Entering the last blue ocean, Kuaishou aims at 60 million Brazilian users

![]() 11/07 2024

11/07 2024

![]() 448

448

Latin America, known as the last blue ocean for cross-border e-commerce, has welcomed another Chinese cross-border e-commerce platform.

Recently, Kuaishou International, Kwai, officially announced the launch of its e-commerce platform, Kwai Shop, in Brazil. Prior to this, Kwai Shop entered the testing phase at the end of 2023, with daily purchase orders increasing by 1300% in 2024.

Brazil has developed into Kuaishou's largest international market, accounting for over 80% of its overseas revenue and 50% of its daily active users outside China. In Brazil, approximately 60 million people use Kwai daily, with an average usage time of 80 minutes.

Kwai's success as a social platform in the Brazilian market hinges on heavy investment and localization. Since entering Brazil in 2019, Kuaishou has invested over 7 billion Brazilian reais locally. In 2022, after Ma Hongbin became the head of Kuaishou's international business, he urged the international business commercialization team to spend more time locally, emphasizing that localizing business overseas from China alone would not suffice. Cheng Ji, the head of its international operations, resides in Beijing but visits Sao Paulo three to four times a year.

While Kwai has achieved remarkable success in Brazil, it still faces numerous challenges in expanding its e-commerce business.

On one hand, Kwai Shop competes with established e-commerce companies like MercadoLibre and newcomers like Temu. Temu began operating in Brazil in June this year and reached 25 million active users within a few months, surpassing Alibaba's AliExpress and Brazilian e-commerce platform Magazine Luiza, ranking second only to MercadoLibre and Shopee.

On the other hand, Kwai faces stiff competition from live streaming e-commerce giant Shopee, which launched live streaming in 2022 and surpassed Amazon Brazil this year to become the second-largest e-commerce platform in Brazil.

Despite fierce competition, the Brazilian e-commerce market is relatively less competitive compared to Europe, the United States, and Southeast Asia. Will the Brazilian e-commerce market, with its low competition and high potential, change due to Kwai Shop?

I. Harvesting Brazilian users?

Deepening its presence in the Brazilian market was a necessary decision for Kuaishou.

In a 2021 interview with Bloomberg, Kuaishou founder Su Hua said that the company refused to prioritize expansion to North American users, partly due to TikTok's dominance in the US. At that time, Kuaishou had already set its sights on Indonesia and Brazil.

Currently, concentrating resources in Brazil appears to be the right decision.

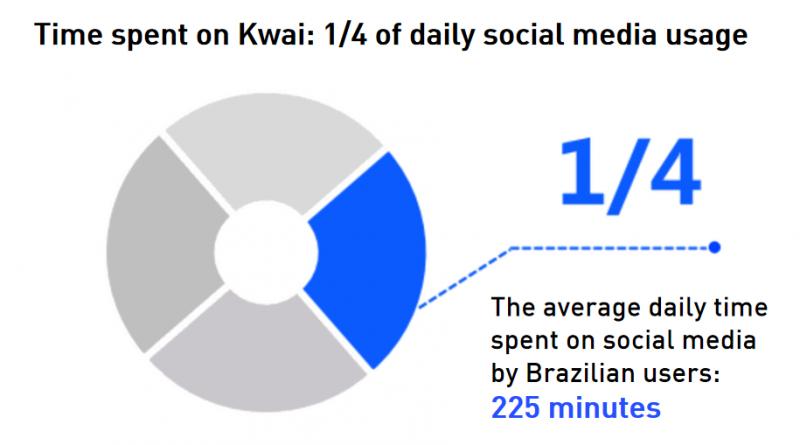

Cheng Ji, head of international operations, revealed to the media, "Within five years, our daily active user count has grown from zero to over 30 million, with monthly active users exceeding 60 million." With a total population of over 210 million in Brazil in 2023, roughly one-quarter of Brazilians are active Kwai users.

These users spend considerable time on Kwai. According to reports from Deloitte Digital Media Trends and eMarketer on social network users in Latin America, Brazilian internet users spend nearly four hours daily on various social media platforms, using over eight platforms monthly. Kwai accounts for a quarter of Brazilian users' daily social media time.

Behind this rapid user growth is Kuaishou's strong emphasis on content localization. Similar to China, Kuaishou's user base in Brazil also skews towards the "lower-tier market." Compared to TikTok, Kuaishou focuses more on regional and community content, with many videos created by users from smaller cities or surrounding areas, avoiding direct competition with TikTok.

