Seeing JD.com's Resilience from Two Battle Reports

![]() 11/15 2024

11/15 2024

![]() 538

538

Author | Meng Xiao

Learn more about financial information | BT Financial Data Hub

The main text totals 3,822 words, estimated reading time 11 minutes

Since the birth of "Singles' Day" in 2009, it has been 15 years. Over these 15 years, major e-commerce platforms have shown their prowess, and various promotional tactics have been dazzling. This year may be the "quietest" shopping festival since the inception of "Singles' Day". The Hongxing News even reported that Ralph Lauren, preferred by the middle class, surpassed 1.6 billion yuan in GMV (Gross Merchandise Volume) on Tmall during "Singles' Day," with a return rate of 95%. However, according to Star Chart data, the cumulative sales during "Singles' Day" on comprehensive e-commerce platforms and live streaming e-commerce platforms amounted to 1.4418 trillion yuan, an increase of 26.6% year-on-year. Among them, the total sales of comprehensive e-commerce platforms were 1.1093 trillion yuan, an increase of 20.1% year-on-year; live streaming e-commerce sales were 332.5 billion yuan, an increase of 54.6% year-on-year; and total instant retail sales reached 28.1 billion yuan, an increase of 19.1% year-on-year. Among major e-commerce platforms, JD.com is undoubtedly one of the most closely watched.

On the eve of "Singles' Day," Taobao Tmall officially accessed JD.com logistics, while JD.com accessed Cainiao Express and Cainiao Post Stations as parcel collection points, along with Alipay payments. In Xinjiang, where free shipping had not been available before, JD.com also offered free shipping during "Singles' Day." Over the past 15 years, JD.com has continuously invested in supply chain infrastructure in Xinjiang, Tibet, and other regions, finally allowing Xinjiang consumers to enjoy high-quality services. Data shows that the express delivery business volume in Xinjiang increased by 37.57% year-on-year from January to September this year.

It is precisely this pursuit of high-quality service experiences that has led to a continuous increase in the activity of JD.com users and merchants, pushing JD.com into a virtuous development channel. In the first three quarters of this year, JD.com's active users and shopping frequency both showed double-digit growth. The continuous activity of users also drove more third-party merchants to settle on JD.com. Along with JD.com's increased support for third-party merchants, the ecosystem of JD.com's third-party merchants has flourished even more. Data shows that as of 11:59 p.m. on November 11, the number of JD.com 11.11 shoppers in 2024 increased by over 20% year-on-year, and the number of JD.com procurement and sales live streaming orders increased by 3.8 times year-on-year. Over 17,000 brands saw transactions increase by over 5 times year-on-year, and over 30,000 small and medium-sized merchants saw transactions increase by over 2 times year-on-year. Among them, transactions for over 1,000 super hit 3C digital products increased by 100% year-on-year, and transactions for over 100 new products surpassed one million users. This is even more commendable in the slightly "quiet" "Singles' Day".

JD.com's efforts this year have also won the trust of the capital market. The stock price increased by 33% within the year. In the context of the cooling of Chinese concept stocks, JD.com has become one of the few Chinese concept stocks with such growth within the year.

1

'Cheap and Good' Becomes the Main Theme

Previous "Singles' Days" were almost dominated by low-price bombardment. However, after two years of continuous bombardment, consumers found that most of the ultra-low-priced purchases were superior substandard products, such as 9 yuan sweaters and shoes with free shipping that were unwearable, and a box of fruits for 9 yuan that were either spoiled or unedible. The saying "Cheap is no good" has become increasingly evident. How to reconcile this seemingly paradoxical contradiction and achieve both affordability and quality is the ultimate goal pursued by major e-commerce platforms, as it will undoubtedly be the best way to attract consumers. Compared to some platforms that win on low prices alone, JD.com's product quality is undeniable, but it lacks a price advantage, which is a contradiction that JD.com urgently needs to resolve. How to reduce product prices is a difficult problem that JD.com must solve. From past experience, the only way is to start from the entire chain—upstream, midstream, and downstream—and delve into industrial belts to find high-quality goods at the source, shortening the supply chain as much as possible and reducing intermediate links to minimize product prices.

JD.com's large platform advantage gives it sufficient bargaining power after bulk purchases. The root cause of cheaper products like Huawei and Apple on JD.com is also the large-scale procurement and high sales volume, which enable certain bargaining power. Consumers are gradually discovering that it's not just large digital products; even some low-priced products are not "cheap and no good." For example, wireless earbuds for 5.9 yuan have a 94% approval rating; Bluetooth speakers for 7.9 yuan and mini massage guns for 7.9 yuan have an approval rating as high as 99%. Such products below 9.9 yuan having such high approval ratings among picky JD.com users is actually quite shocking. If JD.com offers discounts and occasionally releases a high-quality, low-priced product, it may not be convincing. Conversely, the categories of high-quality products below 10 yuan on JD.com are becoming increasingly abundant. Such a JD.com is somewhat refreshing for consumers.

