Subsidiary's procurement qualification suspended by Southern Theater Command, major shareholders successively 'flee' Topsec

![]() 11/15 2024

11/15 2024

![]() 482

482

Produced by | Entrepreneurship Frontline

Art Editor | Xing Jing

Reviewer | Song Wen

One of China's oldest network security companies, Topsec Technology Group Co., Ltd. (hereinafter referred to as "Topsec"), has yet to emerge from the shadow of declining performance.

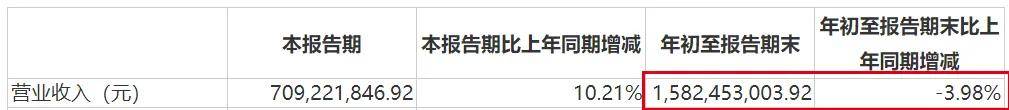

In the first three quarters of 2024, Topsec achieved revenue of 1.582 billion yuan, a year-on-year decrease of 3.98%; the cumulative net profit attributable to shareholders was a loss of 169 million yuan.

In addition to the decline in performance, shareholders have long been "fleeing".

Public information shows that Topsec was originally known as Nanyang Co., Ltd., and was acquired by Nanyang Co., Ltd. To raise funds for the acquisition of Topsec, Nanyang Co., Ltd. conducted private placements and issued shares for supporting financing, leading to a major change in the shareholder base, with Zheng Zhongnan, Mingtai Capital, and Zhang Zhengyu becoming the top three shareholders.

Times have changed, and these major shareholders have frequently reduced their holdings. In 2020, Hongshenghui, a concerted action person of Zheng Zhongnan, liquidated Topsec; in 2023, the remaining shares held by Mingtai Capital were all auctioned off, and they also exited Topsec. By the end of the third quarter of 2024, the shareholding ratios of Zheng Zhongnan and Zhang Zhengyu had both plummeted.

Today, Topsec's shareholding is dispersed, with no actual controller or controlling shareholder, and behind the shareholders' "flight", the company's share price has continued to fall.

As of November 14, the company's share price closed at 7.20 yuan per share, a decrease of about 78% over the four years since its peak of 32.09 yuan per share in 2020.

In just a few short years, what exactly has happened to Topsec?

1. Sustained profit losses, has the turning point arrived?

Recently, Topsec released its financial report for the first three quarters of 2024. During the reporting period, the company achieved revenue of 1.582 billion yuan, a year-on-year decrease of 3.98%.

(Image / Topsec Financial Report)

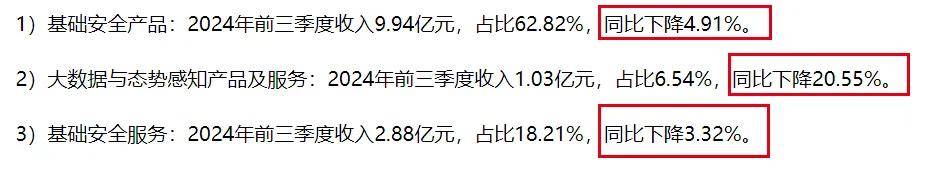

In Topsec's product landscape, it primarily includes basic security products, big data and situational awareness products and services, basic security services, cloud computing and cloud security products and services, as well as other businesses. Behind the decline in revenue, multiple Topsec businesses were hindered.

Among them, in the first three quarters of 2024, basic security products, which contributed over 62% of revenue, achieved income of 994 million yuan, a year-on-year decrease of 4.91%.

At the same time, revenue from big data and situational awareness products and services decreased by 20.55% year-on-year, and revenue from basic security services decreased by 3.32% year-on-year.

(Image / Topsec Announcement)

Compared to revenue, Topsec's profit performance has improved. In the first three quarters of 2024, its cumulative net profit attributable to shareholders was a loss of 169 million yuan, a narrowing of 31.83% compared to the same period last year. However, it is worth noting that this was not based on a recovery in business but mainly benefited from "cost reduction and efficiency enhancement," including layoffs.

