Ele.me aims at Meituan again

![]() 11/04 2024

11/04 2024

![]() 421

421

Text/Xu Wenwen

Editor/Zhang Xiao

At Meituan's Instant Retail Industry Conference on October 16, Wang Puzhong, CEO of Meituan's core local business, revealed that the number of Meituan's Lightning Warehouses is expected to exceed 100,000 by 2027.

Just a week later, Ele.me announced the same goal.

On October 23, Ele.me launched the "Near-Field Brand Official Flagship Store" project at the 2024 Instant E-commerce Future Business Summit, planning to open 100,000 official flagship stores in the next three years.

The background for both sides to propose almost identical expansion goals in quick succession is that the instant retail sector has continued to heat up since 2024, with market competition accelerating towards a white-hot stage.

Both Ele.me and Meituan have compelling reasons not to lose in this sector.

Meituan is eager to find new growth avenues beyond its food delivery and travel services businesses. In the second quarter of this year, the revenue growth rate of Meituan's core local business hit a six-quarter low.

Continuous changes in consumer trends and the overall market environment are also bringing new growth pressures on Meituan.

At the 2024 Catering Industry Conference, Wang Puzhong said that Meituan has reached a "major turning point." He acknowledged that Meituan's growth has slowed significantly, with the urban population stagnating at 800 million and few new users.

At the same time, Meituan's number of transaction users and merchants has also reached saturation since 2022. After the fourth quarter of 2022, Meituan has not disclosed these two figures again.

Ele.me is also facing a severe situation.

After Alibaba acquired Ele.me in 2018, it once hoped to make Ele.me's market share comparable to that of Meituan. That year, Wang Lei, then CEO of Alibaba's Local Life Group, said that Ele.me would at least be on par with Meituan Waimai within a year, with Ele.me aiming to capture at least 50% of the market share.

Subsequently, Alibaba provided sufficient resources to support Ele.me, but the traffic tilt from "Alipay + Koubei + Mobile Taobao" did not help Ele.me win the battle. Instead, Meituan continued to gain more abundant traffic and market share through "WeChat + Dianping."

By mid-2020, Alibaba's Local Life Group conducted a systematic reflection internally. After spending a lot of money and resources over the past two years and learning from its mistakes, it no longer prioritized market share. Since then, China's food delivery market has maintained a stable 70-30 market share split.

To date, Alibaba's Local Life Group is still losing money. In the second quarter of this year, its adjusted EBITA was a loss of RMB 386 million, but it has been reducing losses over the past few quarters.

Even during Alibaba's organizational restructuring throughout last year, rumors of Ele.me's sale frequently emerged, prompting management to repeatedly refute them.

Among them, Alibaba CFO Xu Hong stated during a financial report conference call in February this year that Ele.me is still an important asset for Alibaba's near-field business.

Thus, Ele.me now has a new historical mission: to help Alibaba continue to charge ahead in the instant retail sector and compete with Meituan and JD.com.

01

Mode Debate: Aggressive Meituan, Conservative Ele.me

Although they share the same goal, Ele.me and Meituan's layout paths and models are not entirely consistent.

"Lightning Warehouses" are now the core breakthrough point for Meituan's instant retail business, leaning more towards a "local" logic and focusing on "pre-warehouses."

Meituan hopes to attract more retailers to open more warehouses with it, enriching supply and expanding SKUs, so that users can buy almost all the products they need in daily life through the Meituan platform, similar to ordering takeout. The density of warehouses and Meituan's nationwide delivery network ensure timely fulfillment.

Ele.me follows a different logic, leaning more towards "retail" and focusing on "connection."

Ele.me is not averse to "pre-warehouses," but this may not be its primary model. After brands join the "Near-Field Brand Official Flagship Store" model, they first adopt an "integrated store and warehouse" approach. They can also authorize dealers to distribute through different stations. Additionally, they can rely on third-party partners' "pre-warehouses" to provide instant retail services.

Image/2023 Alibaba Local Retail

In this process, Ele.me does not participate in the actual "warehouse opening" but rather outputs supply chain management capabilities to merchants, helping them better connect online and offline.

Behind these different models lie differing perspectives on instant retail between Ele.me and Meituan.

Meituan believes that many new models have emerged in the instant retail industry in recent years, including Lawson's "warehouse as store" model, Yonghui and RT-Mart's "store with warehouse" model, and independent warehouse models like Xiaoxiang Supermarket, Dingdong Maicai, and Meituan Lightning Warehouses. As of now, Lightning Warehouses are considered a superior model.

