All are admiring Musk for making the right bet, who cares about Google and Microsoft's rivalry

![]() 11/07 2024

11/07 2024

![]() 636

636

One scandal is bigger than the other

Written by Chen Dengxin

Edited by Li Wenjie

Typeset by Annalee

The United States is really good at creating scandals.

A gender showdown that garnered global attention has left onlookers thoroughly entertained, exclaiming, "How exciting!"

The American version of "Lu Dinggong", Elon Musk, saw his net worth skyrocket by $20.9 billion overnight, making him the second biggest winner.

Amidst Musk's glow, another juicy scandal across the ocean has gone largely unnoticed.

Revolving around cloud services, Google and Microsoft have completely fallen out, with Google resorting to "whistle-blowing" and Microsoft retaliating with a "long essay," engaging in off-court tactics.

Correspondingly, cloud services have also become a competitive high ground for Chinese internet companies. To compete for this visibly growing market, they are tacitly engaging in head-on battles.

Why is there such a contrast between China and foreign countries in their approach to cloud service competition?

Elon Musk

Adopting the most straightforward methods in real business wars

As the saying goes, "Opponents always meet again."

Where there are people, there is a competitive environment, and where there is competition, there is fun. "In Shanghai, business wars involve sabotaging the coffee machines of rival companies; in Fujian, replacing the statues of the God of Wealth with Ultraman; in Guangdong, poisoning the money trees of competitors..."

Who would have thought that high-end business wars would also have no limits?

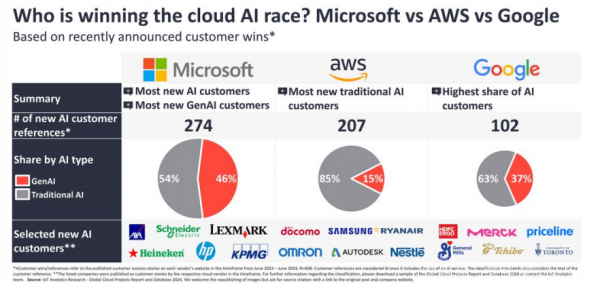

Google recently submitted an antitrust complaint to the European Commission, accusing Microsoft of using unfair licensing contracts to disrupt competition in the cloud computing market, leading to a decrease in cloud service options and a significant increase in service prices.

To put it simply, instead of resorting to legal action, Google directly wrote a whistleblower letter to give Microsoft a hard time.

Source: IoT Analytics

An internet observer told ZM Tech: "Due to the lack of local technology giants in Europe, the region has always adopted a high-pressure stance towards global technology giants, affecting both Microsoft and Google."

For example, the European Commission recently believed that Microsoft's bundling of its communication and collaboration product Teams with its enterprise suites Office365 and Microsoft365 violated antitrust rules.

Another example is the European Court of Justice's recent ruling upholding a €2.4 billion fine against Google for abusing its monopoly power to suppress competitors.

Against this backdrop, Microsoft was furious.

As a result, Microsoft wrote a 1,500-word "long essay" accusing Google of being a sore loser, directly or indirectly funding scholars, lobbying organizations, industry commentators, etc., to smear Microsoft.

Source: IOT Intelligence

In business wars depicted in movies, well-dressed company executives gather to strategize and decide the outcome from afar, defeating their opponents with one move; in real-life business wars, however, the most straightforward methods are often adopted.

The aforementioned internet observer further stated: "Wild business wars are often seen in small and medium-sized companies. Previously, global technology giants competed with dignity. Now, the underlying logic of their falling out is that 'a double loss is better than a single win.'"

In earlier years, Google and Microsoft largely competed in different areas. In recent years, AI has become a core strategy for Microsoft, and the intersection between the two parties has become increasingly prominent, especially as Microsoft and its ally OpenAI have both focused on AI search, cutting into Google's territory, leading to irreconcilable conflicts.

When life and death are at stake, who cares about dignity?

Price wars are tacit understandings

China presents a different picture.

With the entry of players of various sizes, cloud services once became a standard configuration in the internet industry. However, due to the disparity in size between small and medium players and leading players, leading to infrastructure and AI capabilities lagging behind, the industry underwent a major shakeup.

As a result, cloud services have entered an era of competition among giants.

Although the gunpowder smell among giants has intensified with increasing competition, they have not deviated from the rules of the game, instead going all in on price wars.

After all, price wars are understandable.

Cloud services exhibit typical economies of scale. While the initial investment is huge, marginal costs decrease. As scale effects continue to be unleashed, it can provide scale dividends to users by giving back to the market.

Among these, the price war in 2024 was particularly fierce.

Alibaba Cloud was the first to announce a company-wide price reduction for cloud products on its official website, with an average price reduction of over 20%, a maximum reduction of 55%, and for the first time in history, offering discounts on unfulfilled parts of customers' existing orders.

JD Cloud immediately responded: "Feel free to drop prices, let's see who goes lower! We will continue to compare prices across the entire network! Break through the bottom price! Another 10% off!"

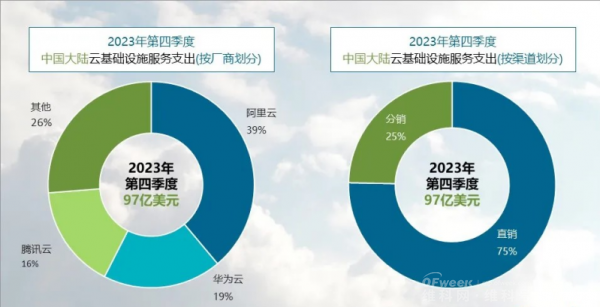

After this, leading players such as Tencent Cloud and Huawei Cloud also joined the fray, each introducing preferential measures, making the competition far more intense than in 2023.

