Triple profit growth, record-high share price, and fundamentally sound SMIC is worth the wait?

![]() 11/15 2024

11/15 2024

![]() 556

556

Text|Hengxin

Source|Bowang Finance

The $800 billion chip giant has set a new record.

As a world-leading integrated circuit foundry and the leader in China's IC manufacturing industry, SMIC has achieved remarkable performance in segments such as CIS (image sensors), PMIC (power management integrated circuits), IoT, and DDIC (display driver integrated circuits), leading to a significant improvement in its performance.

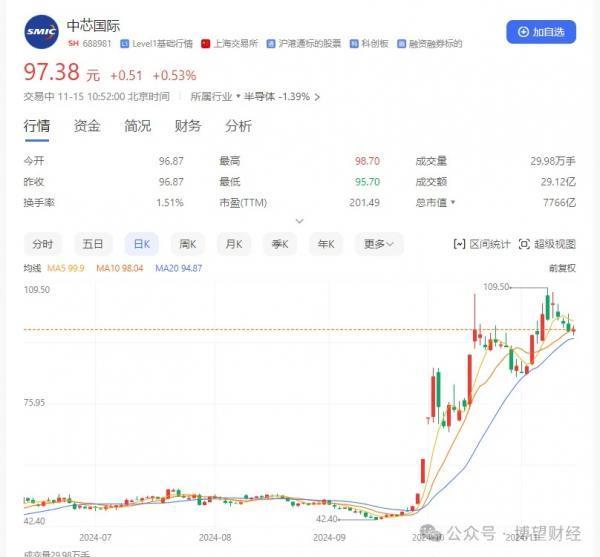

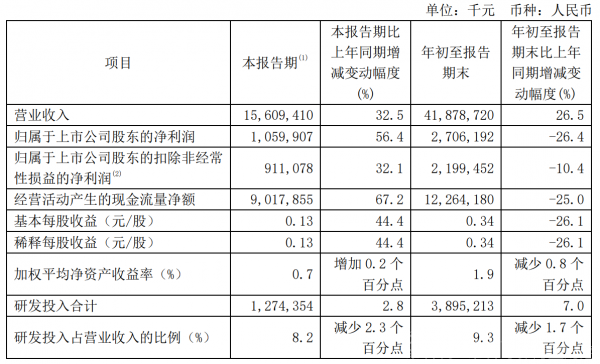

On November 8, SMIC released its 2024 third-quarter report, showing that revenue for the quarter was 15.609 billion yuan, a year-on-year increase of 32.5%; net profit attributable to shareholders of listed companies was 1.06 billion yuan, a year-on-year increase of 56.4%. In the first half of this year, SMIC's net profit declined by 45% year-on-year. Regarding the significant improvement in the third quarter, SMIC stated, "It is mainly due to the year-on-year increase in wafer sales and changes in product mix." According to International Financial Reporting Standards, SMIC's revenue increased by 14% quarter-on-quarter to $2.17 billion in the third quarter, marking a new record high. Additionally, SMIC provided guidance for the fourth quarter, expecting revenue to remain flat to increase by 2% quarter-on-quarter, with a gross margin ranging from 18% to 20%. In other words, SMIC's annual operating revenue for 2024 is expected to reach 57.5 billion yuan, a new record high.

Such outstanding performance is naturally supported by the market. According to a report by market research firm Counterpoint Research, driven by strong AI demand, global foundry revenue increased by approximately 9% quarter-on-quarter in the second quarter of 2024. Among them, TSMC continued to rank first with a 62% market share, while SMIC remained in third place globally for two consecutive quarters. This indicates that even though the semiconductor products and equipment industries, where SMIC operates, are highly competitive, facing international giants like TSMC, Samsung Electronics, NVIDIA, and Broadcom, SMIC can still enhance its competitiveness within the industry due to its outstanding performance in mid-to-low-end consumer electronics and smartphones.