"Meituan's Lightning Warehouse model represents the current evolutionary trend in instant retail and is crucial for promoting the prosperity of the instant retail supply ecosystem," Wang Puzhong said at Meituan's Instant Retail Industry Conference.

To understand Meituan's perspective, there are two key terms: mismatch between supply and demand, and a deterministic lifestyle.

Simply put, in Meituan's view, many of users' immediate needs are currently unsatisfied in the instant retail ecosystem. For example, if you urgently need to buy some daily necessities in the middle of the night or have relatively niche needs, many offline and online supermarkets cannot meet these demands. As users develop the mindset and habit of "everything delivered to your doorstep," such needs will gradually evolve into deterministic needs in their lifestyle.

From this perspective, Meituan aims to capture this incremental demand from users and seize opportunities in this incremental space.

In contrast, Ele.me's approach tends to focus more on helping merchants tap into growth opportunities within existing demand.

Chen Yanfeng, Vice President of Ele.me and Head of Retail Brands and Supermarket Convenience Industry, said that in the past, many brands without physical stores lacked direct communication channels with consumers, making it difficult to directly link to consumer needs and gain accurate insights into consumer groups. Brand official flagship stores can simplify direct service and circulation channels between brands and consumers, improve channel profitability, and bring sustainable growth.

From this perspective, Ele.me may believe that the problem does not lie in insufficient supply but rather in the mismatch between existing supply and user demand. Ele.me aims to bridge this gap.

So, under these different layout models, who has a greater opportunity in this new competition between Ele.me and Meituan?

02

Warehouse and Distribution Debate: Ele.me and Meituan Face Their Own Challenges

From the supply side, it is certain that the overall instant consumer demand from users is continuously increasing.

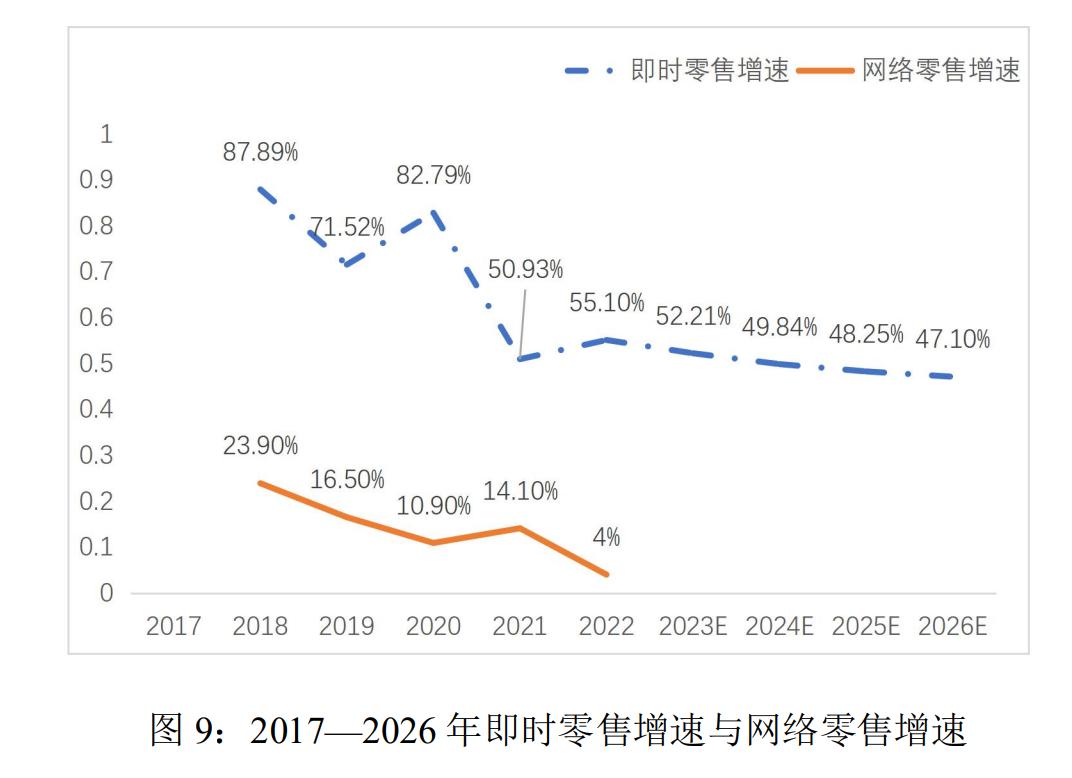

The "Development Report on the Instant Retail Industry (2023)" points out that since 2018, the average annual growth rate of the instant retail industry has exceeded 50%. It is expected that by 2026, the annual growth rate of instant retail may still reach as high as 47.1%. Compared with the growth rate of total online retail sales during the same period, the instant retail growth rate was 71.89 percentage points higher in 2020, 36.83 percentage points higher in 2021, and 51.1 percentage points higher in 2022.