(Image / Topsec Financial Report)

On October 27, Topsec stated during an investor survey that the increase in profit in the third quarter of this year was mainly due to the overall decrease in expenses, reflecting the effectiveness of cost control measures.

"The reduction in expenses after the reduction in headcount takes time to manifest, and the reduction in expenses this year will be more pronounced. As quite a few personnel were also optimized at the end of 2023 and the beginning of 2024, there will also be a more pronounced reduction in expenses at least in the first half of next year," said Topsec.

Behind the company's continuous layoffs lies the prolonged dilemma of Topsec's performance under pressure.

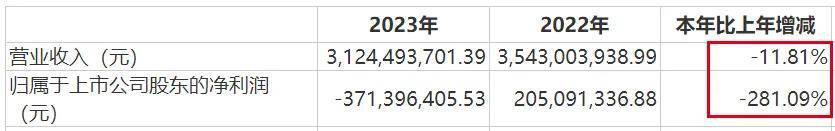

Wind data shows that as early as 2022, the company's net profit attributable to shareholders began to decline. Entering 2023, its revenue also entered a downward channel, and the net profit attributable to shareholders directly shifted from profit to loss, and has yet to emerge from the quagmire of losses.

(Image / Topsec Financial Report)

In fact, viewed from the industry perspective, this is not solely the fault of Topsec. Recently, the China Cybersecurity Industry Alliance (CCIA) released a report stating that the digitization construction of Chinese government and enterprises has slowed down, and the demand for network security has weakened, with many enterprises experiencing performance declines and losses, and most enterprises showing relatively weak revenue growth.

The good news is that at the end of September this year, relevant departments issued a series of policies to actively promote the development of the cybersecurity industry. Against this background, Topsec is quite optimistic about the future.

In the above survey, Topsec executives stated that with the gradual manifestation of the effects of macroeconomic policies, industry demand will gradually recover and accelerate growth, and it is expected that orders in the fourth quarter of this year will increase year-on-year.

2. Subsidiary's procurement qualification suspended, take advantage of “ Huawei concept ”

Although not as well-known as 360, Topsec is a pioneer in the cybersecurity industry.

Information on its official website shows that the company was established in 1995 and is the earliest established cybersecurity enterprise among listed companies. The year after its establishment, it developed China's first firewall product with independent intellectual property rights.

However, He Weidong, one of Topsec's founders, said that the startup period was very difficult. Due to the lack of start-up capital, the few entrepreneurs could only rent an abandoned computer room in Zhongguancun for research and development. "In 1995, 'Topsec' could not be considered a full-fledged company; it could only be considered a research team."

Recalling the difficulties of the early startup period, He Weidong admitted that at that time, after encountering obstacles everywhere, the company had to undertake some national research and development tasks to accumulate some project funds. It was not until 1996 that Topsec won a 6 million yuan system integration project from the National Bureau of Statistics, which led to a continuous increase in the company's sales performance.

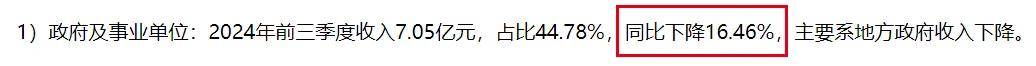

According to this statement, Topsec can be considered a cybersecurity enterprise that grew with the support of government orders. However, today, government orders are declining.

In the first three quarters of 2024, the company's revenue from governments and institutions was 705 million yuan, a year-on-year decrease of 16.46%. In response, Topsec explained that this was mainly due to the decline in local government revenue.

(Image / Topsec Announcement)

It is noteworthy that according to information released by the Military Procurement Network, Beijing Topsec Network Security Technology Co., Ltd. (hereinafter referred to as "Beijing Topsec") is suspected of having irregularities and breaches of trust in its participation in the procurement activities for the network security construction project of the video surveillance system.

