CSRC filed a case! This company is at risk of delisting

![]() 11/18 2024

11/18 2024

![]() 552

552

Text: Poetry and Starry Sky

ID: SingingUnderStars

According to statistics, a total of 44 stocks in the A-share market were filed by the CSRC in the first half of this year, with over 90% of them suspected of illegal information disclosure violations.

Why has information disclosure violation become a 'disaster area' for case filing?

This is mainly because under the full implementation of the registration system, the quality of information disclosure is the top priority of securities regulatory work.

Regulators have zero tolerance for violations of information disclosure and strictly crack down on such behaviors in order to protect investors' rights and interests and promote the healthy development of the market.

On November 15, another listed company, Jinghua Micro [688130.SH], announced that it had received a "Case Filing Notice" issued by the China Securities Regulatory Commission (CSRC) due to suspected violations of information disclosure laws and regulations, prompting the CSRC to decide to file a case against the company.

01

Repeated Warnings, Yet Repeated Pitfalls

Jinghua Micro was listed on the STAR Market in July 2022, focusing on the research, development, and sales of high-performance analog and mixed-signal integrated circuits. Its main products include medical health SoC chips, industrial control and instrumentation chips, intelligent sensing SoC chips, etc., widely used in medical health, industrial control, smart homes, and many other fields.

Since its listing, the company's information disclosure issues have been of great concern to regulatory authorities.

Last October, the Zhejiang Securities Regulatory Bureau issued a warning letter to the company, its chairman Lv Hanquan, general manager Luo Weishao, and board secretary Zhou Rongxin, which was recorded in the securities and futures market integrity files. The main issues found during the on-site inspection were as follows:

First, the company's 2022 semi-annual and quarterly reports contained inaccurate information on operating revenue and profits. Second, the company's initial public offering prospectus contained inaccurate disclosures regarding fund transfers between the company, its affiliates, and Jinyun Zhihe Electronic Technology Co., Ltd. Third, the company's procedures for reviewing and approving cash management of raised funds were not standardized, and after review, there were instances where cash management exceeded the approved limit. Fourth, the company's financial seal was not used in accordance with company regulations.

In June of this year, the Shanghai Stock Exchange issued another regulatory warning to the company, Lv Hanquan, Luo Weishao, and Zhou Rongxin due to information disclosure issues, based on the facts ascertained by the Zhejiang Securities Regulatory Bureau and relevant announcements.

In addition to the regulatory warnings for information disclosure issues, in August, Jinghua Micro also received a regulatory work letter due to a director's objection to the semi-annual report.

Director Luo Weishao opposed the company's proposal regarding the 2024 semi-annual report and its summary due to the company's failure to disclose potential labor arbitration/litigation filed by departing employees in the first half of the year, progress on land acquisition negotiations, and the status of related regulatory matters in the semi-annual report.

Despite the board of directors' explanations that the content of the semi-annual report was true, accurate, and complete, with no false records, misleading statements, or significant omissions, the Shanghai Stock Exchange still took notice and issued a regulatory letter.

Even more dramatically, on the same day the company received the regulatory letter, Luo Weishao was removed from his positions as director and member of the audit committee at the board meeting. He was not only a company director but also an acting in concert person with the actual controllers, Lv Hanquan and his spouse, holding 6.78% of the company's shares and ranking as the fourth-largest shareholder.

The underlying grievances are difficult to articulate, but it is clear that the company's information disclosure is teetering on the brink of violations. Even after repeated pitfalls and objections from directors, the company continues its practices.

02

Peak Upon Listing

While the information disclosure in the 2024 semi-annual report was being questioned, the Shanghai Stock Exchange also inquired about the reasons and rationality behind the changes in Jinghua Micro's operating revenue this year, the decline in gross margin, and the slow progress of fund-raising projects, requiring the company to provide further explanations.