Image/"Development Report on the Instant Retail Industry" (2023)

Moreover, this statistic does not include food delivery and instant services. In other words, more and more people now prefer not only "takeout" delivery but also "everything delivered to your doorstep" because buying various products in daily life through takeout-style methods is highly convenient.

At the current stage, are these user needs still unmet? Or are most needs still unmet?

Actually, not quite.

Instant retail is not a new concept; it has only gained popularity in the past two years. In fact, over the past few years, users have been able to achieve "instant delivery" of various products, including supermarkets, daily necessities, pharmaceuticals, health products, fresh fruits, flowers, cakes, 3C electronics, and baby products, on platforms like Meituan, Ele.me, and JD.com.

However, many users' "one-stop" instant consumption needs and experiences may not yet be fully met, and there is a certain lack of category richness.

This corresponds to the accelerating emergence of new trends in the instant retail industry.",The report summarizes these new trends as follows: all-day consumption, all-scenario penetration driven by demand outbursts, all-category product innovation, full geographical coverage, comprehensive supply chain management, and full-process digitization.",Based on these demand trends, the improvement of the instant retail ecosystem does not rely solely on a single platform or the efforts of platform providers alone. Rather, it requires collaboration between platforms and the merchants on these platforms.",Judging from the above analysis, both Ele.me and Meituan emphasize cooperation with merchants and provide them with digital capabilities and supply chains.",The difference lies in that Meituan goes further and is more targeted, specifically dedicating "Lightning Warehouses" to instant retail.

Meituan's approach has both obvious advantages and disadvantages:

A sufficiently dense network of Lightning Warehouses is indeed more likely to fully cover users' immediate needs and provide 24/7 services. However, it will inevitably lead to excess supply, which is why there is currently industry skepticism that Meituan's Lightning Warehouses may disrupt parts of the physical retail industry.",For a simple example, within a few kilometers around a user's residential area, there may already be offline merchants and convenience stores that have opened online stores on the Meituan platform or other platforms, capable of meeting most of the users' daily instant retail needs. In such cases, opening one or even several Lightning Warehouses can easily lead to excess supply.",In a recent report by LatePost, it was revealed that out of the 30,000 Lightning Warehouses disclosed by Meituan at the Instant Retail Conference, nearly 10,000 were full-category Lightning Warehouses, and nearly 20,000 were various vertical warehouses.",It can be seen that, to a certain extent, Meituan's Lightning Warehouses are also striving to avoid excess supply by opening more vertical warehouses to create differentiated competitive advantages.",However, another challenge facing Meituan is that, as pointed out in a research report by Guosen Securities, only comprehensive convenience warehouses are profitable in the Lightning Warehouse business model, while single-category warehouses struggle to turn a profit. The report notes that comprehensive convenience warehouses can attract customers with low-priced fast-moving consumer goods and earn profits through durable goods like groceries.",In this scenario, Meituan faces challenges in attracting more partners to open warehouses together.",Of course, Ele.me also faces challenges.",The biggest difference from Meituan is that Ele.me's involvement around the "Near-Field Brand Official Flagship Store" model is not as deep, and it approaches the layout more from the perspective of brands/merchants. Hu Qiugen, Senior Vice President of Ele.me and Head of the City Retail Business, explained that through brand official flagship stores, brand merchants enjoy greater operational autonomy and control over their instant e-commerce operations.",To some extent, this means that the extent and density of Ele.me's instant retail supply network depend more on how brands that have opened flagship stores on the platform operate.",

Han Liu, CEO of Ele.me, Image/Ele.me Official WeChat Public Account

According to data disclosed by Ele.me, the number of active official flagship stores on Ele.me has exceeded 20,000, including brands such as Mengniu Group's Daily Fresh, Tsingtao Beer, Nongfu Spring, and Philips.

It seems that Ele.me's model has initially passed market validation. Wallstreetcn reported that the "Near-Field Brand Official Flagship Store" project underwent two years of exploration within Ele.me before being finally launched to the market.",However, from the perspective of market expansion, it is uncertain whether Meituan's relatively conservative and passive strategy can help it attract more brands and continuously enrich and optimize supply.

