024, Transsion Holdings experienced significant fluctuations in performance. Its performance at the beginning of the year was quite impressive, especially with substantial growth in revenue and profit in the first quarter, demonstrating its vitality in emerging markets such as Africa. However, by the third quarter, the company's revenue began to decline, with net profit decreasing by more than 40% year-on-year, and cash flow also under significant pressure. This trend indicates that despite Transsion's achievements in market expansion, its profitability has been affected by rising supply chain costs and fierce competition.

Are African brothers reluctant to buy new phones?

Reviewing Transsion's development journey, Transsion Holdings has been deeply rooted in emerging markets in Africa for many years, with its revenue structure highly dependent on this market. Its brands TECNO, itel, and Infinix have dominated multiple African countries. The 2024 financial report shows that Transsion's revenue in the African market remains stable, but it is highly susceptible to local economic fluctuations.

Image source: Leitech

Transsion's revenue structure shows that although the company has been deeply rooted in the African market for many years, establishing a strong brand influence and extensive distribution channels, its sales revenue is inevitably affected during economic turmoil. According to the third-quarter financial report, Transsion's revenue decreased by 7.22% year-on-year, and its profits dropped by 41.02%, revealing the direct impact of declining purchasing power in the African market on its sales.

Additionally, rising supply chain costs have also had a certain impact on Transsion's revenue. However, it would be unfair to blame all of Transsion's poor performance on external conditions. In the third-quarter financial report, Transsion also acknowledged that its performance changes were affected by market competition.

Different mobile phone markets, same internal competition

Setting aside external factors such as costs and exchange rate fluctuations, we can also uncover some issues from the 2024 African smartphone shipment volume and annual growth rate.

Starting from the first quarter of 2024, Transsion's market share in the African smartphone market has declined from 54% in 2023 to 51% in 2024. Although this is still a relatively high market share, the downward trend indicates that competitors' strategies and products are eroding Transsion's market base. As more brands enter the African market, coupled with their investments in channels and brand recognition, Transsion's position in Africa may face real challenges.

First, international brands such as Samsung, Xiaomi, and Huawei have increased their investments in emerging markets over the years. According to Canalys data, in the second quarter of 2024, Transsion's share of the African smartphone market was 51%, a year-on-year decrease of 3 percentage points. During the same period, Xiaomi's market share increased to 12%, a year-on-year increase of 45%, while realme and OPPO's market shares reached 5% and 4%, respectively, with growth rates of 137% and 39%.

