Why does Pinduoduo only have a PE ratio of 10 times?

![]() 11/18 2024

11/18 2024

![]() 503

503

Many people will remember that Pinduoduo's share price plummeted by nearly 30% after its previous earnings report.

Huang Zheng does not want to be the richest person and is willing to cut many capital tycoons like scallions. It's surprising to see capital behaving this way.

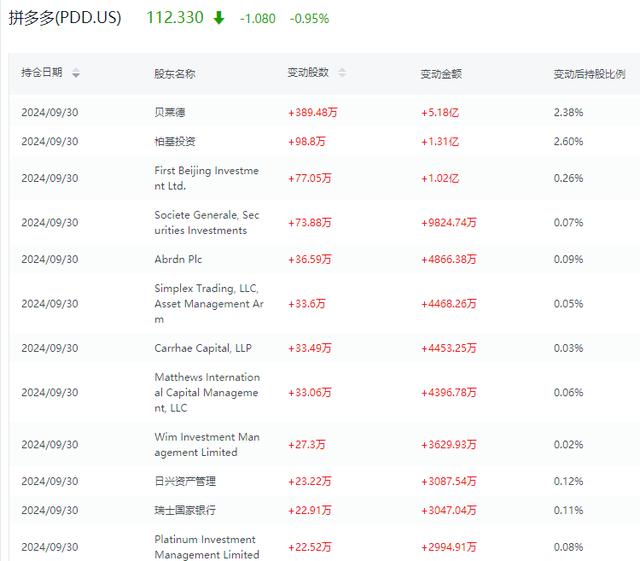

However, after Pinduoduo's sharp decline, many tycoons and institutions increased their positions, creating an interesting scene.

From another perspective, with so many capital eyes focused on Pinduoduo, its market pricing should be considered adequate. But why is it only around 10 times PE?

Pinduoduo is now equivalent to a domestic e-commerce giant plus Temu, which targets Amazon overseas. Is the pricing a bit too low?

1. Pinduoduo is driven by compassion

'Consumption upgrade is not to make Shanghai people live like Parisians, but to enable people in Anqing, Anhui, to have kitchen paper and good fruit to eat,' Huang Zheng said in an interview.

Many people do not understand Pinduoduo's rise, and many long-form bearish reports have become jokes of the past. Of course, this cannot be blamed on them; even Alibaba and JD.com only took Pinduoduo seriously when it was almost upon them.

When Pinduoduo emerged, Alibaba and JD.com were at their peak, leading people to believe that China's e-commerce landscape was set. However, Pinduoduo quickly rose in this narrow gap.

At that time, Alibaba and JD.com were vigorously preparing for consumption upgrades. Jack Ma predicted in a speech in October 2015 that China's middle class would expand to 500 million in the next ten years. Pinduoduo was founded in April of that year.

Unlike Alibaba's perspective, Pinduoduo saw a more rational reality: the number of poor people far outnumbers the rich. Should we make the rich richer, or should the rich help the poor become richer? Pinduoduo aimed to reduce prices so that lower-income markets could afford goods and to help sell good products from these markets better. In just two years of its establishment, in 2017, Pinduoduo facilitated over 900 million poverty alleviation orders, sold 1.83 million tons of agricultural products, and covered 90% of national-level poverty-stricken counties.

Looking back at Huang Zheng's essay 'Turning Capitalism Upside Down' written in 2016, he truly achieved his vision.

'I can't help but wonder if it's possible to use insurance and compound interest, or reversed insurance and compound interest, to distribute wealth more evenly? Are there any mechanisms that allow the poor to sell 'insurance' to the rich, sell their 'soft power,' their willingness, and risk resistance to the rich, thereby achieving a more refined feedback loop with shorter cycles of money flowing back from the rich to the poor?',' he wrote.

For example, if a thousand people think of buying a certain type of down jacket in winter during summer, they can place a joint order with a manufacturer and be willing to pay a 10% deposit at last year's price. In this case, it is likely that the factory would be willing to give them a 30% discount. This certainty from the joint order can be transformed into the convenience of using production troughs or into certainty when purchasing raw materials. The factory can even further sell this certainty to upstream and supporting manufacturers to further reduce costs. In terms of transaction forms, this transaction is like a group of people each spending $1 to buy a $3 limited-time voucher, and then the factory can further purchase similar limited-time vouchers from upstream and supporting manufacturers by selling these vouchers.

If these thousand people have a certain credit history and place a joint order expressing their intention but not paying a deposit, would the factory be willing to give them a discount? I think they probably would, just maybe not 30%, but how about 8%? This is like the factory using its own limited-time discount vouchers to purchase insurance from ordinary consumers guaranteeing future purchases.'

Consolidating orders on the demand side is still the basic operation of Pinduoduo, and merchants can further reduce prices by bidding for orders.

However, low prices are just a way for Pinduoduo to acquire users at this stage. The core is not 'cheapness' but satisfying users' sense of getting a bargain. For example, Pinduoduo's first product was a bag of Lay's potato chips for $1, which sold 10,000 units in a day. As long as half of the chips are edible, customers will feel it's worth it. You might think cheap means fake, but the result is a pleasant surprise.