03

Ecosystem Debate: Ele.me Needs to Take the Lead

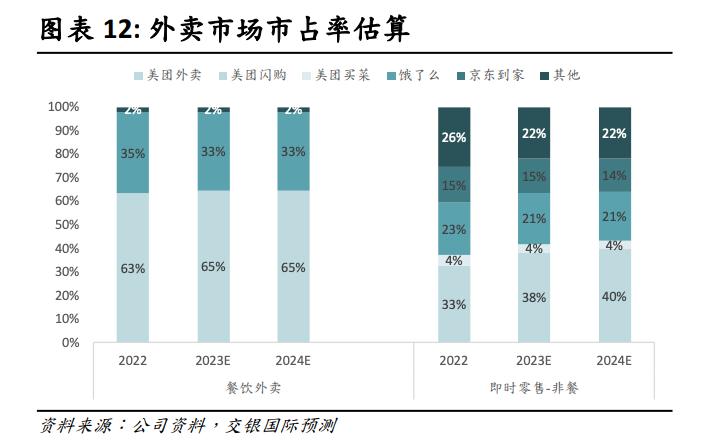

According to forecasts by BOCI Research, in the instant retail-non-dining market in 2024, Meituan's market share has reached 40%, ranking first. Ele.me and JD.com, ranking second and third, respectively, account for 21% and 14% of the market share.

Image/BOCI Research

The current market landscape is still full of uncertainties. Ele.me and JD.com's continued efforts this year and the accelerated entry of more players are continuously putting pressure on Meituan.",However, as mentioned earlier, instant retail is not a new concept nor a new battleground between giants.",As early as five years ago, the battle for city retail had already begun, involving Meituan, JD.com, and Alibaba.",Meituan launched the independent brand "Flash Buy" as early as 2018 and simultaneously established the Flash Buy Business Unit led by Wang Puzhong. Later, the Flash Buy Business Unit was split into three independent businesses: Flash Buy, Pharmacy, and Tuanhaohuo, upgrading their strategic positions.",A year later, JD.com and Alibaba began internal organizational restructuring and resource integration, intensifying their focus on city retail. Alibaba positioned itself as a "near-field e-commerce" player, while JD.com positioned itself as an "instant e-commerce" player.",In September 2019, JD Supermarket launched the "Natural Selection" project, aiming to deliver some products within 30 minutes through cooperation with offline outlets. A few months later, JD.com established the Grand Supermarket Omnichannel Business Group, integrating its original JD Supermarket, Consumer Goods Business Unit, New Channel Business Unit, 7FRESH, and 1haodian, among others.",In April 2020, Alibaba upgraded its Tmall Supermarket Business Group to the City Retail Business Group, which became a top priority for Alibaba Group CEO Daniel Zhang. Subsequently, Alibaba integrated Ele.me's new retail business and other initiatives into this business group. Cainiao also established an independent delivery brand, "Cainiao Direct Delivery," for the City Retail Business Group, integrating the teams of Daniao, Dianwoda, and Lantun.",That June, Alibaba also launched the "One-Hour Delivery" channel in 16 cities nationwide.",It is not difficult to see that, to some extent, the battle for city retail is a smaller-scale instant retail competition. At that time, users' demand for instant services had not yet fully erupted, but habits of instant consumption were forming in categories such as fast-moving consumer goods and fresh produce.",Therefore, when discussing the instant retail layouts of these platforms, it is not sufficient to focus solely on their current models. It is also necessary to consider their respective platform ecosystems.",Let's first provide a brief overview of their overall instant retail business networks:",Currently, in addition to Flash Buy, Meituan also has:",Meituan Pharmacy, a platform model that includes both self-operated and franchised models; in the fresh produce category, self-operated Xiaoxiang Supermarket (formerly Meituan Caimai); in the alcohol category, self-operated Waima Songjiu; and in the self-operated category, Lightning Warehouse Squirrel Convenience.

Picture/Xiaoxiang Supermarket's official Weibo

Among them, LatePost reported that as of the second quarter of this year, Xiaoxiang Supermarket had opened more than 680 front-end warehouses, of which 550 are located in the four major first-tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen. However, Meituan denied these data. Additionally, some media reports indicated that Waima Wine Delivery, which launched in June 2021, had opened more than 800 front-end warehouses as of August this year.

Songshu Convenience is a lightning warehouse operated by Meituan and began low-key testing some time ago. It is divided into a small number of fully self-operated stores and franchised stores, with individual business owners and branded chain merchants as the main expansion targets. As for Meituan Pharmacy, according to data released by Meituan, it currently covers 16,000 24-hour pharmacies.

It is not difficult to find that regarding the instant retail business, Meituan is accelerating the deployment of a "large network". It not only encourages merchants on the platform to open more comprehensive and vertical category lightning warehouses but is also making its own self-operated attempts in various vertical categories.