Source: Canalys

This is closely related to the incremental trend of the market.

China's cloud services market is still a blue ocean, and there is no situation where "your stock becomes someone else's increment, and your increment becomes someone else's stock." It has not yet reached a do-or-die stage.

As such, the original intention of price wars is not to eliminate competitors but to tacitly collaborate in tapping market demand and growing the market pie together.

Regarding this, Liu Weiguang, Senior Vice President of Alibaba Cloud Intelligence Group, stated: "The price reduction measures are not aimed at Tencent and Huawei but to attract 72% of incremental users."

According to data from the China Academy of Information and Communications Technology, the share of public clouds in the United States is 60%, while it is only 28% in China.

In short, price wars in cloud services are not tactical decisions but strategic choices.

"AI+Cloud" Enters the Free Era

It should be noted that scaling down costs is only one aspect of price wars; the other is technology-driven cost reduction.

As AI enters the era of large models, cloud services have also gained new momentum, and cloud services empowered by large models now have more room for price reductions.

Source: JD Cloud

On the one hand, significantly enhance computing power and optimize AI reasoning capabilities to enable large models to perform better in high-performance computing, scenario applications, database deployment, etc.

On the other hand, significantly optimize scheduling to meet both peak demand for high performance, high responsiveness, and high computing power, as well as trough demand for low costs.

An industry insider told ZM Tech: "There is a clear tidal phenomenon in the invocation of large models, with some demands occurring during the day, some at night, and even some in the early morning. Moreover, peak and trough demands may also differ, resulting in temporal and spatial imbalances, necessitating load mixing for the invocation of large models."

Volcano Engine was the first to fire the first shot in technology-driven cost reduction.

Publicly available information shows that the inference price for the Doubao General Model pro-32k is 0.0008 yuan per thousand tokens, while the pricing for models of the same specification on the market at that time was typically 0.12 yuan per thousand tokens, a savings of a whopping 99.3%.

Tan Dai, President of Volcano Engine, stated: "Price reductions are achieved through technology-driven cost optimization. If it were just subsidies, using losses to exchange for revenue would be unsustainable, and Volcano Engine will not take that path."

Subsequently, players followed suit.

More crucially, Baidu Intelligent Cloud took a one-step approach by making its two main models, ENIRE Speed and ENIRE Lite, completely free. "I hope everyone will stop comparing prices by pulling up price lists every day. Instead of doing that, you might as well focus on scenarios and applications."

In this way, "AI+Cloud" has entered the free era.

For users, price wars are like a blessing from heaven, encouraging them to be bolder and faster in innovation.

For cloud service providers, it can avoid homogeneous competition, demonstrating greater commercial value. Large models have also shifted from being technology-driven to value-driven, offering greater promise.

Baidu Cloud focuses on AI, while Tencent Cloud targets gaming

Because of this, cloud services do not have a winner-takes-all scenario.

Competition in the stock market shows a trend of one party gaining while the other loses, while competition in the incremental market allows for the possibility of progressing together. After all, users will not put all their eggs in one basket to avoid being "manipulated" and losing bargaining power.

More importantly, different "clouds" have distinct characteristics, enabling differentiated competition.

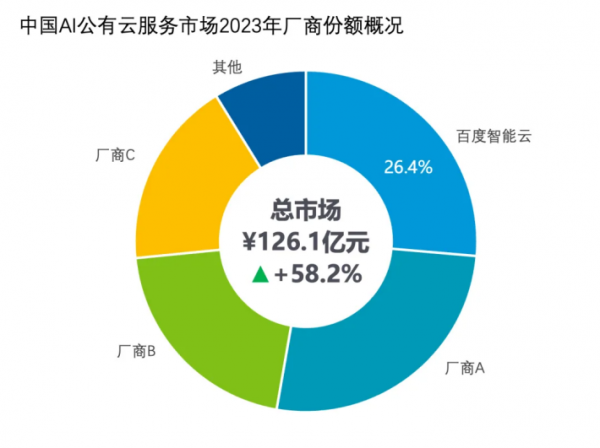

For example, Baidu Intelligent Cloud focuses on AI cloud, with significant advantages in areas such as computer vision and natural language processing.

According to the report "China's Public Cloud AI Service Market Share, 2023," Baidu Intelligent Cloud ranks first in the Chinese AI public cloud service market with a share of 26.4%, maintaining its position as the market leader in China for five consecutive years.

Source: IDC

Another example is Tencent Cloud, which has a deeper understanding of gaming and ranks first in both average monthly cloud host cores and CDN bandwidth.

IDC stated: "Relying on its rich gaming ecosystem resources and advanced technological capabilities, Tencent Cloud has launched multiple solutions covering the entire lifecycle of games, encompassing dozens of critical gaming scenarios such as gaming social interaction, information security, anti-cheating and anti-hacking, cloud-native game development, elastic scaling, high availability, game security, data operations, and user growth."

In addition, the emerging Volcano Engine has also attracted attention.

Volcano Engine only entered the market in 2020, becoming the last of the mainstream players to join the table. However, it quickly made its mark and secured a place.

An insider told ZM Tech: "Volcano Engine's actual competitive advantage lies in its domestic leading resource scale. Volcano Engine and ByteDance businesses such as Douyin and Toutiao are internally and externally integrated, enabling it to provide customers with cost-effective cloud services and thus gain a pricing advantage."

It is easy to see that, backed by ByteDance's ecosystem, Volcano Engine possesses a unique competitiveness.

In summary, the survival states of cloud services differ between China and foreign countries, leading to naturally different competitive landscapes. However, fair competition is crucial and a consensus in the internet industry.

After all, no matter how skilled you are, you still fear a kitchen knife.