Revitalized by 'national subsidies', is JD.com on the rebound?

![]() 11/15 2024

11/15 2024

![]() 596

596

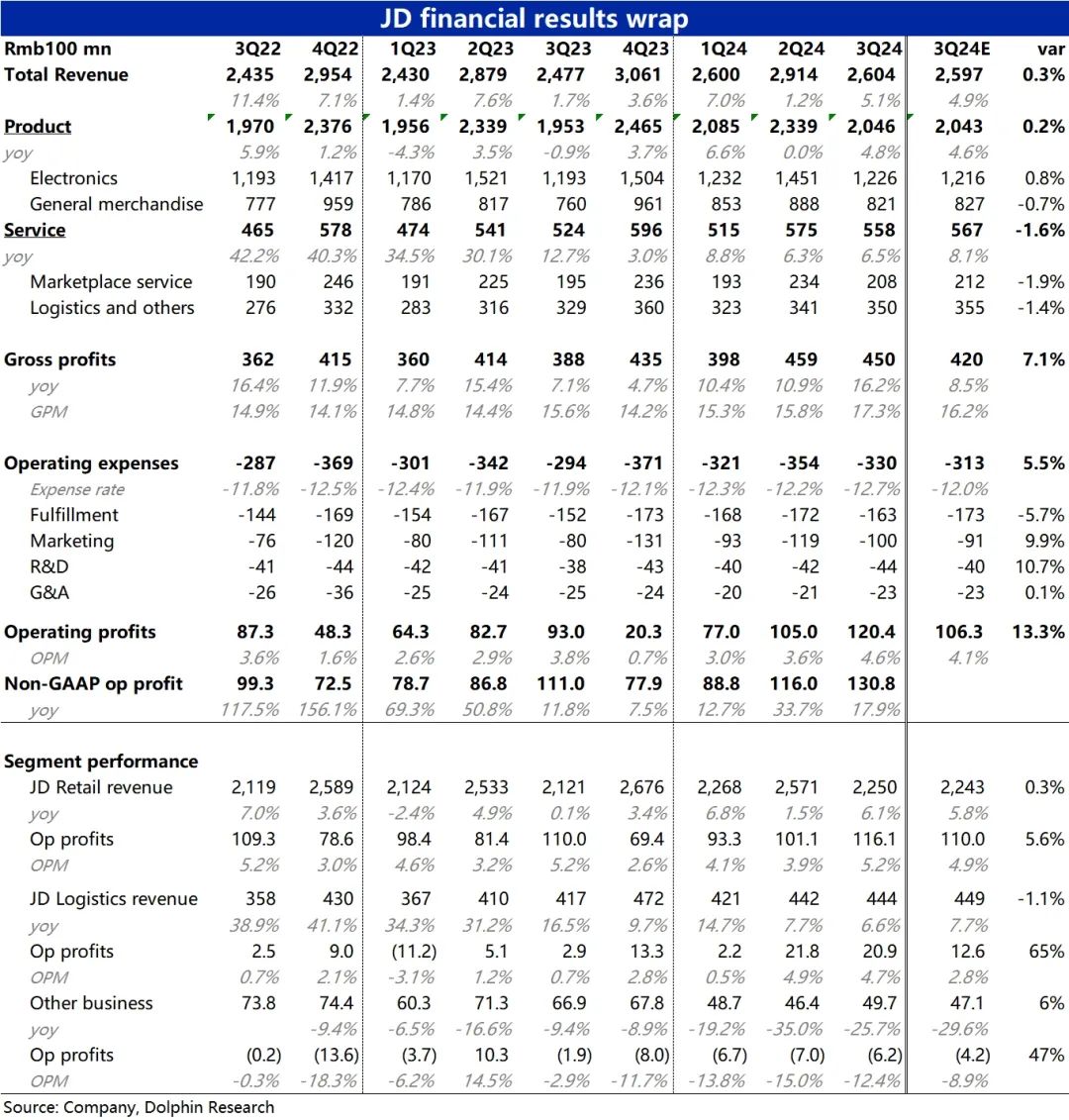

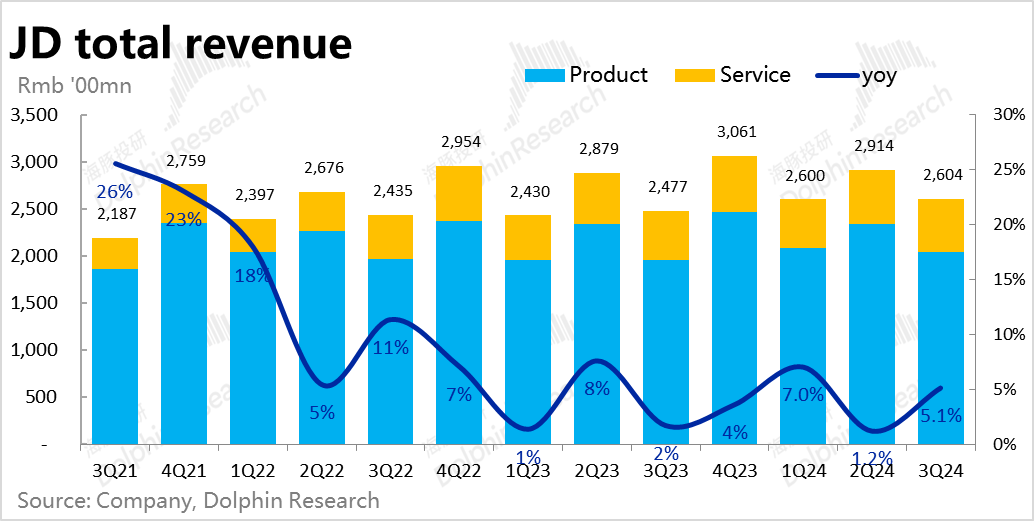

Before the US stock market opened on the evening of November 14, Beijing time, JD.com (JD.US) released its financial report for the third quarter of 2024. Overall, due to sufficient prior communication between the company and the market, the revenue indicators were generally in line with expectations, with no significant surprises. In terms of profits, although the group's operating profit was 13% higher than expected, indicating an overall positive performance, the profitability of the core mall segment (temporarily) stagnated, representing the biggest flaw. Detailed points are as follows:

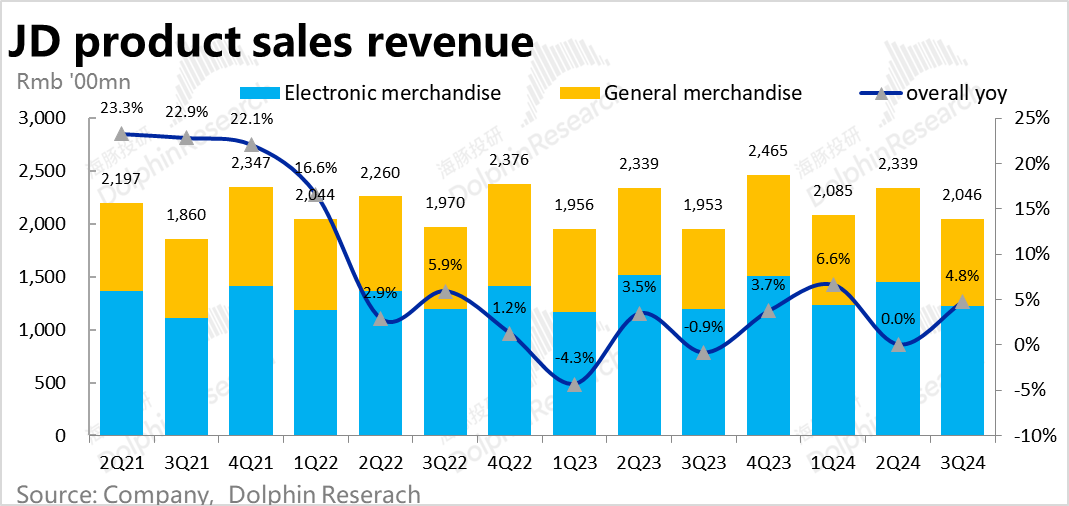

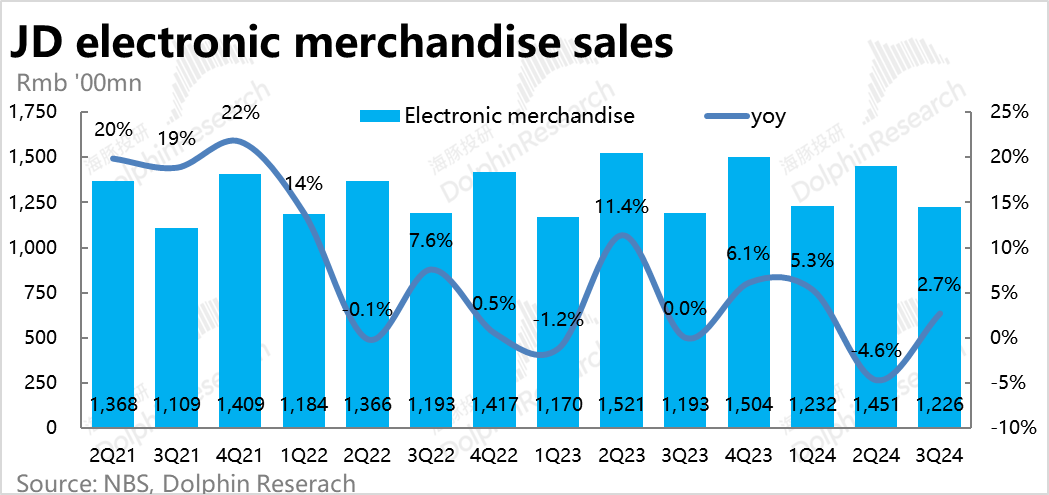

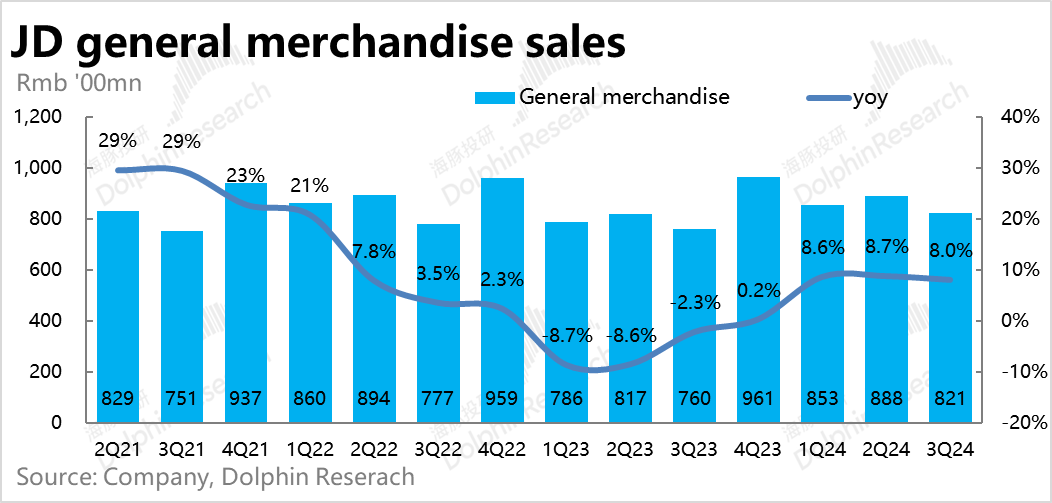

1. The self-operated retail business, which accounts for the largest proportion, generated revenue of 204.6 billion yuan in this quarter, a year-on-year increase of 4.8%. Compared to the zero year-on-year growth in the previous quarter, there was a significant rebound. This was mainly attributed to the sales of electrical products, which benefited from the national subsidy policy for home appliance replacements. The revenue growth rate rebounded significantly from a year-on-year decline of 4.6% in the previous quarter to a positive growth of 2.7%. General merchandise retail maintained a relatively high growth rate of about 8% this quarter, with little change from the previous quarter. Although the rebound in electrical product sales drove an increase in self-operated retail revenue, which was originally good news, there were no surprises as the market had already digested this information and adjusted expectations accordingly.