Multiple securities firms have also given SMIC high praise. Among them, CICC believes that "SMIC's revenue and profitability exceeded expectations, mainly due to strong consumer electronics demand in the third quarter and overseas customers' preference for early shipments, which increased capacity utilization during the period. We are optimistic about SMIC's long-term growth potential as a core leader in China's industry and have raised our target price to HK$33, maintaining an 'Outperform' rating." Meanwhile, Zhaoxin Securities released a research report stating, "Due to the recovery of consumer electronics products and improved demand in the smartphone terminal market, as well as the launch of more new products in China, such as AI, SoCs, and automotive chips, SMIC's expected capacity utilization and gross margin will rebound. Therefore, we maintain a 'Buy' rating for SMIC's H-shares, expecting a robust short-term recovery outlook and raising the target price from HK$24 to HK$37."

SMIC, with its promising future, has also won the recognition of investors. In the secondary market, SMIC's share prices have shown a significant upward trend in both A-shares and H-shares. As of the close on November 14, the A-share price was 96.87 yuan per share, up about 90% since the beginning of 2024, with a market capitalization exceeding 770 billion yuan; the H-share price exceeded HK$26.55 per share, up about 40% since the beginning of 2024, with a market capitalization exceeding HK$210 billion. Based on the latest exchange rate, SMIC's "A+H" market value is close to 1 trillion yuan.

01

Behind the steadily rising K-line is a solid moat

Extreme scarcity is SMIC's greatest asset.

Experts in the field know that the integrated circuit industry chain can be divided into seven categories: design, manufacturing, packaging and testing, IDM (Integrated Device Manufacturer), equipment, and materials, collectively referred to as semiconductors or chip concepts in the stock market. All chips require the manufacturing process. Fortunately, SMIC is currently the only publicly traded company in A-shares that manufactures chips (foundry services), making it highly scarce.

Similarly, vast market demand is also crucial.

The semiconductor market where SMIC operates is gradually recovering, with positive trends in all segments of the industry chain. As a key industry at the front end of the industry chain, wafer foundry services are experiencing a certain rebound in demand. According to the latest data forecast by the World Semiconductor Trade Statistics Association (WSTS), the total size of the global semiconductor market will rise to $611.2 billion in 2024. Meanwhile, SMIC explained that in the medium to long term, the positive trend in the industry remains unchanged. With the continuous increase in interconnection and intelligence demands across various fields such as wearables, home appliances, commerce, transportation, industry, healthcare, education, and scientific research, the semiconductor content in terminal electronic products will increase year by year.

Of course, all of this behind SMIC's success is inseparable from policy support.

National policies have increasingly supported the semiconductor industry, and SMIC, as an industry leader, will benefit from these policy dividends. For example, to address the issue of reliance on semiconductor chip imports, China is now providing unprecedented support to semiconductor enterprises. According to relevant reports, China aims to achieve a 70% self-sufficiency rate for chips by 2030, compared to the current rate of around 30%. This huge market space provides broad development opportunities for semiconductor enterprises like SMIC.

Even in the highly competitive semiconductor products and equipment industries, SMIC continues to enhance its competitiveness through excellent performance in mid-to-low-end consumer electronics and smartphones, as well as continuous technological innovation and capacity expansion. At the same time, SMIC benefits from localized demand in the Chinese market and supply chain changes driven by geopolitics, as some customers gain access to the industry chain, bringing new demand.

02

Cumulative R&D expenses exceed 30 billion yuan, with a more than threefold increase in net profit after deducting non-recurring gains and losses

Apart from external factors, SMIC itself is also very "diligent."

Firstly, it has a diverse product platform and well-known brand advantages. SMIC has long focused on the development of integrated circuit process technology, successfully developing various technology nodes from 0.35 microns to FinFET, applied to different process technology platforms. It has mass production capabilities across multiple technology platforms, including logic circuits, power/analog, high-voltage drivers, embedded non-volatile memory, non-volatile memory, mixed-signal/RF, and image sensors, providing foundry services and supporting services for integrated circuits in different fields such as smartphones, IoT, and consumer electronics for customers. Through long-term cooperation with well-known domestic and foreign customers, SMIC has formed a significant brand effect and gained good industry recognition.