A local Brazilian media report in 2023 noted that Kwai's success in Brazil is partly due to its target demographic. While TikTok targets younger and teenage audiences in Brazil, particularly in wealthier southeastern regions, Kwai serves populations in historically marginalized northeastern states, where most users are blue-collar workers such as ride-hailing drivers, bus drivers, and food delivery workers.

Furthermore, Kuaishou sponsors Brazilian favorite reality shows and football teams. In 2021, Kuaishou became the official sponsor of the Brazilian national football team, exclusively producing short video content for the team ahead of the 2022 World Cup. From 2021 to 2023, Kuaishou continued to sponsor both the Brazilian men's and women's national football teams.

Kuaishou's short dramas are also highly popular in Brazil. In 2022, Kuaishou launched TeleKwai, a short drama brand for overseas markets, which recorded 42 billion views that year and surpassed 60 billion views in 2023. Brands like Coca-Cola and Honda have already conducted marketing campaigns through TeleKwai.

While solidifying its content foundation and leveraging short drama marketing, Kuaishou began deploying live streaming e-commerce.

As early as October 2021, Kwai hosted its first live e-commerce event with retailer Casas Bahia. However, it wasn't until 2023 that Kwai Shop entered its internal testing phase. Compared to TikTok's live streaming e-commerce development, Kwai's investment in Brazilian live streaming e-commerce has been cautious and slow.

Nonetheless, some influencers have emerged.

Alex, a Wenzhou businessman in Brazil, became a Kwai platform celebrity and began live streaming sales on Kwai in early 2023, advertising products during 10-hour live streams. Due to his success, he opened a physical store by the end of last year, with queues stretching for miles.

II. The Biggest Competitor is Shopee

'The scale of live shopping in Brazil may be even larger than traditional e-commerce,' said Etienne Du Jardin, Chief Product Officer and Co-Founder of Mimo Live Sales.

Founded in 2020, Mimo Live Sales is a SaaS and solutions provider for Latin American brands and merchants, offering live streaming e-commerce technology. By providing merchants with live streaming e-commerce technology, the company achieves an average monthly revenue growth rate of 20% and an annual growth rate of 300%.

Live streaming e-commerce is rapidly growing in Brazil. According to the chief analyst for Latin America at Inside Intelligence, a New York-based market research firm, 'Live streaming e-commerce in Brazil is developing very rapidly, with over 60% of buyers making purchases after watching online live streams.'

After officially launching its e-commerce platform Kwai Shop, Kuaishou will directly compete with Shopee.

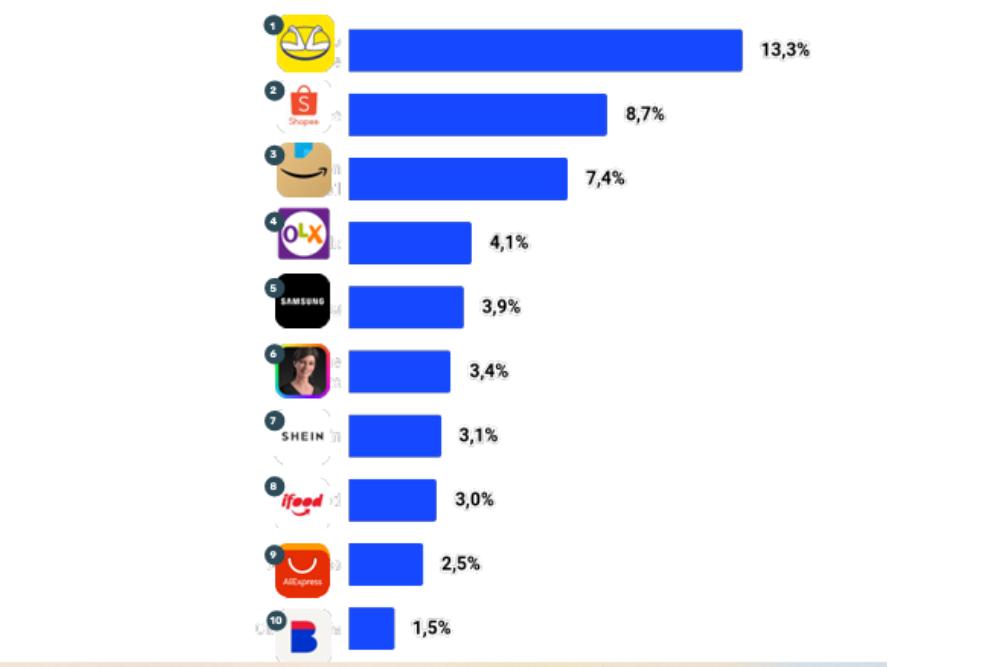

Shopee is currently the second-largest e-commerce platform in Brazil. The top 10 stores in Brazil account for 50.9% of the country's entire e-commerce audience, with MercadoLibre accounting for 13.3%, Shopee for 8.7%, and Amazon Brazil for 7.4%.