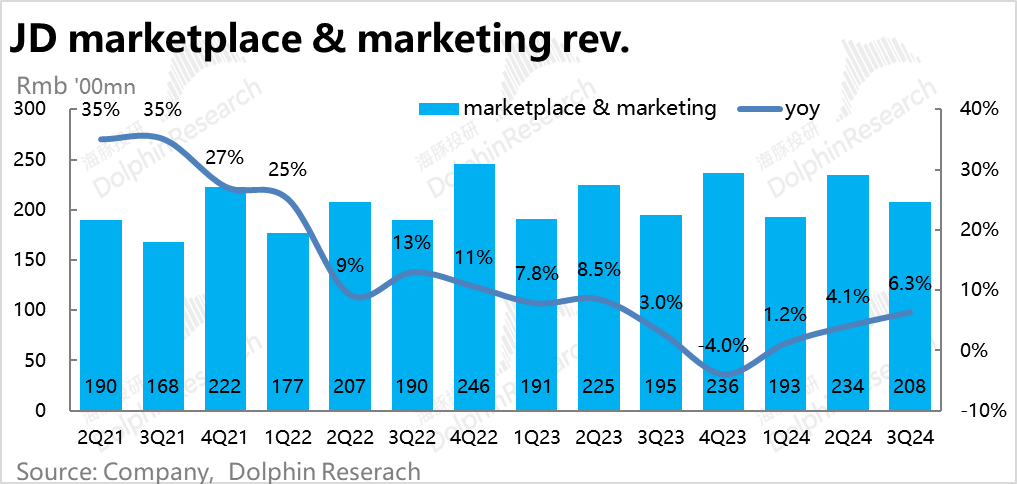

2. The commission and advertising business, which mainly targets 3P sellers, generated revenue of 20.8 billion yuan in this quarter, a year-on-year increase of 6.3%. This followed the trend of the 1P business and also accelerated by 2.2 percentage points compared to the previous quarter. However, it was about 1.9% lower than expected, and the growth rate advantage over self-operated retail also narrowed, indicating a less than stellar performance.