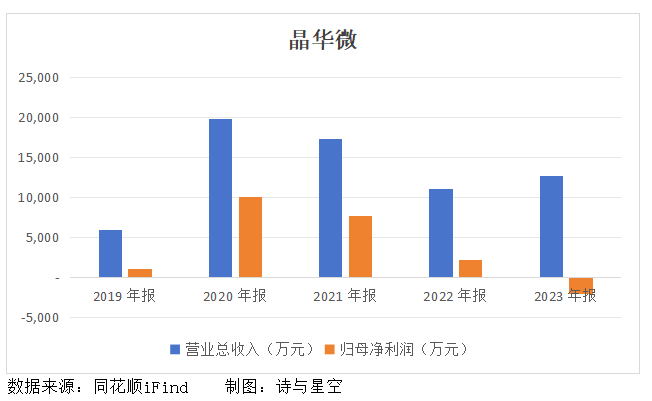

In fact, the company was already on a downward trajectory in the year of its listing. Although revenue in 2023 exceeded 120 million yuan, an increase of 14.19% year-on-year, due to the burden of research and development expenses and asset impairment losses, the company's net profit attributable to shareholders was a loss of 20.351 million yuan, a year-on-year decrease of 191.98%.

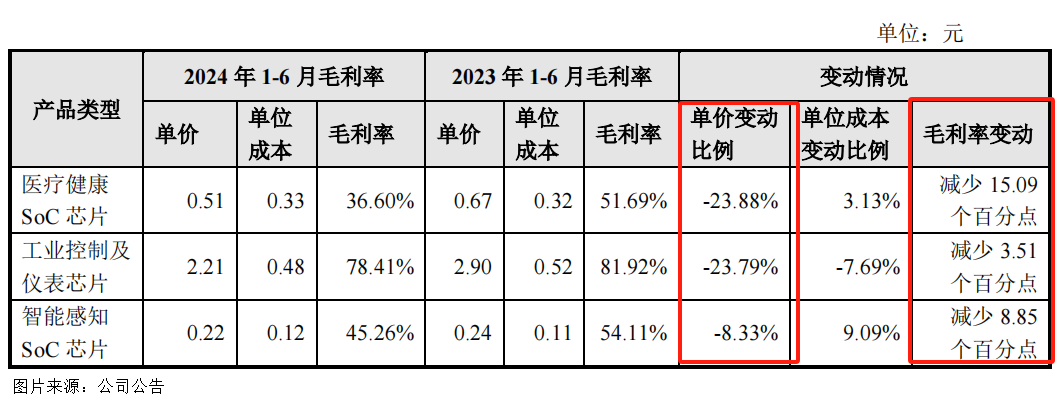

In the first half of this year, the company's chip product sales volume increased by 4.77% year-on-year, with quarterly sales performance gradually improving. However, due to intensified competition in the domestic semiconductor industry, the company adjusted the unit prices of some products, realizing revenue of approximately 60.164 million yuan, a year-on-year decrease of 7.34%.

Among them, revenue from medical health SoC chips decreased by 25.57%, while revenue from industrial control and instrumentation chips increased by 18.60%. These two types of chips accounted for over 98% of total revenue, significantly impacting the company's revenue scale.

From an industry perspective, similar companies have also adopted pricing strategies to cope with fierce market competition. Jinghua Micro believes that the changes in operating revenue across product categories are consistent with the development of sub-sectors, downstream customers, and industry competition trends, aligning with industry changes and being reasonable.

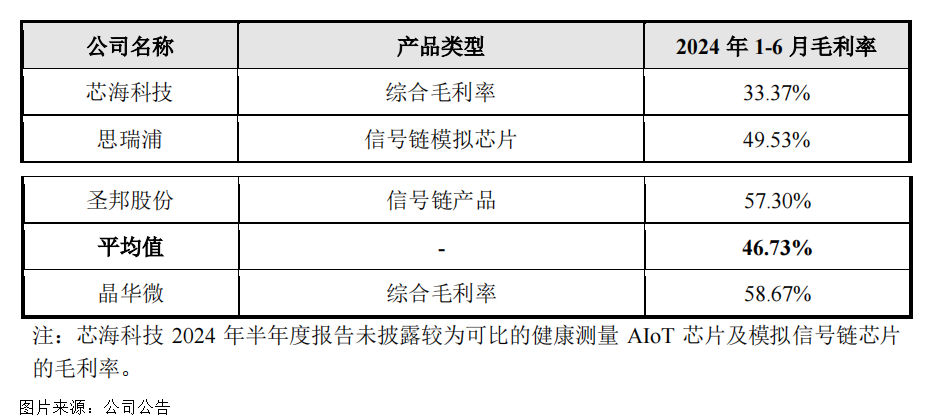

Additionally, the company's main business gross margin was 58.67%, a year-on-year decrease of 5.47 percentage points. The company explained that as domestic semiconductor industry competition continues to intensify and demand in the consumer electronics industry remains weak, the company had to adopt a certain degree of price reduction strategies to promote product sales and expand market share.