Many people are curious about how JD.com achieves low prices and high quality. The answer is that JD.com finds the source of the industry and eliminates all unnecessary intermediate links. For example, for 5.9 yuan earphones, JD.com cooperates with the source earphone factory in the electronic accessory industrial belt, optimizing the supply chain to the extreme. The motherboard is made in Guangdong, and assembly is done in Guangxi, fully leveraging its industrial chain advantages. After cooperating with JD.com, this traditionally small factory saw its unit cost decrease by 50%, sales volume significantly increase, driving nearly 40 factories in Guangdong and Guangxi and employing over 5,000 people. In terms of agricultural products, taking rice as an example, JD.com simplifies the process of acquisition, transportation, warehousing, processing, wholesale, and retail, directly cooperating with enterprises and even establishing a JD.com supermarket Wuchang rice paddy base. By eliminating all intermediate links and directly procuring, it achieves the shortest link, reducing retailers' transportation costs, rent, labor, utilities, and other expenses, ensuring controllable quality, traceable sources, and lower prices. Squeezing out "water" from the supply chain and passing the "water" saved on to users has gradually changed consumers' inherent impression of JD.com's high quality and high price. Nowadays, JD.com's strategy revolves around consumer needs. Through big data analysis, if a product is popular with consumers, production will be increased; if consumers are not very interested, production will be reduced. Production based on sales allows manufacturers to reduce inventory and allocate funds effectively. Moreover, due to guaranteed sales, product prices will further decrease. With low prices and high quality, JD.com has gradually been labeled as such. With the support of JD.com Logistics, the fast and excellent shopping experience has contributed to JD.com's outstanding performance during "Singles' Day."

2

New Opportunities in Live Streaming E-commerce

The end of internet e-commerce is live streaming. It is undeniable that JD.com's previous live streaming was not prominent. Taobao had Viya and Li Jiaqi, Kuaishou had Simba, Douyin had Luo Yonghao and Xiao Yangge, but JD.com has yet to cultivate well-known live streamers comparable to these individuals. Since it is difficult to cultivate internet celebrity live streamers, JD.com took a different approach by directly transforming frontline procurement and sales into live streamers. When internet celebrity live streamers were still competing for traffic through exaggerated performances and false propaganda, JD.com live streaming had already quietly shifted the battlefield. Leveraging the product selection capabilities of its internal professional procurement and sales team, it directly involved "those who know the products best," also reducing issues such as reordering, inventory chaos, and old stockpiling caused by late returns.

These people who know the products best may not have the fame of internet celebrity live streamers or their exaggerated ways of engaging audiences, but they have conquered picky consumers with their solid professional skills. How professional is JD.com's procurement and sales live streaming? Xu Ran, CEO of JD.com Group, said at the "Singles' Day" press conference, "How many layers does a tissue have, how thick is the wire in a clothes hanger, and how many bristles are there on a toothbrush... Each seemingly insignificant detail directly affects the consumer experience. Therefore, our JD.com procurement and sales team will dissect and understand these issues, with the goal of ultimately passing on the benefits to users." Data shows that from October 14 to November 5, the number of JD.com procurement and sales live streaming orders increased by 3.8 times year-on-year. The most popular live streaming room was "JD.com Really Cheap Procurement and Sales Live Streaming Room," with the most ordered categories including home appliances, household cleaning, and beauty and skincare products. JD.com procurement and sales live streaming is winning the trust of consumers with its "professional live streaming" strategy, gradually establishing the user mindset of "good products at affordable prices," and attracting a larger consumer group. In JD.com procurement and sales live streaming rooms, consumers can enjoy "good prices." At the same time, the characteristics of no commission, no pit fees, and no tricks in JD.com procurement and sales live streaming rooms allow JD.com to maintain a healthy business ecosystem while ensuring low prices for consumers, ultimately realizing JD.com's ecosystem of "good and cheap."

Recently, multiple popular live streamers have faced setbacks, causing consumers to no longer blindly trust so-called internet celebrity live streamers. While JD.com's live streaming may not seem dynamic, it has achieved nearly fourfold growth due to its higher level of professionalism. Such growth is relatively rare in the entire live streaming industry. After frequent setbacks by major live streamers like Xiao Yangge, consumers are actively embracing more professional and reliable live streaming rooms. JD.com's procurement and sales live streaming room has gradually developed into consumers' first choice due to the JD.com procurement and sales team's willingness to guarantee product quality. During "Singles' Day," the development of JD.com live streaming exceeded many people's expectations. In addition to the nearly fourfold crazy growth in JD.com procurement and sales live streaming orders, the transaction amount of JD.com's president's live streaming activities increased by 5.2 times compared to 618. These are the successes that JD.com has gradually explored in live streaming. E-commerce live streaming has become an important component of today's e-commerce. According to iResearch Consulting data, the scale of China's live streaming e-commerce market reached 4.9 trillion yuan in 2023, with a year-on-year growth rate of 35.2%. The compound annual growth rate of the market scale from 2024 to 2026 will reach 18%. This indicates that live streaming e-commerce is still a rapidly growing field, and JD.com is expected to occupy a larger share of this market through professional, high-quality content and services. The rise of the live streaming business may even become a watershed for JD.com.