According to relevant regulations on military supplier management, its qualification to participate in procurement activities within the scope of the Southern Theater Command (organs and directly affiliated units, troops stationed in Hong Kong, China, and troops stationed in Macao, China) has been suspended since October 19, 2024.

(Image / Screenshot from Military Procurement Network)

Corporate inquiry information shows that Beijing Topsec, suspected of irregularities, is an indirect wholly-owned subsidiary of Topsec.

What irregularities did Beijing Topsec commit? Was the company aware of them in advance? What impact does the loss of procurement qualification in the Southern Theater Command have on the company? Regarding this, "Interface News·Entrepreneurship Frontline" attempted to obtain information from Topsec, but had not received a response as of press time.

In fact, government payments also affected the company's operating cash flow.

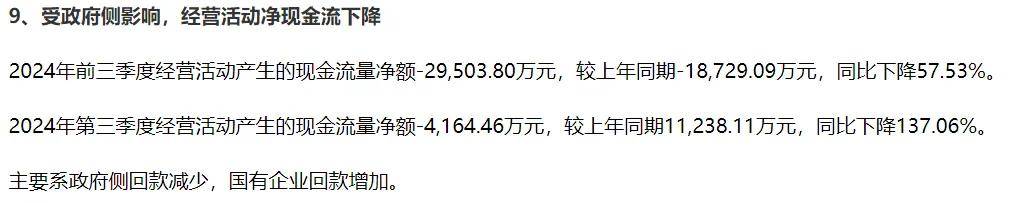

In the first three quarters of 2024, the company achieved a net operating cash flow of -295 million yuan, a year-on-year decrease of 57.53%. Among them, the net operating cash flow in the third quarter was -41.6446 million yuan, a year-on-year decrease of 137.06%. Topsec bluntly stated that the main reason for this situation was the reduction in government payments.

(Image / Topsec Announcement)

However, Topsec believes that with the introduction of various policies such as debt resolution, special treasury bonds, and long-term treasury bonds, the government's financial situation will improve, and it is expected that government industry payments will improve in the fourth quarter.

In fact, with traditional businesses hindered, Topsec has long been aware of expanding its business boundaries and seeking to build a second growth curve.

Since the launch of cloud computing products in 2019, the company has deployed many new scenarios such as network security, data security, cloud computing, cloud security, information innovation security, AI+security, industrial internet security, IoT security, and vehicle networking security.

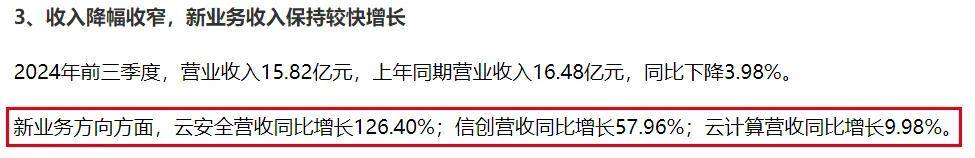

Currently, the performance of multiple new businesses is showing an upward trend. In the first three quarters of 2024, cloud security revenue increased by 126.40% year-on-year, information innovation revenue increased by 57.96% year-on-year, and cloud computing revenue increased by 9.98% year-on-year.

(Image / Topsec Announcement)

However, on the whole, the "cloud computing and cloud security products and services" business achieved revenue of 188 million yuan in the first three quarters of this year, an increase of 11.58% year-on-year, contributing less than 12% of revenue and unable to boost overall performance.

While expanding new businesses, Topsec's partner boundaries are also expanding, and it has hopped on the "Huawei Concept" express train.

Tonghuashun data shows that on October 23, 2024, Topsec added the "Huawei Concept" due to its connections with Tencent, Huawei, Alibaba, and other enterprises.

As for the extent of cooperation between Topsec and Huawei, "Interface News·Entrepreneurship Frontline" attempted to obtain information from Topsec, but had not received a response as of press time.

