Reassessing Double 11: White Label Down, Brand Up

![]() 11/18 2024

11/18 2024

![]() 589

589

Wang Hai has been very busy recently. As China's most well-known counterfeit buster, Wang Hai has practically single-handedly turned "counterfeiting busting" into a profession that has garnered nationwide attention.

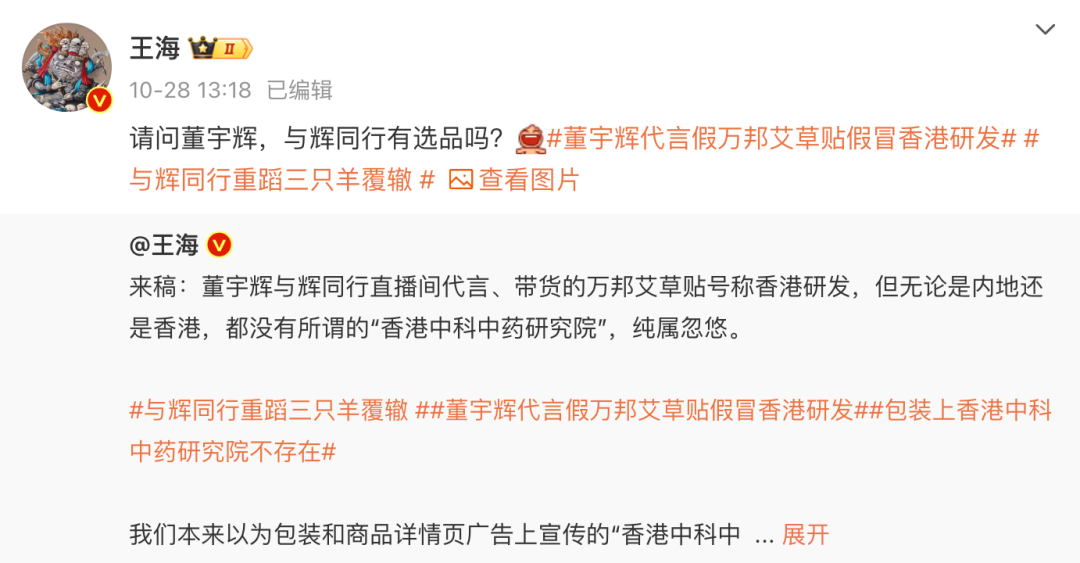

Since September this year, he has closely monitored popular live streamer Dong Yuhui, posting multiple updates on social media questioning the authenticity of up to seven products sold in Hui Tongxing's livestream. For example, when pointing out issues with the "Wanbang Mugwort Patch," Wang Hai challenged Dong Yuhui from afar: "May I ask, Dong Yuhui, does Hui Tongxing still have product selection standards?"

Behind Wang Hai's targeting of popular live streamers, Dong Yuhui is not the only one. Before Crazy Little Yang Brother's complete downfall, he was repeatedly targeted by Wang Hai for selling counterfeit goods in his livestreams. However, Wang Hai seems to focus solely on top live streamers with such high frequency, leading many to question his true motives. Public opinion on him is mixed, with some seeing him as a hero and others calling him an extortionist. The latter includes Luo Yonghao, who directly referred to Wang Hai's counterfeit busting as blatant "bump and run." Professional counterfeit busting has always been controversial, but the public's unprecedentedly high attention to the results of counterfeit busting, similar to previous months, is unprecedented.

The outside world can still clearly perceive that controversy does not only mean traffic but also attention: Consumers' demand for abundant, quality-assured products at more favorable prices has never disappeared. Behind the controversy sparked by Wang Hai's targeting of popular live streamers, it precisely reflects a turning point in the momentum of impulsive consumption created by entertainment-oriented live streamers through emotional provocation and atmosphere creation over the past few years. The key is that the vast majority of consumers lack the professional knowledge to discern some consumption traps, such as mismatching products, passing off inferior goods as superior ones, lowering quality due to low prices, and "bait-and-switch" tactics. This information gap between merchants and consumers provides fertile ground for counterfeit busting bloggers to harvest traffic.

Wang Hai once revealed in an interview with the media that he targets top live streamers for counterfeit busting because he believes that, based on common sense, live streamers excel at rapping and performing rather than making value judgments and risk control. Each industry has its expertise, and live streaming sales are unprofessional in terms of value judgments and risk control. He also emphasized that live streaming sales are based on trust between people. Scamming money is a minor issue; undermining trust between people in society is a bigger problem with dire social consequences. This statement can be interpreted as the information gap between merchants and consumers being the space for consumer trust gained by popular live streamers. The establishment of this trust is partly based on factors such as the live streamer's traffic halo, professionalism in sales, and IP endorsement; more importantly, it relies on the comprehensive strength of the platform and the products themselves.