Alibaba also considered tapping into lower-income markets. In 2014, Alibaba launched the 'Thousand Counties and Ten Thousand Villages' plan, intending to invest $10 billion over 3-5 years to bring hundreds of millions of rural residents to its e-commerce platform by establishing service stations in counties and rural areas. However, Alibaba did not understand the needs of the lower-income population and assumed everyone would want branded products. When they realized they couldn't make it work, they turned their focus back to the middle class, which was more profitable.

But Pinduoduo succeeded. 'Buying in groups is cheaper' initially sounded like a business trick to deceive people into inviting more people to buy together. Group buying has long been a tool and competitive means in the e-commerce field, mostly used to create incremental GMV.

But when customers realize the prices are indeed cheaper, especially when the same items are cheaper than on larger platforms, the sense of getting a bargain makes them think, 'Why not give it a try?'

Pinduoduo's much-criticized social fission feature of 'help cut the price' and seemingly low-quality mini-game strategies are effective in converting the lower-income market. In Huang Zheng's view, more marketing activities are the duty of a commercial organization.

The form and means are not important; the focus is on understanding the target audience. Although urban elites may view this as the expulsion of good money by bad, Huang Zheng said when discussing Pinduoduo's core competitiveness, 'Our core competence is something that people within the Fifth Ring Road can't understand.' Now all platforms are learning from Pinduoduo, but they can't replicate its success, which is its moat.

Pinduoduo's approach has been different from traditional e-commerce from the start.

'Alibaba, JD.com, Didi, and Meituan are imperialistic in their competition, with clear territorial boundaries. But I don't think our generation's mindset should be like that,' he said.

New things always revolutionize old things. When you compete with old things using the same mindset, you won't win. But when you use a new era's perspective to attack in lower dimensions, the times will help crush the old system.

Traditional e-commerce has long relied on traffic logic, with search as the main focus. Users need to find products themselves, so a massive number of SKUs are required to meet long-tail demand. In contrast, Pinduoduo represents matching, recommending products to consumers with limited SKUs but structural richness.

Search itself is long-tailed and difficult for reverse customization. Pinduoduo concentrates massive traffic into limited products, then customizes them after achieving scale, significantly reducing costs. This is the difference between Walmart and Costco.

Traffic logic belongs to the last era.

It's important to know that better display positions in search results are given to merchants who bid heavily for advertising space, which can easily lead to money being spent on advertising competition, reducing quality and creating a vicious cycle that benefits merchants and platforms at the expense of consumers. The platform sells this demand certainty, leading merchants to become low-quality and inefficient. Large brands can easily make money while small businesses struggle to rise.

In contrast, recommended matching distributes traffic to products with maximized value and cost-effectiveness. Multiple merchants compete for the same display position daily, and the one offering the lowest price wins. No matter how big the brand or merchant, this rule applies. Merchants who deceive consumers are penalized (refunds only, deposit deductions, account bans, etc.), gradually forming a consumer-friendly cycle.

Which of these differences will ultimately go further?

After Pinduoduo's rise, Alibaba has been changing. Search traffic continues to decline, but as one of the most successful companies of the last era, it has burdens as it enters a new era. Reform means weakening the original search function, impacting the original revenue model. Meanwhile, even with changes, the algorithm logic differs; Taobao and Tmall's algorithms favor higher GMV, while Pinduoduo's favor conversion rates, meaning products that more people will buy.

If a company only partially copies Pinduoduo's strategy, hard-pressing on low prices will be painful. For Pinduoduo, it is a natural result of its rules.

In 2019, Pinduoduo launched its magical $10 billion subsidy, offering discounted branded products preferred by users within the Fifth Ring Road, starting to acquire these users. The marketing campaign has no complex discount rules, ensuring branded authentic products in the product pool, with everyday prices always the lowest on the entire network.

Pinduoduo directly subsidizes consumers with money originally used for customer acquisition, gaining high attention. Initially, people within the Fifth Ring Road didn't understand this move, thinking it was unsustainable malicious competition. But after purchasing, they realized the appeal of getting a bargain. The psychology of getting a bargain also applies to users within the Fifth Ring Road.

Pinduoduo deeply understands the needs of different groups and has reasonable means to attract them.

As consumers gradually accepted the $10 billion subsidy, Pinduoduo became more assertive, demanding further price reductions from suppliers. The subsidy model also shifted, with the platform and merchants jointly subsidizing or merchants offering discounts, and the platform only providing traffic subsidies.

Merchants' perception of Pinduoduo's $10 billion subsidy has also changed, gradually considering it an important channel.

This has allowed the $10 billion subsidy to exist long-term.

Later, competitors also introduced $10 billion subsidies, but this had little impact and, to some extent, deepened the perception of Pinduoduo as a cheap option. This year, on Singles' Day, Pinduoduo casually introduced a super-doubled subsidy.