3. Major shareholders compete to 'flee', is the 'sweet cake' no longer delicious?

When mentioning Topsec, it is impossible to bypass its "curved listing" history through acquisition.

Turning back the clock to 2016, Topsec was then known as Nanyang Co., Ltd., a wire and cable business enterprise with little connection to the cybersecurity industry.

In August 2016, Nanyang Co., Ltd. announced its intention to acquire 100% of the equity of Beijing Topsec Technology Co., Ltd. (hereinafter referred to as "Topsec Technology") through the issuance of shares and cash payments, with a transaction price of up to 5.7 billion yuan.

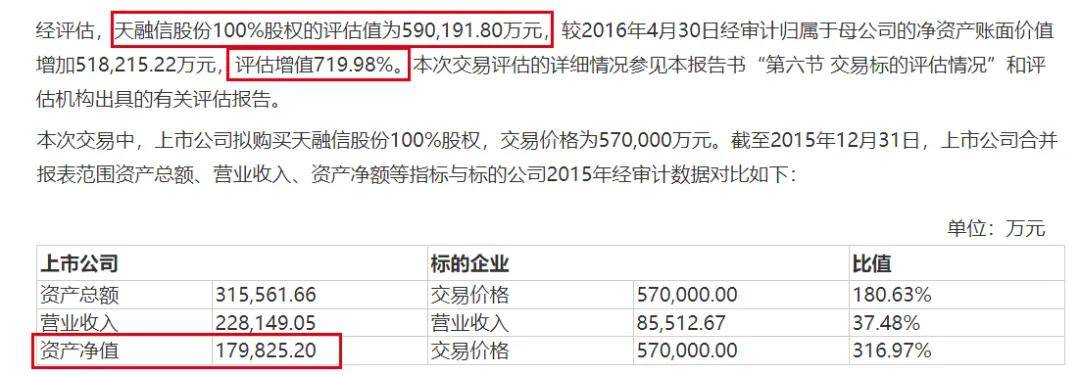

According to the asset appraisal report issued by Zhongqihua, as of the appraisal base date of April 30, 2016, the appraised value of 100% equity of Topsec Technology was 5.902 billion yuan, with an appreciation rate of 719.98% compared to its audited net asset value of 720 million yuan on the parent company's books. As of December 31, 2015, the net asset value of Nanyang Co., Ltd. was even less than 2 billion yuan.

(Image / Topsec Announcement)

There has been frequent external skepticism about this "snake swallowing elephant" acquisition, which is actually a "backdoor listing" of Topsec Technology. However, Nanyang Co., Ltd. insisted that this transaction did not constitute a backdoor listing, reasoning that the company's controlling shareholder and actual controller had not changed and were still Zheng Zhongnan.

Public information shows that before this transaction, Zheng Zhongnan held 54.63% equity in Nanyang Co., Ltd. After the transaction, considering the impact of newly issued shares for supporting financing, Zheng Zhongnan's shareholding in the listed company dropped to 24.30%, while Hongshenghui, which is actually controlled by Zheng Zhongnan, held 1.80% equity, making Zheng Zhongnan the controlling shareholder.

At the same time, Mingtai Capital, the original largest shareholder of Topsec Technology, and Zhang Zhengyu, one of the original founders, became the second and third largest shareholders of Nanyang Co., Ltd., holding 13.98% and 4.97% of shares, respectively.

(Image / Topsec Announcement)

After acquiring Topsec Technology, Nanyang Co., Ltd. welcomed two heavyweight strategic investors in 2019 - Tencent and China Electronics Technology Group Corporation (CETC).

Also in 2019, Nanyang Co., Ltd. suddenly announced at the end of the year that to focus on the field of cybersecurity, it intended to sell all assets, related rights, and liabilities related to its wire and cable business to Zheng Zhongnan or his designated affiliates, which were the core assets of Zheng Zhongnan's business startup.