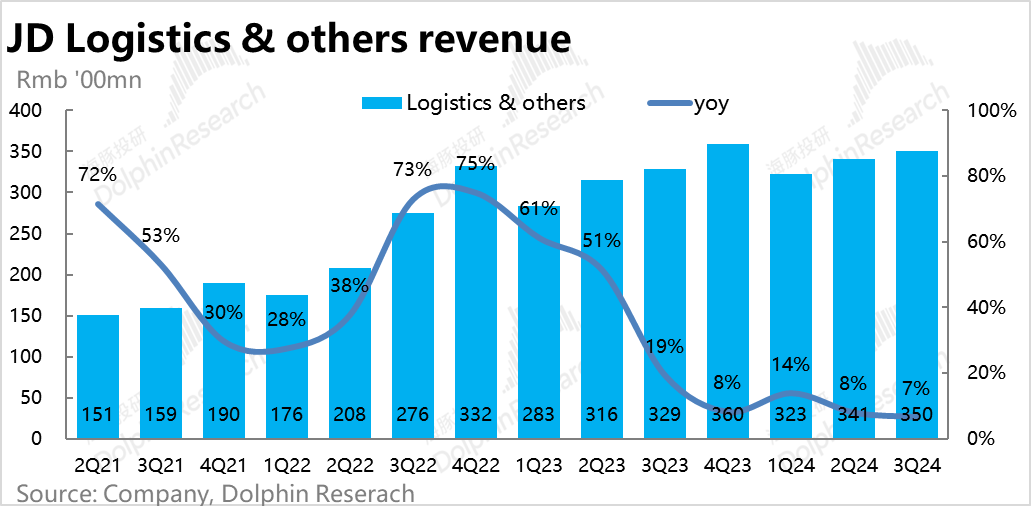

3. The logistics revenue, including JD Logistics and Dada Now, slowed from approximately 8% to 6.5% in this quarter. The actual revenue was about 1.4% lower than expected. Recently, JD Logistics' access to the Taobao platform is expected to boost logistics business growth, but this has not yet been reflected in the third quarter. Nevertheless, although the growth of the logistics segment was somewhat disappointing, the profit release was very impressive.

4. As mentioned earlier, the group's overall operating profit was 12 billion yuan, about 1.4 billion yuan (or 13%) higher than expected, indicating an overall positive performance. However, the operating profit of the core JD Mall only increased by 5.5% year-on-year, falling behind the 6.1% revenue growth rate of the segment. This indicates that the operating profit margin of the mall segment slightly declined year-on-year. Although the decline was minimal, the signal that the trend of improving mall profit margins may have come to an end is a "huge" problem.

5. The main contribution to the group's profit beat actually came from the JD Logistics segment. According to JD Logistics' (independently listed) own financial report disclosure, compared to the 6.6% revenue growth rate, the cost of JD Logistics only increased by 2.2% year-on-year. Among them, labor costs such as employee and external costs increased at a low single-digit rate year-on-year; other costs such as rental depreciation, fuel, packaging, and consumables were generally flat or declined year-on-year. This was the main reason for the significant profit beat in the logistics segment.

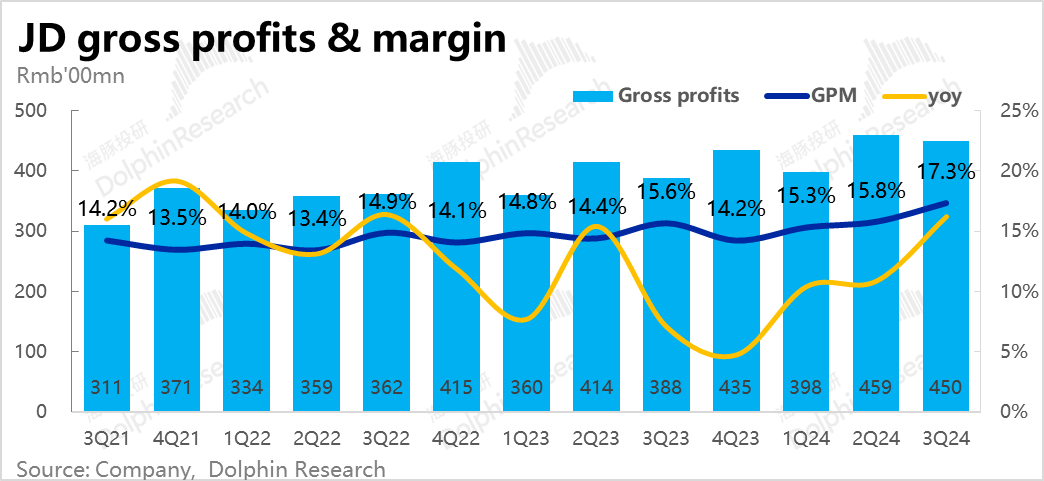

6. From the perspective of costs and expenses, what are the reasons for the decline in the operating profit margin of the mall segment? At the gross profit level, the group's overall gross profit margin reached 17.3% this quarter, a significant increase of 1.7 percentage points year-on-year. The gross profit was also nearly 3 billion yuan higher than expected, indicating no issues at the gross profit level.

