Consumers can't afford domestic phones, yet manufacturers claim they're not making money. Where is the money going?

![]() 11/03 2024

11/03 2024

![]() 715

715

Recently, multiple domestic mobile phone brands have released new flagship models, with prices generally exceeding 4000 yuan. This has left domestic consumers lamenting that they used to avoid domestic phones but now can't afford them. Despite this, domestic phone manufacturers still claim they're not making money. So, where is the money going?

1. It's hard to justify that domestic phones aren't profitable

Early flagship domestic phones were priced as low as 1999 yuan, but now they commonly cost 4499 yuan, more than doubling in price. This significant increase has dissatisfied domestic consumers.

Manufacturers commonly blame rising chip prices for their inability to turn a profit. However, when phones were priced at 1999 yuan, Qualcomm chips cost 300 yuan, leaving the company with a profit and other component costs totaling around 1699 yuan. Today, although Qualcomm chips have risen to 1700 yuan, the company's profit and other component costs still total 2499 yuan, an increase of 50%.

The development of the domestic phone supply chain is also helping reduce costs. It can now produce OLED screens, memory, cameras, etc., effectively lowering component costs. For example, a Texas Instruments analog chip once sold for 70 yuan, but domestic production drove the price down to 1 yuan, while domestic chips sell for only 0.7 yuan.

Marketing and distribution costs are also declining. Compared to a decade ago, marketing efforts have significantly decreased as market share is now concentrated among a few companies. E-commerce channels now account for a higher proportion of sales, and competition among the top three e-commerce platforms is fierce, reducing sales costs.

With the exception of rising chip costs, other costs for domestic phones are actually decreasing. It's hard to convince consumers that manufacturers aren't profitable under these circumstances.

2. Qualcomm and TSMC are the most profitable

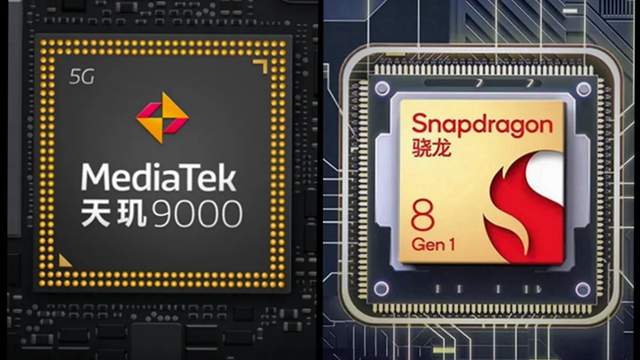

The mobile chip market was once diverse, with companies like Qualcomm, Texas Instruments, MediaTek, and Spreadtrum sharing the market. Today, however, it's dominated by Qualcomm and MediaTek, who together hold nearly 90% of the Android chip market.

With a monopoly, Qualcomm has raised prices consecutively, with high-end chips increasing from 300 yuan to 1700 yuan, a more than fourfold increase. MediaTek has followed suit, with its Dimensity 9400 priced only about a quarter less than the Snapdragon 8 Gen 2.

Qualcomm and MediaTek are highly profitable, and TSMC, which manufactures their chips, is even more so. TSMC's chip manufacturing prices have doubled over the years, with a net profit margin exceeding 40%. Below the 5-nanometer node, TSMC holds the majority of chip manufacturing shares, leaving Samsung struggling to compete. TSMC plans another 10% price increase next year due to its substantial profits.

3. Domestic consumers vote with their feet

With rising chip and phone prices, consumers have no choice but to vote with their feet. Chinese phone sales have fallen from 470 million units in 2016 to 270 million in 2023. Some consumers haven't upgraded their phones in four years.

In contrast, during the sales peak in 2016, people replaced their phones every 18 months. Now, besides slowing down upgrades, consumers are turning to the second-hand market, which reports consecutive sales increases.

Another way domestic consumers express their opinions is by purchasing iPhones. iPhone sales in China have grown considerably, making it the largest iPhone market globally in 2023. The expensive iPhone 16 Pro has seen a 44% increase in sales.

Faced with consumer attitudes, domestic phone manufacturers have opted to maintain high prices and offer few discounts during shopping seasons like 618 and Singles' Day. In contrast, Apple offers significant discounts in China, sometimes up to 2000 yuan, attracting more consumers.