Ultimately, Guangzhou Nanyang Capital, Tianjin Jiayi, Guangdong Nanyang Capital, and Shantou Nanbiao took over the wire and cable business for 2.105 billion yuan, and all four enterprises are controlled by Zheng Zhongnan or his children.

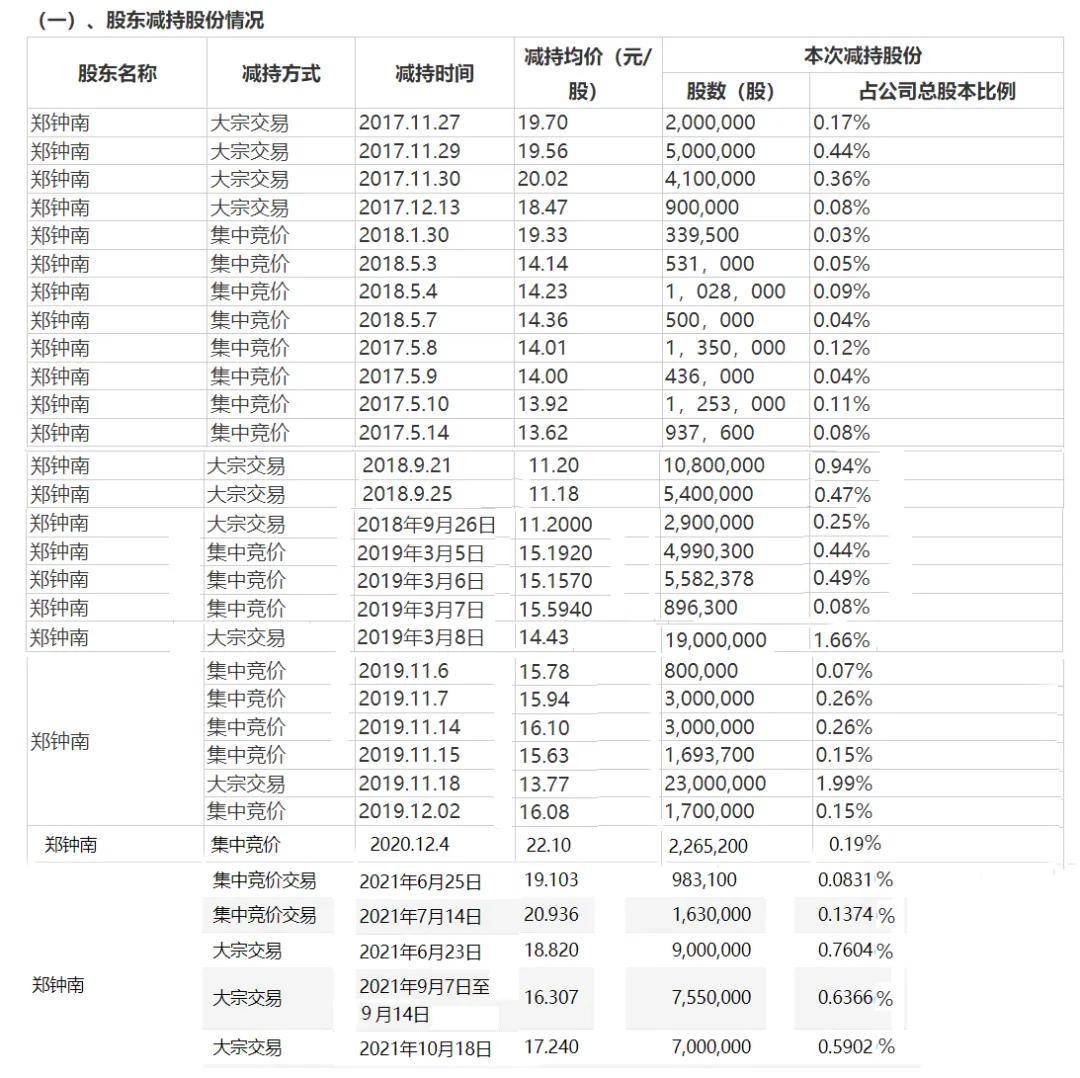

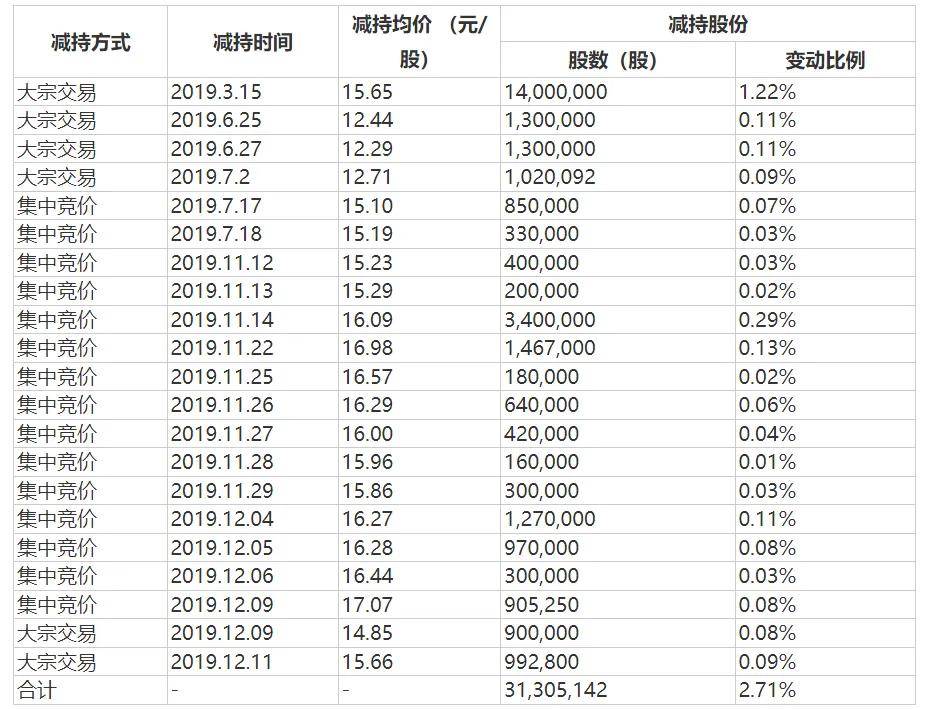

In fact, Zheng Zhongnan's departure came earlier, starting from 2017, Zheng Zhongnan frequently reduced his holdings. According to the incomplete statistics of "Interface News·Entrepreneurship Frontline", from November 2017 to October 2021, Zheng Zhongnan reduced his holdings by over 30 times, cashing out nearly 2 billion yuan.

(Image / Topsec Announcement)

During the introduction of CETC in November 2019, Zheng Zhongnan transferred 33 million shares of the company to CETC (Tianjin) Network Information Technology Partnership (Limited Partnership) (hereinafter referred to as "CETC Network Information") at a price of 13.77 yuan per share, cashing out 454 million yuan.

In addition, the shareholding of the company held by Hongshenghui, a concerted action person of Zheng Zhongnan, was lifted from trading restrictions in February 2020. Between November 25 and December 1 of that year, all the shares held were reduced and directly liquidated.