However, as mentioned earlier, while the increase in the proportion of general merchandise may increase the gross profit margin, it may not necessarily be favorable for the operating profit margin (due to the high fulfillment cost ratio caused by low average order value). Additionally, although the difference in revenue and cost growth rates in the logistics segment will reflect an increase in the group's overall gross profit margin, it is not favorable for the profits of the mall segment.

7. At the expense level, marketing expenses significantly increased to 10 billion yuan this quarter (compared to 8 billion yuan in the same period last year), exceeding the expected 9.1 billion yuan. Similarly, research and development expenses also increased from 3.8 billion yuan last year to 4.4 billion yuan, exceeding the expected 4 billion yuan. It is evident that expenses in this quarter significantly increased and exceeded expectations. Therefore, it can be inferred that JD.com should have genuinely increased subsidies or customer acquisition efforts in the third quarter, which is the main reason for the slight decline in the profit margin of the mall segment despite no increase.

In addition, due to the reduction in the free shipping threshold, the proportion of fulfillment costs in self-operated retail revenue also increased year-on-year (+0.2 percentage points), which may also be one of the factors suppressing the profit margin of the mall.

Dolphin Investment Research Perspective:

Originally, with the recovery in sales of electrical products driving an acceleration in the group's overall revenue growth, coupled with the group's overall operating profit slightly exceeding expectations, this quarter's financial report was considered a decent performance. However, as the market had already anticipated this, after the surprise of revenue growth rebound faded, the (temporary) stagnation in the improvement of the operating profit margin of the core mall business became the main focus of this financial report.

Although the year-on-year decline in the operating profit margin of the mall segment by 0.03 percentage points in this quarter was almost negligible, under the premise that JD.com's current revenue growth rate is still stuck in the single digits, the previous significant improvement in the mall segment's profit margin, which brought about a profit growth rate significantly outpacing revenue growth, was one of the key reasons why JD.com became the most preferred e-commerce stock in the market for nearly a quarter. After all, if the logic of profit margin improvement is lost, how can a company with only single-digit revenue growth and similar profit growth rates attract market attention?

However, in the short to medium term, Dolphin Investment Research is not pessimistic about JD.com. Under the pressure of the third-quarter environment, some flaws in performance are understandable. During the Double 11 period, JD.com's sales of electrical products, stimulated by national subsidies, remained impressive according to research, with the potential for further growth. Moreover, the market's expectation for the revenue growth rate of the mall segment in the fourth quarter was 6.2%, showing no acceleration compared to this quarter. In other words, the market has not yet been "spoiled" about the fourth-quarter performance, leaving room for exceeding expectations. Therefore, what will have a greater impact on subsequent trends is the management's updated guidance for the fourth quarter during the earnings call and how long the favorable national subsidies can last.

From a valuation perspective, after a recent correction of about 25% from a high of approximately $48, according to our calculations, the pre-market capitalization corresponds to approximately 9.5x PE for the 2025 after-tax operating profit (after adding back share-based compensation and non-recurring expenses). This has returned to a relatively neutral to low price level. Therefore, if the guidance for the fourth quarter can be revised upwards, the current price still presents an opportunity.

Detailed Interpretation of This Quarter's Financial Report

I. Rapid Rebound in Sales of Electrical Products Due to National Subsidies, but the Market Has Already Digested This Information in Advance

1. First, let's look at the self-operated retail business, which accounts for the largest proportion. This quarter, it generated revenue of 204.6 billion yuan, a year-on-year increase of 4.8%. Compared to the zero year-on-year growth in the previous quarter, there was a significant rebound. However, as mentioned earlier, the market had already digested this improvement, with consensus expectations raised to 4.6% growth, so it can only be considered in line with expectations.

Specifically, the revenue from electrical products rebounded from a year-on-year decline of 4.6% in the previous quarter to a positive growth of 2.7%. The pull of national subsidies was evident, but the market had also anticipated this, with actual performance only slightly higher than expectations by 0.8%. According to overall retail sales data released by the NBS, the sales growth rate of household appliances quickly rebounded from negative growth in June and July to over 20% year-on-year in September, indicating a clear trend of improvement. It remains to be seen whether there will be surprises in the growth of electrical products in the fourth quarter.