Secondly, it is inseparable from its internationalization and industrial chain layout. Based on the concept of international operations, SMIC serves customers worldwide, establishing an international management team and talent pool, as well as a global service base and operational network. It has set up marketing offices in the United States, Europe, Japan, and Taiwan, China, and a representative office in Hong Kong, China, to better expand the market and quickly respond to customer needs. At the same time, SMIC attaches great importance to cooperation with upstream and downstream enterprises in the integrated circuit industry chain, actively enhancing its ability to integrate and layout the industry chain, building a tight integrated circuit industry ecosystem, and providing customers with comprehensive and integrated integrated circuit solutions.

Furthermore, the R&D platform advantage also facilitates faster growth. SMIC's R&D center, guided by overall strategy and customer needs, continuously enhances process R&D and innovation capabilities, strengthens platform construction, and upgrades product performance. R&D projects fully align with product technical requirements from the initial stage, effectively utilize R&D resources, ensure output quality and reliability, actively shorten the cycle from R&D to mass production, meet market demand for product innovation and rapid iteration, and strive to provide new business growth points.

The data speaks for itself, with SMIC's R&D expenses continuing to grow. Since verifiable data became available in 2018, SMIC's annual R&D expenses have exceeded 4 billion yuan. In 2022 and 2023, R&D expenses were 4.953 billion yuan and 4.992 billion yuan, respectively, representing year-on-year increases of 20.20% and 0.78%. In the first three quarters of 2024, R&D expenses reached 3.895 billion yuan, a year-on-year increase of 7%. In other words, SMIC's cumulative R&D expenses have exceeded 30 billion yuan in the past eight years.

The rapid performance growth is understandable. According to previous financial reports, from 2019 to 2021, SMIC's net profit doubled annually. From the perspective of net profit after deducting non-recurring gains and losses, the growth is even more impressive, with -522.1 million yuan in 2019, 1.6969 billion yuan in 2020, and 5.32542 billion yuan in 2021, achieving a more than threefold increase. Since 2024, SMIC's performance has continued to improve, with revenue of 41.879 billion yuan in the first three quarters, a year-on-year increase of 26.53%; net profit of 2.706 billion yuan, a year-on-year decrease of 26.36% (mainly due to increased depreciation expenses and reduced wafer foundry prices), of which third-quarter revenue increased by 32.5% year-on-year and net profit increased by 56.4% year-on-year.

However, it should be noted that compared to TSMC and Samsung Electronics, SMIC still has a certain gap in advanced process technology, especially in the 7nm and below process nodes. Additionally, there are voices in the market suggesting that "after Trump takes office, there will not be significant changes to the tightening trend of export controls on China." Of course, this is also supported by research reports. A research report from China Construction Bank Fund Management believes that "after Trump's election, restrictions on China's semiconductor, defense technology, biotechnology, artificial intelligence, and other technology industries may not ease, which will further deepen the substitution of domestic products in China's technology industry chain, especially in the midstream and upstream materials and equipment."

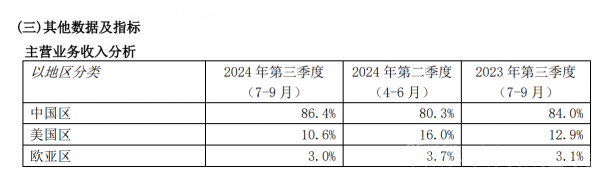

In fact, for SMIC, the impact is not significant, as its "main battlefield" is still in China. According to the latest financial report, in terms of regions, in the third quarter, SMIC's main business revenue in China, the United States, and Eurasia accounted for 86.4%, 10.6%, and 3.0%, respectively.

How SMIC will develop in the future still needs the market to provide answers, and we will wait and see.