(Brazilian e-commerce rankings)

Shopee launched live streaming e-commerce in 2022. In an interview with Brazilian media outlet Exame in July this year, Rodrigo Farah, head of Shopee Brands and Live Streaming E-commerce, revealed that live streaming e-commerce had generated over tenfold revenue growth within a year.

Currently, Shopee hosts around 400 live streams daily. Among the 3 million Brazilian sellers on the platform, 100,000 can use this tool, and the number is expected to reach 200,000 by the end of the year, up from just a few dozen at the beginning of last year.

To ensure the quality of live streaming operations, Shopee has a team of around 100 people covering marketing, training, and quality control. 'This is a significant challenge because sellers may sometimes overlook issues such as music copyright. Our team monitors live stream content in real-time, making adjustments or issuing warnings to sellers and affiliate partners when necessary,' said Farah.

To attract consumers, Shopee frequently invites influencers and celebrities to host live streams and sponsors in-app live performances, such as the 'Numanice' concert hosted by a singer in December last year. During the event, product live streams ran simultaneously, with shopping carts visible on users' screens throughout.

The success of live streaming e-commerce has allowed Shopee to surpass Amazon Brazil this year. According to a Conversion report, in May this year, Shopee surpassed Amazon for the first time to become the second most visited e-commerce platform in Brazil, with 201 million visits, exceeding Amazon's 195 million visits, while MercadoLibre led with 363 million visits.

Compared to Shopee, Kuaishou has an advantage in content, but its live streaming e-commerce mindset is still developing. Locally in Brazil, more people view Kuaishou as a social platform rather than a live streaming e-commerce platform.

Therefore, attracting more sellers is the top priority.

At the end of December last year, Kwai partnered with a Brazilian ERP company, Bling, to streamline the sales process for sellers on the Kwai platform. Claudine Bayma, General Manager of Kwai Brazil, said, 'As our e-commerce business in Brazil continues to expand, the demand for integrating more sellers and ERP systems is also increasing. This partnership with Bling aims to further strengthen Kwai's influence among local sellers.'

Now that Kwai Shop is open, Kuaishou plans to provide incentives and commissions to encourage merchants to join the platform, hoping to rapidly increase the number of sellers next year. It is understood that 70% of small businesses in Brazil seek to increase their visibility on social media, which may be an advantage for Kuaishou in attracting sellers.