After overcoming the impact of model changes, general merchandise retail continued to maintain a relatively high growth rate of 8% this quarter, with little change from the previous quarter and generally in line with expectations. At the same time, the growth rate of general merchandise still outpaced that of electrical products, and the gross profit margin of such merchandise is relatively high, which will have a pulling effect on the overall gross profit margin of the mall.

2. Platform Service Revenue: The commission and advertising business, which mainly targets 3P sellers, generated revenue of 20.8 billion yuan in this quarter, a year-on-year increase of 6.3%. This followed the trend of the 1P business and also improved compared to the previous quarter (with an acceleration of nearly 2.2 percentage points). However, the actual revenue was about 1.9% lower than expected, and the gap in growth rate leading self-operated retail also narrowed. Nevertheless, according to company disclosures, the number of transaction users for 3P merchants increased by 20% this quarter, and the number of completed orders increased by 30%. The actual business growth does not appear poor, indicating that it is mainly affected by the decline in average order value or the drag from the conversion rate.

3. Logistics and Other Services: The logistics segment, including JD Logistics and Dada Now, saw its revenue growth rate slow slightly to 7% this quarter, slightly lower than market expectations by 1.1 percentage points. The recent official access of JD Logistics to the Taobao platform is expected to boost logistics business growth, but this has not yet been reflected in the third quarter. However, although the growth of the logistics segment slowed down, the profit release was very impressive, as discussed later.

II. Strengths: Profit Beat; Weaknesses: The Beat Did Not Come from the Mall Segment

Summarizing the above businesses, JD.com achieved a year-on-year growth rate of 5.1% in overall revenue this quarter, a noticeable increase from the previous quarter, but this was already within market expectations. This was mainly attributed to the sales of electrical products under self-operated retail.

The previous section classified by revenue type; this section will classify by business segment.

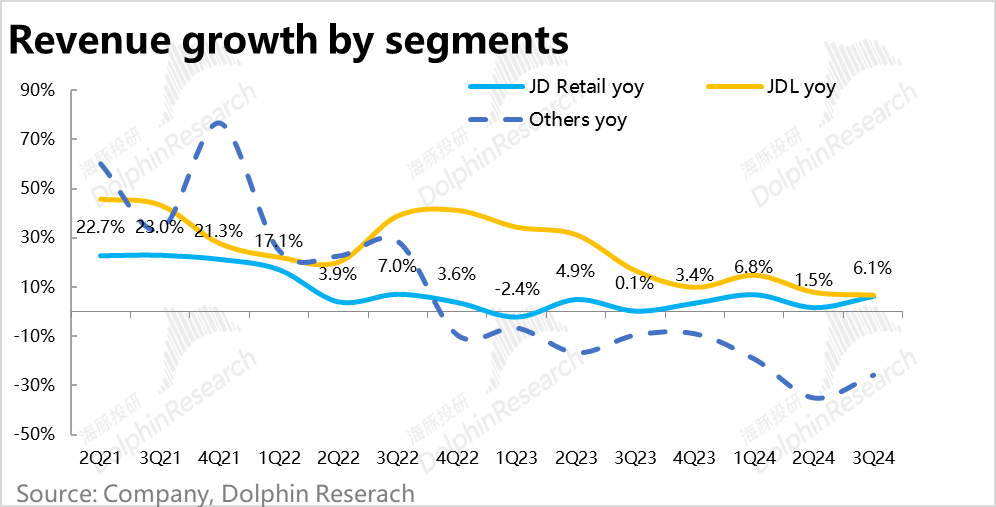

1) The key JD Mall achieved a year-on-year revenue growth of 6.1% this quarter (mainly following the trend of 1P self-operated retail revenue), which was in line with expectations.

2) JD Logistics (JDL) saw its revenue growth rate decline slightly by 1.1 percentage points to 6.6% this quarter, which was slightly lower than expected, as mentioned earlier.