In the former case, during the peak years of entertainment-oriented live streamers, livestream viewers placed much higher trust in the live streamers than in the products themselves, ignoring whether the sales were professional or whether the live streamers understood the products they were selling. In a sense, this is a transfer of trust, where consumers shift their trust in the products sold in the livestream to the live streamers themselves, placing orders without hesitation after the countdown. However, this trust is fragile. As Wang Hai said, "It is impossible for a live streamer's value judgments and risk control to be stronger than those of Walmart and Carrefour." Once incidents like Dongfang Zhenxuan's "trough meat steamed pork with preserved vegetable" scandal, Sanzhiyang Livestream's "fake Maxim's mooncakes," and Northeast Yujie's "sweet potato vermicelli without sweet potatoes" occur, consumers' illusions of trust in them are shattered, leading to a series of knock-on effects.

At this point, what is exposed is not only the quality issues of the white-label products sold but also the integrity issues of popular live streamers in sales. For example, when multiple products sold by Sanzhiyang turned out to be problematic, their approach was not to shift responsibility to the brand but to have their female live streamers apologize or even use their previously undisclosed status as advertising publishers as a shield. Currently, relevant departments classify live streamers as advertising publishers.

This double betrayal of both consumers and brands has driven the industry's trust in entertainment-oriented live streamers to an all-time low. At this point, there are undoubtedly only two aspects that can provide the greatest trust to consumers: platform endorsement and brand strength. Breaking it down further, during Crazy Little Yang Brother's peak period, to obtain low-cost pricing power in the supply chain and maximize profits, they followed the strategies of Xinba and Dongfang Zhenxuan, devoting considerable effort to creating their proprietary brand "Xiaoyang Zhenxuan." In fact, whether it's Xiaoyang Zhenxuan, Xinba, or Dongfang Zhenxuan's proprietary products, they are all betting on white-label products. So-called white-label products, according to the common definition, are unbranded products produced by manufacturers or channel providers, also known as white-label products. Typically, they are also understood as "affordable alternatives" to well-known brands that lack recognition. In the context of live e-commerce, they are often used to refer to so-called knock-off brands or products labeled with channel brands, such as Xiaoyang Zhenxuan's popular trash bags and Dongfang Zhenxuan's branded milk. Looking back at the development of white-label products, their popularity was driven by the rise of live e-commerce around 2020. At that time, a large number of white-label products were eager to clear inventory, and entertainment-oriented live streamers lacked a product base and needed low-cost supplies. To some extent, the two sides reached a "tacit understanding," with white-label products flooding into livestreams, occupying short video platforms dominated by live e-commerce, and even becoming a new trend in e-commerce. It is worth mentioning that Pinduoduo's development is essentially supported by white-label products, which contributed up to 60% of its revenue of over 247.6 billion yuan in 2023. In an abnormal competitive environment characterized by traffic coercion and cut-throat pricing, white-label products once maintained a strong position against branded products, presenting a situation where the west wind overpowered the east wind, forcing branded products to retreat to a defensive position.

Amid this wave of "white-label fever" and "white-label alternatives," white-label products were almost synonymous with cut-throat pricing. Entertainment-oriented live streamers played the role of drummers, affecting the entire industry. However, neither new domestic brands nor white-label products can continuously burn money to sell products, earning meager profits or even losing money to gain attention. Their only way out is to transition to branding and enhance their brand strength. This is because only brand strength can support a product's premium space; otherwise, it can only involve intense competition in products, costs, and supply chains. Once there are no new products to stimulate users, sales will continue to decline. From this perspective, we can also see that cut-throat pricing is not sustainable, and the industry will self-correct and reassess brand value. When the entire industry shifts and no longer insists on cut-throat pricing, popular live streamers' control over low prices is also weakening. Without the support of the platform's ecosystem capabilities, they will only become more vulnerable, increasing the likelihood of collapse.