Now, let's look at Alibaba. Overall, compared to Meituan, Eleme's actions are not as aggressive, except for the newly launched "Near-Field Brand Official Flagship Store" project.

However, Alibaba's approach to instant retail is more inclined towards being a platform. There are not many attempts at self-operated businesses. It places more emphasis on how to more effectively integrate Alibaba's retail resources.

In July this year, Taobao officially announced an upgrade to its one-hour delivery channel: A new first-level traffic entry was added to the "One-Hour Delivery" tab at the top of Taobao, and a deep cooperation was reached with Eleme. The scene cooperation covers categories such as supermarkets and convenience stores, pharmacies, vegetables and fruits, alcoholic beverages, flowers, and green plants.

Of course, in addition to Eleme, Hema, RT-Mart, and others are also enriching the supply for Taobao's "One-Hour Delivery" channel.

Based on this, compared to Meituan's lightning warehouses, Eleme's "Near-Field Brand Official Flagship Store" may be more important to Alibaba's instant retail business -

After withdrawing its IPO application, being rumored to be sold, and replacing its CEO, Hema is now in a period of contraction. Assets and businesses such as RT-Mart and Intime Retail have been clearly identified by Alibaba as "non-core assets," and there have been multiple rumors of their sale. Their future is uncertain.

04

More Players Are Coming: Competing in Explosive Power and Endurance

In addition to dealing with Meituan, Eleme cannot ignore another rival that has already accelerated its efforts: JD.com.

In recent years, the strategic position of the instant retail business within JD.com's retail operations has gradually increased. In 2024, "content ecosystem, open ecosystem, and instant retail" were internally referred to as JD.com's "three must-win battles".

JD.com's layout is accelerating, and its efforts are intensifying.

First, in September of last year, JD.com's instant retail services were unifiedly renamed "One-Hour Delivery." Then, in May of this year, JD.com's instant retail business brand was integrated and upgraded from the original JD.com One-Hour Delivery and JD Daojia to "JD Instant Send," and the JD app also opened a first-level traffic entry.

On November 1, JD Seven Fresh Supermarket initiated a "price war" with activities such as "Unbeatable Prices, Genuinely Affordable." This was seen by the outside world as JD.com initiating an instant retail price war against Alibaba's Hema and Meituan's Xiaoxiang Supermarket during Singles' Day.

Picture/7FRESH's official WeChat public account

On the other hand, JD.com is also accelerating its exploration of the front-end warehouse business model.

According to E-commerce News, in June of last year, JD.com established the "Innovative Retail Department," which includes four business departments: Seven Fresh, front-end warehousing, technology research and development, and supply chain operations, focusing on offline and instant retail scenarios. In terms of operating mode, JD.com's front-end warehouses are "store-warehouse integrated," allowing users to make purchases both offline and online.

Although JD.com's pace in deploying front-end warehouse operations is not fast, neither Meituan nor Eleme can ignore this competitor.

The first front-end warehouse of Seven Fresh was opened near Shunliutu Road in Beijing, only about 1 kilometer in a straight line from Meituan's "Xiaoxiang Supermarket" in the same area. An employee of Seven Fresh told China Entrepreneur, "This new front-end warehouse is benchmarked against Xiaoxiang Supermarket, providing door-to-door delivery services for users within a 3-kilometer radius after they place orders."

Another important point is that in the instant retail sector, warehouse and distribution capabilities determine the platform's core fulfillment capabilities. JD.com also has the strength to compete because there are no obvious shortcomings in its distribution capabilities.

For example, previously, according to in-depth web reports, since May of this year, Douyin's One-Hour Delivery has slowed down its city expansion plans. Except for the six cities where One-Hour Delivery is already available - Beijing, Shanghai, Shenzhen, Fuzhou, Xiamen, and Chongqing - no new merchants are allowed to join the One-Hour Delivery business in other cities.

Regarding this, industry insiders analyzed that, "Instant retail has moved beyond the stage of simply seeking traffic and blindly expanding scale. When Douyin's One-Hour Delivery categories are not perfect and fulfillment links such as warehousing and distribution cannot keep up, it is expedient to temporarily halt city expansion and refine the operation of the One-Hour Delivery business."

In summary, in the long run, the competition in the instant retail sector will only become more intense. From another perspective, in addition to comprehensive platform players such as JD.com, Alibaba, Meituan, and Douyin, more self-operated players are also accelerating their entry into the market.

For each of these players, this competition may require long-term and sustained investment, competing in both explosive power and endurance.