III. The Last Blue Ocean, Also the Most Challenging E-commerce Market

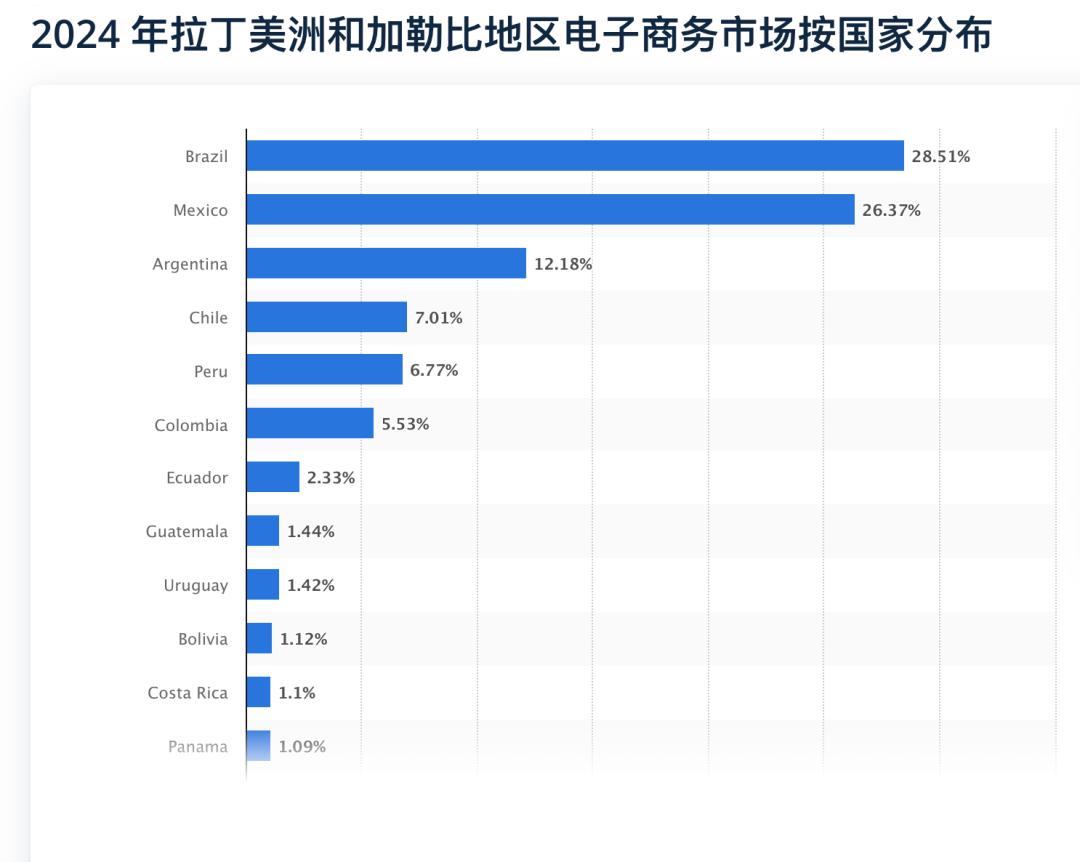

Latin America is known as the last blue ocean for cross-border e-commerce, with Brazil being its largest e-commerce market. According to a Statista report, Brazil accounted for 28.51% of the entire Latin American e-commerce market in 2024.

Amidst global e-commerce slowdown, Brazil remains one of the few rapidly growing e-commerce markets. According to Brazil's Ministry of Development, Industry, Trade, and Services (MDIC), Brazil's e-commerce scale has more than quintupled since 2016.

MercadoLibre, Brazil's largest e-commerce platform, is also experiencing rapid growth. Its financial report shows revenue of $5.1 billion in the second quarter of this year, a year-on-year increase of 42%, and net profit of $531 million, a year-on-year increase of 103%.

Known as the 'Latin American version of Alibaba,' this growth rate is impressive compared to Alibaba's single-digit growth in China in recent years, reflecting the rapid development of the Brazilian e-commerce market.

While it is a blue ocean, doing business in Brazil is not easy.

A 2024 study commissioned by Alibaba found that cross-border e-commerce accounts for only 0.5% of Brazil's total retail sales. This is because importing goods into Brazil is both expensive and difficult.

The United States International Trade Administration has stated, 'Doing business in Brazil requires a deep understanding of the local environment, including high direct and indirect costs of operation.' Over the years, regulators have attempted reforms but still face complex tax schemes, strict labor laws, and tricky import barriers.

Brazil places great emphasis on protecting local merchants. Last year, Brazilian legislators introduced a tax-free policy for international sellers on online purchases of $50 or less, but due to opposition from domestic merchants, this policy was revoked in August this year, replaced by a 20% fee, and a 60% tax on purchases over $50.

Additionally, logistics and payment are significant barriers to e-commerce in Brazil. Half of the population lacks bank accounts. As the fifth-largest country in the world, much of Brazil is covered in rainforest, but infrastructure is inadequate—insufficient roads, poor maintenance, and limited port capacity.

Therefore, those who can provide payment and logistics solutions for consumers and businesses will dominate the e-commerce landscape. For example, MercadoLibre provides its merchants with its logistics services, offering shipping options and warehouse stockpiling for local and overseas merchants. Since entering the Brazilian market in 2019, Shopee has continuously invested heavily in logistics, hiring MercadoLibre executive Rodrigo Calderaro as the head of logistics in Brazil.

Despite the challenges of cross-border e-commerce, consumers vote with their feet. Studies have shown that over half of customers (55%) prefer to purchase from stores on Asian websites, even though they know it may harm local businesses.

Chen Yonghui, president of the Brazil Chinese Overseas Chinese E-commerce Association, told China News in an interview that in recent years, some traditional Brazilian import and export traders have transformed into e-commerce. The number of Chinese merchants and their business volume have doubled. Statistics show that the number of Chinese merchant sellers on a certain e-commerce platform increased from over 1,700 to over 2,500 from 2023 to 2024. While this accounts for only 1% of all sellers, their business volume exceeds 25%.

It must be said that Chinese e-commerce platforms and sellers are resilient. While Brazil is the most challenging e-commerce market, it also presents immense opportunities and will be a potential market that Chinese e-commerce platforms and merchants cannot afford to miss.