In sharp contrast, quality livestreaming is rapidly becoming a new trend. For example, during this Double 11, Li Jiaqi returned to the center stage. According to Meiwan statistics, nearly 1,700 brands participated in Li Jiaqi's livestream during this year's "Double 11," an increase of nearly 20% year-on-year, with a total of over 4,000 product links. Among them, domestic product links accounted for over 60%. At the same time, as of 24:00 on November 11, 119 livestreams on Taobao generated over 100 million yuan in transactions, doubling last year's 58. Additionally, 49 of these livestreams achieved over 100% year-on-year growth. Furthermore, Alibaba Group just released its fiscal Q2 earnings report on the 15th. During this quarter, Taobao and Tmall's order volume increased by double digits year-on-year, driving online GMV growth. The number of 88VIP members increased from 42 million in the previous quarter to 46 million. During the analyst call that evening, Group CEO Wu Yongming stated that Taobao and Tmall's GMV grew robustly during the recently concluded 2024 Double 11, with the number of monthly active buyers hitting an all-time high.

Not only in live e-commerce but throughout Double 11, Tmall's commercial success was driven by branded merchants, especially mature brands. During this year's Double 11, 45 brands surpassed 1 billion yuan in transactions on Tmall. High-priced luxury goods in the beauty and apparel categories saw an explosion in sales, while mobile phones priced above 4,000 yuan grew the fastest in the electronics category. White-label down, brand up. This change is highly indicative, with the keyword being: This Double 11 marks the return of brand value, or the reassessment of brand strength. The brand's home court solidifies the essence of Double 11. Brand strength is a combination of consumers' perceptions, evaluations, emotions, and loyalty towards a brand, which is not a simple physical addition or subtraction but a chemical reaction of various factors. It is also the core competitiveness for a brand's development. Losing brand strength means that consumers naturally have to pay higher screening costs.

Ifeng Tech mentioned that there are numerous posts on Xiaohongshu telling people how to choose "affordable beauty alternatives" and "how to buy truly reliable white-label products." There are also various warnings to avoid pitfalls, such as "don't easily buy white-label products" and "why I don't recommend buying white-label products." Essentially, there is no inherent good or bad between white-label and branded products. White-label products are not "counterfeit or inferior," but due to the limitations of manufacturers' capabilities and channel providers' levels, they are more prone to issues such as false advertising and product quality, which have always been hidden dangers in popular live streamers' livestreams. For example, both Little Yang Brother and Dong Yuhui had issues with "Meicheng Mooncakes." Some media have analyzed that Little Yang Brother's "mooncake controversy" was seemingly an eruption of problems but was also a concentrated display of the hidden dangers of white-label products in live streaming sales. In Tang Chen's view, Wang Hai's intense targeting of top live streamers like Dong Yuhui, Xinba, and Crazy Little Yang Brother was just the "straw that broke the camel's back."

The current reality is that consumption stratification continues, and white-label products still have a large consumer base and are sought after by many consumers. However, white-label and branded products are not a zero-sum relationship; brand value is rapidly returning, and the brand moat remains solid. Moreover, this is Tmall's home court. In an interview before Double 11, Tmall President Jialuo stated that this year's two important themes were quality and brand. This trend was evident during this year's Double 11. Judging from transaction data from Li Jiaqi's and Taobao's livestreams and the emphasis on quality by various platforms, the essence of this year's Double 11 is quality. In its Double 11 special report, Wall Street investment bank Jefferies wrote, "Key Opinion Leader (KOL) live e-commerce has lost its previous momentum because merchants are paying more attention to profitability and product return rates, which are better for shelf e-commerce than live e-commerce." The report also stated that "merchants are returning to Taobao and Tmall from other platforms."

In other words, during Tmall's Double 11, mature brands are the protagonists. From the sales performance of high-price products across various industries on Tmall's Double 11, it can be seen that the mainstream consumer base has not contracted but expanded in terms of branded consumption. Tmall announced that at 24:00 on November 11, the total transaction volume for Tmall's Double 11 in 2024 grew robustly, with a record number of purchasing users. During the entire Double 11 period on Tmall, 589 brands surpassed 100 million yuan in transactions, a year-on-year increase of 46.5%, setting a new record. This also means that the discourse power of shelf e-commerce is returning, and the value of brand strength is being rediscovered. When Tmall was first established, the then-responsible person pointed out, "Cats are sexy and tasteful. Online shopping on Tmall represents fashion, sexiness, trendiness, and quality; cats are naturally picky, picky about quality, brands, and environment, which is precisely the city of quality that Tmall strives to create." Reassessing Double 11 reveals a new development cycle, a cycle moving out of internal competition and towards a virtuous cycle: merchants and brands achieve balanced growth, consumers reap tangible benefits, and the e-commerce ecosystem transitions from disorder to order. This win-win situation and sustainable growth are signs that e-commerce is moving towards refined operations and a virtuous cycle, which is also the original intention and essence of Double 11.