Essentially, Pinduoduo serves consumers and keeps merchants competitive. As long as you offer high-quality products at low prices, you have the opportunity to gain traffic, gradually forming an efficient and high-quality ecosystem.

Huang Zheng's strength lies in his keen insight into unsatisfied consumer needs and his ability to break down goals and quickly implement solutions. His simple, direct approach hits the core, providing funds when needed without empty promises, fostering an efficient and pragmatic style at Pinduoduo with significantly fewer employees than other platforms. By the time competitors understood, Pinduoduo's momentum was unstoppable.

Even after Huang Zheng stepped down, Pinduoduo retained its aggressive spirit, and the introduction of site-wide promotion enhanced its profitability. Site-wide promotion is a tool provided by the Pinduoduo platform to promote products across all pages and channels, achieving widespread advertising exposure. Fortunately, it is charged based on sales proportions rather than a lump-sum amount. Otherwise, it remains to be seen if the original intention would deviate from here.

2. Domestic traffic peaking remains a challenge for startups

According to a UN report, approximately 1.1 billion people worldwide live in extreme poverty. Using the international poverty line of $5.50 per day, the global poverty population exceeds 4 billion. Simultaneously, years of global inflation have plunged more people into hardship.

Can we enable poor people worldwide to live slightly better lives? Temu has stepped in.

On the other hand, traditional e-commerce platforms like Amazon and past Alibaba face high traffic costs. Their self-operated products and branded stores easily make money, leaving small and medium-sized merchants without hope, and consumers can only buy increasingly expensive items.

This class solidification resembles capitalism, where it's time to turn things around and give newcomers a fair chance to compete.

With domestic overcapacity, Temu continues Pinduoduo's 'low-price, high-quality' strategy, quickly accumulating consumers through price advantages during the expansion phase. Meanwhile, Temu targets overseas consumers' most critical decision factors, offering policies such as free returns and exchanges within 90 days of the first order, free standard shipping on any order, and express shipping for orders over $129.

To help merchants quickly expand overseas, Temu offers a fully managed mode where merchants only need to be responsible for product quality and supply speed, with Temu handling everything from product selection, pricing, shipping, to traffic promotion, cross-border logistics, after-sales, legal affairs, and intellectual property. For merchants with stronger operational capabilities, Temu provides semi-managed services, allowing them to independently decide on warehousing and logistics solutions for greater independence and flexibility.

In 2023, on the US App Store's app download rankings, Temu surpassed TikTok, Instagram, Google, YouTube, and other apps to top the free app download chart.

Two years after its launch, Temu directly surpassed eBay to become the second most visited e-commerce website globally, second only to Amazon. According to US Sensor Tower data analysis, as of August 2024, Temu's global user base had reached 91% of Amazon's, and it is expected to surpass the 30-year-old Amazon within the year. Currently, Temu covers 82 countries globally.

After domestic traffic peaked for Pinduoduo, Temu became the primary focus.

Temu's overseas expansion also benefits from countries' duty-free tariff mechanisms for low-priced goods. However, due to 'safety concerns,' some countries have started considering relevant regulatory measures. Simultaneously, potential tariff policies after Trump's presidency could severely impact Temu.

In the latest earnings report and earnings call, Pinduoduo's management emphasized that due to intensified competition and external challenges, revenue growth will inevitably face pressure in the future. Management also stated, 'As we continue to invest firmly, we are prepared to accept short-term sacrifices and potential profitability declines.' Pinduoduo plans to invest $10 billion over the next 12 months to support high-quality merchants. Due to the ongoing investment phase, Pinduoduo will not repurchase shares or distribute dividends in the coming years.

Pinduoduo's management took a bold step, and capital has rarely seen such a ruthless individual who truly views money as dirt.

Investors now face a situation where if profit expectations decline, the expected valuation is no longer 10 times PE but possibly 12 or even 15 times PE, with no shareholder returns.

On the one hand, the impact on profits is uncertain, and on the other hand, the resistance to globalization is also uncertain. Both require observation for some time.

Moreover, Amazon, a competitor, reacts quickly and learns efficiently, rapidly adapting to changes without underestimating the threat.

Simultaneously, Huang Zheng's threshold for becoming the richest person looms over Pinduoduo like a ceiling.

For investors who still have a long-term optimistic view on Pinduoduo, the best strategy is to set a bottom line and buy when the market is cheap. For example, they can apply a safety margin discount to Huang Zheng's potential wealth as the richest person. If the price rises too much, Pinduoduo may increase investment to short itself.

Conclusion

The market's pricing of Pinduoduo is largely due to its disregard for shareholders, let alone shareholder returns. But on the other hand, Pinduoduo always knows what it's doing, with profit as a byproduct. As long as it's not abruptly cut down by hegemony, not making profits now will likely lead to profits eventually.

Huang Zheng doesn't want to be the richest person, and Pinduoduo doesn't want to grovel to capital. Instead, they want to do something different. Titles of wealth and capital's arrogance are stumbling blocks.