3) Including Dada and other innovative businesses, revenue continued to decline year-on-year this quarter, with a decline rate of 26%. The decline rate was slightly lower than expected. Generally, JD.com is continuing to eliminate unprofitable marginal businesses.

From a revenue perspective, the significant improvement in the growth rate of core electrical products in the self-operated retail segment was originally a notable positive, but unfortunately, the market had already anticipated and digested this information, bringing no surprises. However, at the profit level, JD.com still had some notable performances this quarter. The group's overall operating profit was 12 billion yuan, about 1.4 billion yuan (or 13%) higher than expected. Although the overall performance was good, the profit structure was not ideal.

By business segment:

1) The operating profit of JD Mall was 11.6 billion yuan, a year-on-year increase of 5.5%. Although it was still 600 million yuan higher than market consensus expectations, the growth rate of the segment's operating profit lagged behind the 6.1% revenue growth rate, indicating a year-on-year decline in the operating profit margin of the mall segment (from 5.19% to 5.16%). Although the decline was minimal, the issue is that with a revenue growth rate of less than 10%, the market's relatively favorable view of JD.com among e-commerce players was its expanding profit margins, which could drive profit growth rates that surpass revenue growth rates. Therefore, once the trend of profit expansion stops, what attractiveness can less than 10% revenue and profit growth rates have?

2) JD Logistics, although its growth rate slightly declined and was slightly lower than expectations this quarter, achieved impressive profit release, with an operating profit of 2.09 billion yuan, far exceeding market expectations of 1.26 billion yuan.

According to JD Logistics' (independently listed) own performance report, the main reason for the significant profit beat was the noticeable decline in the cost ratio. JD Logistics (as an independent company) achieved a revenue growth rate of 6.6% this quarter, but its costs only increased by 2.2% year-on-year. Among them, labor costs such as employee and external costs increased at a low single-digit rate year-on-year, while other costs such as rental depreciation, fuel, packaging, and consumables were generally flat or declined year-on-year.

For a heavy asset business like logistics, with the increase in order volume, there is considerable potential for the release of scale effects and average order revenue logic. Therefore, JD Logistics may still have considerable room for further growth in the future.

3) As for other business segments including Dada, they still incurred a loss of 620 million yuan this quarter, exceeding the expected loss of 420 million yuan.

III. Reducing Purchasing Prices and Increasing Gross Profit Margins Are the Main Contributors to Profit Expectations

From the perspective of costs and expenses, what are the reasons for the decline in the operating profit margin of the mall segment?",

We believe that the increase in gross profit margin is due to the rise in the proportion of general merchandise with high gross profit in the self-operated retail product mix, as mentioned earlier, and the fact that the cost growth rate of JD Logistics is significantly lower than the revenue growth rate. Both of these factors have contributed to the increase.

However, although general merchandise has high gross profit, its operating profit rate may not necessarily be high (due to the low customer transaction price, the fulfillment cost accounts for a relatively high proportion). Moreover, the outperformance of the logistics segment is unrelated to the marketplace business.

"Expenses: It can be seen that marketing expenses have significantly increased from 8 billion yuan last year to 10 billion yuan this quarter, which is also higher than the expected 9.1 billion yuan. Similarly, R&D expenses have increased from 3.8 billion yuan last year to 4.4 billion yuan, exceeding the expected 4 billion yuan. This indicates that there has been unexpected expansion in expenses this quarter, suggesting that JD did indeed increase subsidies or customer acquisition investments in 3Q. This may be the main reason why the profitability of the marketplace segment did not increase but slightly decreased.

Meanwhile, due to the previous reduction in the free shipping threshold, the proportion of fulfillment costs to self-operated retail sales has also increased year-on-year (+0.2 percentage points), which may also be one of the reasons suppressing the profitability of the marketplace.

- END -

// Reposting Authorization This article is an original piece by Dolphin Investment Research. For reposting, please obtain authorization.