3

Increasing Employees and Raising Salaries

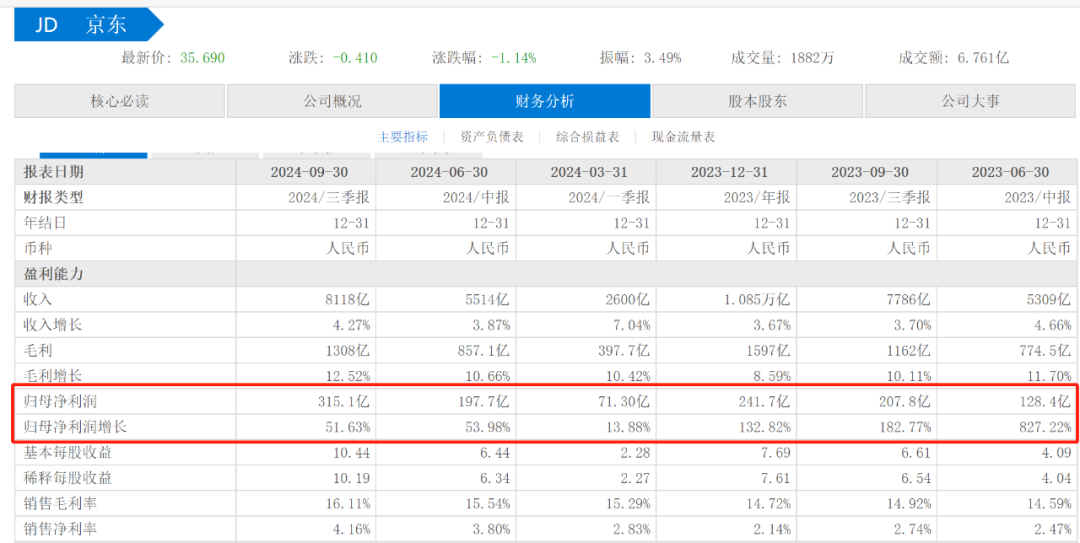

JD.com's persistence and efforts are directly reflected in its performance. In the first three quarters of 2024, JD.com's revenue was 811.8 billion yuan, an increase of 4.27% year-on-year, and its net profit attributable to shareholders was 31.51 billion yuan, an increase of 315.1% year-on-year. Among them, the sales gross margin was 16.11%, and the net profit margin was 4.16%, both hitting recent highs.

In fact, JD.com's net profit increase is not just this year. In the past two complete fiscal years, JD.com's net profit has achieved significant growth. In 2022, JD.com's revenue was 1.046 trillion yuan, an increase of 9.9% year-on-year, exceeding the trillion yuan mark for the first time. The net profit was 10.38 billion yuan, an increase of 391.57% year-on-year. In 2023, JD.com's revenue was 1.085 trillion yuan, an increase of 3.67% year-on-year, and the net profit was 24.17 billion yuan, an increase of 132.82% year-on-year, achieving more than double growth in net profit for two consecutive years. With its positive development and continuously improving profit levels, JD.com has the confidence to recruit more employees, solidifying its B-end supply chain and C-end user experience advantages. In August this year, JD.com once again launched a large-scale campus recruitment globally, planning to recruit over 12,000 graduates of the 2025 class and over 6,000 interns. As of the third quarter, the total number of JD.com employees reached 620,000, exactly 10 times the number a decade ago, making it the largest among all domestic internet companies and even equivalent to the sum of the next few. In the third quarter, JD.com Logistics' compensation and benefits expenditures for frontline employees were approximately 14.6 billion yuan. JD.com also provides "six insurances and one fund" for all frontline employees. Now, over 1,000 frontline employees have retired from JD.com Logistics and receive pensions. Solving the employment of 620,000 people means addressing the livelihoods of 620,000 ordinary families and millions of people, which is indeed not simple. At the same time, JD.com comprehensively increased the salaries for the 2025 campus recruitment positions, with core positions such as procurement and sales, technology, and product seeing salary increases of no less than 20%. Increasing the number of employees while also raising salaries can promote better corporate development, forming a positive cycle and realizing the dual pursuit of corporate commercial value and social value. After JD.com released its mid-year report, Benchmark maintained its buy rating for JD.com with a target price of $48.00. Based on the current stock price, there is still a 33% upside potential. Goldman Sachs previously also rated JD.com's Hong Kong stocks as a buy with a target price of HK$161. Based on the current stock price of HK$141.8, there is still a 14% upside potential. Many institutions have raised their ratings for JD.com, indicating their optimism about JD.com's profitability and stability. After achieving free shipping in Xinjiang, accessing Taobao Tmall, adhering to low prices and high quality, and continuously making efforts in the live streaming field, JD.com may bring more surprises to the market and consumers in the future during this smokeless "Singles' Day."

The article represents the author's personal viewpoint. For any questions or feedback, please leave a message in the comments section directly.