Compared to comparable companies in the same industry, Jinghua Micro's gross margin is relatively close to that of Siray and SGP Microelectronics, higher than Chipsea Technologies.

Regarding whether the gross margin will continue to decline and its impact on the company's performance, Jinghua Micro stated that it will change the current situation by adjusting sales strategies, continuously launching new products to consolidate and enhance the company's gross margin. However, it also disclosed in the risk warning section of its financial report that there may be risks of gross margin decline due to various factors in the future.

03

Another Case of Irregular Information Disclosure

In addition to the main inquiries mentioned above, the company's disclosure of risks related to the slower-than-expected progress of fund-raising projects was incomplete. It should be noted that the company also has a prior record of irregular procedures for reviewing and approving cash management of raised funds.

The net proceeds from the initial public offering totaled 920 million yuan, including projects such as the upgrading and industrialization of smart healthcare ASSP chips, the upgrading and industrialization of industrial control and instrumentation chips, the upgrading and industrialization of analog signal chain chips like high-precision PGA/ADC, and the construction of a research and development center.

The semi-annual report showed that the cumulative investment progress of these four projects was 11.13%, 5.28%, 11.58%, and 5.29%, respectively, indicating slow project investment progress.

The company explained that the current cyclical adjustment and structural demand decline in the semiconductor market, coupled with the destocking phase, have led to a slowdown in customer order demand. The company has appropriately delayed the purchase of office space, resulting in the unused portion of the fund-raising capital.

Regarding the risk of slower-than-expected progress of fund-raising projects, the company made additional disclosures in its response letter. Without the inquiry from the regulatory authorities, this information would likely remain unknown.

04

Third-Quarter Performance Turned to Loss in 2024

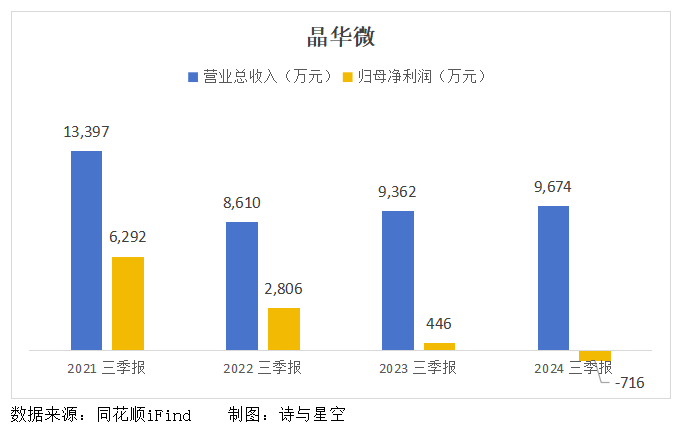

In the first three quarters of this year, Jinghua Micro achieved revenue of 96.739 million yuan, an increase of 3.33% year-on-year. However, the net profit attributable to shareholders of the listed company was a loss of 7.158 million yuan, a year-on-year decrease of 260.34%.

Despite a slight increase in revenue, profits decreased significantly due to factors such as increased operating costs and administrative expenses, decreased interest income, and unaccrued deferred income taxes.

Furthermore, in the first three quarters, the company's share-based compensation expenses amounted to 8.465 million yuan. Excluding the impact of these expenses, the net profit attributable to shareholders of the listed company was 1.307 million yuan, a year-on-year decrease of 88.95%.

05

Conclusion

Since its listing, Jinghua Micro's performance has plummeted. During the inquiry into its semi-annual report this year, there were even questions about the risk of the company's revenue falling below 100 million yuan and its net profit, either before or after deducting non-recurring gains and losses, being negative for the entire year.

According to the new delisting criteria, a negative net profit, either total or after deducting non-recurring gains and losses, combined with revenue below 100 million yuan, will trigger delisting.

-END-

Disclaimer: This article is based on the public company attributes of listed companies and an analytical study focusing on information publicly disclosed by listed companies in accordance with legal requirements (including but not limited to temporary announcements, periodic reports, and official interaction platforms). Poetry and Starry Sky strives for fairness in the content and viewpoints presented in the article but does not guarantee its accuracy, completeness, timeliness, etc. The information or opinions expressed in this article do not constitute any investment advice. Poetry and Starry Sky assumes no responsibility for any actions taken based on the use of this article.

Copyright Notice: The content of this article is originally created by Poetry and Starry Sky and may not be reproduced without authorization.