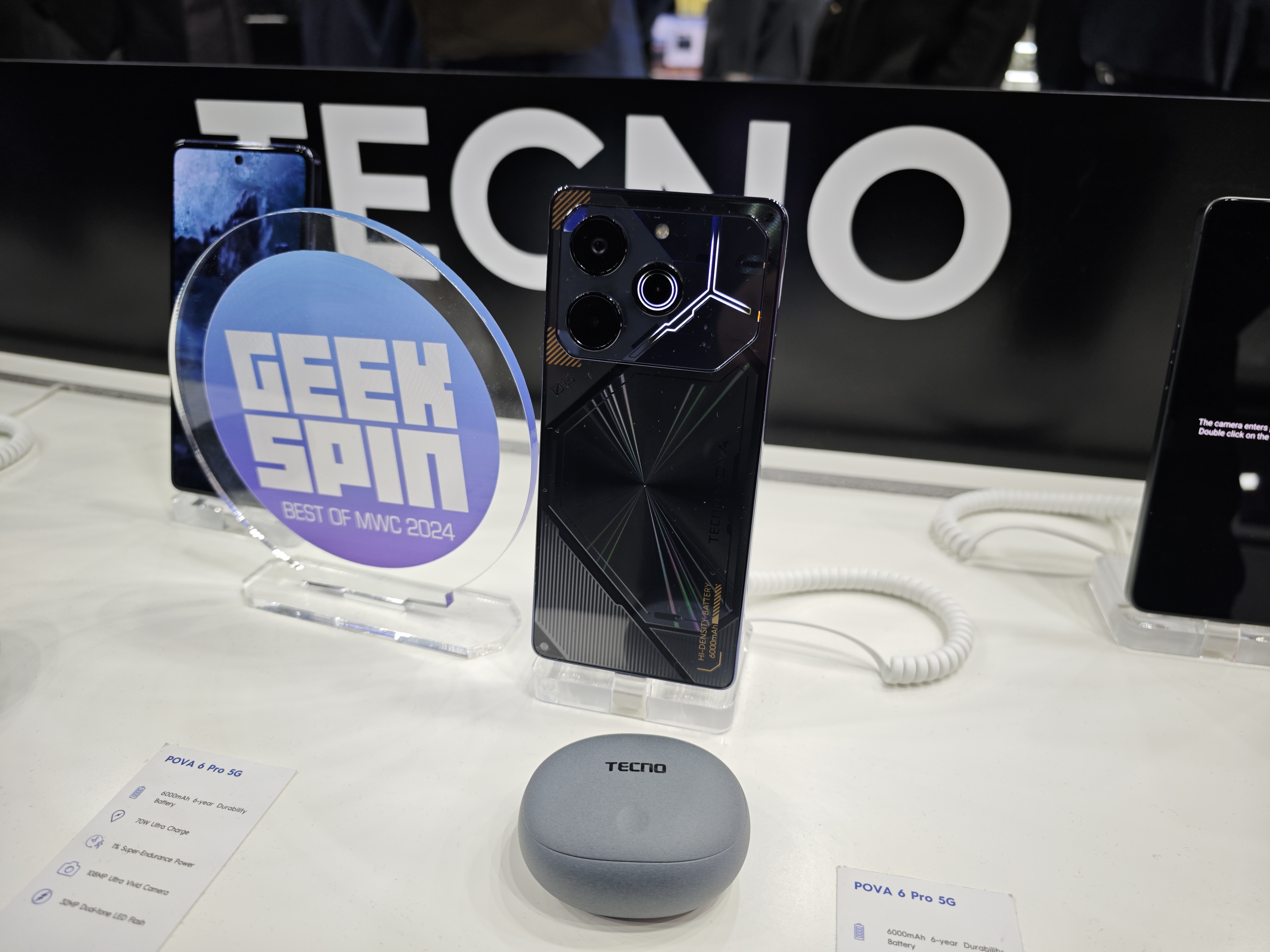

Image source: Counterpoint

In comparison, Transsion's performance appears somewhat 'mediocre.' The market's demand for smartphones has shifted from basic functions to higher performance and multi-functionality, opening up opportunities for Samsung and Xiaomi. Leveraging their technological advantages accumulated in the global market, these brands have met African consumers' increasing performance demands for smartphones, posing a substantial threat to Transsion.

Moreover, Transsion's cash flow situation also reflects the intensifying competitive pressure. The third-quarter financial report for 2024 shows that its net cash flow from operating activities decreased significantly by 89.1% year-on-year, indicating the company's financial pressure in market expansion, channel maintenance, and cost control. Unlike the US market, Transsion does not rely on operator sales networks in emerging markets like Africa.

Price competition in emerging markets and rising channel construction costs have put Transsion in a financial dilemma while maintaining its market share. Although Transsion's localization strategy in the African market helps solidify its market foundation, it needs more effective fund management to face fierce competition from international brands.

Meanwhile, Transsion's investments in AI and laptops have further increased profitability pressure. Betting on AI reflects Transsion's vision for the future. In the first half of 2023 alone, Transsion invested nearly 100 million yuan in AI, AIGC, and other projects. Despite targeting the lower market, Transsion has invested considerable costs in research and development. These high R&D costs are also reflected in Transsion's cash flow and performance.

In the new round of AI mobile phone competition, does Transsion still have a chance?

Market research firm IDC mentioned in its 'AI Mobile Phone White Paper' that with the establishment of the AI mobile phone concept, 2024 will usher in the first wave of phone replacement trends.

Image source: Leitech

At the MWC24 exhibition, Transsion collaborated with MediaTek to launch the AIOS system. Besides the common generative AI assistant, Transsion also introduced AI-enhanced photography, utilizing large models to accurately identify different skin tones while providing sufficient optimization suggestions. Furthermore, Transsion will introduce flagship-level gaming technology, optimizing game scenarios with AI.

In fact, Transsion has learned from mobile phone competition in the Chinese market, focusing on areas such as imaging, AI, and game optimization, which are common in the Chinese market. However, as Transsion focuses on the international market, most Chinese mobile phone brands that venture abroad struggle with 'acclimatization' due to various reasons, making it difficult to perfectly apply the Chinese market model in the international market, leaving ample room for development for Transsion.

Facing declining performance and intensifying market competition, Transsion Holdings is at a critical turning point. Although it has long dominated the African market, the 2024 financial report shows that the company faces challenges in both revenue and profit.

Transsion's 'competition' signifies that the global smartphone market will usher in the next round of competition, especially in the mid-range segment. The era of 'high prices with low configurations' may soon come to an end. Models without exceptional performance, excellent software optimization, and AI large models will no longer be favored by consumers. The global layout plan of the TECNO CAMON 30 series also demonstrates that Transsion is well-prepared for this battle, awaiting the moment to commence.

For Transsion, challenges and opportunities coexist. As long as it stays confident, dares to innovate, and seizes the opportunities of the AI era, Transsion is expected to achieve new breakthroughs in the global market and continue to lead the development direction of smartphones in Africa and beyond. The future story of Transsion is worth waiting for.

Source: Leitech