(Image / Topsec Announcement)

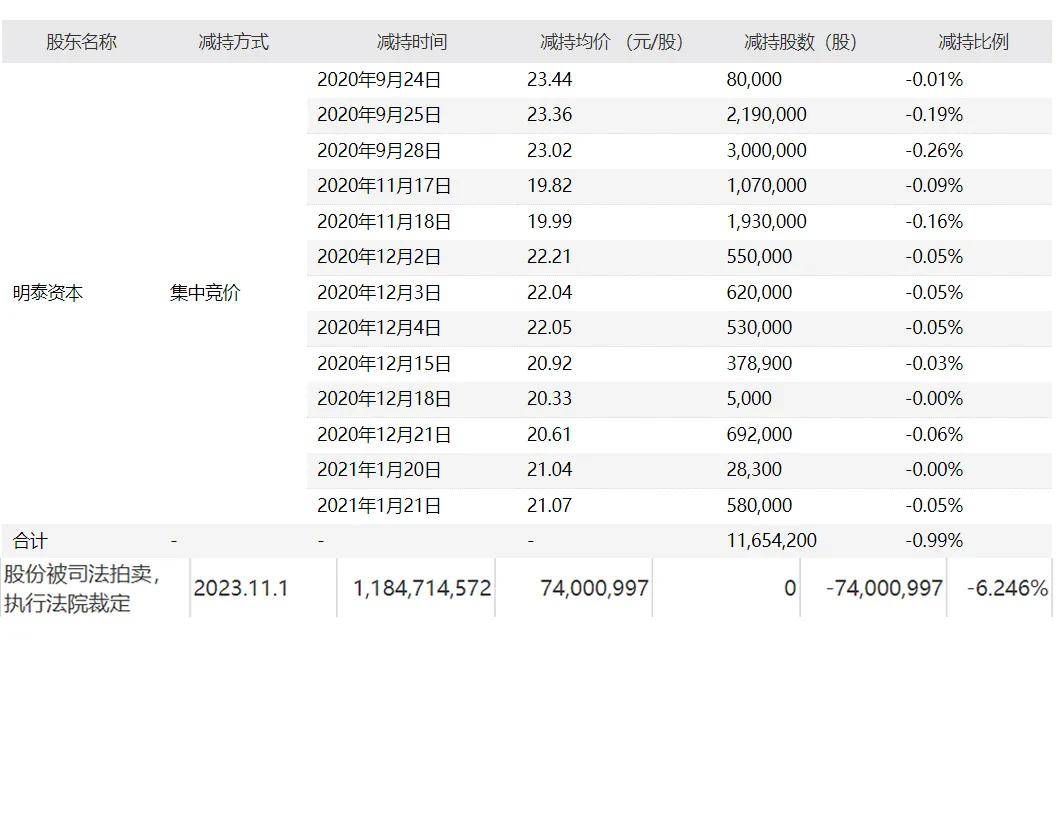

However, Zheng Zhongnan is not the only shareholder who has 'fled'. Also in November 2019, Mingtai Capital also transferred 25 million shares of the company to CETC Network Information at the same price of 13.77 yuan per share, cashing out 344 million yuan.

According to incomplete statistics from "Jiemian News: Entrepreneurship Frontline", Mingtai Capital reduced its stake in Topsec by more than 30 times from 2019 to 2021. By November 2023, the remaining 6.246% stake in Topsec held by Mingtai Capital was auctioned off by the judiciary, marking its complete exit from Topsec.

(Image / Topsec Announcement)

As of the end of the third quarter of 2024, Zheng Zhongnan's remaining stake in Topsec was only 7.20%, and Zhang Zhengyu's was only 1.17%. The 2023 financial report shows that neither Zheng Zhongnan nor Zhang Zhengyu holds a position in Topsec's management.

(Image / Topsec Financial Report)

Currently, Zheng Zhongnan remains the company's largest shareholder, but since October 26, 2020, Topsec has had no controlling shareholder or actual controller.

Behind the rush of major shareholders to leave, Topsec's share price has continued to fall. As of the close of November 14, Topsec closed at 7.20 yuan per share, down about 78% from its peak of 32.09 yuan per share in 2020.

Now, after joining the "Huawei Concept," how will Topsec change in the future? "Jiemian News: Entrepreneurship Frontline" will continue to pay close attention.

*Note: The featured image in this article is from Shutterstock, based on the VRF agreement.